Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Timing - today's report is now finished.

Agenda -

Comments from last night's Mello Monday, re Rbg Holdings (LON:RBGP) (I hold) and Smiths News (LON:SNWS) (I hold)

Headlam (LON:HEAD) (I hold) - Final results for FT 12/2020 - good H2 recovery, and shares still look good value

Science (LON:SAG) - Audited results for FY 12/2020 - looks an interesting company, trading well

Dfs Furniture (LON:DFS) - interims to 31 Dec 2020 - trading really well, but balance sheet still terrible! Positive read-across forScs (LON:SCS) (I hold)

Marshall Motor Holdings (LON:MMH) - Full year results (this section written by Jack)

.

Mello Monday

Last night was excellent, with some interesting presentations. The CEO of Rbg Holdings (LON:RBGP) (I hold) said something that stuck in my mind. Namely that the M&A division was now completing deals which had been done entirely online - i.e. selling businesses where the buyers & sellers had never met! It's now all done through Zoom or Teams, email, phone, etc. This reinforces to me how things have permanently changed in the last year. It's dawning on many of us, that it's actually so much more efficient to have meetings online, instead of taking a whole day to travel in & out of London. Having said that, I really miss the de-briefings at the Lord Aberconway, after meetings at Finncap, so whilst Zooms are great, I can't wait to participate in actual meetings again - just perhaps not as many as previously.

.

Smiths News (LON:SNWS)

(I hold)

My stock pick in the BASH session at Mello Monday last night, was the turnaround at Smiths News (LON:SNWS) (I hold). Click here for the presentation slides I referred to, which give details on the main points. I have a 1-2 year timeframe on the turnaround here. I reported on it here in last week's SCVR, with an in line trading update, and a remarkably low PER of about 3.

Note that the StockRank is strong, at 90. I think the net debt could halve in the next year, from strong free cashflow, plus the deferred disposal consideration re Tuffnells and a possible pension surplus payout. If that happens, then it should transform investor perception of the company, and resumption of dividends would be a further catalyst fora re-rating.

Its CFO described the business as "boringly resilient", generating c.£10m EBITDA per quarter, and little capex required (outsourced business model) going forwards. The stock market has begun recognising these improvements, but it seems to be lagging behind in my view.

.

Paul’s Section

Headlam (LON:HEAD)

(I hold)

422p (pre market open) - mkt cap £359m

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings distributor, today announces its final results for the year ended 31 December 2020.

I’m going to watch the results presentation video here, then comment on it below later:

.

Profitability - H1 was badly impacted by covid in Q2, leading to a small loss of £1.2m in H1. There’s been a strong recovery in H2, giving overall underlying PBT of £15.9m. In other words, in H2 the business pretty much returned to its previous run rate of c.£40m p.a., assuming no further covid problems. Therefore, I’m valuing the business on the likely future run-rate of profits.

Note there was a £5.5m bad debt provision, a hit to profits absorbed within the underlying figures. Hopefully that should be a one-off, giving another reason to expect a bounce back in future years. It sounds from the results video as if the FD is being prudent, and expects for some of this to be collected in, which would help 2021 profits. Non-underlying items are mostly non-cash, being a goodwill write-off, plus some cash restructuring costs.

Current trading - soft, due to the latest lockdown, but I don’t think this matters, because everything’s opening up shortly. Valuing shares is about looking forwards, not backwards -

Trading in January and February 2021, typically the quietest trading months, soft given lockdowns and non-essential retail businesses being closed. The busier months ahead to benefit from easing of restrictions, reopening of retail businesses, and the OIP improving performance and revenue growth opportunities

Cost-cutting & efficiency gains - covid has accelerated changes that were already underway to make the business more efficient. Hence future profits could not only match historic levels, but end up higher than before. I think the current broker forecasts of 26.8p for 2021, and 30.9p for 2022 seem far too low. Without covid disruption in future (hopefully) then 40p+ EPS seems more likely, or possibly higher, given the efficiency improvements being implemented.

The benefit from efficiency measures is £4m in 2021, and £8m in 2022 - increased profits, which is quite material in the context of a business with a normal run rate of about £40m p.a. profit. Headlam is targeting a UK operating margin of 7.5% by 2023.

Dividends - are starting up again. Only 2p, which is nothing compared with the pre-covid level of c.25p p.a.. Given that Headlam received £11m benefit from furlough in 2020, perhaps it was considered prudent to hold back on rewarding shareholders, to prevent an outcry?

