Good morning from Paul & Graham! Today's report is now finished - 9 companies, didn't we do well! :-)

Agenda -

Paul's Section:

SThree (LON:STEM) (£529m) - sparkling interim results, from this decent quality, international staffing group. The valuation metrics remain attractive. Strong balance sheet, although cashflow has been mainly absorbed into receivables. Interim Results video presentation is here.

Shoe Zone (LON:SHOE) (£100m) - another positive update, coming just a month after the last one! Profit guidance upped from £8.5m to £9.5m. Interesting that is also notes supply chains are easing, and margins improving. I think that has potential read-across for other retailers, where bombed out valuations may contain some bargains, possibly?

Reach (LON:RCH) - this took me a lot longer than expected, as it's a complicated situation. It could be cheap (if the disputed pension scheme payments reduce), or it could wither away to nothing by the time the pensions are fully funded (last reported as expected c.2027, in the 2021 Annual Report). Short term headwinds on ad spending are becoming apparent. I don't have a strong view either way, as the pension situation is so highly material, little else matters. Digital growth story has stalled too.

OnTheMarket (LON:OTMP) (£69m) (I hold) [No section below] - an AGM statement today contains nothing new. It reassures on trading so far in FY 1/2023. This excerpt might be of interest, given that it's the latest property-related company to say that the market remains healthy -

"The Group has made a positive start to FY23, and trading has been in line with the Board's expectations. Notwithstanding the well-publicised macro-economic uncertainty, the fundamentals of the UK residential property market currently remain good, with market activity remaining high and demand for properties significantly outweighing supply."

I think many property-related shares look good value right now. Property prices go up in times of high inflation, not down. It's only when interest rates go sky high that property prices are impacted badly. No sign of that being likely, real interest rates remain massively negative, so fixed rate borrowings against property, at a historically advantageous negative real interest rate, makes a lot of sense to me. So I suspect the property market might remain buoyant. Just an opinion, could be wrong, as always!

Brighton Pier (LON:PIER) Up 6% to 86p - [No section below] - a positive trading update for FY 6/2022. This looks quite good. Ahead of expectations. £10.8m EBITDA (on what basis?) for H1, on revenues of £40.1m. Cenkos forecast adj PBT of £6.4m, EPS of 13.5p, but falling back to 9.0p in FY 6/2023. Net debt reducing rapidly, forecast £6.1m at year end. All divisions trading well. Looks good, but why decline in EPS forecast for next year? I’m intrigued, worth a closer look.

dotDigital (LON:DOTD) up 28% to 99p - [No section below] - TU for FY 6/2022. Revenues in line, at £62.8m (up 8% on LY). 94% recurring revenues (I’m impressed). As before though, the growth is driven by charging more per customer (ARPC up 17%), which again suggests customer numbers must be shrinking, to only achieve 8% total revenue growth. EBITDA & op profit (adj) both ahead of market expectations.Cash pile up to £43.9m (=15% of market cap). Strong Q4. and sales momentum continuing into FY 6/2023.

Thanks to Canaccord for an update note, they reckon it’s a 3-4% earnings beat. Does that justify a 28% share price rebound? I don’t think so, and with customer numbers still declining, how is this a growth business? BUT, if revenue growth (from a shrinking customer base) is now accelerating, it could be worth a fresh look, and a re-rating. Also, I like the big cash pile. Overall, I’m not convinced, but good luck to holders.

.

Graham's Section:

Animalcare (LON:ANCR) (£180m) - the H1 trading update for this animal products company is confident and in line with expectations. Revenues are flat/lower (depending on how you measure them) as the post-Covid spending boom could not be repeated. The company is focusing on higher-margin products but also increases R&D spending, and has some inflationary pressures. So there is no improvement in underlying profitability. I’m still waiting for a clean set of results from this company.

