Good morning from Paul & Graham.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

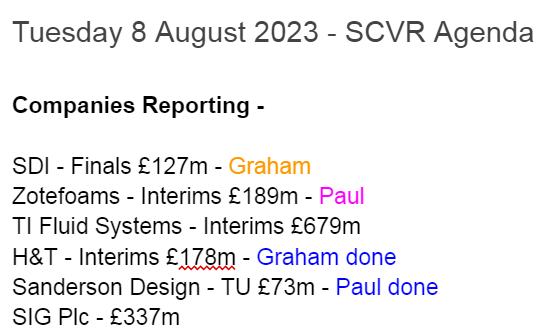

Summaries of main sections

H & T (LON:HAT) - up 2% to 410.4p (£178m) - Interim Results (EPS downgrade) - Graham - GREEN

The RNS doesn’t lay it out but there is an EPS downgrade from H&T’s broker due to a lower retail margin, higher operating expenses and higher interest costs. However, I believe that revenue growth and pawnbroking momentum remain very encouraging despite those points.

Sanderson Design (LON:SDG) - Up 2% to 104p (£74m) - Half Year Trading Update - Paul - GREEN

This luxury fabric & wallpaper group reassures again with an in line with expectations H1, and in line outlook for FY 1/2024. Strong balance sheet with plenty of net cash. Very low valuation seems to be anticipating a profit warning, which so far anyway has not materialised. Strong licensing profit is mopping up weakness elsewhere. I like it a lot, seems really cheap for quite a nice business. Thumbs up again.

SDI (LON:SDI) - down 1% to 122p (£127m) - Final Results (in line) - Graham - AMBER

This owner of a portfolio of scientific businesses reports an improvement in adjusted results, but statutory results are held back by impairments. Operational cash flow is promising and as this share price continues to drift lower it may start looking interesting to value investors.

Paul’s Section:

Sanderson Design (LON:SDG)

Up 2% to 104p (£74m) - Half Year Trading Update - Paul - GREEN

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group, is pleased to announce its trading update for the six months ended 31 July 2023.

Background - SDG is one of my watchlist top picks for 2023, but despite reassuring updates it’s about 10% down year-to-date (YTD). We never know why people are selling share, but I think it’s safe to assume that general macro worries must be weighing in sentiment, as it is with so many small caps right now. Is this a risk, or a buying opportunity? We don’t know in the short-term, but I’m pretty confident SDG shares should do well in the medium to long-term, as it’s a decent business, with sound finances, and strong management.

Here are my previous comments on SDG this year (all marked as GREEN) -

8 Feb - In line TU. Thumbs up from me.

22 Feb - Major new licensing deal with Next. Underpins forecasts.

30 Mar - Major licensing agreement with Sainsburys.

27 Apr - FY 1/2023 in line with expectations. Outlook also in line. I like it, but macro uncertainty.

22 Jun - AGM TU in line expectations. I like it L/T, not sure about S/T due to macro uncertainty.

This is today’s news - it’s another in line update -

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group, is pleased to announce its trading update for the six months ended 31 July 2023.

Strong performance from licensing underpins half year profitability

Company remains on track to meet the Board's full year profit expectations

A strong performance in the half year from the Group's high-margin licensing activities and encouraging growth in the US have mitigated the difficult market conditions in the UK discussed in the Company's AGM statement on 22 June 2023…

The strong contribution from licensing means that adjusted underlying profit before tax for the half year is expected to be slightly ahead of the same period last year (H1 FY23: £6.3m).

That all looks fine to me, I don’t think there’s any point in drilling down any further into the detail. Licensing is the stand-out performance, which is mopping up the shortfall elsewhere.

Net cash looks fairly static, and healthy, at £15.9m - which is significant for a company with a market cap of £74m. Hence I see little to no risk of dilution or insolvency, even in a downturn.

Outlook is mixed, but overall this reassures me -

Focus remains on the significant international growth opportunity in the US market and the growing pipeline of licencing opportunities, both of which will underpin trading in H2 FY24 and beyond.

The Group continues to benefit from a strong balance sheet and, whilst the outlook is uncertain, the Board's expectations for the Group's full year profits remain unchanged.

