Good morning, it's Paul here with the SCVR for Weds.

This post is initially a "placeholder" - i.e. just an introduction, put up at 7am, so that readers can add your comments below, whilst I spend the rest of the morning & early afternoon writing up the main sections.

It's Budget Day today in the UK, which starts at around 12:30.

Estimated timings - I'll need to get the main report done by 12:30, so that we can then focus on what the Chancellor, Rishi Sunak, has been told to say by Dominic Cummings!

Update at 12:30 - today's report is now finished.

Volatility continues, with another huge rally in the US markets last night, which has almost completely dissipated in the futures overnight.

I went on a shopping spree yesterday, buying smallish new long positions in small caps, and increasing my existing small cap positions, but then got cold feet last night and decided to re-open my short on the Dow, as a hedge. Probably like everyone else, I really haven't got the foggiest idea where markets are heading. It seems to me that the headlines now are far worse than I'd been expecting - e.g. talk of Italy needing a large-scale financial bailout. Also the trajectory of new coronavirus cases in Europe, and USA, means this looks like the start of a wide-scale outbreak here. I just cannot imagine markets are likely to shrug off a wave of imminent terrible newsflow. Hence I'm now worried about another possible lurch downwards. Bottom line is - I have no idea what's going to happen next.

Breaking news - the Bank of England has cut base rate from 0.75% to 0.25%. It's also announced a package of measures to support SMEs. It looks like policy-makers want to be seen to be doing something to combat the economic impact of coronavirus, and of course trying to further prop up asset prices with ultra-cheap money.

Trying to prevent the banks from pulling essential credit lines to SMEs seems very sensible to me, given that this is a temporary factor - the last thing I would want to see is fundamentally sound businesses being put into administration due to short term cashflow problems.

As for interest rates, it seems increasingly likely that ultra-cheap money is now a permanent thing - markets are addicted to it, and it can't be withdrawn without crashing asset prices, it seems. Governments can borrow long-term, incredibly cheaply, so to my mind this is the perfect time to be undertaking major infrastructure projects, provided the cost:benefit calculations are genuinely favourable. Surely the obvious thing to do, is to build huge numbers of new affordable houses, and rent them out with a right to buy attached, thus giving younger people a decent way to look forwards.

Dart (LON:DTG)

Share price: 1028p (up c.6% today, at 08:41)

No. shares: 148.9m

Market cap: 1,530.7m

Dart Group PLC, the Leisure Travel and Distribution & Logistics group, today issues the following update on trading. Year ending 31 March 2020 (FY20)

Its main business is the Jet2.com airline, and its relatively new package holidays business. Plus there's a freight division too.

Why am I covering DTG in a small caps report? Because it's on my watchlist of possible purchases, once the coronavirus problem subsides. For anyone not aware, I'm first & foremost an investor, with report-writing being a secondary role, where I share my thoughts & research notes with subscribers here. It's recycling the same information & views basically, which makes sense all round. Hence if I think a company looks interesting as a possible purchase, then I'll cover it here, regardless of market cap size.

Today's update - looks surprisingly strong for y/e 31 Mar 2020 -

Due to the continued success of our growing Leisure Travel business, the Board expects Group profit before foreign exchange revaluation & taxation (excluding any impact of hedge ineffectiveness) for the financial year ending 31 March 2020 to be significantly ahead of current market expectations...

Normally that would have put a rocket under the share price, and it's the latest in a long line of forecast beats. This is a tremendously impressive company, which I admire very much, and want to part-own at some point.

