Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Timing - TBC

Disclaimer -

A friendly reminder that we don’t recommend any stocks. We aim to cover notable trading updates & results of the day and offer our opinions on them as possible candidates for further research if they pique your interest. We tend to stick to companies that have news out on the day, and market caps up to about £700m. We avoid the smallest, blue sky type companies, and a few specialist sectors (e.g. resources, pharma/biotech).

A central assumption is that readers then DYOR (do your own research) and discuss in the comments below. The comments, incidentally, sometimes add just as much value as the articles. We welcome all rational views, whether bull or bear!

It's helpful if you include the company name or ticker within reader comments, otherwise some readers may not be aware of what company you are commenting on.

Agenda -

Paul's Section:

Smiths News (LON:SNWS) (I hold) - an unexpectedly positive trading update, from this distributor of newspapers & magazines. Obviously an activity in structural decline, but it's now a cash cow, with lucrative dividends in the pipeline. PER of just above 4 looks too low, now that legacy issues have been fixed. One for value investors.

Hotel Chocolat (LON:HOTC) - an impressive update, with performance ahead of expectations for FY 06/2021. Lots more detail about growth plans. A little light on numbers, but there's no doubt the company is trading well, and making impressive gains online & internationally. Still expensive, but I'm warming to this share.

Jack's Section:

Circassia (LON:CIR) - Ex-pharma co (now medical devices) in turnaround mode but with costs reduced and EBITDA to be ahead of expectations. Still loss-making and market cap is well ahead of continuing revenue, but the group has a dominant asthma testing product in the form of NIOX that it can now focus fully on.

Solid State (LON:SOLI) - shares down on today's update. You might argue that the price got a little ahead of itself in recent weeks but this strikes me as a well run company with potential for steady long term growth.

Paul’s Section

Smiths News (LON:SNWS)

(I hold)

42.5p (last night’s close) - mkt cap £105m

Background - this is UK’s largest distributor of newspapers and magazines. It’s a structurally declining business (although rising cover prices offset some of the decline in volume), but still a substantial size (over £1bn revenues), bolstered by long-term contracts (with major publishers), variable costs, and decent cash generation.

A botched acquisition policy under previous management has now been sorted out (successful disposal of Tuffnells), as has the pension scheme (now in surplus, with a receipt expected fairly soon). Problem bank debt has also been reduced, and is set to hit c.1x EBITDA within 6 months, at which point the company has indicated it will pay out future cashflows in normal (and possibly special) dividends.

Hence I think there’s an opportunity for value investors here, because the (credible) forward PER of just 4.4 seems too low, and it seems to me that market hasn’t yet fully grasped that the business has been comprehensively sorted out.

Today’s update - the current financial year ends 08/2021.

It’s positive news -

Smiths News is pleased to report a strong operational and financial performance for the 43-week period to 26 June 2021, with trading expected to be ahead of market expectations for the 52 week period ending 28 August 2021.

- Sales of newspapers & magazines have “continued to stabilise”

- Positive Y-on-Y sales against soft comparatives for lockdown 1

- One-off boost from European Football Championship of £1m EBITDA (re sales of stickers, albums, etc)

- Cash generation & other key financial metrics are in line with the Board’s expectations

Given the continued strong performance of the business, together with the one-off benefit to sticker and album sales this year, the Board expects full year adjusted EBITDA to be ahead of market expectations.

"Our performance since the half-year has been pleasing, with robust operational control securing the benefits of the improving sales and stability in our core markets. We remain focused on delivering for all stakeholders and are confident that the business is well placed to build upon recent progress as the remaining restrictions on social movement are lifted."

My opinion - I wasn’t expecting this, so it’s encouraging news.

Current forecast is 9.2p EPS, so we’re above that. Maybe 9.4p to 10.0p could be in the offing for FY 08/2021? Compare that with a share price of only 42.5p!

There are restrictions on dividend payments until net debt has reduced further, which should happen when the pension scheme surplus, and Tuffnells deferred consideration are received. From next year then, I reckon the divis could shoot up, with the possibility of a double-digit dividend yield, well covered.