Franchise Brands (LON:FRAN) (£194m) - an excellent set of H1 results from this franchisor. It provides services to commercial kitchens and now includes the international operator Filta (FLTA). Revenues, profits, EPS and the dividend are all significantly higher, thanks to both organic and inorganic growth. I previously thought that this company’s shares traded too expensively, but I’m being won over. In addition to the attractive franchise model, with good cash generation, there is also a strong argument for synergies to be extracted from providing a wider range of related services.

Wickes (LON:WIX) (£355m) (-19%) [no section below] - this was supposed to list in 2019, but eventually floated during the Covid-induced DIY boom in 2021, as a spin-off from Travis Perkins (LON:TPK) . Today’s trading update starts promisingly and reports like-for-like sales growth of 5.4% in Q2 (so that H1 like-for-like sales are up 0.8% overall). But it then describes “signs of softening” in its markets, in more recent weeks.

Customers are “reacting to the uncertain macroeconomic backdrop” and “taking longer to commit to big ticket projects”. Full-year adjusted PBT is now expected in the range of £72-82m. At the bottom end of the range, that looks like a miss of up to c. 17% against consensus forecasts, helping to explain the sharp drop in the share price today.

The DIY retail sector is one of the most economically exposed. While business at Wickes has boomed recently, the high profit margins seen in FY 2022 may not be representative of a sustainable or average performance. Estimates can get cut very, very quickly and the volatility of trading may correctly justify the cheapness of these shares.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

SThree (LON:STEM)

395p (up 2% at 10:21)

Market cap £529m

SThree plc ("SThree" or the "Group"), the only global pure-play specialist staffing business focused on roles in Science, Technology, Engineering and Mathematics ('STEM'), today issues its financial results for the six months to 31 May 2022.

Sparkling H1 figures are published, unsurprisingly, given a series of strong trading updates this year. We flagged here on 20 June, that STEM shares looked excellent value, and an attractive entry point at 319p, after a series of positive trading updates, and steadily increasing broker forecasts -

.

STEM shares have already bounced 23% from our last look in June, and the 1m and 3m relative strength indicators have turned positive, as well as the 50-day moving average, for chartists -

.

Is sentiment levelling out?

.

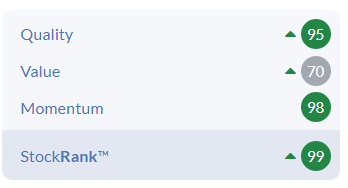

Also note the high StockRank -

.

Lots to like here - STEM is trading well, has positive momentum on earnings, a strong balance sheet, and a modest valuation. Hence why we like it here at the SCVR.

Some key numbers from H1 results -

Revenue £772m (up 26% on H1 LY) - includes pass-through revenues of contractors’ wages, as 77% is contractors (temps), with the balance being perms.

Net fees £203m (up 24%)

Strong across all regions - this is an international group remember, not just UK focused.

Profit before tax £44.3m (up 60% on H1 LY)

Strong rise in operating margin, from 17.1% H1 LY, to 22.0% this year - so presumably this means a tight labour market is enabling STEM to charge more.

Diluted EPS 23.4p (up 68%)

Interim divi of 5.0p (H1 LY: 3.0p) - policy is to maintain FY dividend cover of 2.5x to 3.0x - not very generous, considering the balance sheet strength - so there is capacity to pay more in divis, in my view - it’s always better that way around! Forecast divi yield is 3.3%

Fantastic numbers there, but are they sustainable, or is this an earnings peak? That’s key for valuing the shares.

Forecasts - Liberum helps us out with updated forecasts. Note that the company flags costs are expected to be higher in H2, so we cannot just double the H1 figures to estimate the FY 12/2022.

Latest forecast is -

£71.5m PBT, and 37.6p EPS for FY 12/2022 (a PER of 10.5),

rising to 41.2p for FY 12/2023, (a PER of 9.6)

The commentary from STEM suggests that it sees growth as structural, with ongoing strong demand for candidates with the necessary skills in its niche areas.