My opinion - I’ve been considering taking a starter size position here, but wanted to wait for a trading update, in case a profit warning might happen, reflecting tough macro. So far, that’s not happened, as we’ve got an in line update today, and they sound quite perky about the outlook.

For that reason, and with such a modest valuation (forward PER is only 7.4), I think this share has considerable appeal as a value investment, that should also re-rate upwards once the economy improves. It looks like a buying opportunity to me, and I might dip my toe in with a small opening position. Thumbs up. There's obviously still some macro risk, but I feel the low valuation provides for that risk. We can't avoid profit warnings, but in a balanced portfolio the good performers should offset the odd one that disappoints, that's what I'm finding this year so far.

Graham’s Section:

H & T (LON:HAT)

Share price: 410.4p (+2%)

Market cap: £178m

H&T Group plc (AIM:HAT), the UK's largest pawnbroker and a leading retailer of high quality new and pre-owned jewellery and watches, today announces its interim results for the six months ended 30 June 2023 ("the period").

I covered many aspects of this stock at the H1 update in July.

Here are the interim highlights:

Total revenue up 31% to £101.7m

PBT up 31% to £8.8m

Pawnbroking pledge book up 14% in six months to £114.6m.

In pawnbroking, redemption rates (i.e. customers repaying their loans and taking their items back) are “above historic levels, at c. 85% and have been consistent at this level for more than two years”.

Other parts of the business are doing well, too: retail sales are more than matching inflation (+11%) although the margin fell to 28% (last year: 42%).

The company gave us plenty of warning about this: they wanted to get certain luxury watches off their books “where we identified changes to the sentiment of some customers towards values”.

In its recent full-year results, Watches of Switzerland (LON:WOSG) said: “Luxury watch demand remains strong and continues to outpace supply, with our client registration lists extending and average selling prices growing.” So I don’t think there are any problems in the market for new watches.

Conditions in the used market have been more turbulent, and a helpful article from CNBC explains that the average price of a second-hand watch is down by 31% since March 2022. The hardest-hit brands are Rolex, Patek Philippe and Audemars Piguet.

From the article:

During the pandemic, many people who were stuck at home and flushed with stimulus cash took to luxury spending. With so many watch models unavailable at retail, enthusiasts flocked to the secondhand market.

It was interesting that the price hike mainly happened among three family-owned brands…

Now, individuals have been flooding the market with the very same inventories, dragging down overall prices.

In summary, there was a temporary boom in second-hand watch prices due to a shortage in new watches and the stimulus-driven/work-from-home spending spree. Cashing in some bitcoin winnings and buying a Rolex - thought to be another type of appreciating asset - was apparently a common strategy.

However, like other Covid-related disturbances, the impact of these trends may finally be coming to an end, as prices stabilise and new economic factors take on greater importance. H&T says that “overall, demand for high quality pre-owned watches remains high”.

Another key source of revenue for the company is currency conversion: currency volumes are up 19% and they have launched a “Click and Collect” service for customers.

Net debt increases from £3m to £17m over the six months. There aren’t many companies where I’m excited to see net debt rising, but I am in the case of high-quality, booming financial stocks. With a rapidly growing pledge book, it makes sense to borrow in order to fund this.

Operating expenses rose 19%, led by employee expenses which were up 21% (and account for the majority of operating expenses). Pay rises were implemented in January ahead of the new National Living Wage in April.

Outlook

The company has “a list of locations where we would like to open new stores”, but I’m relieved to see that store expansion has been modest. In H1, eight stores opened, and two closed, leaving the total number at 273. Over-expansion is a key risk in this industry!

A new point of sale system is growing in its functionality and will give H&T “a single view of the customer relationship across all products”.

For the retail website, “a major redevelopment of our online offering is planned”.

Funding - the company can now borrow £50m (up from £35m), although it must now pay a slightly higher margin over the benchmark interest rate.

Interim dividend - 6.5p (last year: 5p).

Estimates - broker Shore Capital has increased revenue estimates for all future years, thanks to continued momentum in the pawnbroking pledge book.

Their actions relating to profitability are more mixed, however.

The reduced retail margin, higher operating expenses and higher interest costs result in a 7% reduction in forecast adj. EPS for the current year, to 53.7p.

