Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Journeo (LON:JNEO) - 216p (pre-market) £36m - Trading Update (ahead) - Paul - GREEN

Another good trading update, with profit guidance raised about 5%. Positive outlook comments for 2024. This looks a decent growth business, still priced reasonably, so I like it - providing growth can be maintained, and the orders aren't one-offs.

Marlowe (LON:MRL) - down 17% to 417p (£405m) - Interim Results - Paul - AMBER/RED

The market doesn't seem to like these numbers - operating profit looks resilient, and is up, but higher finance charges from the excessive debt pile, and higher corporation tax, cause EPS to fall. The horrible balance sheet is a deal-breaker for me. It's now doing a strategic review, after making 36 acquisitions in under 3 years! All a bit extreme if you ask me.

IG Design (LON:IGR) - up 2% to 150p (£147m/$186m) - Interim Results (outlook in line with Board expectations) - Graham - GREEN

The bull thesis is playing out with much-improved cash generation, a year-on-year reduction in net debt, and no change to the company’s target for pre-Covid profit margins. I continue to view this one as too cheap relative to its prospects. Crucial Christmas period is coming up.

Paul’s section:

Journeo (LON:JNEO)

216p (pre-market) £36m - Trading Update - Paul - GREEN

Journeo plc (AIM: JNEO), a leading provider of information systems and technical services to transport operators and local authorities, is pleased to report an update on trading for the year ending 31 December 2023 ("FY 2023").

Strong H2, revenue now expected to be £46m for FY 12/2023, ahead mkt exps.

Order intake strong, and up on £27m last year - so good visibility into FY 12/2024.

Recent acquisitions (Infotec & MultiQ) trading in line with exps.

Sales mix - more lower margin products.

Adj PBT guidance is now £3.9m, ahead of mkt exps (by about 5%).

Balance sheet - nothing is said today, but at 30 June 2023 the balance sheet looked OK, with £5.3m NTAV. Note that the cash pile of £11.3m on that date had come from customer up-front payments, which might not necessarily always be the case, so I'd be careful about reading too much into the favourable cash position in the interims, as it might unwind possibly? I'll ask management about that at Mello. They should have updated on the current cash position in today's update, but didn't.

Outlook for 2024 sounds good -

Strong sales order intake in Journeo's core Fleet Operator Systems and Passenger Information Systems businesses continues and has surpassed the £27m achieved for FY 2022 giving good forward earnings visibility into FY 2024…

Margins are expected to increase in FY 2024 as the effect of component shortages in supply chains improves, delivery of delayed rail contracts and associated SaaS revenues commence, and the overall business mix changes as the Group's integration programme starts to deliver consolidated products design, unified software and integrated services to its growing international marketplace…

We have an increasingly compelling offering, which combined with continued government support and investment in the sector is delivering our growth plans together with ever more advanced solutions for our customers."

Broker update - Cavendish ups its FY 12/2023 forecast profit by 5% to £3.9m (previously £3.7m). This is 20.6p adj EPS, a PER of only 10.5x, which seems modest, assuming this level of profitability can be maintained, and orders are not one-offs.

Forecast for FY 12/2024 is also increased a little, 4% upgrade to £4.4m adj PBT, or 23.1p adj EPS, a PER of 9.4x - I’d say there’s probably upside on that PER multiple.