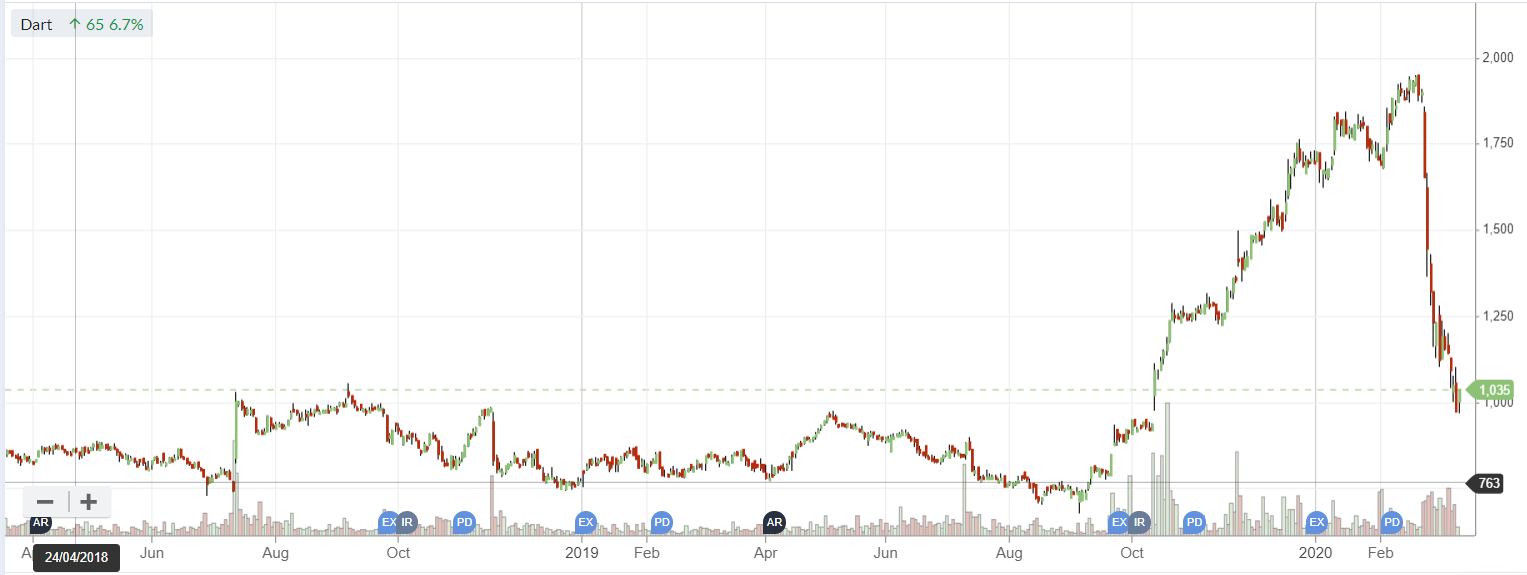

Look at how the share price was exploding upwards on positive trading updates, and then see what happened recently when coronavirus struck;

.

Without coronavirus, we would probably be over 2000p per share by now. Therefore, the current level of 1028p is looking very tempting.

Hedging losses - unfortunately, profits will be hit with what looks like a one-off exceptional charge for hedging contracts that have gone wrong. The way I interpret that, is that, because fewer flights will be using fuel, and fuel has also fallen a lot in price recently, then the company is probably committed to buying too much fuel, and at too high a price, with now loss-making forward hedging fuel purchasing contracts. I imagine this might be a problem for many airlines and cruise ship operators. Hedging contracts basically just defer price changes, therefore airline and cruise ships that undertake fuel cost hedging are not going to benefit from the lower fuel price until their hedges expire.

... However, future reductions of FY21 flying capacity will result in a proportion of the Company's existing hedging contracts becoming ineffective, thereby impacting those profits.

It would have been helpful for the company to have given an indication of the size of this problem, but they haven't done that.

Coronavirus impact - obviously this is the big problem right now, as it's likely to seriously impact revenues and profits from now on, for an unknown length of time;

Until very recently, Customer demand for our very popular Package Holidays and Flight-Only Leisure Travel products has remained consistently strong, with the important January and February booking performance resulting in our Summer 2020 bookings tracking well ahead of our 16% summer seat capacity increase...

That sounds great, but I wonder about cancellations? How many customers are cancelling bookings, or refusing to pay the balance if they've only paid a deposit? Who is legally liable I wonder? With cheap operators, often the customer can choose between a cheaper, non-refundable ticket, or a higher priced ticket that can be changed. All this information is missing from today's update.

I'm very surprised that forward bookings have not fallen a lot more than this - maybe there are further falls in the pipeline, once flights that were booked before coronavirus have washed through the system?

Understandably, however, momentum has weakened over recent weeks with the increased reporting of Covid-19 cases in Europe. Nevertheless, our current cumulative Summer 2020 bookings remain above those at this time last year.

