Good morning, Paul & Jack here. Today's report is now finished.

Agenda -

Paul's Section:

A couple of brief company comments -

Biffa (LON:BIFF) - not a share I’ve ever looked at (it does waste management). It announces today a possible cash takeover bid, at 445p per share - a 37% premium. From America again, where investors seem keen to buy up UK listed companies. Maybe more takeover bids could trigger a recovery in the UK market generally, as it’s signalling to us that valuations are now attractive to bidders. [no section below]

Ted Baker (LON:TED) - another company that’s up for sale, in a formal sales process. The preferred bidder has pulled out. The company is deciding whether to proceed with any of the other approaches it has received. Looks like the chances of a successful bid are receding, so it might make sense to bank profits here.

Looking at TED's FY 1/2022 results, they look poor to me (still heavily loss-making), so little tangible evidence of the turnaround working. Balance sheet looks adequate for now, but if losses continue, it would probably need an equity fundraise. I’m steering clear. [no section below]

Photo-Me International (LON:PHTM) - a positive update, with guidance raised. Finncap note reveals the profit split across the divisions - key info I've been asking for. This reveals the fast growing laundry division is producing a third of group EBITDA. That's game-changing (positive) information. A PER of 8, and a rising yield over 4%, for a growing, net cash business, which is self-funding rapid roll-outs of new machines, looks to me a highly attractive buying opportunity.

Newriver Reit (LON:NRR) - the market doesn't seem to like the results from this property REIT. I think it looks interesting, with a dividend yield now over 8% [EDIT: but set to fall next year, due to disposals], and debt has been greatly reduced from disposals, so it's not financially distressed any more. Worth taking a closer look I think.

Jack's section:

Gooch & Housego (LON:GHH) - staff absences and supply chain shortages have impacted H1 performance but the group says its record order book points to a better second half. The share price has come down quite a lot now, which makes it more interesting, but it’s far from bargain territory. I would want more tangible signs of growth at c20x forecast earnings, but there are signs of quality here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Photo-Me International (LON:PHTM)

70.6p (yesterday’s close)

Market cap £267m

Photo-Me International plc (PHTM.L), the instant-service equipment group, provides an update on the Group's trading for the six months ended 30 April 2022.

This is the halfway mark in FY 10/2022.

How nice (and unusual) to be seeing some positive news -

Trading above expectations leads to upgraded FY22 forecasts

Key points -

H1 revenue up 24% vs LY (driven by recovery in photobooths, e.g. for passports, esp in UK & France)

Net cash £41.4m

Demand “stronger than ever”, due to easing of travel & socialising.

Trading recovered to pre-pandemic in all markets except Asia. Japan expected to recover when covid restrictions removed.

Laundry division - performing well. Installed 53 machines per month. Further growth planned.

Trading “extremely positive” from new “Flex” low cost laundry machine - rapid roll-out planned.

Pizza vending machine “proving very attractive” - “great future development opportunity”

Doing well despite consumer uncertainty.

Inflation - significant increase in supply chain & raw materials, but has “strong position in markets”, and “significant pricing power”

H1 results due out in mid-July.

Guidance for FY 10/2022 - assuming no new covid restrictions -

Revenue up at least +20% vs LY

Adj profit before tax (PBT) £47-50m

Valuation - as I’m typing this, the share price is up 10% to almost 78p.

Many thanks to Finncap for publishing a new note this morning to help us.

This note is particularly helpful, because it gives a breakdown of where the profit comes from, which I’ve not seen before.

Photobooths 55% of FY 10/2021 EBITDA, as I thought, the main profit earner.

Laundry machines 34% of EBITDA in FY 2022, which might be a typo, perhaps they meant 2021? This is a lot more promising than I imagined, and the number of machines grew 16% in just 6 months.

Finncap estimates 9.8p adj EPS for this year, FY 10/2022, up 46% on LY. At 78p currently, that’s a PER of only 8.0 - which strikes me as excellent value.

Forecast divi for this year is 3.3p, a yield of 4.2% - but I think there’s upside on the divis, as they’re well covered, and the company has net cash, so its dividend paying capacity looks very good - I think this is a safe, and rising yield - which is attractive.

Finncap's price target of 123p (raised from 105p today) looks entirely realistic to me.

