Good morning, it's Paul here.

I added a few more sections to yesterday's report (on PhotoMe and Nexus Infrastructure (LON:NEXS) ) late yesterday afternoon. So if you missed that, here's the link.

Please see the header above for the 5 companies whose results/trading updates have caught my eye this morning.

Estimated timings - should mostly be done by 1pm today, although I'll probably add some more sections mid to late afternoon, as yesterday.Update at 17:40 - sorry, I nodded off after lunch, so am running late. I'll keep going until it's finished, so estimated completion now 21:30.

Update at 21:30 - today's report is now finished.

Sopheon (LON:SPE)

Share price: 605p (down 12% at 08:18)

No. shares: 10.17m

Market cap: £61.5m

Trading update (profit warning)

Sopheon plc, the international provider of software and services for Enterprise Innovation Management and Strategy Execution Management, provides an update on the Group's performance for the year ended 31 December 2019.

Here we are, less than 3 weeks from its financial year end, and Sopheon's profit for the year could still be anywhere in a very wide range of possible outcomes. This is the inherent problem with small software companies - they have hardly any visibility, because the outcome for the year hinges on closing deals in the busy Q4. If things slip into the following year, then it can have a large impact on profits. I imagine most Sopheon shareholders are already aware of this lumpiness, it just goes with the territory for small cap, software sector.

This is part of what it says today;

Today, overall revenue visibility2 for the year stands at $28m with $9.9m in remaining opportunities with 2019 target close dates...

The figure for potential deal closures by 31 Dec 2019 is so large, that it makes this share pretty much impossible to value. Revised broker forecasts are out today, but these numbers could materially change in the next 3 weeks, if the company does manage to close some more deals.

The split is given of the $9.9m potential deals;

...Of this, up to $2.7m represents perpetual license fees which, if signed, would contribute to recognized revenue in the current financial year. An additional $4.8m represents potential orders for multi-year SaaS or other recurring commitments, and the balance associated consulting services...

So the $2.7m perpetual licence fees would drop mostly straight through to the bottom line, materially improving the 2019 outcome. Whereas the SaaS deals would presumably have minimal impact on 2019 outcome, because those revenues are spread over multiple years, presumably recognised as revenue on a monthly basis.

Forecast changes - two brokers have put out revised numbers today. I was wondering if we should just ignore revised forecasts, because there's so much uncertainty about the closing of Q4 deals.

There again, the brokers wouldn't have put out revised numbers today, unless they'd been given a good steer by the company as to the likely outcome. On balance then, I think it makes sense to see the revised broker figures as being estimates that should probably turn out to be the most likely outcome, or close to it anyway.

On that basis, the announcement today is a big profit miss. One broker has revised down 2019 adj PBT from $4.9m to $2.7m, a 45% drop.

Another broker drops 2019 from $4.5m to $2.4m, so fairly similar.

Forecasts for 2020 are also slashed.

In EPS terms, it's rather stark;

2018 actual: $33.9m revenues, diluted EPS: 65 US cents

2019 forecast: $29m revenues, diluted EPS: 20.5 US cents.

2020 forecast: $35.5m revenues, diluted EPS: 21.3 US cents.

In other words, profitability seems to have crashed by about two thirds from 2018. That looks pretty awful to me. Although the narrative does mention discretionary increases in overheads, to drive growth & product innovation.

Looking back to the 2018 results (published on 21 Mar 2019), it stated full year 2019 revenue visibility as being $20.6m. That has only grown to $28m by today - which strikes me as surprisingly little growth.

Deferral of orders - this section of today's announcement gives convincing-sounding reasons as to why some 2019 sales have slipped into 2020;

In some of these cases, Sopheon has already been selected as preferred vendor. The reasons for the extended buying cycles vary; some relate to extra scoping effort to expand the use of Accolade into a strategic purchase for the customer; others are due to customer specific factors such as M&A, personnel changes or budget consideration impacting decision making.

Specific examples include a very substantial new SaaS deal with a top tier global customer, where Sopheon is the selected vendor but has since been held up due to customer resource availability due to another system implementation delay. At the other end of the scale, a mid-size perpetual license extension order from an existing customer has experienced delays due to an organizational restructure. The Company now expects both of these examples to sign in the first half of next year.