Maybe DTG customers are more stoical, and are pressing ahead with their holiday plans regardless? Given the spread of coronavirus in the UK is now happening fast, albeit from a low base, I can't see demand remaining this robust for much longer. Short haul destinations in Europe are also seeing coronavirus rising rapidly, e.g. Spain, France, Germany. This is bound to hit DTG and other airlines. So I think the situation could probably get a lot worse than the company is letting on today. This sounds like a rose-tinted glasses type of update to me.

It says here that they don't know what the impact will be, but we can safely assume it's likely to be very bad in the short term, in my view;

The continuing success of our Package Holidays, including our newly launched ''Vibe'' brand, together with our strong and prudent balance sheet gives us long term confidence for the future. However, given the limited visibility on the impact of Covid-19, the Board is currently unable to determine how this will effect Group profit before foreign exchange revaluation and taxation for the financial year ending 31 March 2021.

Balance sheet - is indeed strong. Although it's complicated, as with almost all travel companies, that customers pay up-front. Hence cash is often offset by deferred income (the creditor side of the double-entry). The risk being that if an act of God causes operations to cease, or be sharply reduced, then the deferred income unwinds quickly, leaving weaker players insolvent. Remember the volcanic dust cloud a few years ago? There was a lot of concern then, that weaker balance sheets could blow up as the cash is pouring out, with little to no new cashflow coming in from forward ticket sales.

Later this year, I think travel companies are likely to be offering amazing discount deals, just to get cash flowing in again, and bums on seats. Therefore, I suspect readers would be well advised to hold back on holiday plans, and snap up the bargains later this year. Also, make sure we pay for holidays using a credit card that has refund protection if the travel company goes bust.

Fowler & Welch - is trading OK;

We are also pleased to report that our Distribution and Logistics business, Fowler Welch, is trading in line with expectations and continues to develop its revenue pipeline with existing and new business opportunities.

My opinion - I definitely want to own shares in DTG at some point, ready for a recovery. It's a fundamentally excellent business, with a great long-term track record.

Anyone buying this share now is likely to do very well long-term, I reckon. However, there's also a distinct chance that there could be another violent lurch down, if the next update (as seems probable) discloses a large drop in bookings, and even heavy temporary losses & cash outflows. How much of that is already in the price though? Nobody knows! This could be one where it might make sense to start off with a small long position, and then add more if coronavirus begins to subside. I might do that at some stage, but it feels a bit early right now.

.

Somero Enterprises Inc (LON:SOM)

Share price: 237.5p (up 12% today, at 09:52)

No. shares: 56.3m

Market cap: £133.7m

(at the time of writing, I hold a long position in this share)

This is a US-based maker of laser-guided concrete laying machines. We've covered it a lot here in the SCVRs, as it's a high quality, reasonably priced company, that generates loads of cashflow which it pays out in divis. The downside risk is that it's highly cyclical - so demand drops away considerably in recessions.

The company had a poor H1, blamed on bad weather in the USA. This was true, because performance recovered in H2, so kudos to management and advisers for telling it how it is.

Today's figures look fine to me, I won't go through all the detail, just a few bullet points;

Revenue & profits are as expected, down a bit, raising the question as to whether we're at the top of the cycle?

Adj EPS is 37 cents (the company reports in US dollars), down 3% on prior year. Converting into sterling gives us 28.7p = PER of 8.3 - very cheap, so clearly the market is assuming future earnings are likely to fall.

Balance sheet - fantastic, with plenty of surplus cash. The company is in great shape to withstand any downturn.

Dividends - a strong feature of this share. For 2019 it paid a regular divi of 18.75c, and a supplemental divi of 7.7c. Obviously the bumper divis could be curtailed if the world goes into a recession in 2020, a distinct possibility I'd say. But that's already factored into the lowly valuation.

Coronavirus - this is reassuring;

Whilst we have not seen an impact to date on our business, we are closely monitoring the evolving Coronavirus situation. Our supply chain has been unaffected as we do not source components from China and while we have yet to see delays in projects outside of China, we remain in the early stages of understanding the impact of the virus. We will provide updates in due course if we anticipate our full-year 2020 results will be impacted.

I think it's safe to assume that there might be some disruption to 2020 revenues/profits from the economic damage we're starting to see from coronavirus.