As mentioned before, it’s not something I want to own forever, but by my calculations the current share price looks far too low. I’m planning on holding for at least a year, or until the share re-rates to a more appropriate valuation (I’d be happy to start top-slicing if it gets over 60p, with a target of about 80p - a PER of 8, hardly demanding).

There was no dilution to shareholders during the pandemic.

As you can see, the value metrics are at levels we rarely see for a solvent, cash generative business, which could also attract a bidder perhaps? -

.

.

.

Hotel Chocolat (LON:HOTC)

385p (up 3%, at 08:51) - mkt cap £485m

Hotel Chocolat Group plc, a premium British chocolatier and digital-led retailer, today announces a post-close trading update for the 52 weeks ended 27 June 2021 ("FY21"), an update on recent trading, the Group's financial position and outlook.

Lots of upbeat-sounding comments in this update.

- Revenue for FY 06/2021 is £165m - which is nearly 2% above the £162m forecast shown on the StockReport

- Revenue up 21% vs last year - that’s impressive, because FY 06/2021 would have been impacted a fair bit from lockdown closures, although FY 06/2020 would also have caught about 3 months of the most severe lockdown 1, so it’s difficult to compare.

- Revenue is up 24% on the pre-pandemic year of FY 06/2019, probably a better comparator.

I remember saying here in previous updates that HOTC was only delivering a modest growth rate, considering how expensive the PER was. However, it now looks as if more convincing growth is coming through, which is impressive given pandemic conditions - see graph 1 below (and bear in mind actual revenues are £3m higher than the forecast of £162m, the lighter colour blobs are forecasts, more solid blobs actuals) -

.

.

Although the above figures do look small, for a company valued at nearly £500m - we’re being asked to pay up-front for several years' growth, well into the future.

Re-opening trading - impressive figures here, although it doesn’t say what the growth in store numbers has been over these periods, so it may not be like-for-like -

Since the previous trading update in May, Group trading has remained strong. With all channels open, Group sales for the 10 weeks from 19 April 2021 to 27 June 2021 grew 34 per cent compared to the same period in 2019, and 63 per cent compared to the same period in 2020 when all physical locations were closed.

Digital & subscription - the most interesting part of the business. The 3m database of UK customers isn’t the same as active customers though -

Having grown the UK customer database by 66 per cent to 3 million in the 18 months since December 2019, digital and subscription sales are now a substantially larger proportion of the Group's total revenue and have remained so after full store channel reopening. Increases in visits, conversion, and average order value have combined to substantially increase customer lifetime value (LTV).

Strong % growth in USA & Japanese markets, but no actual figures.

UK stores - strong trading smaller towns/cities, largely offsetting weaker trading in commuter & tourist locations - makes sense, and probably the same for many other retailers/hospitality chains.

UK store rents - 30% of sites renegotiated to lower rents. Remaining 70% have lease renegotiation possible in next 24 months - encouraging.

Growth projects explained - new products, increased production, distribution centre almost doubled in size, etc.

Overall profitability - no figures given, but it’s positive -

The Board now anticipates underlying pre-tax profit will be higher than its previous expectations. Preliminary results are scheduled for 28 September 2021.

Liquidity - cash on hand (no figure provided), and access to £25m undrawn bank facility, expires Dec 2021.

Outlook - expecting more than half sales this year to come via digital. Step change in growth from USA & Japan (JV). Creating >250 jobs in the UK this year - that’s a lot extra overhead.

My opinion - HOTC is looking a lot more interesting now that growth has stepped up a gear, and more seems to be in the pipeline. I’m warming to this share. Maybe it’s expensive for a good reason? It’s quite tempting to pick up a small starter position, to tuck away for 5 years. HOTC is starting to look like it could be a long-term success, with international growth & strong online performance making it stand out. With such a big planned increase in overheads, there could be a long wait for profitability to achieve a level that justifies the valuation.

.

.