That's all great, but the upshot is that it looks like 2019 revenues will fall about 13% versus 2018 actual. No amount of spin can convince me that this is in any way satisfactory. It's not just timing issues, revenues are falling.

The company focuses our attention on the pipeline growing, but it's actual sales that count, not sales leads.

Balance sheet - is very strong when last reported at 30 June 2019. The company has done a remarkable job of trading its way out of a previously precarious financial position a few years back. That is very impressive - it's turned out to be a highly cash generative business.

The cash position has risen slightly compared to the $18.7m reported in the last interims;

The Group's balance sheet also remains robust, with net cash as at the end of November 2019 at $19.2m.

My opinion - this is a very well-presented profit warning, and seems to have successfully convinced the market that the future is still rosy, and that these are pesky delays, rather than anything more serious. I don't think anyone outside the company can really judge things accurately, because we don't know any of the granularity of the sales pipeline.

If you trust management, and believe in the company's long-term prospects, then the big drop in share price in recent months could be a good buying opportunity.

If you're more sceptical, then it might be safer to steer clear.

I don't have a strong opinion either way. There's obviously something good here, because the company has traded very well in recent years. Therefore, on balance, I'm starting to lean towards being more positive than negative, although not enough to actually buy any. However, there does seem to be a problem with converting pipeline into actual sales. Given that revenues in 2019 are likely to be well below 2018, I do wonder if there's a deeper underlying problem here, maybe it's not just about timing? Who knows. We'll find out in 2020. I do think the company has quite a lot to prove to the market, to get things back on track - so it might take the share price some time to regain its composure perhaps? It depends. If the company is able to issue updates in 2020, saying that delayed 2019 contracts have indeed been won, then that could trigger a recovery in market confidence, and hence share price maybe?

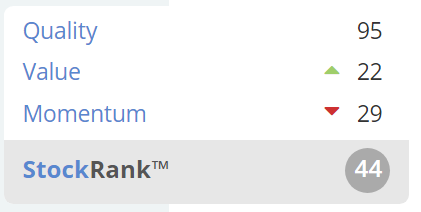

Stockopedia is sceptical, with "Falling Star" classification, and a lowish StockRank (due to poor value & momentum scores). Bear in mind that the large reduction in 2019 & 2020 forecast earnings hasn't come through yet, so the value & momentum scores are likely to drop further;

The other thing to bear in mind is that the share price has fallen by more than 50% from its highs of a year ago, so arguably the bad news is in the price now. The recent selling, before the profit warning, looks a bit suspicious - insider dealing possibly?

Kromek (LON:KMK)

Share price: 19.5p (up 13% at 10:55)

No. shares: 344.6m

Market cap: £67.2m

Kromek (AIM: KMK), a worldwide supplier of detection technology focusing on the medical, security screening and nuclear markets, announces its interim results for the six months ended 31 October 2019.

This share has been a serial disappointer, and fundraiser (the share count has more than tripled since it floated on AIM in 2013). However, it does seem to have some interesting products & sales pipeline, so I'll spend a bit of time rummaging through the figures & commentary issued today. Sometimes jam tomorrow shares do actually deliver, although not very often.