Outlook -

The Board is confident in the outlook for 2020 with the solid momentum in the US carrying forward from 2019 supported by the strength of the US customer project backlogs that span well into 2020. Outside of the US, while market conditions and activity levels remain generally positive, the Board continues to recognize factors impacting each market that slightly temper underlying growth expectations for 2020.

Clear guidance is given, from a management team that we can rely on, because they've always been honest in the past;

With this comprehensive view, the Board expects 2020 will be a profitable year with healthy cash generation.

Revenues are expected to be comparable to 2019 with EBITDA broadly in line with 2019 and in line with current market expectations.

Also note that additional expenditure is planned, to drive sales of the new product, SkyScreed. Shareholders should be happy with that, as it will drive future growth.

My opinion - I really like everything about this share, apart from the cyclicality of earnings.

For this reason, I'm keeping my personal shareholding in the company, bought quite recently, on the small side. Very small actually. The reason is that we're in a period of uncertainty, and I imagine that trading updates later this year could well talk about delays from customers, due to coronavirus. That might take the share price back down again. Or it might not, I don't know.

I think the litmus test is this - would I want to own this share once coronavirus is out of the way? Also, does the company have strong enough finances to survive any downturn this year? In both cases, the answer is a strong yes.

Quick comments now, as time is running short;

Dignity (LON:DTY)

Down 19% to 404p today.

Highly indebted chain of funeral directors.

2019 results look poor. Underlying EPS down 29% to 60.6p - although this only looks slightly below consensus of 60.6p

Some negative factors flagged;

· Changing competitive landscape has lowered average income per funeral as expected

· Further downward pressure on average income per funeral and cremation expected

· The CMA investigation could materially impact the industry and the Group

CMA sounds like a big deal, and aspects of turnaround plan have been paused until its findings are known.

Balance sheet - is one of the worst I've ever seen. Huge net liabilities - once we deduct intangibles, then NTAV is negative at -£510.3m!

My opinion - the way I look at things, it's insolvent. Therefore I think the equity is probably worth nothing.

This balance sheet has all the hallmarks of private equity having wrecked it, thinking they were being clever by gearing up annuity-like revenues at inflated profit margins (preying on vulnerable people by over-charging).

Anyone buying it recently, hoping to cash in on coronavirus deaths, richly deserves the 19% share price fall today!

Costain (LON:COST)

This infrastructure contracting services group has halved in price in the last month.

It's raising £100m in an underwritten placing. Looks like the bank & pension trustees likely to have pushed the company into this, as extending bank facilities is said to be dependent on it completing.

This bit caught my eye, and looks to have read-across to other contracting companies, and maybe other sectors too?

The introduction of the Prompt Payment Code whereby contractors are required to pay their suppliers earlier has also resulted in higher working capital requirements - in response, Costain has implemented revised processes to ensure that suppliers are paid promptly, with the average time taken to pay invoices reduced to 34 days from 58 days.

That's a really good thing for all the little companies that all too often have been exploited in the past. But it clearly means that the bigger companies need stronger balance sheets to finance quicker payments. If you invest in this sector, this strikes me as a key point to check out.

2019 results also out today, look like the company is very busy, but only scraped just over 1% operating profit from its many activities.

My opinion - this situation further reinforces my aversion to this sector. Shares in infrastructure companies seem to be time-bombs waiting to go off - large, complex projects with numerous risks, on wafer thin margins. Why on earth would anyone want to invest in this sector, hoping to pick a company that doesn't blow up?

Kin And Carta (LON:KCT)

A very quick note to flag the weak balance sheet here. NTAV is negative, at -£33.6m

There's a fair bit of bank debt, which could become a problem in a slowing economy. Also note the deferred consideration payments, and pension fund, which could be further drains on cashflow.

I wouldn't want to be holding this type of share in a slowing economy.

Lookers (LON:LOOK)

I've only just spotted this - shares down 30% to 26p.

A bombshell announcement last night is the reason;

Delay to announcement of results

In the final stages of preparing its results for the financial year ended 31 December 2019, the Company has identified potentially fraudulent transactions in one of its operating divisions.

As a result the Board has decided to postpone the announcement of its results until the second half of April.

Whilst the initial findings are not material in the context of the Group, the Board is appointing an external adviser to lead a full investigation into the matter.

Uh oh, I don't like the sound of that. Recent history tells us that it's best to sell immediately when accounting problems emerge.

That's it for today!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.