Also note that STEM is an international business, so you have a good geographic spread. I wonder about possible vulnerability in Germany, a big market for STEM, if its dependence on Russian gas hampers things this winter?

Outlook -

We are very pleased with the continued momentum in the business. Sales remain robust, with good new placement activity. Productivity levels remain high, even as we hire new heads into the Group, and we are executing very well against all elements of our strategy.

While mindful of the changing macro-economic situation, we are confident in the resilience of our business and the macro trends that underpin our continued growth. Our relentless focus on delivering the skills our customers require to succeed means we occupy an important role as trusted talented provider at the heart of their operations, a position we value and take great care to fulfil.

The addition of our strategic investments will provide us with an exciting opportunity ahead, though will impact on the conversion ratio in the very short term. We are well placed to build on our position as one of the leaders in the sector and continue to deliver very good growth for our stakeholders…

…This strong cash balance positions us well for the Group-wide strategic investments in our people, talent acquisition and digital infrastructure, which is weighted towards the second half of the year and will require significant expenditure over the coming years.

They’re calling it “strategic investments”, but being old-fashioned, I think I’d just call this: higher costs.

It’s in the forecasts already, so isn’t a new negative.

Balance sheet - NTAV of £176m is good, very robust. So dilution/insolvency risk looks negligible. This is confirmed by a “safe” Z-score, and earnings manipulation score is also low -

.

Working capital is healthy, with £391.2m of current assets (including cash of £48.4m), less current liabilities of £231.3m, a current ratio of 1.69 - good for the sector, where some competitors rely on debt, STEM doesn’t, so it’s safer.

There’s only £22.7m in non-current liabilities, being mainly lease liabilities.

Receivables (money owed to the company from its customers) stands out at a gigantic £342.5m. This is up 15% on a year earlier, which is not surprising considering revenues are up more, at 26%.

Reasonableness check on receivables - if we take H1 revenues of £772m, double it for a full year that’s £1,544m, add say 20% sales tax (because receivables are stated at full invoice value, including VAT or similar), that’s £1,853k annualised invoiced sales. Hence £342.5m unpaid at year end, is 18.5% of annual sales, times that by 365 days, and I arrive at debtor days of 67. There are probably some smaller items in receivables that are not trade receivables, so the reality is probably closer to 60-days payment terms. That’s fairly normal.

It does however mean that STEM is helping its clients cashflow, by absorbing costs (wages to contractors) before it gets paid by the customer - not ideal, but it can afford to do it with such a strong balance sheet.

I think a key priority would be to tighten up credit control, and persuade customers to pay more promptly. This looks a little slack.

Cashflow statement - reflects the big increase in receivables. Positive cash generation mostly ended up being absorbed into larger receivables on the balance sheet. That looks inevitable given strong revenue growth, combined with customers paying on c.60 days. Hence if revenue grows, then the business absorbs cash into receivables.

The reverse happens in recessions, working capital unwinds, and companies in this sector generate cash, as receivables reduce. We saw that happen in 2008-9, and during the pandemic. So it’s not a major concern. The cash hasn’t vanished, it’s just temporarily tied up in receivables.

Although I generally prefer businesses where the customer subsidises the company’s cashflow, rather than the other way around, in this case!

My opinion - I think STEM’s claims are convincing, that strong demand is structural for its niche of technical expert contractors. Hence it’s credible that demand could remain strong, even in tougher macro conditions.

For that reason, I remain of the view that this share seems good value.

Robert Walters (LON:RWA) is another good option in this sector, in my opinion.

A more bearish view would be to avoid staffing companies altogether, if you think a recession is coming.

See yesterday's SCVR, for an interesting reader discussion of this share.

.

Shoe Zone (LON:SHOE)

200p (up 8% in early trades, at 08:18)

Market cap £100m

Shares in this budget shoe retailer have been a rare standout performer in an otherwise very tricky sector.