H1 revenue is up 43% to £5.3m

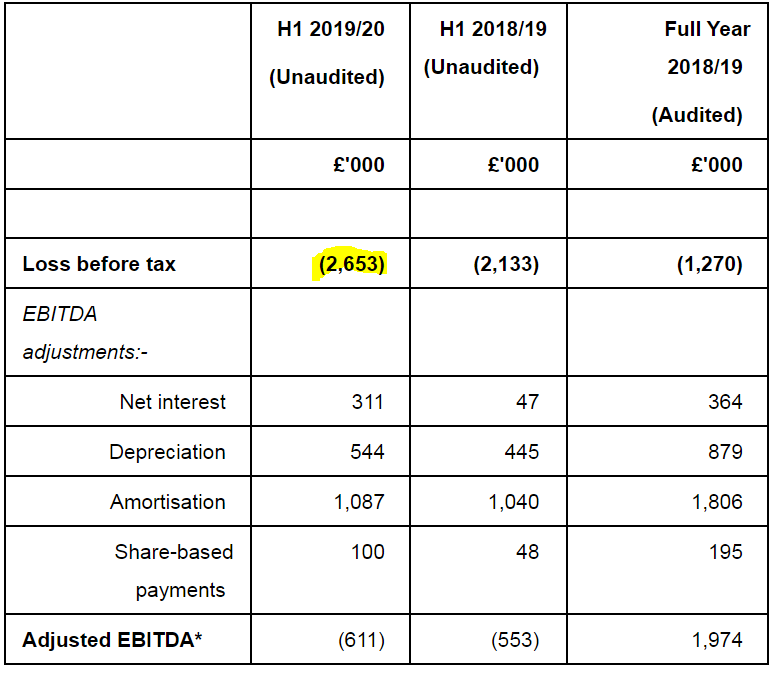

However, it remains significantly loss-making, as you can see from the table below. Remember that these numbers are for just 6 months, so that's a run rate annually of about £5m losses. Therefore revenue would have to roughly double, to make this a viable business;

It capitalised £1.7m in R&D costs in H1, which means the EBITDA number needs to be adjusted for that. There is a benefit from R&D tax credits though (negative tax charge). Management of Intercede (LON:IGP) (in which I hold a long position) explained the tax regime for R&D to me in a recent meeting, and it's a very considerable financial benefit, so needs to be factored in (favourably) for valuation purposes. That's assuming that Govt policy remains the same.

Balance sheet - looks very strange to me. Receivables are £20.8m - that's equivalent to over 2 years's sales, up from an already excessive £13.1m a year earlier.

As noted in the FY 2018/19 results announcement on 27 June 2019, 59% of the balance of trade and other receivables related to the build of amounts recoverable on contract ("AROC"), the majority of which is concentrated with one customer. This reflects the Group's revenue recognition in line with IFRS 15 on long-term contracts and the position was accumulated over the 12-24 months prior to 30 April 2019.

That seems to be saying that Kromek is booking sales & profits through the P&L, but the customers isn't paying Kromek. It sounds as if there might be a potentially large problem lurking here;

With the exception of fluctuations in foreign exchange, the proportion of AROC has remained static, with no further increase in the position and no additional contract related costs incurred at the end of October 2019. Whilst the Group's management did not expect to see a significant unwind of this particular AROC balance in this 6-month period given the delivery plan agreed with the customer for product, there has been a delay in an expected payment. However, the Group's management continues to be in active and regular discussions with the customer regarding firm shipments of completed products and payments, and continues to believe that the recovery of the AROC will be achieved within the 18-month period previously communicated in the FY 2018/19 report.

I don't like the sound of that one bit. Kromek has a massive, extended receivable, and there's been a delay in expected payment. That screams risk to me. Maybe amounts are being disputed by the customer, who knows? It could all turn out fine, but personally I wouldn't invest where there's any (even slight) question mark over whether a large receivable is going to be recovered or not.

The cash position looks good, at £13.4m, but note there is also debt, totalling £5.8m, which looks odd. Maybe some of the cash is restricted? If companies have both cash, and debt, I like to find out why. There might be a reasonable explanation, do any readers know?

Outlook - this is where the excitement comes from - large, multi-year contracts;

Kromek is at the early stages of delivering contracts worth approximately £100m won over the past three fiscal years (compared with c. £50m and c. £30m for the three years to 31 October 2018 and 2017 respectively) in its target markets in medical imaging, nuclear detection and security screening, including the seven-year medical imaging contract expected to total $58.1m awarded in January 2019....

The valuation of the company rests entirely on it delivering improved financial performance in future.

Unchanged outlook for FY 2019/20: on track to achieve revenue and EBITDA profit in line with market expectations

That's fine as far as it goes, but note that forecasts are showing that it remains loss-making at the adjusted operating profit level of -£1.1m loss for this full year, and that's based on assuming a large increase in H2 revenues.