I’m more interested in dividend paying capacity, which in this case is very good. The business has net cash, lots of freehold property, and is back to generating reliable cashflows again. Therefore, it seems highly likely to me that dividends should get back to previous levels gradually. I can’t see any reason why they wouldn’t. What else is the company going to do with the positive cashflows? I always look forward a couple of years with shares I buy, and in this case, I reckon buying now should lock in a future dividend yield of about 6% - very attractive in a low interest rate environment.

Some commentators reckon that the recent 10% correction in NASDAQ, and the re-opening of economies, could herald a shift in focus from tech shares, towards value, possibly? I think that’s a persuasive argument, given the absolute gulf in valuations from cheap recovery things like HEAD, where the broker forecasts look too low, and there’s the prospect of decent dividends resuming. I think that’s bound to be attractive to some investors, especially people who think a bit longer term, like myself, and who enjoy receiving dividends from cash generative businesses.

.

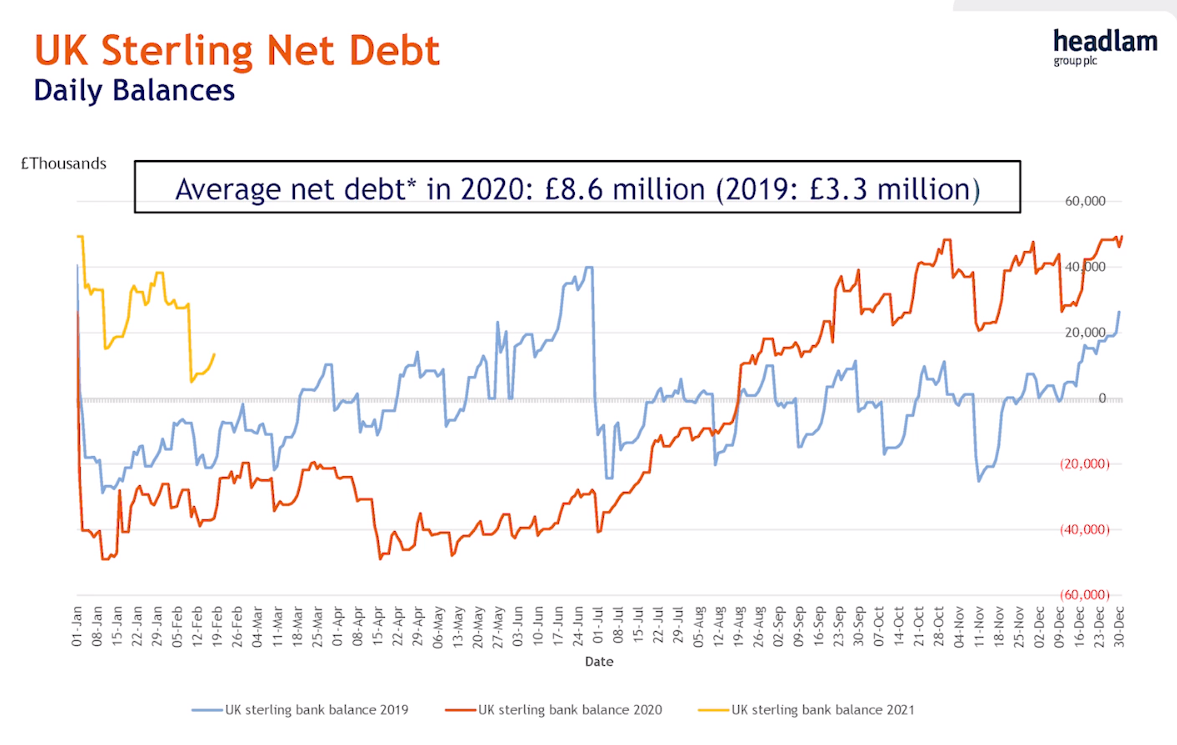

Net cash/debt - top marks to Headlam for this excellent disclosure - it reports average daily net cash at the bank. This is far more meaningful than just giving period end cash figures, which are only a snapshot, and often don’t reflect the typical level. That’s one reason why enterprise value is such a flawed measure to use when valuing companies, because it relies on an erratic & easily manipulated year end cash balance. I hope to see more companies reporting average daily cash/debt as well as year end balances. It’s a good indicator of how transparent (or not) a company is in its reporting.

What we can see from the graph above, is the blue line (in the centre, trending sideways) is net cash/debt in FY 12/2019. It trends upwards, but then drops sharply down mid-year, which reflects payment of the dividend.

