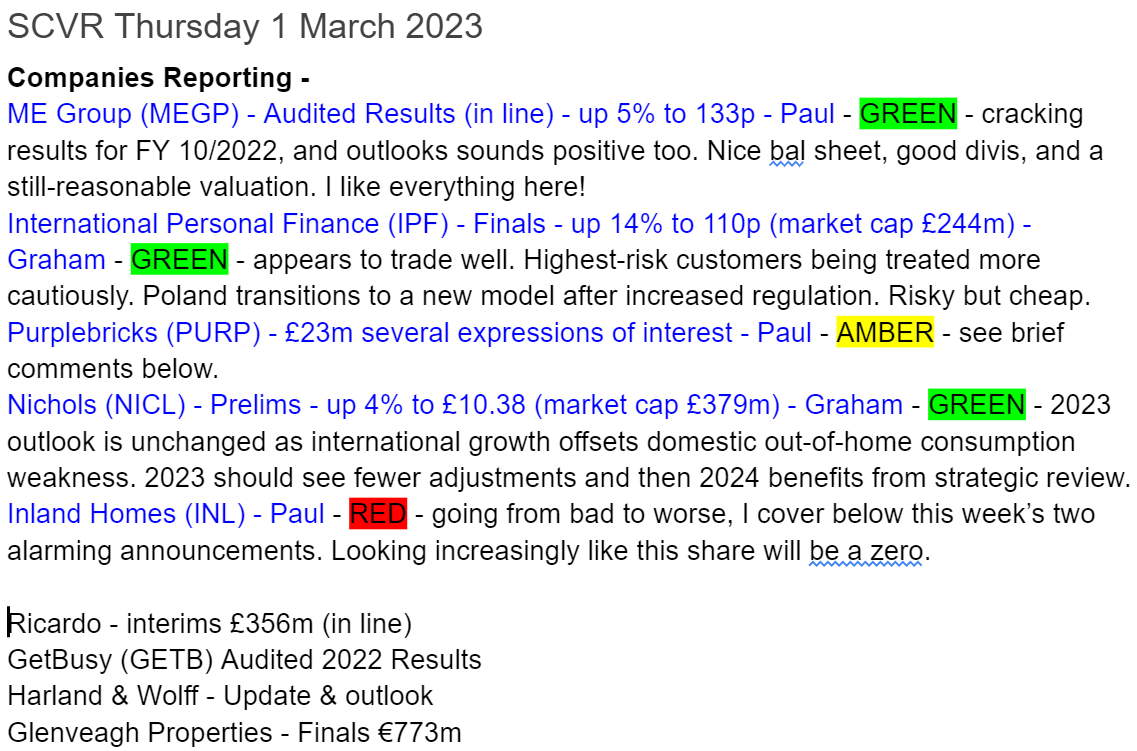

Good morning from Paul & Graham!

I'm not very good with dates, as you know. For some reason I thought it was Thursday until about my third cup of coffee. Now corrected!

I'll sign off today's report, as I need to move on to watching an IMC webinar from Beeks Financial Cloud (LON:BKS) (I hold). However. I've got some spare time later today, so will prepare some backlog items for tomorrow's report.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

£INL

Quick comment. This is looking increasingly likely, by the day, to go to zero,. Yesterday it said that more time is needed to complete the audit for FY 9/2022 accounts. I imagine PWC are probably having a feast on the fees. It’s hoping to publish accounts some time in March 2023. Today we’re told the Chairman & 2 NEDS have resigned. The Chairman stays on the Board for a maximum of 2 weeks, to allow time to reappoint a new Director (to avoid a breach of the Articles, which would require shares being suspended). Ironically, it says Stephen Wickes is returning to the Board (I suspect he’ll end up presiding over the collapse of the company he ran so badly for years).

My opinion - it’s been a bargepole job for me for a long time. I can’t see it lasting much longer, and the numbers cannot be relied upon. So it’s safest to assume the shares could be worth nothing. Hence purely now for gamblers only.

ME International (LON:MEGP)

133p (up 5% at 08:49)

Market cap £502m

Me Group International plc (LON: MEGP), the instant-service equipment group, announces its results for the 12 months ended 31 October 2022 ("FY 2022" or the "Period").

Highly attractive numbers in the highlight table, especially the big increase in profitability, and extremely generous dividends, whilst retaining a healthy net cash position. Really impressive stuff (hence why the share price has been so strong, as good results were flagged in advance) -

Reasons given for profit rising strongly - good demand, and price rises.