We covered SHOE in my interview with Richard Crow (CockneyRebel) last Friday, here. We both rate this share highly, due to its strong performance in tough times.

A key point we both spotted a few months ago, was the broker forecasts seemed too low, relative to the trading updates being issued. That removed the risk of a profit warning, and made an earnings upside surprise likely. Which is what has happened today -

Shoe Zone is pleased to announce that since the publication of its trading update on 29 June 2022, trading has been stronger than expected due to higher than expected demand for summer products, particularly in the last two weeks. The Company has also continued to experience margin improvements as a result of good supply chain and cost management.

As a result, the Company now expects adjusted1 profit before tax for FY 2022 to be not less than £9.5m.

1 Adjusted to exclude the profit on the sale of freehold property and foreign exchange revaluations

Supply chain - this is very interesting. One of the reasons why both Richard Crow and I are bullish on some retailers now, is because they could now be seeing upside from supply chains easing, and freight costs from the Far East reducing. The stock market doesn’t seem to have factored this in, instead being obsessed with the consumer squeeze.

Many retailers took big hits last autumn, from excessive container shipping costs, often long delays to shipments, meaning the peak period inventories weren’t necessarily in the right place at the right time.

This year should see those problems easing comparatively, and retailers should have worked out how to get stock in earlier. Shortages often become gluts, so this is also quite encouraging with regard to the outlook for inflation, which I think should come down somewhat in 2023, as some of these negative inflationary factors start to feed through.

Hence it’s particularly interesting to hear SHOE confirm this idea, in saying that margins are now improving. SHOE makes particularly strong gross margins.

Demand - strong in the last 2 weeks particularly. Again, that doesn’t seem to be consistent with the daily deluge of doom from the BBC and others, about consumer retrenchment.

If products/services offer good value for money, they sell, even in recessions.

Latest guidance is now at least £9.5m for FY 9/2022. They’ll probably beat that number too!

Checking my previous notes here, it was only a month ago here that it last upped profit guidance, from £6.5m to £8.5m.

Back in May, I flagged up here that the forecasts looked clearly too low, and this share seemed excellent. Although my worries about low income consumers retrenching, has clearly not (so far anyway) happened.

Many thanks to Zeus for crunching the numbers through its spreadsheet, which comes out at 15.2p EPS for this year FY 9/2022, but a drop to 11.0p EPS next year.The valuation looks reasonable on this year’s forecast, but not so much on next year’s.

So shareholders need to hope that forecasts for FY 9/2023 end up being far too pessimistic. I can’t see any specific reason for Zeus’s caution on the FY 9/2023 numbers, but think it might be related to higher costs, and normalising of business rates, possibly?

My opinion - another terrific update from SHOE.

Given how cautious current year forecasts have turned out to be, shareholders need to be confident that the low forecasts for FY 9/2023 also end up being way too cautious.

So far, so good though. Well done to shareholders here, you’ve certainly picked a rare winner, in a bombed out sector. I would expect to see some people banking profits though, since it’s had a great run this year, and there’s still a lot of macro uncertainty.

As supply chains ease, and margins recover, we could see more retailers reporting better than expected progress from here. Although that depends which areas consumers decide to cut back on, when they feel the pinch in the autumn from another wave of food & energy price inflation that seems likely.

.

.

Stockopedia loves it, with the StockRank jammed on maximum -

.

Reach (LON:RCH)

85p (down 27% at 09:32)

Market cap £269m

The selling seems to be accelerating this morning, so I’ve moved this up my list of priorities. Reach had attempted to bounce a little in recent weeks, but has today given up all of that, and reached a new low for the year. Momentum has been terrible, and remember that the data is updated overnight, so these numbers will probably look even worse tomorrow -

.