My opinion - this looks excellent. Now I finally have the information I need (a breakdown of which activities generate the profits) then I’m much more bullish on this share. The problem with photobooths is that they’re structurally declining, but people have been saying that for the last 20 years, and they’re still churning out big profits.

Laundry is much more significant than I thought, and growing fast. Plus there are a few other bits & bobs, like juice & food vending. Armed with this new information, I’m now leaning much more in a bullish direction with this share - the growth in laundry & food machines looks more than enough to offset future declines in photo booths, hopefully.

A low PER, decent balance sheet, good & growing yield, plus self-funding the roll-out of successful new machines in other categories (mainly laundry) looks very attractive to me. Plus it's got pricing power, so shouldn't be hit by inflation. Main markets also recovering. No wonder the major shareholder tried to buy it recently! That lowball offer lapsed in March 2022.

I didn’t expect to be this impressed with PHTM, but it gets a very solid thumbs up from me! This share looks one of the best value shares I’ve seen for a while, and it’s very tempting to buy some.

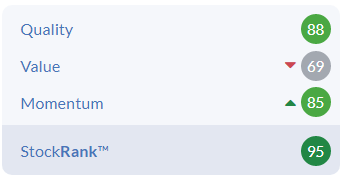

High StockRank is the icing on the cake too!

.

.

Newriver Reit (LON:NRR)

88.4p (down c.12%, at 11:23)

Market cap £270m

I’m not sure why the market has sold off this property REIT share by 12% today, on decent volume too, over 4m shares volume printed so far today. I’ve followed this share for years, because management presented very well at a Mello event, and it just got me interested in the company. I tend not to follow the sector, and only understand the basics of it really.

Key points -

Disposals - substantial, and recently at book value, the biggest one being its Hawthorn pubs division.

Debt - greatly reduced due to disposals, and now quite low at LTV (loan to value) of 35% - says it has surplus capital now.

Property portfolio is retailing mainly, value retailers mainly, in low rent, high occupancy minor shopping centres.

EPS seems to be reported differently, as Underlying Funds From Operations (UFFO) at 9.2p, which is ahead of the upper end of guidance given on 21 April 2022 trading update, of 8.8p

Dividends - particularly attractive, as REITs have to pay out nearly all profits as divis, to keep their tax status. Today FY 3/2022 divis are 7.4p, giving a very attractive (and probably sustainable, given low gearing) yield of 8.4%, at the current 88.4p share price.

EDIT- many thanks to Bouden54 and ChrisW, who helpfully point out in the reader comments below, that the divis at NRR are forecast to fall next year, due to disposals. So that means the yield would drop to just under 7% (based on 6.0p divis and 88.4p current share price), still good though). End of edit.

Net asset value per share (EPRA basis) is 134p, so the share price of 88.4p is a nice 34% discount. Is that justified? It seems a bit excessive to me, given that the property portfolio has already been heavily written down in value, in the last couple of years. If property values hold up, after big falls in the pandemic, then the discount to NAV could gradually reduce or disappear, giving potential decent upside for shareholders, on top of the bumper divi yield. It’s up to you to make that call though, I have no view on commercial property values, other than that higher inflation tends to pull property prices up over the medium to longer term. Although investors might seek higher rental yields, thus exerting downward pressure on capital values, who knows how it will pan out?

Occupancy (95.6%) and rent collection (96%) look good, and improving.

Outlook -

- Improved liquidity in capital markets.

- Retail parks in demand from investors, and values rising.

- Shopping centres less positive, but values have stabilised after long declines.

- NRR expected to be insulated from consumer caution, due to tenants generally selling essentials, not discretionary products.

- More disposals planned.

- Keeping a buffer of capital, given uncertainty.

My opinion - NRR shares look interesting to me, on a fairly superficial review.

So readers, as always, would need to do your own, more detailed research.

An 8.4% dividend yield (EDIT: set to reduce to c.7% next year), and a robust balance sheet with modest gearing, seem a good place to start.

Thinking about the downside risks, there could be more insolvencies of tenants, now the rent moratorium has ended. Although NRR’s biggest client list reported today looks impressive, mainly big names.

NRR was a much higher risk situation during the pandemic. It’s been transformed since the Hawthorn disposal, and big debt reduction. So it’s a much safer bet now, yet the share price has just gone sideways since early 2021, which doesn’t seem to reflect the improving fundamentals.