In FY 12/2020 (the orange line which rises strongly in the middle of the year) we can clearly see that it benefits from withdrawal of the usual dividend, plus strong measures to improve working capital in H2 - mainly focusing on reducing slow-moving stock lines.

Finally, the short, yellow line is 2021 to date, which obviously stops in late February.

I really like this slide, as it shows us the overall trend of cash balances, utilisation of debt facilities, and even the intra-month volatility. Excellent stuff!

Balance sheet - I’m very happy with this. Remember it includes c.£100m of freehold property, effectively thrown in for free. Although you could argue that this boosts profits by maybe £5-7m, given that if the property were leased, that would be the likely rental cost.

NTAV is c.£200m, which is really excellent.

The pandemic has shown how companies with strong balance sheets, especially those with freeholds, easily retain the support of the bank, and can concentrate on dealing with trading, as opposed to being forced into emergency, dilutive fundraising. This is so important in lowering investment risk, but is often overlooked (especially in a bull market). Headlam did not dilute shareholders in 2020, since no fundraising was necessary, very positive.

Cashflow - very good. Despite reduced profitability in 2020, the company has streamlined its inventories, by clearing out slow-moving stock lines, and focusing more on best sellers, which has caused quite a large favourable move in working capital. There’s £12m of deferred VAT to take into account, which will reverse at some point.

As you can see, the overall picture is very positive, and there will be a useful interest cost saving from not utilising the borrowing facilities much, if at all, this year. Although remember there will be a £12m lurch down in cash, when the VAT arrears are paid.

My opinion - I’ve only skimmed through the key parts of the results announcement, because I already know that this company ticks the boxes for my investment criteria. I think it’s modestly priced still (PER of 10 maybe, or even lower, once trading has fully returned to normal), with a good recovery underway.

The business model makes a lot of sense - offering outsourced bulk buying supply, and warehousing to smaller carpet retailers, who can order lots of typically small orders on a just-in-time basis from HEAD’s extensive ranges.

I like the measures being taken to make the business more efficient, which look set to provide upside surprise on current forecasts.

Divis could return to a yield of up to 6%, if we’re patient.

There’s a lot to like here.

Management strike me as down-to-earth, and focused on improving the basics of the business.

Overall, this looks a nice safe, value share, that should be a decent long-term investment, providing an income again in due course. It won’t set our portfolios on fire, and probably won’t be exciting enough for many people in this bull market, but for people who like decent companies at modest valuations, then I think this fits the bill, despite a strong recent recovery from the completely irrational lows of last autumn.

This share is surprisingly illiquid, perhaps investors buy & hold?

Note the consistently strong StockRank, shown below, under the share price chart.

What's the upside? I think it's worth 500-600p, so I see the price of c.410p as still being attractive.

.

.

Resumption of cruises

The Telegraph is reporting today that the maritime minister has told a group of MPs that cruises in English waters will be allowed to resume from 17 May 2021.

P&O has already announced that it's planning "staycation" cruises in UK waters

This looks a good stop-gap, whilst other countries catch up with the highly successful UK vaccine rollout.

.

Science (LON:SAG)

339p (up 8% at 12:42) - mkt cap £140m

Several readers have flagged up the results published today for FY 12/2020, with some interesting comments and analysis which engaged my interest. SAG is a slightly odd collection of consultancy businesses and a maker of digital radio components (Frontier).

I reviewed the FY 12/2020 year end trading update here on 12 Jan 2021. The year ended with a flourish, with expectations raised to £10m adj operating profit, or 18.1p EPS. It's beaten those numbers today a bit.

Audited results - for the year ended 31 Dec 2020.

Revenues are £73.7m, which is 1% above the guidance given in January - always good to slightly over-deliver.

Adj diluted EPS came in at 19.1p, a PER of 17.7 which is usefully above the most recent guidance of 18.1p, it looks as if the negative tax charge helped there. SAG has plenty of tax losses, and also gets R&D tax credits (see note 3), which boosts EPS (since EPS is always stated post-tax).

Very strong rise in profitability vs LY, up 62% at adj operating profit level. Note 2 shows how this has mainly come from the big turnaround at Frontier, which improved from a £(1.3)m adj operating loss in 2019, to a profit of £3.25m in 2020 - very impressive, but a key issue to research is whether this is sustainable? Possible supply shortages are mentioned, which could be an issue in 2021. The commentary says management is still considering its options re Frontier (might be sold, maybe a separate float?)