Is it a buying opportunity I wonder? Also, remember that RCH seemed to get into a speculative bubble last year, with a lot of talk about it being an emerging digital advertising giant. There wasn’t enough hard evidence, from facts & figures, to verify that claim, so personally I treated it with a pinch of salt. Although am keeping an open mind, it might still happen, but we need proof, not aspirations & general chat on the subject.

So it could be the case that the negative share price momentum is just re-setting valuation back down to where it should have been all along - a highly cash generative, but cigar-butt type share, in a structurally slowly dying sector. Facing a cyclical downturn in advertising as the economy slows. With a massive pension scheme.

It’s amazing how the market can swing so quickly from glass half full, to glass half empty, isn’t it?. I wish I’d seen that coming, but was far too complacent last year, drunk with success, which the market has now quickly erased! We’ll get it back though, over time.

On to today’s figures -

H1 revenue of £297.4m is down 1.6% on H1 LY - remember that in a high inflationary environment, that’s a real terms fall of c.10%

The headline figures don’t look good - a big drop in H1 operating profit margin, from 22.8% to 15.9%, although last year was outstandingly good.

The main culprit seems to be higher newsprint costs, which rose from £25.2m to £38.8m in H1 (the commentary says mitigating actions will help newsprint costs in H2).

Other costs look well-controlled, which they have to be, in a declining sector.

Adjusted PBT is £45.9m (down 32% vs H1 LY) - a big drop in profit, but still a substantially profitable business, that’s just for a half year remember, so full year c.£90m, for a £269m market cap company remains impressive. Broker forecasts are actually a good bit higher than £90m profit, see further below.

Adjustments boost PBT by £13.9m, so statutory PBT is £32.0m. My concern is that the adjustments seem to be recurring, although £13.9m adjustments is a lot lower than £42.1m in H1 last year (LY), but similar in nature - including phone hacking that’s still rumbling on (there’s a £40.8m provision, which should be remembered is future cash leaving the business, to pay people off, and pay lawyers) - and restructuring costs, which I would argue are an ongoing thing, not one-offs, as the business has to downsize as circulation & ad revenues gradually fall -

.

.

Going concern statement - these are so useful, and I try to remember to always read them, not gloss over.

The downturn in digital demand in Q2 is mentioned.

Net cash of £43.8m, and no drawdown on the £120m bank facility (RCF), trumps other considerations, hence the Directors are on solid ground, adopting the going concern accounting basis.

Digital revenue is quite significant, but only grew slowly (+5.4%) to £72.5m, or £74.0m if we include recruitment website, which is 25% of total revenue.

A “marked slowdown during Q2” occurred with digital advertising. Hardly a surprise really, that companies are trimming their ad spending, that’s what happens when economic conditions tighten.

Pension scheme - as I’m always droning on about, accounting deficits are often meaningless, and usually horribly under-state the real world cash outflows required. So I’m ignoring the £69.1m accounting deficit, down £48.1m in the last 6 months. That may look nice, but it doesn’t matter, because cash outflows are not calculated using this number. As the last Annual Report told us (in note 20) -

Pension scheme accounting deficits are snapshots at moments in time and are not

used by either the Group or Trustees to frame funding policy. The Group and Trustees

seek to be aligned in focusing on the long-term sustainability of the funding policy

which aims to balance the interests of the Group’s shareholders and members of the

schemes. The Group and Trustees also seek to be aligned in reducing pensions risk

over the long term and at a pace which is affordable to the Group.

Actuarial deficit - this is what matters for funding. The Dec 2019 valuations have still not been agreed for 3 out of the 6 pension schemes. I don’t like this comment today over delays being due to -

…differences between the Group and the Trustees as to possible de-risking and the required pace of funding.

The cash contributions (which remember, are not accounted for in the profit figure, so this comes off profits) are still massive -

Group contributions in respect of the defined benefit pension schemes in the first half were £23.0m (2021: £37.1m), under the current schedule of contributions of the five schemes. Contributions in 2022 are expected to be £55.1m under the current schedule of contributions for the remaining five schemes.