Conclusion - NRR shares could be worth readers taking a closer look. Let me know what you think!

.

.

Gooch & Housego (LON:GHH)

Share price: 926p (+8.3%)

Shares in issue: 25,040,919

Market cap: £231.9m

Interim results for the six months to 31 March 2022

Gooch & Housego manufactures photonic components & systems for the aerospace & defence, industrial, life science and scientific research sectors.

- Revenue -7.4% to £54.1m,

- Adjusted profit before tax -26.6% to £3.6m,

- Adjusted basic earnings per share -24.8% to 11.8p,

- Net debt ex-IFRS 16 is up £1.2m to £5.9m,

- Interim dividend is up 0.2p to 4.7p.

Statutory results come in some way below the adjusted results after accounting for amortisation and non-recurring items (statutory profit before tax of £1.2m and statutory basic EPS of 6.9p).

Revenue has been constrained by pandemic related factors. COVID related staff absences at its US and UK sites, plus supply chain shortages (particularly for electronic components from Asia). Gooch has consequently invested in increased capacity and progress has been made with recruitment of operators and securing our supply chain.

Labour markets remain competitive in both US and UK and this has 'gated' the rate at which we have been able to add staff to service our growing order book. Real progress in the hiring and training of operators has been made in the first half of the financial year. There has been wage and material inflation across the period, but the Company is passing on those additional costs in the form of price increases across most of its portfolio.

Adjusted profit before tax down due to lower volumes and investment in R&D and manufacturing capacity.

The group’s order book is in good shape at least, standing at a record £119.9m (31 March 2021: £92.8m), an increase of 29.2% or 25.6% at constant currency. H1 order intake was 1.42 times H1 revenue.

Here’s the revenue performance by segment:

High demand for industrial lasers, in particular from semiconductors. The company has increased market share here, while Medical lasers continue to benefit from the return of elective surgery. A&D (Aerospace & Defence) has been affected by customer driven delays and new programmes not yet progressing to volume phase, but recent order intake has been strong.

Balance sheet

Group remains in a strong financial position. A new five year revolving credit facility ($40m committed/ $30m uncommitted) was put in place in March. Net tangible assets of around £64m and a good current ratio, 3.5x.

Conclusion

Gooch says it has a ‘clear route to mid-teens returns in the near term through organic growth, internal investment and our well-established acquisition strategy’. Perhaps, but trading has been tricky recently, the shares are not obviously cheap, and I’m generally wary of companies pointing to an H2 weighting amid the current changeable conditions.

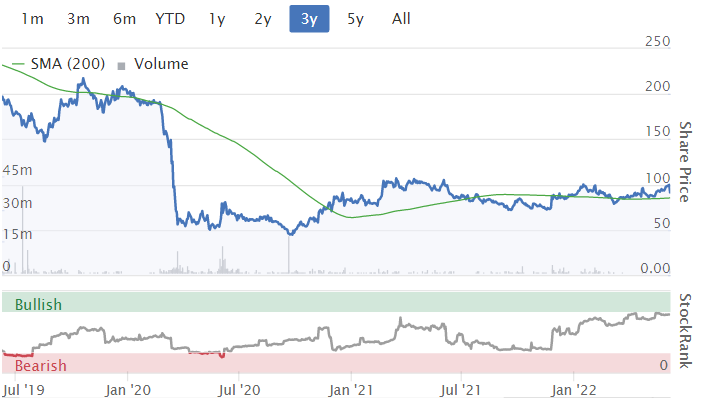

The chart’s not appealing to me right now. Even after halving recently, shares still trade on around 20x forecast earnings. I do think this is a good company though, so perhaps some kind of premium is warranted.

It seems like revenue growth has been stalling. The past couple of years have obviously been a difficult environment for most operators, so I’m not extrapolating this performance by any means. But I would be hoping for a return to growth at the current valuation.

And the order book is at record levels (hence a degree of confidence from management about a better H2 performance), while net debt is very manageable, so the company looks in fine shape fundamentally. It is capable of passing on costs, taking market share, and investing in capacity and R&D.

At the current level, Gooch looks more interesting than the last time I covered it, when it was in the 1,200p range, particularly if there is a longer term growth opportunity based on superior quality and IP. But I’m still not madly excited by the valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.