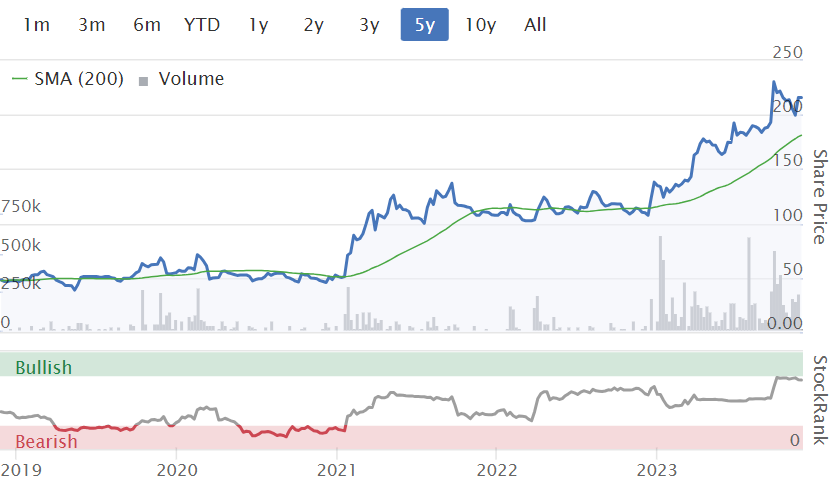

Paul’s opinion - this company really seems to be on a roll. The improvement in performance in 2023 is really striking, with revenues more than doubling, and profitability making a step change upwards from the many years of rather lacklustre performance in the past. This was driven by what seems a transformational acquisition.

This has already been rewarded with a more than 4x increase in share price, but looking at these numbers, I wouldn’t be surprised to see this share continue its up-trend.

Management are presenting at Mello Chiswick tomorrow, so I’ll try to have a chat with them to discuss the impressive performance.

My view, has got to be GREEN, since performance and outlook are strong, and the shares still look good value.

Marlowe (LON:MRL)

Down 17% to 417p (£405m) - Interim Results - Paul - AMBER/RED

Marlowe plc ("Marlowe", the "Group" or the "Company"), the leader in business-critical services and software which assure safety and regulatory compliance, announces its unaudited results for the six-month period ended 30 September 2023 ("HY24").

I’ll keep this brief, as Marlowe fails my balance sheet testing. When last reviewing it, my summary notes were -

28/3/2023 - Marlowe - down 4% to 480p (£460m) - In line exps TU FY 3/2023. Positive tone. But Paul dislikes overly indebted, weak balance sheet. Too many acquisitions done.

H1 key numbers -

Revenue up 13% to £251m

Adj PBT down 9% to £24.1m

Operating profit is up 9%, so it looks as if finance costs must have shot up - yes they’ve more than doubled to £8.9m cost in H1 (H1 LY: £4.0m)

Statutory loss before tax is £(8.9)m. Lots of adjustments, restructuring, etc. No wonder, as they’ve done a ludicrous 36 acquisitions since April 2021.

Net debt excl leases is up 23% to £192.7m - too high, and expensive now.

Strategic review - they’ve bought a load of businesses now they want to sell some, is how I read this - failed strategy maybe? Or bank putting them under pressure to reduce debt possibly? Placing maybe? -

The outcome of this review may or may not lead to the Board deciding to undertake a managed separation of certain Group businesses with a view to optimising the Group's organisational and capital structure…

This may be via a divestment in the form of a sale, a spin off or a public listing of certain Group assets. Such an action, if pursued, could potentially provide an optimised organisational and capital structure, growth capital for certain Group businesses whilst also enabling a potential significant return of capital to shareholders in the future.

Outlook - sounds mixed to me -

Going concern statement gives itself a clean bill of health.

Balance sheet - they seem to think it’s OK -

The Group looks to maintain a strong balance sheet that is commensurate with the high levels of recurring revenues associated with the business model.

But it’s not OK at all. NAV of £438m contains £667m goodwill & similar. So NTAV is nastily negative, at £(229)m. Being kind, we could eliminate £(55)m in deferred tax (usually related to goodwill), which leaves us with NTAV negative £(174)m.

This means there’s a nasty hole in MRL’s balance sheet, which is plugged by hefty bank borrowings of £193m (net of cash).

It’s true that recurring revenues software businesses can manage on a tight balance sheet, but even so, MRL takes it too far. That rules it out for me as a possible investment.

Cashflow statement - it’s not generating much cash, none in H1 actually, and not a lot last full year. The cash was mainly absorbed by restructuring costs and capex (including intangibles). There are no divis, and the mania for acquisitions is being funded by running up more debt each year.