The pension deficit is still a massive cash drain, and this is a big issue re valuation of the shares.

I think a lot of investors don’t understand this issue, and wrongly think that the accounting deficit of just £69m means that the problem is resolved. Yet the cash contribution this year alone, is £55m, not fast short of the entire deficit on the balance sheet! The real world deficit is probably hundreds of millions, which is missing from the balance sheet, due to pension accounting rules being unfit for purpose.

See the top of the cashflow statement, to see how much of the cash generation has to be put into the pension scheme -

.

The biggest items further down the cashflow statement, are -

£13.9m divis paid in H1

£17.1m deferred consideration paid

£4.0m internal development spending was capitalised

Overall, the cash balance fell from £65.7m to £43.8m in H1.

That’s fine, it’s not a problem, I’m just highlighting the key facts.

Balance sheet - NAV is £682m, which needs to be heavily adjusted to make sense.

First I would deduct the humongous intangible assets of £863.5m.

Pensions - there’s an asset of £94.4m, and a liability of £185.8m, which net off to a liability of £91.4m. I think the real world position is probably nearer £500m liability, so I’m going to add £409m in additional liabilities onto the balance sheet.

We can probably lose the £201.2m deferred tax liability too, as that normally relates to intangibles & pensions.

That results in my heavily adjusted NTAV being negative, at £(389)m. What does that mean in reality? The short term liquidity & working capital positions are fine, no issues there. However, in future years, it could well be that declining cashflows are increasingly absorbed into paying off long-term liabilities, especially the pension scheme, but also balance sheet provisions for things like phone hacking, property closures, etc.

This share is incredibly highly geared to pension scheme cash contributions. The delay to the 2019 triennial calculations, due to a dispute between the company and the trustees, worries me, and doesn't seem to augur well.

Hence dismiss the pension scheme at your investing peril. This is actually the biggest issue facing the company, in my view. £55m in agreed cash outflow for 2022, and they can’t agree subsequent years. I’d be very worried about that, if I held this share. It might turn out fine though, I don’t know the outcome, am just flagging the risk.

Singers comments today that the accounting deficit could close in just 2 years. If that is reflected in the actual cash contributions too, then that would be fantastic, but it doesn’t seem to work like that in reality.

I’m looking through note 20 in the 2021 Annual Report, and it says that the arrangement currently involves annual cash payments of £52m from 2022 to 2027. I make that £312m! So unless a much more favourable agreement is made with the 2021 triennial valuation (currently in dispute for 3 out of 6 schemes), then contributions look very high still.

Higher bond discount rates might reduce the actuarial deficit, possibly?

This is also said in the 2021 Annual Report -

At the reporting date, the funding deficits in all schemes are expected to be removed before or around 2027 by a combination of the contributions and asset returns. Contributions (which include funding for pension administrative expenses) are payable monthly. Contributions per the current schedule of contributions are for £55.1m pa in 2022 and 2023, £54.9m pa in 2024 to 2026 and £52.9m in 2027.

This is where the pension assets were held at end Dec 2021 (from note 20 in AR) -

.

The sensitivities of the pension deficit are so massive, that anything could happen, look at this -

.

If you think the pension liabilities could disappear, then that could present a buying opportunity for this share.

Even if the pension scheme deficit were to disappear, it could come back again, if the assets are not somehow locked in with the liabilities, e.g. through an insurance contract, or disposal of the scheme.

It’s way too complicated for my pay grade, and arguably this share is probably only investable for actuaries! The rest of us probably cannot reliably determine what is likely to happen next, which is highly material to how much the shares are actually worth.

Many asset classes have plunged in value, especially shares and bonds this year. Also RCH pension schemes holding £588m in cash doesn’t look too good, when inflation is eroding the purchasing power by 9% p.a..

Outlook - drawing out come key points -

We therefore expect total H2 digital growth to remain subdued.