My opinion - there's an interesting note from Equity Development out today, which talks up how great the technology is apparently. I'm sceptical. Given the poor track record, and the high risk from excessive receivables, I wouldn't be able to sleep at night holding this share.

If things go well, it could be a multi-bagger, who knows? I don't feel able to assess how likely that is or isn't. The large contracts do sound very interesting/exciting though. It would need a lot more research to ascertain whether risk:reward here is any good. Even then, it would really just be a punt.

It would be good to find some third-party, independent views on its technology, that's the crux here. If an industry expert or two were to tell me that Kromek's technology is the bees knees, then it might be worth having a punt on. The danger generally, is that we get all our info from the company itself, and its PR people, which nearly always give an overly optimistic outlook.

Global Ports Holding (LON:GPH)

Share price: 238p (down 5% at 11:56)

No. shares: 62.8m

Market cap: £149.5m

Global Ports Holding Plc ("GPH" or the "Group"), the world's largest independent cruise port operator, today announces its unaudited results for the nine months ending 30 September 2019.

This is a new one for me, it floated on AIM in May 2017. As it's my first ever look at the company, this won't cover everything. It takes a while to get to know a company.

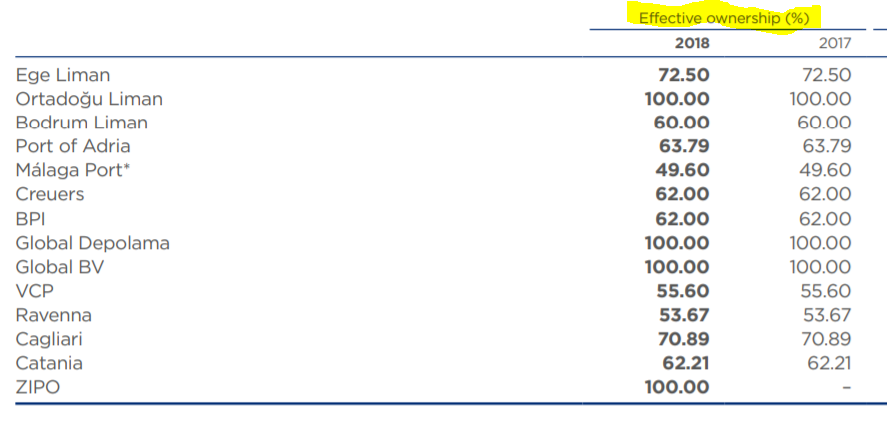

It operates these ports;

Reading through the 2018 Annual Report, it's noteworthy that GPH has a variety of ownership structures - i.e. it doesn't own a lot of ports outright, but only partially. Therefore we'll have to look out for "non-controlling interest" figures in its results, and value it accordingly.

Note that Peter Mandelson is one of its NEDs. He's paid $156k in fees in 2018. A slippery character,but of course as a former EU Commissioner, he probably knows the right people in Brussels, which could be useful. Incidentally, his memoirs were one of the worst I've ever read - pure tittle-tattle, and intrigue. He seemed to treat politics like a game.

Shareholdings - note that the largest holding is 59.55%, which seems to be connected to the founder & Exec Chairman, Mehmet Kutman, who owns 24.33% of the largest shareholder. Hence the free float isn't huge, and there's always a risk that the controlling shareholder might do something that hurts small shareholders.

Dividends - it seems to have prioritised paying big dividends in recent years. The 2018 cashflow statement shows it paid out $34.8m in 2018, and $45.0m in 2017. This looks imprudent, given the weak balance sheet.

A 15.5p interim divi was paid on 29 Nov 2019.

Q3 results - I'm not sure why the company issues quarterly results? Maybe its debt providers require that, or it could have a dual listing, I'm not sure.