Outlook - no surprises here, it’s in line for FY 10/2023 so far -

Whilst still early into the financial year, the Board has seen a continuation of positive trading momentum and as a result, the Board anticipates that results for FY 2023 will be in line with current market expectations*, subject to any changes to the broader macroeconomic environment

* The Group's compiled analysts' consensus forecast for the financial year ended 31 October 2023 shows revenue of £284.8m, EBITDA of £91.1m and profit before tax of £58.5m.

Confusingly, the outlook section then gives the company’s own guidance, which is higher than market expectations. That seems to contradict the in line statement above, because the numbers below are higher than market expectations above -

Unless there are major changes to the macroeconomic, the Board remains confident in the Group's long-term growth opportunities and its ability to deliver its key strategic priorities. For the 2023 financial year, the Board expects the Group to achieve revenue between £280 and £300 million, EBITDA between £95 and £105 million and profit before tax between £61 and 65 million.

Valuation - I’m working from the adj, diluted EPS figures in this morning’s update note from Finncap (many thanks), and the current (at 08:50) live share price of 133p -

FY 10/2022 actual: 8.9p = PER 14.9

FY 10/2023 forecast: 11.6p = PER 11.5

FY 10/2024 forecast: 12.9p = PER 10.3

That strikes me as a reasonable (cheap, even) valuation, despite the strong share price of late. This share has roughly doubled in the last year, and I think that’s fully justified. This strikes me as a rise that is likely to stick, and continue, rather than a flash in the pan. But that is obviously dependent on future events, which as always, are unknown - investing is after all, educated guesswork to a considerable extent.

Divisional analysis - this was previously a bugbear of mine, that it wasn’t possible to see where the profits came from. This matters, because the photo booths part of the business has always had questionable longevity (although it’s lasted much longer than people expected - I remember the same conversation about 20 years ago!)

Things are much better now, with full transparency. MEGP comprises 2 main divisions, with the photobooths the key part, but the expanding laundry business now rapidly catching up, and it’s also higher margin. The other parts are financially almost insignificant (although I’m keen to try out the pizza vending, and orange squeezing machines, providing they are clean!)

Many thanks to Finncap, whose forecasts contain a table showing revenues & EBITDA for each division.

For FY 10/2023, photo booths are expected to generate EBITDA of £53m, laundry is £38m - which makes laundry a lot more significant than I realised. It’s growing strongly too, with a roll-out, and laundry makes an EBITDA margin of 50%, strikingly higher than the other divisions (including photo booths) which are 30-31%.

I think this higher margin, growing laundry business, deserves a higher rating than the more mature photo booths business. Note also that the next generation of photo booths is being rolled out, so capex will increase, and that might reduce the ability to be quite so generous with divis in the short term, maybe?

Balance sheet - NAV is c.£100m, which is very similar to the fixed assets figure. Hence the machines are basically funded with equity, which I like.

The rest of the balance sheet is dominated by the £136m cash pile, which is largely offset with loans of £82m (over 1 year), and £36m (under 1 year). This looks inefficient in terms of interest payable, so I cannot understand why the finances are structured like this. Surely it would make sense to save millions in net interest payable, by repaying at least some of these loans using surplus cash? If anyone speaks to management or advisers, this would be a key question to ask. There’s bound to be a reason for it, people running a highly successful business like this aren’t stupid.

Cashflow statement - very straightforward. It generates a ton of cash, which funds heavy ongoing capex, and big divis to shareholders. Increased debt was offset by increased cash, so there’s no worry about debt funding divis (which it isn’t).

My opinion - this is such a good business. I’ve enjoyed going through these numbers. As regards the photo booths business, the worry has always been people switching to submitting photos from their smartphones, thus removing the need for travel booths for ID purposes. Opinions vary on this, with some people pointing out that it can be quite a faff getting the photo exactly right for submission to authorities. I found this when doing my recent passport application, and ended up having to rig up a tripod in the communal hall outside my flat! It would have been so much easier to pop down to ASDAs and just use the photobooth there.

I’m really impressed with the size, growth, and margins of the laundry business. This share is no longer a binary bet on photo booths. Plus there’s growth potential from the other, smaller activities.