Circulation will benefit from a full half of increased cover prices during H2, strengthening print revenues.

We expect a year over year improvement in total operating costs during H2, with the benefit of further strategically driven changes to our operating model and additional cost management actions mitigating the impact of inflation and preserving our ongoing investment plans.

We do not anticipate an improvement in the existing rate of newsprint during the second half.

In the context of an uncertain macro and political climate, we remain mindful of the risk of further deterioration in economic conditions.

We currently expect management actions and the natural phasing of our business, to support a stronger than historical H2 profit contribution.

Well that’s just confusing overall! I’ve read it three times, and in the circumstances, I think it sounds quite reassuring actually, so I’m confused as to why this has triggered a 29% share price fall, to 83p at the time of writing (12:19)?

Broker comments - let’s turn to the experts - Singers has put out a brief update on Research Tree, many thanks for that.

It’s trimmed operating profit forecasts by 11% for both 2022 and 2023, so fair enough then, this update is negative overall. That wasn’t really clear to me from the results RNS itself.

But the profit forecasts are still huge: £113.3m PBT (adj) for FY 12/2022, and a rise to £119.8m in 2023.

That’s EPS of 28.6p, and 28.0p.

So at 83p per share, I make the PERs 2.9, and 3.0! - a level that is so low, it’s flagging that there’s a problem. Net debt is not an issue any more, as it holds net cash, but clearly the pension scheme is a big risk.

Summarising -

Bear points seem to be -

- Pension scheme sucking out £55m p.a. in cash, which is about half forecast profits. So the PER is really more like 6, once this is adjusted for.

- Long-term decline of the sector, as we’ve known for 20+ years - it’s amazing that newspapers still exist really, and even more amazing that they’re so hugely profitable.

- By the time the pension scheme is fully funded (c.2027 according to 2021 AR, but that might have changed since), there could be little to nothing left, in terms of profitability or cashflows.

- Short-term decline in advertising revenue is apparent in today’s update, due to macro factors - could get worse - profit warning likely?

- How will circulation hold up in a tighter consumer spending economy?

- Is there a limit to cover price increases? I baulked at paying £4.50 for the Financial Times this weekend (buying 4 tins of Carling instead). The Mirror is up to £1 a copy now, which could be a psychological barrier to go above, in terms of demand holding up?

Bull points -

- Incredibly cheap PER, so if the pension scheme does get resolved in a positive way, then this share could soar from current levels, as much more generous divis could be paid in future.

- Digital is a decent chunk of the business, so if growth were to resume there, once we’re through this soft patch in the economy, the bull story could come alive again.

- RCH remains a highly profitable & cash generative business, with a dirt-cheap market cap.

Overall - for me, it all hinges on the pension schemes. The cash requirements for those are so material, that almost nothing else matters in terms of valuation.

Reach has proven resilient, and well able to manage costs, and increase cover prices, over multiple years.

It’s 83p currently, and I must admit to being tempted to have a nibble. Or it might be easier to just watch from the sidelines, and see where it settles?

.

.

Graham’s Section:

Animalcare (LON:ANCR)

- Share price: 300p (pre-market)

- Market cap: £180m

This company provides products for a wide range of animals - all the way from “Companion Animals” to “Production Animals” and Horses.

Spending on pets is a growth trend, so naturally the company’s current priority is to focus on the opportunity in this segment.

Today’s H1 trading update is in line with expectations. Some key points:

- Sales £38.3m, which is flat at constant exchange rates (down slightly at actual exchange rates). This is attributed to Covid volatility - very tough comparatives for last year, when markets reopened.

- Gross margins improving thanks to product mix, offset by higher R&D spending and staffing costs.

Net debt finished the period at £7.5m. Animalcare sees this as providing opportunities for further M&A and other investments.

It’s a confident RNS:

Despite the deterioration in macroeconomic conditions over the period we have yet to see a widespread negative effect on the veterinary pharmaceutical market and our business. However, we continue to carefully monitor the impact of inflation on costs and customer demand levels.