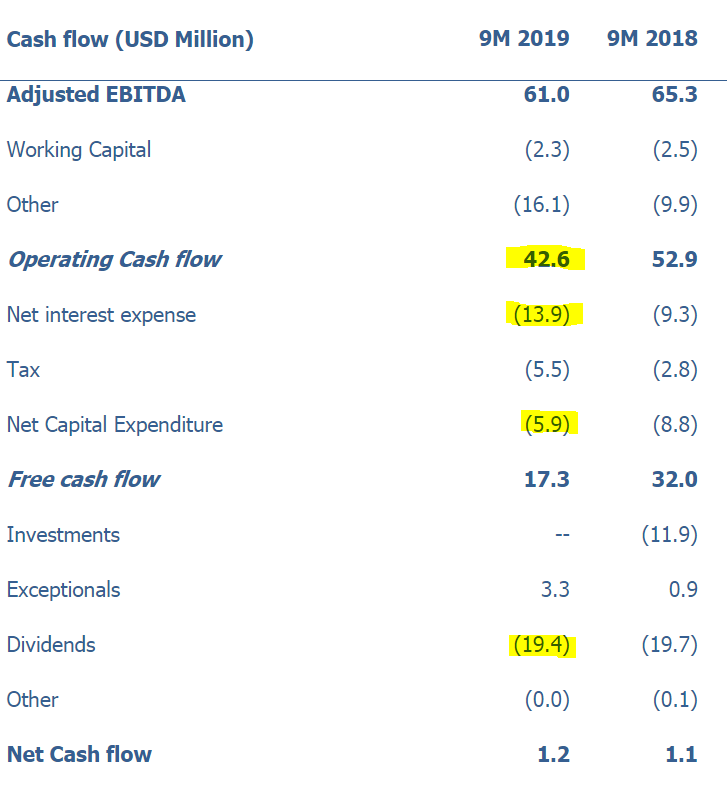

Adjusted EBITDA is large, at $61m for the 9 months to 30 Sep 2019. That's down 6.6% on LY.

Operating profit is much smaller at $10.3m (mainly due to large depreciation charges)

This cashflow summary gives a nice flavour for the business - i.e. cash generative, using that cashflow to fund capex, interest cost, and large divis;

Outlook comments - tariff wars are hurting its commercial freight business, but the cruise business is doing well, and growing fast;

Overall the trends highlighted at the interim results have continued into Q3. Our Cruise business continues to perform well in Q4 2019 and looking into 2020 and 2021, organic growth is expected to be strong driven by a significant increase in passengers at both Ege and Bodrum. The recent addition of Nassau and Antigua cruise ports to our cruise portfolio is a truly transformational for the group. Cruise passenger volumes for 2020 will increase by close to 100% and we expect to deliver in excess of $85m of EBITDA from our Cruise business by 2022, a growth rate of in excess of 100% from 2018 levels.

As expected, macro-economic factors such as trade tariffs continued to negatively impact our Commercial business in Q3, particularly Port Akdeniz. Throughput container volumes were once again weak in the period and this sustained weakness has continued into Q4. Longer term an agreement to end the current escalation of trade tariffs involving China and a general improvement in Chinese GDP are, we believe, the most likely catalysts for a meaningful improvement in container throughput volumes.

As a result of the weakness in our Commercial ports, we now expect the Group to deliver for the full year a decline in Consolidated EBITDA in percentage terms of mid-single digit against 2018.

That's a mild profit warning, by the looks of it.

Net debt - rose to $272.9m - so highly indebted.

I'll look at the nature of the debt (repayment dates, interest charges, etc) in a future report.

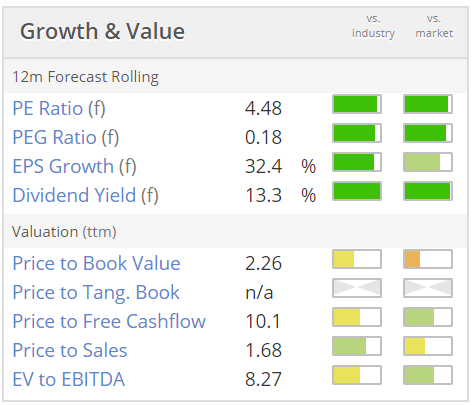

My opinion - on my very first look at this company, I've only scratched the surface. It looks quite interesting though. It looks a highly cash generative business, and the valuation numbers look strikingly cheap. Usually when the PER is this low, and the divi yield this high, then there's something wrong;

The cashflow looks good, but the balance sheet looks rather weak.