For next year, FY 2024, there is a 1% reduction in the adj. EPS forecast to 69.8p.

And they have increased their adj. EPS forecast for FY 2025.

Graham’s view

While it’s true that business is booming at H&T, the revised EPS estimates do give me pause for thought. Clearly, it is not all plain sailing, given those three headwinds which resulted in the EPS downgrade.

But then let’s remind ourselves of the value on offer here:

Not only is this stock offering cheapness on an earnings basis, it also offers asset backing with latest net assets at £167m.

And the quality isn’t bad. This will never be a company that earns sustainably high ROCE, but it does have the great habit of churning out profits year in, year out.

Therefore, despite a few headwinds and an EPS downgrade for the current year, I’m going to remain positive on these shares.

SDI (LON:SDI)

Share price: 122p (-1%)

Market cap: £127m

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing and control applications, is pleased to announce its final audited results for the year ended 30 April 2023.

I last looked at this one in May, on the day of a nasty profit warning which saw the shares fall by 21%.

It was yet another post-Covid normalisation story: the company was forced to write off the prospect of any further sales related to PCR (the Covid testing technology).

The shares have drifted further since that mid-May profit warning:

We have final results from the company as follows:

Revenue +36% to £67.6m (not organic growth and includes £8.5m of PCR revenues that won’t be repeated).

Adj. operating profit +5.8% to £12.8m

Actual operating profit falls from £10m to £6.8m, due to an impairment charge.

Scrolling down to the income statement, I see that the final profit for the year is £3.9 million, after interest expenses and taxes. That’s down from £7.5m last year.

The outlook is in line with expectations, the Chairman saying:

While we are mindful of the challenging external environment, we remain optimistic for the year ahead and we expect to deliver FY24 results in line with expectations."

Two acquisitions made during the year have “performed well”.

Organic growth is 0.9%, which is poor and worse than the figure disclosed for H1. Although if you exclude the declining PCR sales, organic growth is 6.4% - not too bad.

Goodwill impairment relates to two companies, acquired in late 2020/early 2021, which are less profitable now than they were in a Covid environment, and which need to be reorganised.

Outlook statement from the CEO is worth a read:

…Supply chain delays were prevalent in the first half of FY23. These still exist but have eased somewhat in recent months.

The market for acquisitions appears buoyant, and SDI expects to acquire additional businesses in the FY24 financial year.

The economic backdrop does remain a concern… However, SDI has started the FY24 financial year well and we are confident that we can continue to trade profitably and generate free cash flow over the coming financial year.

Funding: the CEO mentions higher interest rates on debt: the company finished the financial year with £13m of net debt, giving a net debt/EBITDA multiple of 0.9x (this would in general be considered a low-risk level).

At year-end, the company had drawn down £16m of its £25m facility at HSBC. To my eyes, that doesn’t leave a huge amount of headroom: £9m, plus £5m that might also be offered by HSBC through an additional facility.

The company says that it has enough funding to acquire new companies and invest in its current portfolio, but it spent £21m of cash on acquisitions during FY 2023. Another set of acquisitions of that scale in FY 2024 will, I think, require plenty of cash from operations to help fund it.

Balance sheet: net assets are £41m but are zero if you deduct the value of intangible assets.

Graham’s view: I continue to prefer Judges Scientific (LON:JDG) to SDI (LON:SDI) , but I think it’s important to study both and I also think there will be a level where SDI becomes an attractive value investment. Have we reached that level yet? Ultimately that’s up to you to decide, but from my point of view we might reach that level before too long.

Checking the cash flow statement (because the income statement is full of non-cash charges), I see the following:

£14.8m in (pre-tax, pre-interest) operating cash inflow before working capital movements (working capital movements were a drain on cash, but could improve in the current year). This is an improvement on last year.

Only about £1.5m was spent on capex/capitalised development spending. This is slightly less than last year.

Of course, we have to think about more than these two numbers, but they do say to me that SDI has the ability and the potential to generate substantial amounts of free cash flow.

I’m not ready to go green on SDI yet but I think it’s starting to look interesting at a sub-£130m market cap. I think I’d be very interested at a £100m market cap. For now I’m neutral. Any improvement to the organic growth figure would be highly encouraging.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.