Good morning!

Today we have:

- Next (LON:NXT) - trading statement

- Cenkos Securities (LON:CNKS) - acquisition

- StatPro (LON:SOG) - interim results

- Hargreaves Services (LON:HSP) - preliminary results

- FCA - statement re: CFD products

- GetBusy (LON:GETB) - half-year report

Next (LON:NXT)

- Share price: 5596p (-6%)

- No. of shares: 140 million

- Market cap: £7,817 million

(Please note that I currently own NXT shares.)

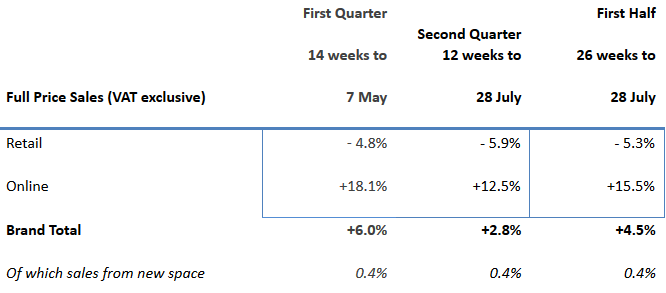

It's an H1 update from this retailer. The new bit is the middle column:

The sales growth in Q2 is not as good as Q1, although those Q1 numbers were remarkably strong.

The company puts the results in context: it had guided for full price sales for the rest of 2018 to be up around +1%. Therefore, this +2.8% result for Q2 is ahead of guidance.

But, since many of these sales have probably been pulled forward from August, Next is leaving full-year guidance unchanged.

We get a useful chart showing the performance of each week compared to last year - it shows that the first week of heatwave in 2018 saw sales up more than 25% against the same week in 2017.

The end-of-season sale went better than expected, but gains were offset by higher warehousing and distribution costs.

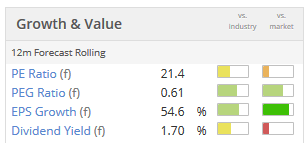

Cash flow & profit guidance: no change. 2018 PBT is still guided to be 1.3% below 2017 PBT, though EPS will be higher thanks to the completed share buyback programme.

My view: Share price weakness today reflects the fact that the company has been so conservative with its full-year forecast, implying that H2 is going to be much weaker than H1.

I'm happy to continue holding. This share fits my pattern of buying into large, leading companies where growth may have stalled in the short-term but where management are highly competent and the balance sheet and cash flows are strong. Next expects to generate £300 million of surplus cash this year and that's after paying ordinary dividends. And crucially, it looks like it will survive the ongoing transition to online sales.

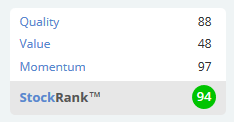

The algorithms love it:

Cenkos Securities (LON:CNKS)

- Share price: 92.5p (+0.5%)

- No. of shares: 55 million

- Market cap: £51 million

I've been mentioning this mid-tier investment bank a few times lately.

The share price has been struggling as revenue forecasts for the rest of the year have been slashed.

And then shareholder Crystal Amber came out swinging with the call for the entire company to be put up for sale.

Today we learn that rather than putting itself up for sale, Cenkos has instead made a purchase of its own: the Nomad/Broker business of Smith & Williamson.

The sale price isn't given, but I'm sure that Cenkos can afford it. I've not seen Smith & Williamson signing off vast numbers of RNS announcements. Six staff will join Cenkos as a result of the transaction.

I continue to suspect that a trade buyer (for example £NUM? it has a £450 million market cap) would be willing to pay a premium to the current share price to take over Cenkos. There has been speculation that one or two of these smaller banks might be thinking about or hoping to merge.

It's not my style to speculate on deals like this, as I've been hurt betting that deals would go through before. Nonetheless, I do think the Cenkos share price is near some interesting levels.

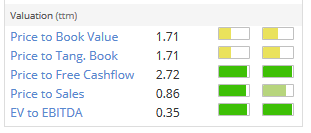

The trailing value metrics are extremely strong:

StatPro (LON:SOG)

- Share price: 162.5p (-5%)

- No. of shares: 66 million

- Market cap: £107 million

This company provides software to the asset management industry - very sticky customers who provide a dependable revenue stream.

Sadly, organic growth has been hard to come by and today it reports organic growth of just 3%.

It also has found it very difficult to convert adjusted EBITDA to pre-tax profits in recent years. Today, it shows £4.3 million of EBITDA and £0.9 million of PBT for the H1 period.

The use of EBITDA as a KPI looks questionable to me, as Statpro capitalises a lot of its spending on intangibles - so if you focus on EBITDA, you never take into account this spending.

A more interesting KPI is the ratio of a customer's lifetime value (LTV) to the average cost of customer acquisition (CAC).

The big acquisition Statpro made ("Delta") has reduced the group's overall ratio of LTV:CAC, implying a lower general rate of profitability in future. Though Statpro still reckons it is well above the industry average.

I've been sceptical of the Statpro market cap for a while and don't seen any reason to change my tune today.

Showing weak organic growth, a balance sheet stuffed full of intangibles and £23 million of net debt, I don't see why the share price has remained supported around current levels for so long.

Hargreaves Services (LON:HSP)

- Share price: 353.5p (unch.)