It's going on my watch list, this could be quite interesting. I like to gradually research companies, over time, as that usually results in a better understanding - it's easy to miss important things on the first review.

If any readers know this company, I'd like to hear your views!

EDIT: Many thanks to both jwebster (comment no. 24 below), and sharw (comment no. 21 below) who posted excellent points about GPH. In particular, I think jwebster's post below is a much better review of the company than mine! Well worth reading.

Eurocell (LON:ECEL)

Share price: 210p (flat on the day)

No. shares: 100.3m

Market cap: £210.6m

Eurocell plc is a market leading, vertically integrated UK manufacturer, recycler and distributor of innovative window, door and roofline PVC products.

Eurocell(1) provides this update for the 11 months to 30 November 2019.

This is another new company for me, that I've not looked at before. I'm not sure why it slipped through the net, as it's been listed since Mar 2015, and there doesn't seem to have been any change of name in that time.

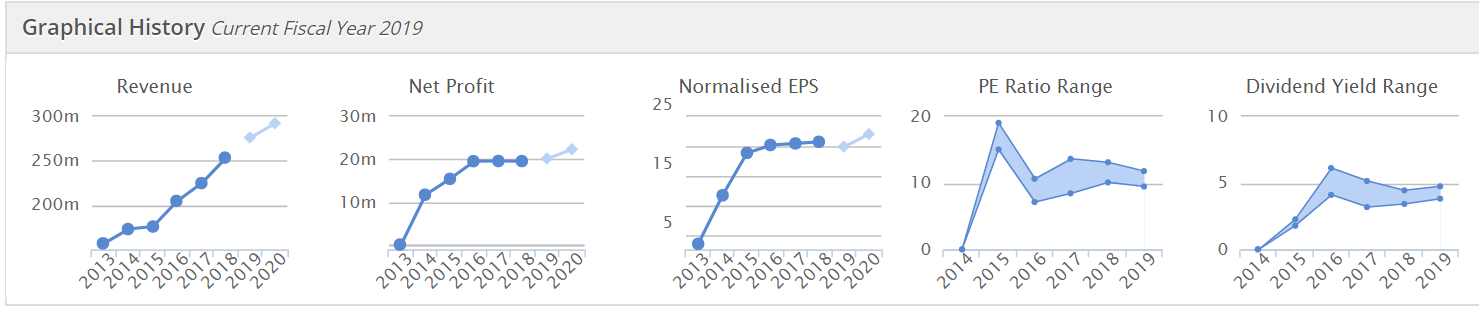

As you can see from the Stockopedia graphs below, it has a good track record of consistent (albeit flattish, in EPS terms) profitability. Increased revenues don't seem to be feeding through to higher profits, implying competitive pressures maybe? Note all the strong dividend yield.

Therefore this looks a mature business, hence why the PER is fairly low at about 10 times. It's amazing what you can quickly glean from these 5 little graphs! Which is why they are always where I start, when researching anything new to me.

Today's update - looks to be in line;

Taken together, these factors underpin our current expectations for full year earnings.

More detail is given. To summarise, it looks like sales & margins have been good, but some operational problems have caused inefficiencies. New COO is dealing with that - hence there could be upside next year possibly?

Balance sheet - as you know, I always check out the most recent balance sheet, to determine the financial strength of every business I look at.

This one looks adequate, although net debt looks a touch on the high side at £36.7m when last reported at 30 June 2019 (that excludes notional debt re IFRS 16, which is my standard way of looking at it - because future lease rents are not interest-bearing debt, so should not be included within net debt figures).

Capex has been heavy in the last 2 years.

My opinion - on an initial review, this looks a solid, reasonably-priced company. It looks a bit like £EPWN and is on a similar valuation. Could be worth a closer look, if you like value-type shares.