Dividend - of 4.0p is declared. That’s not much, only a yield of just over 1%, but seems to be double what was expected

A key theme for me is backing founders/owner/managers with big shareholdings, which this share is. They usually tend to make better capital allocation decisions, and avoid mistakes made by empire-building hired hands, plus they’re usually more financially prudent. This is evidenced at SAG with the strong statement that it has grown considerably since 2010, but has the same share count in issue. Although a cynic might point out that £1.7m share buybacks in 2020 masked the generous £1.2m (same LY) in share based payments to management.

Acquisitions - more are being evaluated. Given the good track record there, I think this is more opportunity than threat.

Balance sheet - is nowhere near as strong as the commentary makes out! NAV: £41.4m, less intangible assets of £24.2m, gives NTAV of £17.2m - that’s OK, but not amazing by any means, for a £140m mkt cap company.

The balance sheet structure is interesting though. Note there is hardly anything in inventories, only £1.3m, which is because the main business is services, not physical goods, hence it ties up less capital than a manufacturer or distributor of physical goods.

Own cash of £27.1m looks great, but bear in mind that note 11 shows that £13.8m is “Payments received on account”, which are shown within creditors until the work has been invoiced. Hence about half the cash pile has come about because of getting cash up-front from customers. Nothing wrong with that, in fact it’s a good thing, but personally I tend to deduct this creditor off the cash balance, to arrive at what cash is truly the company’s own surplus funds.

Freehold property is in the books at cost of £21.2m, with current valuations being £22.6-33.9m, so there could be some additional value there. Most of this is funded by mortgages.

Overall then, I can’t get excited about the balance sheet. It’s solid, but nothing special.

Cashflow - highly cash generative, helped by a favourable movement in working capital in 2020, which could possibly unwind next year maybe?

My opinion - the consultancy businesses look really good - generating very high profit margins, although about three quarters of revenue is non-recurring. These look very good, quality, niche businesses. Frontier, I don’t know enough about to judge, but the turnaround from losses into a decent profit is certainly impressive. It makes me feel that management seem backable, and know what they’re doing, in creating shareholder value.

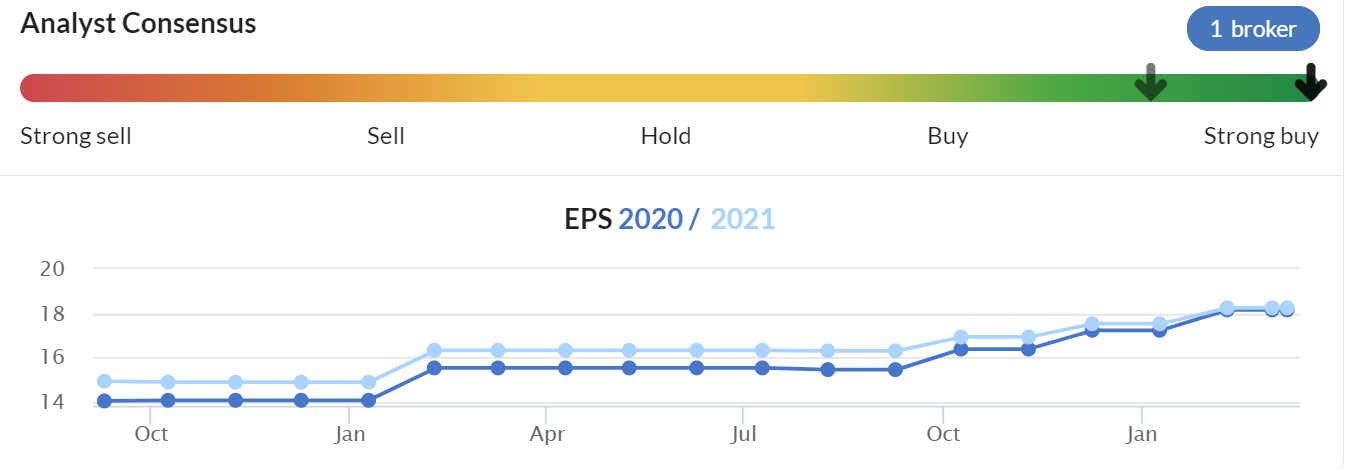

As I concluded last time in Jan 2021, this share is very straightforward, in that it looks priced about right if you think earnings forecasts are accurate. However, the broker consensus graph below shows that the company tends to out-perform. Therefore, this share might end up looking cheap, if a similar trend pans out in the future.