Jack’s section

Circassia (LON:CIR)

Share price: 32.95p (+9.83%)

Shares in issue: 418,203,781

Market cap: £137.8m

This is a pharmaceutical company that is streamlining its operations to focus on its core NIOX asthma product, with a new management team spearheaded by executive chairman Ian Johnson and including CFO Michael Roller. Both formerly worked at Bioquell.

NIOX is a medical device for fractional exhaled nitric oxide (FENO), which is a market of airway inflammation. This patented technology helps with point-of-care asthma diagnosis and management and ‘is the device of choice for both Clinical and Research use’.

It’s a huge market - 340m people are affected worldwide and the number is growing, while 50% of asthma is either misdiagnosed or not spotted at all.

The group has been heavily loss making in the past but reduced and refocused operations are expected to significantly close this gap in the coming years. The headcount has reduced from 385 to 150 and operating losses fell from £64m to £17m in FY20.

The emphasis now shifts from pharmaceuticals to medical devices. Circassia made the decision to hand back its COPD business to AZ, resulting in some $150m of debt getting written off and a balance sheet free of debt.

… the Board believes that, notwithstanding revenue visibility continuing to be limited, the Company's full year EBITDA performance is likely to be ahead of current market expectations.

Highlights:

- Revenue +27% to £14.5m

- NIOX business EBITDA positive for first time (excluding corporate costs)

- Net cash £11.3m

- Completion of runoff period for Tudorza and Duaklir

- Settlement of Beyond Air dispute, with potential upside to Circassia

Clinical revenues were up 16% to approximately £12.1m and up 10% on H2 2020, as more patients were able to visit their physician. Clinical sales in the first half of 2021 were around 84% of H1 2019 underlying sales.

H1 2021 Clinical revenue included a one-off £0.6m benefit arising from the final unwinding of certain historical trading arrangements in China. Stripping this out indicates revenue growth of just over 10%.

The Research business made a strong start to the year as clinical studies resumed. Revenues here more than doubled to £2.4m (H1 2020: £0.9m), were up 50% on H2 2020 (£1.6m), and up 9% on the first half of 2019 (£2.2m).

The COPD business was transferred back to AstraZeneca on 31 March 2021.

Fixed costs have been reduced in the sales and marketing strategy, with more emphasis on third party distribution. This has resulted in a 34% reduction in overheads, from almost £14.0m in H1 2020 to approximately £9.2m in H1 2021.

H1 2021 EBITDA has improved to approximately £0.5m for the Niox business (before corporate overheads) compared with an EBITDA loss of £4.8m in H1 2020.

Unaudited net cash at 30 June 2021 was £11.3m (31 December 2020: £7.4m) with a net cash outflow of £1.1m in the period. A total of £5.0m was raised in equity in March 2021.

ASubject to FDA approval of their product, the settlement reached with Beyond Air, Inc. will provide further cash resources of up to $16.5m over time.

Interim results are expected on the 16th of September 2021.

Conclusion

The continuing revenue of the reduced business is quite small compared to Circassia’s market cap of nearly £140m, so the aim now is top line growth and to take advantage of its significantly reduced cost base in the second half.

It’s still loss-making, but with a valuable product in a large market, and a wider IP portfolio behind that. NIOX is registered and reimbursed in all major markets and has close to 40m tests to date, with worldwide sales of more than 17,000 devices. The group says this is a dominant market position.

Meanwhile, around 90% of Circassia’s revenue comes from recurring sales of consumables. So top line growth should then provide good visibility for further investment. Gross margins are high - 50% for devices and 80% for consumables - and capex is low due to 3rd party manufacture.

So there’s clearly value here beneath the mountain of historic losses and the group’s evolving profile. Directors have bought a bit of stock.

Trading was hit by the pandemic but has steadily recovered.

This isn’t your usual financial profile of a high quality stock. It’s all buried underneath the wreckage of what appears to have been a mismanaged company until recently. But if Johnson et al. can complete the turnaround and reshaping of the business, Circassia looks to have a very strong product to invest in in the form of NIOX, so it’s worth keeping an eye on.