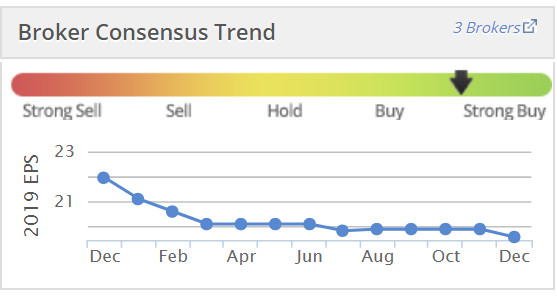

Note that broker consensus has been steadily falling, so meeting expectations actually involves meeting a number that has been managed down;

DWF (LON:DWF)

Share price: 122p (up 1% today)

No. shares: 300.0m + 19.5m new shares issued for acquisition

Market cap: £389.8m

DWF Group plc, the global legal business providing Complex, Managed and Connected Services, today issues its half year results for the period to 31 October 2019.

Acquisition - of a Spanish law firm, with consideration being mostly in shares & deferred consideration (sensibly locking in fee earners for up to 5 years, and subject to performance criteria)

Interim results - these figures look OK, but I note that H1 adjusted diluted EPS is down 28% from 3.6p to 2.6p, despite underlying adjusted profit being up 3% to £9.7m. That implies either a lot of new shares might have been issued perhaps?

On scrutinising note 7, the share count (including options & shares held in trust) is unchanged at 300m. The offending item seems to be the earnings figure used in the calculation of adj EPS, which seems to be worked out on a different basis to the figures shown in the financial highlights - confusing!

Outlook - there's a full year, in line comment, which simplifies things for me, as I can just work on broker forecasts for the full year 04/2020;

The first half results, investments made, and trading through November reinforce management's confidence in delivering expectations for the full year

Valuation - there are 2 updated broker notes out today, available on Research Tree.

Full year forecast for FY 04/2020 is 10.9p fully diluted, adjust EPS. That relies on a heavy H2 weighting, since only 2.6p was delivered in H1. The current year PER is 11.2 - hardly demanding.

EPS is forecast to rise strongly in FY 04/2021 to 14.2p (PER of 8.6), and 17.4p in FY 04/2022 (PER of 7.0)

These forecasts also suggest that net debt can be paid down almost completely by end FY 04/2022, in addition to paying large & rising dividends. Sounds interesting (too good to be true possibly?)

Balance sheet - is heavily distorted by IFRS 16. Property plant & equipment of £80.2m looks great - I assumed there must be loads of freehold property. Er, no. Most of it £66.7m, is a book entry for IFRS 16 called "Right-of-use asset", which of course is not an asset at all.

In terms of resale value then, the fixed assets of £80.2m have little real world value.

Receivables is huge, at £170.0m. Note 12 gives the breakdown, at £80.9m unpaid invoices, and £69.7m fees not yet billed. As receivables are generally such large figures in the accounts of lawyers, it would be essential to calculate some ratios, and compare those with other legal firms, to make sure it's reasonable. i.e. debtor days, before & after including WIP. I don't have time to do that now.

Other stand-out items on the balance sheet include a fair bit of interest-bearing debt - namely £3.7m in current liabilities, and £65.7m in longer term creditors.

Note also the £35.7m creditor due within 12 months, to be paid to partners in the firms. Note 23 shows how this is partnership current & capital accounts. Or it can just been as Director loan accounts (i.e. partners/Directors have left money in the company, which they can later withdraw. These accounts seem a strange hybrid of partnership and limited company accounts. I find them a bit confusing actually.

My opinion - I don't invest in any quoted law firms. That's because there's an inherent contradiction in their business models. Lawyers & accountant are traditionally partnerships. so the top brass (partners) receive the profits through their drawings.

Once a law firm lists on the stock market, it brings in capital from outside investors, who then need to be paid dividends. Therefore partners have to be locked in, to ensure they don't disappear off into the sunset to work for a competitor, or set up on their own, in order to keep 100% of the money they make, rather than sharing it with outside shareholders.

Lock-ins & deferred consideration surely just postpone the eventual likelihood that the top fee earners will ultimately be financially motivated to walk away, causing earnings to eventually collapse.

Outside shareholders seem to be funding partners cashing out, even if it is deferred. That doesn't appeal to me at all, no matter how attractive the short term metrics have been made to look. It all feels a bit like financial engineering, and I don't think I would come off best in that kind of deal, against smart lawyers on the other side of the trade!

All done for today, I got there in the end!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.