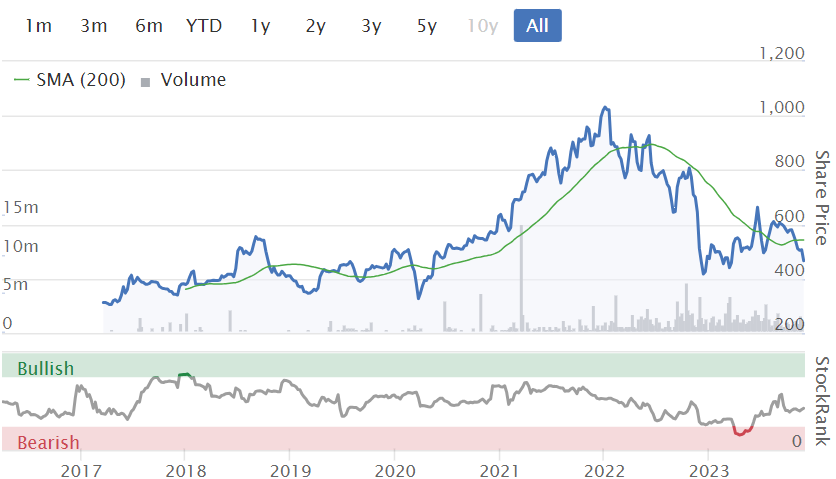

Paul’s opinion - I really don’t like these numbers, so I’m shifting from amber to AMBER/RED. It strikes me that management might have created something of a mess here, with acquisitions fuelled by too much debt, which is now costing a lot more in finance charges, and there’s no evidence of much cash generation from the enlarged group.

It looks cheap on a PER c.10x, but bear in mind the debt pile is about half the market cap, so simplistically adjusting for debt would push the PER up into the mid-teens.

More restructuring is now on the cards, so who knows what the outcome of that will be? Maybe there are some nice parts within this sprawling group of companies?

Software companies can command high valuations, so this could go either way. Anyway, it’s not of interest to me.

The chart shows the market has fallen out of love with Marlowe - company-specific, or just the general market malaise?

Treatt (LON:TET)

Up 1% to 456p (£275m) - FY 9/2023 Results - Paul - GREEN

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, announces today its audited results for the financial year ended 30 September 2023.

Pretty good figures here -

Profit is in line with management expectations, it says.

Adjustments to profit are larger this year, relating to the factory relocation & restructuring, which fair enough is a one-off.

That’s a PER of 19.9x

Dividend yield 1.8%

Net debt now modest.

Outlook - the new factory is now running, and provides a -

...strong platform to drive growth and efficiencies in the year ahead and beyond…

Having made significant investments in our infrastructure in recent years, we now have the opportunity to deliver improved operational leverage and gain further efficiencies from our modern facilities, and from our supply chain and procurement as the business continues to grow, utilising new capacity.While we remain cognisant of ongoing macroeconomic headwinds, we are confident in our strategy and in the strength of our teams and their expertise to deliver this…

Thanks to the drive and dedication of colleagues, the business is well-positioned to capitalise on its future opportunities. We have honed our cost base appropriately for the growth we expect in the next few years, and there are further operational efficiencies to be derived as volumes grow, which we expect to come from multiple categories and regions. Our core areas of expertise align with macro trends. Citrus remains a strong suit, with one in four new beverages globally based on those flavours, and we have some exciting new offerings coming to market across our portfolio. We are seeing signs of a return to growth in our largest geographical markets and are continuing to invest in China, where our burgeoning relationships and new business wins bode well for a healthy order book. By continuing to nurture what makes Treatt special, I am confident in the ability of our team to achieve our objectives for the years ahead.

Balance sheet - is excellent, very strong. NTAV is £134m. My main quibble is that inventories are way too high, at £62.4m. That compares very unfavourably with a whole year’s cost of sales of £103m on the P&L. So this balance sheet is tying up far too much in inventories, and excessive inventories can often be a lurking ground for problems. So this needs querying if anyone talks to management. Why aren’t they doing more just in time production? I would have expected inventories to be c.£20-30m tops, so £62.4m is way, way too high.

