Good (Tuesday) evening, Paul here. This is a placeholder article for Weds morning's RNSs, so that readers can post your comments in advance of me writing the main report. See you in the morning! Best wishes, Paul.

Good morning! Paul here. I'm a bit pushed for time this morning, as I have an investor lunch shortly. So I'll work through as many stocks in the header as possible, and then finish off any stragglers this evening.

Next (LON:NXT)

(at the time of writing, I hold a long position in this share)

Q3 trading update - not a small cap, I know! However, traditionally I report on this company's updates, as they're so full of useful information, and have read-across for the general retail sector.

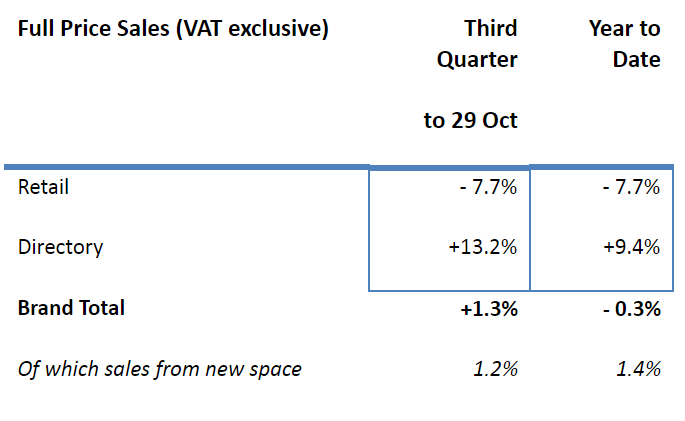

The continuing trend for Next is that its shops are struggling, but its Directory business (a lot of which is online now) is doing really well;

Full year (y/e 31 Jan 2018) profit guidance remains unchanged, but the lower & upper ranges have both been tightened by £5m.

EPS forecast is now in the range of -10.0% to -3.5% versus last year, little changed from previous guidance.

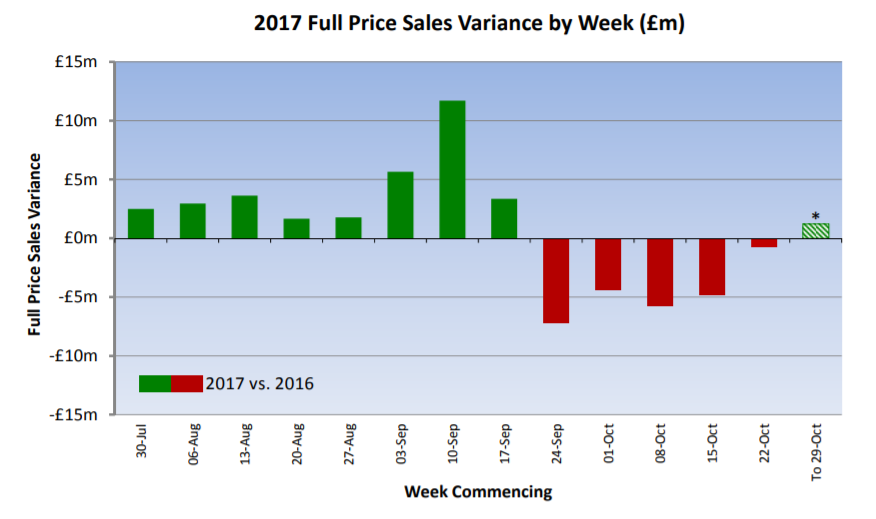

This is probably the most interesting graphic, showing a sharp recent slowdown in sales

No doubt some people will want to blame this on Brexit. However, it's actually due to the weather;

It can be seen that sales performance has remained extremely volatile and is highly dependent on the seasonality of the weather. In August and September sales were significantly up on last year, as cooler temperatures improved sales of warmer weight stock. The change in sales trend came at precisely the same time UK temperatures became warmer than last year

Normally I scoff at retailers blaming the weather. However, in this case, Next has a well-deserved reputation for being absolutely straight with investors. Next tends to tell it like it is, hence why its updates are so worthwhile to follow.

A friend (former fashion retail FD) flagged to me yesterday that John Lewis's weekly sales data showed a sharp slowdown in recent weeks. So he correctly forecast that Next would likely show a similar recent deterioration in sales. I owe him lunch actually, as his warning yesterday promoted me to sell half my Next. I've bought them back this morning, because the initial 7%+ drop in share price looked wrong to me. Short term weather-related blips can provide buying opportunities with fashion retailers.

My opinion - I remain very positive about Next. It's a hugely cash generative business, and the divi yield is remarkable, if you include the quarterly special divis on top of regular divis. Plus there is another £50m this year for share buybacks (half done).

Sceptics see it as a declining business, and there's some merit in that view - profits are falling, after all. However, I see it as a successful eCommerce business, with a bank thrown in for free, and a declining but still highly profitable store portfolio. Rents are coming down on the stores, so it's not a foregone conclusion by any means that profits will vanish.

I see the future of the High Street being all about drastically lower rents, and some space being converted to residential. Next has fairly short leases, so it should be able to navigate more difficult markets fairly well. Also bear in mind that online fashion retailers have a 40% returns rate, whereas physical retail is much, much lower (sub 10% in my experience). So that's one of the reasons why online fashion retail is actually tougher than people think.

Begbies Traynor (LON:BEG)

(at the time of writing, I hold a long position in this share)

Q3 red flag report- this is always an interesting read, giving some useful pointers as to what's happening in the UK economy.