Source: Company Presentation

Solid State (LON:SOLI)

Share price: 902p (-9.8%)

Shares in issue: 8,553,504

Market cap: £77.2m

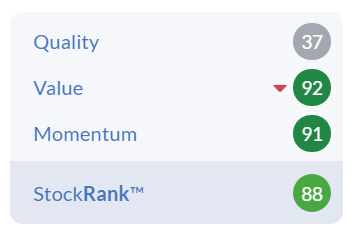

In terms of StockRanks, Solid State has been up there with the best of them for some time. It’s another one where had you bought in at the tail end of 2018 when the Ranks ticked up, you’d be sitting on a handsome profit by now.

It’s high QM in terms of factor profile.

The company itself is characterized more by a consistent strategy of organic investment, niche acquisitions, and steady growth over time - but that steady growth is more impressive when paired with the recent improving margins & returns on capital, and excellent cash conversion.

The group provides customers broad-based access to trusted electronic technology for demanding applications and extreme environments and has a commercial focus on high growth markets including security & defence, medical, green energy, transport, communications and industrial.

It has an operating track record stretching back 50 years and has been a listed company for more than two decades now.

Highlights:

- Revenue -1.6% to £66.3m,

- Operating margin +40bps to 6.5%; adjusted operating margin +110bps to 8.3%,

- Reported profit before tax +5% to £4.2m; adjusted PBT +14.9% to £5.4m,

- Reported earnings per share +15.7% to 46.4p; adjusted diluted EPS +18.1% to 54.7p,

- Underlying cash flow from operations -13.8% to £6.9m,

- Net cash -237.5% to -£4.4m,

- Dividend +28% to 16p,

- Open order book at 31 May +34.6% to £51m.

Adjustments relate to: non-cash charges arising from share-based payments and the amortisation of acquisition intangibles, non-recurring cash costs relating to the re-organisation of the Manufacturing division and acquisition costs, non-recurring profit from the sale of fully written down stock, and non-recurring tax credits arising primarily from prior year R&D claims and tax deductions on share options.

Stable revenue and increased profits is a good result over the Covid period relative to many other enterprises. There’s also a notable 28% increase in dividend - a far cry from the placings and temporary net losses we’ve come to expect elsewhere. The open order book increase of 34.6% provides further grounds for optimism.

There were two acquisitions in the year: Willow Technologies and Active Silicon, bringing with them enhanced technology to the portfolio and better international sales capabilities across the USA and Europe.

Internal development also continues, with the Solid State's battery pack and Battery Management Systems (BMS) offering, own brand computing products and portfolio of communications products. In-house Electromagnetic Compatibility (EMC) testing capabilities have also been established through its capital investment programme.

The group comments:

The Board is confident that the achievements of the last year and the post period end growth in open orders are a very good foundation going into the current financial year. The experience of our team, focus on structural growth markets and the balance sheet strength set Solid State aside from many in our sector, giving the Directors confidence in the mid-term prospects.

Conclusion

This continues to look like a well-run, growing small cap regardless of today’s share price reaction in my view.

The medium-term financial objective is to double fully diluted adjusted earnings from 30p to 60p per share over a five year period to March 2022 is on track. That would give an FY22 PE ratio of 16.35x.

Not particularly cheap, and after a strong run you could argue that the share price got a little ahead of itself given the more modest compound annual growth rates. But on the other hand, that run up is partially justified by a good track record and scope for upside earnings surprises.

On the whole, I find it a more interesting proposition with the shares marked down slightly.

There has been an accelerated growth rate recently, and management references ‘the significant opportunities for continued growth’ that lay ahead. As with other operators, there are currently short term supply challenges - this could be another reason for the market’s reaction to today’s announcement. It’s not the first company to be punished for flagging supply chain issues.

But the demand outlook for customised electronic solutions is robust and Solid State has a strong portfolio with scope for further investment in specialist skills and knowledge both through internal development and acquisition. International expansion is on the agenda, which signals a degree of ambition from the management.

However the share price reacts in the short term, this company strikes me as having the potential for steady longer term growth. It’s an illiquid stock so that makes it harder to anticipate how the share price will react in the coming days and weeks - all the more reason to keep tabs on it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.