Wrapping it up, my personal opinion on this share is very positive. A firm thumbs up from me. If I held, I’d be trying to resist the temptation to bank the profits. I could see this getting up to 200p+ in the fullness of time. Providing nothing goes wrong of course.

Stockopedia's algorithms are strongly positive, with a top notch StockRank of 93.

Purplebricks (LON:PURP)

7.6p (pre market) £23m

Formal Sales Process (FSP) underway (previously announced 17 Feb).

“Several credible expressions of interest”.

Still possible that it may remain an independent, listed company.

Not currently in receipt of any takeover approach.

My view - often when companies put themselves up for sale, competitors get involved just to have a good look through the books. It would be interesting to hear the stats on how many FSPs actually result in a takeover deal. My hunch is that the answer is - not many. Personally I don’t see a lot of value in PURP, although it does still have plenty of cash, which is quite unusual in an FSP situation. Plus there's probably some value to the brand name. So who knows, holders might get a decent outcome, or they might not. It’s just a complete punt at this stage.

Graham’s Section:

International Personal Finance (LON:IPF)

Share price: 110p (+14%)

Market cap: £244m

This is a specialist lender, offering home credit and online loans to customers across Eastern Europe, Mexico and Australia (although not every product is available in every country).

They offer loans to customers on “low-to-moderate incomes including those with limited or no credit history, as well as customers who are regularly refused credit by banks”.

IPF shares lurched into what I considered to be bargain territory in late 2022 (see my October comments). They have since made a recovery:

During that 2022 sell-off, I noticed that IPF’s retail bond offered potentially very good value, and might also be worth a look. The December 2023 bond (ticker:IPF2) was yielding over 12%, with just over a year until maturity.

The yield on that bond has since tightened up, and it has been superseded by a new December 2027 retail bond. The yield on that bond (ticker:IPF3) is in the region of 12%, but with a 2027 maturity it does require a more significant level of trust in the company.

Anyway, that’s enough background. Given the recent share price strength, the market has clearly rediscovered its faith in IPF. Let’s see what these full-year results for FY December 2022 have to tell us.

Highlights:

Net loans/receivables up 14% to £870m (this is calculated by subtracting £500m of loss allowances from £1.37bn owed by customers)

Reported PBT up 14% to £77m

Full-year dividend up 15%

Impairment rate (as % of gross receivables) is 8.6%, up from the exceptionally low 4.9% in 2021.

Company commentary on the impairment rate:

This metric continues to be lower than pre-Covid-19 levels and has benefited from improved credit quality and strong execution on debt sale activity and post-charge off recoveries, delivering c.£15m more customer repayments than 2021. We expect our Group annualised impairment rate to rise to around 14% to 16% as we regrow the business and the Covid-19 period flows out of the calculations.

It’s worth noting that total customer numbers actually fell by 3% year-on-year, after the company tightened up its lending criteria for the highest-risk customers.

Balance sheet

There are balance sheet net assets of £445m (up from £367m year-on-year). So that’s 80% higher than the latest market cap.

The company has borrowed £554m and has further headroom of £76m. They say that their funding requirements are met “into 2024”, although they are also actively looking for new sources of funding.

It makes sense that they would continue to consider all their options when it comes to raising capital. Their cost of funding has risen to 13.3%, reflecting the general rise in interest rates. They have junk credit ratings from both Fitch (BB-) and Moody’s (Ba3).

Regulation

Poland has introduced a cap on non-interest fees to 45% of loan value, down from 100% previously. This went into force in December. There will also be new affordability rules and increased supervision.

IPF has responded by switching focus to digital instalment loans and a new credit card product. Customer representatives “will continue to visit their homes regularly to provide service and collect repayments. We have issued almost 10,000 cards and, encouragingly, the rollout is tracking ahead of our plans.”

Outlook

It’s a balanced outlook statement. An excerpt:

In 2023, our focus will be on transitioning our Polish business to the new lower TCC [total cost of credit], rolling out mobile wallet and continuing the very successful territory extension plan in Mexico home credit. We will also maintain strict control of costs and we see further opportunities to drive operational and structural cost efficiencies.

We have a strong balance sheet and robust funding position with headroom on our funding facilities to support our business plans into 2024. As previously outlined, we expect overall Group receivables growth in 2023 to be more modest and our returns to moderate as we transition the Polish business under the new lower TCC.

My view

I need to wrap this up now. My bottom line view is that I continue to find this one interesting at the current valuation.