- No. of shares: 32 million

- Market cap: £113 million

Hargreaves Services plc (AIM: HSP), a diversified group delivering key services to the industrial and property sectors, announces its preliminary results for the year ended 31 May 2018.

This is an unusual conglomerate with a lot of asset backing and where earnings have been volatile. You can find some decent coverage of previous results in the archives.

Trading has been in line with expectations.

The group remains too complicated for most investors to be bothered with, and it continues to trade at a discount to net assets of £136 million.

Management have made some progress in winding down and disposing of legacy assets, "with the majority to be realised by 31 May 2019".

These lines sound interesting:

- Independent property valuation confirms £20m market value uplift and a further £28m development value uplift

- Total property valuation uplift equates to 129p per share

As for the earnings performance, there is a small operating loss on a reported basis, but this is after lots of items that the Board considers to be "non-underlying" or "exceptional".

I'm a little disappointed that net debt is so high (£31 million). It has previously been promised to reduce.

If we scroll back to February 2017, management promised that net debt would fall to less than £10 million. That didn't happen.

Moving forward, HSP intends to continue running the following divisions:

- Distribution & Services - This consists of "Production & Distribution", "Industrial Services" and "Specialist Earthworks".

- Hargreaves Land - a property developer and regeneration specialist.

It still feels too complicated as a structure, and the sectors don't excite me anyway (coal distribution, construction engineering, etc), so I might cease coverage of this stock from now on. If you fancy digging around for an asset play with it, you won't have much competition.

Financial Conduct Authority

Statement re: CFD products - this struck me as negative news for the CFD providers but their share prices haven't reacted much. The FCA is preemptively warning companies not to provide "substitute products", with similar leverage to CFDs, as a way of getting around ESMA's leverage restrictions.

When recently covering IG Group (LON:IGG) (in which I hold a long position), I noted the firm's reference to

"new, alternative, OTC leveraged derivative products under development that are compliant with regulations and that will be attractive for retail clients".

My interpretation of the FCA's statement today is that trying to work around the regulations is probably not going to work. If firms such as IG create products that share similar features with traditional products but are exempt from the rules, then the FCA/ESMA will ban those new products, too.

So if UK/EU retail customers want to trade the FTSE at 100:1 leverage again, for example, their only long-term option will be to use unregulated brokers operating outside the EU. It won't be possible to find any alternative products offering this at regulated brokers.

GetBusy (LON:GETB)

- Share price: 51.5p (-6%)

- No. of shares: 48 million

- Market cap: £25 million

This is a new one for me. It's "a leading document management software business".

The numbers reported today are unattractive. The only way it can present a positive earnings number is if it uses "adjusted EBITDA before development costs".

And even by that measure, it only generated £780k of earnings, less than it generated in H1 2017.

More positively, if you also exclude "corporate costs", which have increased following the company's IPO, then adjusted EBITDA (before corporate costs and developments costs) is up 33% to £1.3 million. But of course that is a very heavily manipulated number.

I'm expecting that there is a lot of growth and expansion baked into expectations, to justify a £25 million market cap.

The top line grew at a good pace: up 18% (at constant currencies), compared to a year ago.

One of Getbusy's major products, "SmartVault", has been launched in the UK and Australia as recently as last month (it is said to be long-established in the USA). This sounds like it could be an important source of growth. GDPR compliance has been a tailwind.

Coincidentally, Getbusy references its LTV:CAC ratios for SmartVault (see the section on StatPro (LON:SOG) above). It says "both the US and Australia have virtually pure-play subscription models, enabling us to benefit from favourable LTV:CAC ratios to build a strong, growing recurring revenue base".

LTV:CAC has improved to 5:1, suggesting an improvement in the long-term outlook for profitability.

My view - it's too speculative for me, but I can see that there is potential for SmartVault to roll out successfully in new regions and for the company to benefit from a growing base of recurring revenues.

Paul previously mentioned the balance sheet when he covered this stock, and it's worth a mention. The latest position is as follows:

- Intangibles & PPE: £700k

- Receivables £1.7 million

- Cash £2.4 million

- Trade Payables (£1.65 million)

- Deferred Revenue (£4.7 million)

Leaving the non-current assets (intangibles and PPE) to one side, the company only has c. £4 million of current assets to protect it from £6.3 million of current liabilities.

However, most of the current liabilities are in the form of deferred revenue, and are therefore non-cash (clients paying upfront for products and services)

Given the company's very low historical COGS, I would hope that the future cash outflow associated with satisfying these liabilities will also be very low.

So I don't think there is any current distress, but it's just something to be aware of. When you have a company that is in negative equity and is loss-making, you need to check how vulnerable the balance sheet is. Because most of its liabilities are in the form of deferred revenue, I think Getbusy has some headroom.

I've checked the most recent annual report, and I see that the auditors have been investigating certain matters to do with revenue recognition and the capitalisation of the development costs.

This seems like an interesting quote, recorded as a "Key Observation":

We note that there is insufficient evidence available to support the reliable measurement of development costs capitalised in previous periods.

It's generally impossible to know for sure what intangible assets are worth, but I would take this as a sign that Getbusy's intangibles are particularly mysterious.

I'll keep an eye on this share going forwards, and see if it can evolve into something a bit more blue-chip.

I might call it a day there. Thanks for dropping by.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.