Cashflow statement - looks healthy. Note that there was a big jump in inventories last year, which has not significantly unwound this year. There’s a lot cash tied up in those inventories, so this is again my main query on the numbers. It makes sense that inventories might have been built up during the factory relocation, and during supply chain disruption, but why isn’t it now normalising?

Paul’s opinion - this story is developing nicely. I think the valuation still looks a little high, but that can be justified given the growth potential in both revenues and margins, provided by the new factory.

I’ve been following TET for years, and always complained that the share price was much too pricey for what was on offer. However, today I think risk:reward looks better than it has done for a long time. So this could be a reasonably good time to consider picking up a few of these shares, if your own research backs up my opinion.

I’ll go with GREEN this time, as things seem to be nicely lining up.

The hope is obviously that growth and margins might accelerate more than forecast, now the spangly new factory is operating.

Graham’s section:

IG Design (LON:IGR)

Share price: 150p (+2%)

Market cap: £147m ($186m)

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of Gift Packaging, Celebrations, Craft & Creative Play, Stationery, Gifting and related product categories announces its unaudited results for the six months ended 30 September 2023….

We’ve been following this potential recovery story for some time, and I’m pleased to see signs that the bull thesis may be playing out. We last commented on it in October.

I’ve highlighted the key features above: revenues down but profits up, and there is a huge reduction in net debt.

IGR say that the profit and margin recovery in H1 has been “ahead of the Board’s expectations for the period”. However, they leave full-year profit and margins expectations unchanged.

The large fall in revenues, as previously explained, is exacerbated by the fact that last year saw H2 revenues getting pulled into H1 by supply chain concerns.

This year, a more normal H2-weighted seasonality is expected, which means that H1 is weaker.

Outlook

On top of that, there is “continued uncertainty over consumer demand, and therefore ordering by our customers, given the current economic climate”.

The orderbook is weaker, a sign that “the retail environment continues to be challenging”.

So it is understandable that despite a strong H1 result, the company is not raising full-year profit expectations.

Here’s the really good news from the outlook statement:

Cash delivery over the year is expected to be above Board expectations

Remain on track for aspiration of pre-Covid-19 operating profit margin recovery by 31 March 2025

These are the key points of the investment thesis with this stock: that the company will deleverage and that it will return to pre-Covid performance levels.

The pre-Covid operating margin at IGR did fluctuate but was somewhere in the region of 5%.

The operating margin according to today’s statements is over 8%, but the company will need to follow that up with a robust performance in the seasonally crucial H2.

The cash flow performance is also remarkable.

Last year, the company suffered a $104m outflow in H1.

This year, the company has only suffered a $66m outflow in H1, i.e. there is an improvement of nearly $40m in the H1 performance this year.

That sets it up for an excellent full-year cash performance.

Estimates

Progressive Research have made some changes to their estimates this morning, which I find puzzling as the RNS from the company states that profits and margins for the current year will be in line with Board expectations. Perhaps the analysts are catching up with the changing views of the Board?

In any case, the new estimates from Progressive suggest revenues for the current financial year (FY March 2024) of $801m (estimate lowered by 3%) and adjusted PBT of $21.5m (estimate raised by 20%).

Year-end net cash is seen at $75m (estimated raised from $60m).

Given the hoped-for improvement in profit margins, adjusted PBT is seen rising to $37m in FY March 2025.

Graham’s view

I have no reason to change my positive stance on this one, as IGR keeps moving in the right direction operationally and financially.

The share price does not agree yet:

Converted to dollars, the market cap is $186m. If the company finishes the current financial year with $75m of net cash - admittedly this is a seasonal high - and if the adj. PBT estimate of $37m still seems reasonable for FY March 2025, then I see a lot of upside here.

Against that, investors need to weigh IGR’s vulnerability to consumer sentiment and economic conditions. And many of the companies we cover here can generate operating margins higher than IGR’s, so this is not a “quality” stock. But it might still be too cheap.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.