More M&A looks likely, although I’ve heard from several sources that private equity is bidding up prices of potential targets to high levels which can’t be matched by acquisitive groups looking for bargains. So perhaps a more creative approach is needed to entice target companies to sell up for the right price? Or maybe more distressed turnaround targets could be found, since a very good job seems to have been done by SAG with Frontier. There could be rich pickings here maybe, given the economic turmoil we’ve had in the last year.

All in all, I continue to think this share looks interesting.

.

Dfs Furniture (LON:DFS)

245p (up 6.5% at 15:18) - mkt cap £633m

DFS Furniture plc (the "Group"), the market leading retailer of living room and upholstered furniture in the United Kingdom, today announces its interim results for the 26 weeks ended 27 December 2020 (prior year comparative period is the 26 weeks ended 29 December 2019).

A couple of members have mentioned this in the comments below, which jogged my memory to take a look. As mentioned numerous times before, I consider this share uninvestable because of its terrible balance sheet. So rather than raking over the coals on that yet again, I just want to have a quick look at how it’s trading, mainly for possible read-across to smaller rival, the much more solidly financed Scs (LON:SCS) (I hold). SCS shares have risen 10% today, which is very unusual for a share which seems permanently tethered to 200p! It’s risen to 230p today, which is rather exciting, although personally it’s a long-term holding for me, as I think SCS is probably worth 300-400p on fundamentals.

Back to DFS. The H1 figures (July-Dec 2020) look fantastic! Revenues up 17.3% vs LY, and underlying PBT up 361% to £76.5m. There must be a fair bit of catching up from sales lost in Feb-Jun 2020, but even so, these are still very impressive numbers.

Digital is 25.7% of revenues, which to me seems surprisingly high for furniture.

Order book is strong. Note that furniture retailers have weathered lockdowns well, because when they can open, customers place orders, which then give a backlog which tides them over during subsequent lockdowns. Plus more people are buying furniture online too, which does surprise me a lot. But I suppose if you trust the brand, then you might be prepared to buy online, on the basis that the actual product should be similar to the website pictures. That must be what’s happening.

Outlook - also sounds upbeat, despite the latest lockdown -

The investments we've made in our digital channels have generated exceptional revenue growth. Consequently our order bank remains well above normal levels and, subject to showrooms reopening by 12 April 2020, our central planning scenario is for an expected full year profit before tax outcome of approximately £105m, with further benefits to be realised in next year's financial results.

Special mention must be made for the excellent guidance which DFS gives us. It even provides a table (below) giving 3 possible outcomes for the remainder of FY 06/2021, and how that would affect profit & net debt. How brilliant is this! All companies should be doing this, as it helps manage investor expectations, and ultimately makes the share more attractive for us to buy/hold, because it reduces uncertainty & helps us assess risk & performance. Bravo to DFS!

I really hope other companies take up this excellent format for reporting guidance. After all, it’s ridiculous to just home in one one number for profit forecasts. It should be a range of possible outcomes, because the future is inherently uncertain. All companies have this information internally, so there's no reason at all why it can't be shared with investors.

Balance sheet - I wasn’t going to comment on this, but whilst writing the above have been pondering whether I should drop my aversion to DFS’s balance sheet, given that it’s trading so strongly, then the balance sheet will be repairing itself somewhat. Plus when profits & cashflow are pouring in, there shouldn’t be much risk of the company being forced into doing another placing.

No scrap that idea, the balance sheet is still horrendous! An example - current assets are £100.7m, current liabilities are £376.1m! How is it possible to run a business with so little working capital? There's no slack in there, in case of emergencies. Hence why DFS had to an emergency placing in 2020, but SCS (I hold) didn't. So it does make a difference.

NAV is £246.4m, take off £532.6m intangible assets, at NTAV is negative £(286.2)m.

That’s a really precarious situation, so it’s still uninvestable for me.

My opinion - great performance, but the awful balance sheet wouldn’t allow me to sleep at night. Read-across to SCS (I hold) is positive, although DFS points out that accordingly to Barclaycard data, it has gained some market share, on top of consumers wanting to spend on furniture, in the well-known trend to revamp our homes.

How have DFS and SCS shares performed? Over a 1 year period, DFS seems to have greatly out-performed. However, the devil is in the detail, and this time last year saw DFS take a much deeper dive in price when covid struck, than better-funded SCS. I think the 2-year chart is more meaningful, as it strips out this distortion. As you can see below, they've performed exactly the same (ignoring divis)! However, DFS nearly went bust a year ago, whereas SCS sailed through with pots of cash in the bank. The same return, for taking huge risk with DFS, and little to no risk with SCS. Therefore, SCS is the clear winner, when you factor in risk as well as reward.