Business distress on the rise ahead of interest rate decision

c.450,000 UK businesses now suffering from 'significant' financial distress; up 27% year on year

I thought that zombie companies were a thing of the past, but apparently not;

The research highlights that almost 250,000 of these companies (Q3 2107: 248,619) ended the period with negative net worth, representing a sizeable population of so called "zombie" companies that have managed to survive thanks to the prolonged low interest rate environment and flexible labour market, but which do not have adequate working capital to fund any growth or absorb rising input prices.

I challenge Begbies definition of zombie companies being anything with negative net asset value. There are plenty of listed companies which are cash generative, but which have negative net worth. They're not necessarily in financial distress, providing the banks remain supportive.

This commentary below is also very interesting. Could we be moving towards credit crunch, part II ?

Julie Palmer, Partner at Begbies Traynor, said:

"The number of firms experiencing 'Significant' financial distress has reached unprecedented levels over the past 12 months, as businesses in search of growth have overstretched themselves, taking too many risks after being lulled into a false sense of security by the continued low interest rate environment.

Following a spate of downbeat economic updates, showing everything from rising inflation and increasing corporate insolvencies to slumping retail sales and the further decline of the UK's vital construction sector, our data shows that no segment of the economy has ended the period unscathed.

"With consumers continuing to borrow using credit cards, personal loans and car finance at a rate almost five times faster than their growth in earnings, my biggest concern is on the UK's ever-expanding consumer credit bubble, which could burst at any minute, knocking the consumer industries and financial sector for six. While the prospect of an interest rate increase will of course go some way to addressing this, the knock-on effect for many struggling businesses with high levels of debt could be severe."

I'm surprised the above is couched in such strong terms. It's certainly worth pondering.

Zotefoams (LON:ZTF)

Share price: 379.7p (up 7.9% today)

No. shares: 44.4m

Market cap: £168.6m

Q3 trading update - this is a specialist maker of foam (e.g. for car seats).

Things seem to be going well;

Full year revenues expected to be ahead of market expectations.

Adjusted profit before tax and exceptional items for the year ending 31 December 2017 expected to be at the top end of the range of market expectations

It's a pity that the company omitted to put a footnote in, stating what it believes the range of market expectations actually is. More companies are doing that now, and it's extremely helpful to investors - especially private investors, who often don't have access to broker forecasts.

Stockopedia shows a consensus broker EPS forecast of 15.2p for calendar 2017. So presumably the company will report a bit above that figure - maybe around 16p? That would value the share at a PER of 23.7.

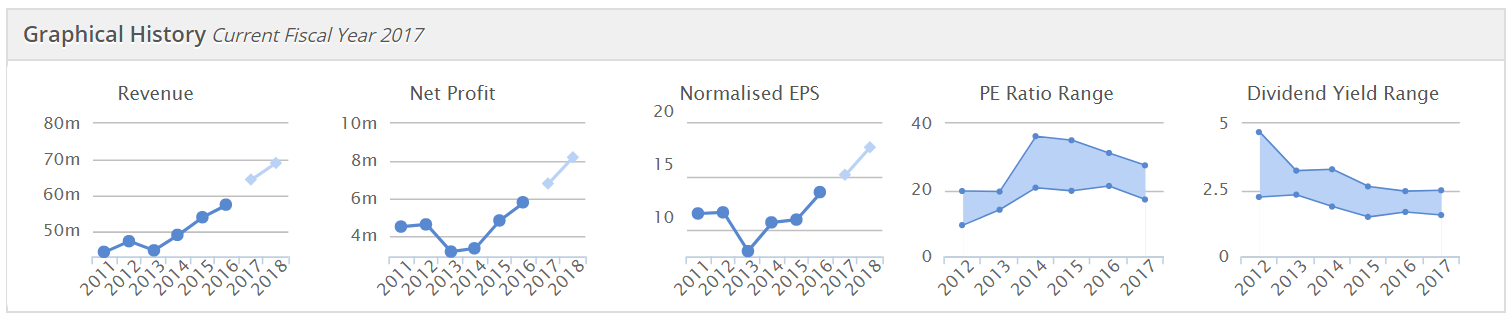

Given that we're only 2 months away from 2018, this is the time when we should really be valuing companies on their 2018 earnings. That might be say 18-20p, which would bring the 2018 PER down to between 19.0 and 21.1 - hardly cheap, but it's a reasonable growth company, and as you can see from the 4th graph below, it's not been cheap on a PER basis since 2012;

My opinion - I like this company, as it has decent margins, and has demonstrated good growth in recent years.

There could be some upside here from new products - that rings a vague bell. It's not something I've ever researched in any great detail, so sorry if this sounds a bit vague.

I wonder what its reliance on car manufacturers as clients is, given that new car sales seem to be falling now? (both in USA & UK).

LPA (LON:LPA)

Share price: 151p (up 16.2% today)

No. shares: 12.4m

Market cap: £18.7m

LPA Group Plc, theLED lighting and electro-mechanical system manufacturer and distributor, is pleased to provide the following trading update for the financial year ended 30th September 2017.

Slightly odd wording in its update today;

Further to the Chairman's Statement issued with the interim results on 26 June 2017 which confirmed that the Group had established itself on a new trading level, output during the second half was at record levels and, given the volume of deliverable orders on hand, this is likely to be sustained during the new financial year.

Margins, which had been depressed by an unfavourable product mix in the first half, responded well to higher volumes and manufacturing efficiencies have improved significantly.

Expectations for the year just closed anticipated significant progress and the Board believes it has delivered on this.

I would have preferred some specifics, some numbers. This is a bit waffly, but it seems to be saying that they've traded in line with expectations.

Outlook - again, a bit vague, but sounds positive;

The Group remains very confident of further progress in the current year.

My opinion - looks an interesting little company.

The forward PER was about 9, but with today's share price rise, that's probably now 10-11.

Looks worthy of a closer look, if you're prepared to accept the lack of liquidity in a share this small.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.