Some bull and bear points to summarise my view. Bull points:

Impairment rate is still acceptable despite the inflation which will be affecting many of IPF’s customers.

With the help of that reasonable impairment rate, profitability remains very high.

Management are focused on excellent metrics which include an internal ROE calculation (15%-20%), payments to shareholders and balance sheet strength.

Balance sheet net assets 80% higher than the market cap.

The other value metrics are also very tasty:

Bear points:

It’s inherently risky to invest in Eastern Europe and Mexico without local knowledge.

The average cost of debt for IPF of 13% is very high and reflects that debt markets treat it with great caution.

The junk credit ratings also reflect the high level of caution from debt investors.

Small changes in the impairment rate could have a very large impact on profitability. Remember that the company’s net receivables of £870m are stated after making a bad debt allowance of £500m.

Increased regulation is always a concern, and the Polish market is likely to be less profitable in future years as a result of the cap on the total cost of credit.

I have five bull points and five bear points. While I might live to regret it, I’m going to give this company the thumbs up. It’s a high-risk investment but there is just too much value on offer here, and not enough that is obviously wrong with it.

Nichols (LON:NICL)

Share price: £10.38 (+4%)

Market cap: £379m

This soft drinks group also produces results for the full-year ending December 2022.

Key points:

Revenues +14% to £165m

Adjusted PBT +14% to £25m

Actual PBT £14m

The adjusted numbers produce 27% ROCE, while the actual numbers produce 14% ROCE.

The “exceptional” items add up to £11m of costs. These include:

£1.5m to review and change the company’s supply chains. This project has resulted in new five-year manufacturing and distribution arrangements. While the amount spent on this project was unusually large in 2022, I’m not sure if it is a truly “exceptional” expense.

£0.5m to review the company’s “Out-Of-Home” route to market, with a view to improving profitability. More costs related to this project will be incurred in 2023. I think this is a very important mission and I hope that it finds success. But as with the supply chain review, I don’t consider it to be a truly “exceptional” item.

Impairments of almost £9m to both intangible and fixed assets. This flows from deterioration in the Out-of-Home division as trading in Cinema, Holiday and Theme Park venues has seen a “significant volume decline” versus pre-Covid levels. The impairment also reflects an increase in the company’s estimate of its own cost of capital (from 8% to 13%).

I do accept that these impairments are truly one-off in nature and it’s fine to adjust them out of the results. However, it is another reminder, if one were needed, to be wary of balance sheet values - not just intangible assets, but also fixed assets are often vulnerable to writedowns!

Cash flow and dividends are both healthy.

Free cash flow is still good at £14.6m, although lower than last year, as cash conversion reduces to 72% (from 103% last year).

The full-year dividend increases 20% to 27.7p. Half of adjusted EPS is being paid out to shareholders.

The company ended the year with a cash balance of £56m. That’s material given the market cap is less than £400m.

Balance sheet net assets are now £89m, down from £93m last year. With intangibles and fixed assets having been written down, this is a very liquid balance sheet with few liabilities and over £100m of current assets.

Strategic highlights - Vimto has outperformed the broader dilutes market by 2.3%.

Outlook - FY 2023 adjusted PBT is seen in line with expectations. Weakness in the Out-of-Home division will be offset by strength in International trading.

With a long-term track record of growth, a proven and diversified strategy in the UK and internationally, a quality range of brands and a strong balance sheet, the Board remains highly confident that the Group is very well positioned to deliver its long-term growth plans.

The consensus estimate is for an adjusted PBT of £25m in 2023, i.e. the same result as in 2022. Hopefully there will be fewer adjustments this time! The intangible assets have already been written down, and one of the strategic reviews has been completed already, so it should be a cleaner result in 2023.

My view

I’m in the camp which says that margins should normalise as inflation feeds through the system. I also note the company’s strategic reviews which are explicitly focused on improving margins and profitability.

The company has today published the actions it will take to improve the performance of the Out-of-Home segment. These include running it as a distinct division within Nichols, exiting underperforming contracts and categories, and improving financial reporting so that divisions and regions must report their ROCE.

Since my suspicion is that margins will improve, and since the management team is so focused on making it happen, I have to give this company the thumbs up. Even at the current, somewhat muted level of profitability, the PER is only around 20x. In my view this is a good price for a cash-rich, consumer-facing business with excellent heritage and a fine chance of seeing profits and returns improving in the years ahead.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.