.

.

.Jack’s section

Marshall Motor Holdings (LON:MMH)

Share price: 154p (+6%)

Shares in issue: 78,232,237

Market cap: £120.5m

Marshall Motor Holdings (LON:MMH) is the 7th largest motor dealer group in the UK. The group operates 113 franchise dealerships representing 22 different brand partners and has put together an encouraging track record of top line growth over the years.

But, with their razor thin margins, general industry headwinds, and a world increasingly focused on reducing pollution, car dealers have at times suffered from poor share price momentum. And that’s before you begin to talk about the impact of lockdowns.

A one-year chart shows share prices have now recovered fairly strongly amid market expectations of reopening economies (the FTSE All Share is orange, MMH is blue).

So perhaps the bulk of the rerating has played out here.

That said, MMH is still cheap across a range of metrics including a forecast PE of 8x and a price to sales ratio of just 0.06x. Together these metrics are a reminder of just how low operating margins can get in this space. The 2020 profit margin was forecast to be just 0.6% and today we find out it is 0.65%.

But the macro picture is improving and MMH has proven itself as a quality operator over the years. So there might be further to run if Marshall can hit the ground running and take market share in a post-lockdown environment.

Highlights:

- Revenue: reported -5.3% to £2,154.4m; underlying -13.5% to £1,866.4m

- Profit before tax: reported +3.7% to £20.4m; underlying -5.4% to £20.9m

- Earnings per share: reported -10.6% to 17.8p; underlying -7.9% to 21.1p

- Dividend cancelled but, with last year’s interim payment of 2.85p typically about one third of the final dividend, we might expect future payments of around 8.55p or a yield of 5.9%

- Reported net debt down from £138.6m to £70.5m, helped by government support measures, working capital control, and other cash preservation measures.

These financial results strike me as fairly resilient and reinforce my view of Marshall as a quality operator in a brutal, competitive, low margin sector.

It’s been a tough backdrop for operators in this space and that has unsurprisingly continued over the past year.

Total new vehicle unit sales at MMH fell 9.2% with like-for-like total new vehicle unit sales down 19.4% - but that makes for double-digit outperformance against a UK new vehicle registration decline of some 29.4%.

Total used vehicle unit sales dropped 5.3% with like-for-like unit sales down 14.6%, compared with used vehicle transactions down 14.9%. So not too bad given car room closures. Aftersales total revenue was down 5.2% and like-for-like revenue declined by 13.5%.

Back in April or May of last year, I would have been tentatively penciling in much steeper lockdown-related falls in the full year figures.

CEO Daksh Gupta comments:

Through a combination of support received from both the Government and our business partners, a number of one-off sector tailwinds and our continued and significant outperformance of the wider market, we are pleased to report an underlying profit before tax for the Year of £20.9m. Our financial position also remains strong, with adjusted net cash at 31 December 2020 of £28.8m.

Our resilient business model, ability to adapt to changing consumer behaviours, such as those enforced by showroom closures, together with our exceptionally strong relationships with our brand partners, gives us confidence in the Group’s future prospects and success.

Conclusion

I’ve talked with the CEO here before and Gupta comes across as knowledgeable, competent, and enthusiastic. He’s been heading MMH for a long time now - in fact I believe he is the longest serving CEO in the sector.

The group has a clear identity and strategy at the premium end of the market, it associates with aspirational brands, and it has grown from a small player in 2008 to become one of the premier automotive group’s in the UK and one of the fastest growing in Europe.

And it looks like the group continues to outperform the rest of the sector.

Marshall works hard to differentiate itself in a difficult sector: it is now in its eleventh consecutive year of having the Great Place to Work status and sixth consecutive year of being ranked as one of the UK’s best workplaces. It is big on social media and has spent years building up a proprietary tech dashboard to give it deeper insights into its show rooms and customers. And it continues to spend on TV advertising.

There is much more detail and colour included in the full year results so do take a look. My view is that Marshall is one of the better operators in this space so if you are interested in car dealers, it should certainly be on the list.

It’s a shame share prices have already recovered so convincingly. Mind you, at 154p, it is around its IPO price in 2015 despite revenue having doubled over that period. Profits have made far less progress over that time frame, which does bring us back to the fact that car dealers are low margin and prone to shocks.

A low sector multiple is probably warranted but MMH is one of the better operators and has a good opportunity to win market share going forwards. On that basis, it is worth a look as a potential longer term sector winner.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.