People cut back on lots of things in recessions, but spending on the health of their animals is presumably one of the last things that gets cut back?

My view - I used to think that this was a high-quality company, but its financial performance has been poor for several years now. I’m wondering if we could soon reach an inflection point, where real, healthy profits are generated at last?

Judging by its valuation, the market seems happy to judge it on the basis of the underlying figures it presents. On that basis, maybe we will get a clean set of results one of these days. I’ll reserve judgement for now.

.

Franchise Brands (LON:FRAN)

- Share price: 150p

- Market cap: £194m

These interim results have a joyous headline:

Trading in the first half of 2022 has been buoyant, at the top end of expectations, supporting a 50% increase in the interim dividend

During the period, Franchise Brands completed the acquisition of the international franchisor Filta (FLTA). This deal was described by Roland here.

I’m encouraged to read that instead of looking for any more deals, their main focus is on exploiting the deal they’ve just completed:

"In the near term, we are focussed on integration to capitalise on the opportunities the acquisition presents.”

Let’s take a look at some of the key figures from this report:

- Total revenue +60% to £44.5m, a mixture of organic and inorganic growth.

- Record organic growth, driven by commercial drainage company Metro Rod (revenues +17% in this division to £19.5m).

- There was also good organic revenue growth at Willow Pumps (+12% to £8.8m).

Note that under the franchise model of doing business, revenue numbers don’t necessarily reflect sales to end-customers. Instead, they often represent sales from Head Office to franchisees. That is the case with Filta and with Metro Rod, for example.

Overall profitability has leapt higher:

- Adjusted EBITDA +74% to £7.3m

- Statutory PBT +83% to £4.8m

- EPS +89% to 3.08p with the help of some non-recurring gains. Adjusted EPS is +51% to 4.07p.

The Executive Chairman confirms that the full-year performance is expected to come in at the top end of market expectations, and the consensus expectations are helpfully provided: revenues £91.2m, adjusted EBITDA £14m.

Net cash - the company reports net cash of £4.7m. It gets there by subtracting obligations under leases (£2.8m) from cash (£7.5m).

I think that few investors would begrudge FRAN if it ignored obligations under leases when calculating net cash (leases are a “non-financial” form of debt, and they bring operational benefits).

Personally, I would be happy to sign off on FRAN having net cash of £7.5m.

My view

There is a lot to digest in these interims, due to the acquisition, the many different moving parts, and the unconventional nature of the franchisor/franchisee reporting.

As I’ve read through it, however, I’ve warmed to this share. Whenever I’ve studied it before, it has always looked quite expensive to me. But I can’t deny that its cash flow generation is good. For example, it generated £5m of cash from operations in H1 - or £7.3m, before working capital movements. While I tend to distrust adjusted EBITDA, I don’t mind using cash flow numbers! And these are good numbers.

I also understand the attractions of running a franchise model. It’s possible to generate very high returns on capital by doing business this way.

Finally, the combination of Filta with the many different services already included within Franchise Brands is interesting to me. In addition to making cost savings, they also aspire to offer a comprehensive set of services for commercial kitchens. I’m curious to see how the synergies will work, in reality.

Peter Lynch used to look for companies like this (as summarised by someone else):

The name is boring, the product or service is in a boring area, the company does something disagreeable or depressing, or there are rumors of something bad about the company--Lynch likes these kinds of firms because their ugly duckling nature tends to be reflected in the share price, so good bargains often turn up. Examples he mentions include: Service Corporation International (a funeral home operator--depressing); and Waste Management (a toxic waste clean-up firm--disagreeable).

What could be more boring or disagreeable than fixing blocked drains or cleaning deep fat fryers?

I don’t know if this one is overvalued any more. Given its positive characteristics and trading momentum, it might be at fair value or even cheap:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.