Good morning, it's Paul here.

It's not been a good start to the day. The council are cutting down a huge tree nearby, so I have the loud buzzing of chainsaws to contend with, making it difficult to concentrate. Plus there's been a profit warning from something in my portfolio - £CCT So let's start with that. I've put the tickers of companies of interest (which I intend reporting on here) today into the article header. I've got plenty of time available today, so there's probably also scope for 1 or 2 reader requests, within the sectors that I cover.

Profit warnings just come with the territory for small caps. Hence why I don't let them bother me too much. It's a straightforward decision - is the company in a downward spiral (which would make an immediate selling of the shares the most sensible decision)? Or, are the problems being reported limited, and fixable? (in which case I would hold, or buy more). Plenty of companies do recover from profit warnings, hence why I think the concept of automatically selling after a profit warning is far too simplistic. Each situation is unique, so there will never be a one-size-fits-all strategy that is guaranteed to work.

The fact that a lot of people do sell instantly on profit warnings (often due to stop losses on spread bet accounts) can create some nice buying opportunities, when fundamentally sound companies are sold off far too aggressively on a profit warning which might have no bearing on the long-term prospects of the company.

Character (LON:CCT)

Share price: 357p (down 19.8% today)

No. shares: 21.1m

Market cap: £75.3m

(at the time of writing, I hold a long position in this share)

Trading update (profit warning) - I'm quite surprised that the market has reacted so negatively this morning to the latest update. The company had already told us here on 19 Sep 2017 that market conditions were challenging, and that a major customer (c.8% of total sales, estimated by one broker) Toys R Us, had filed for bankruptcy protection in USA & Canada.

Results for y/e 08/2017 - the company had already reported that results would be in line with expectations. This is reiterated today, as follows;

As reported in September, the business has had a solid finish to the 2017 financial year. Accordingly, the Directors anticipate that, Group underlying pre-tax profits for the year ended 31 August 2017 are projected to meet current market estimates. The Group's balance sheet remains strong.

To put a figure on that, the forecasts I've seen are around 51-52p EPS - so at this morning's lower share price, the (how historic) PER is just 6.9.

As we know, the market looks into the future, not backwards.

Results for y/e 08/2018 - this is what has spooked the market today - somewhat surprising, given that the company had already warned previously about the issues it was facing, but there we go;

UK sales are OK. The issue is with international;

Our international and "FOB" sales have been adversely effected by a combination of several factors, not least of which is one of the world's largest toy retailers entering into Chapter 11 bankruptcy protection in the US and Canada, which has had subsequent knock-on repercussions in every market where it trades (including the UK). Our international customers are also taking a very conservative approach to purchases.

At this early stage of the Group's new financial year the Board consider that, based on the latest sales and market data available to them, the Group's performance for the year ending 31 August 2018 is now expected to be significantly below current market estimates.

Broker forecasts - so far I've only seen one broker note this morning. Panmures have revised down their forecasts, in a new note this morning, which is available on Research Tree.

Based on the new EPS forecasts of 38.1p 08/2018, and 45.3p 08/2019, then the forward PER is 9.4 and 7.9 - which looks good value - providing that this is the full extent of the damage. Bear in mind that the net cash is now 25% of the entire market cap, and the PER would be a lot lower still if you adjusted out the net cash.

Also note that forecast dividends are 21p and 25p. At the current share price of 357p, that would produce divi yields of 5.9% and 7.0% - a very attractive return. Those forecast divis are still well covered by the reduced earnings forecasts. Note that Character has a strong balance sheet, with net cash, which further reinforces my confidence in the projected divis.

Today's comments on divis are reassuring;

Furthermore, we are committed to maintaining our progressive dividend policy and continuing our share buy-back programme, as and when considered appropriate.

Note that the company's website shows 24.2m shares in issue, but about 3.3m of those are held in treasury. Stockopedia shows a net figure of 21.1m shares in issue, which is in the same ballpark.

Outlook comments sound upbeat;

Nevertheless, the Directors believe this to be a temporary downturn and that the Group anticipates returning to its previous growth pattern during the second half of the 2018 calendar year, and this ultimately is expected to be reflected in the financial performance for the year ending 31 August 2019.

The single biggest factor underpinning our optimism is that during 2018 we shall be introducing exceptionally exciting new products, many developed in-house which, together with the current product portfolio will, the Directors believe, give the Group its strongest ever product line up.

Additionally, even in these tough trading conditions, we expect our cash flow to remain positive, our reserves to grow, and our Christmas stocks to remain under control.

So this seems to be a situation where investors who look through the current difficulties, and accept that they are temporary, could end up with a nice buying opportunity. The risk is obviously that problems get worse, and another profit warning has to be issued.

Balance sheet - I thought it would be useful to refresh my memory on the most recently reported balance sheet. It looks excellent, here are a few key measures as at 28 Feb 2017;

Net Asset Value (NAV): £25.2m

Net Tangible Asset Value (NTAV): £24.5m (there is only £729k of intangible assets to be deducted)

Current Ratio: 2.27 - very strong, and this includes net cash of £18.6m - that's almost 25% of the entire company's market cap.

Overall then, this is a really strong balance sheet with plenty of surplus working capital. So there should not be any issues over solvency, even if trading deteriorates a lot more.

My opinion - based on the information provided in Sept 2017, and more recently today, I see this as a good buying opportunity. So I've currently got a buy order in, to increase my existing position size. My main worry is that the price could fall further - my broker reckons that sellers have not finished yet. It's usually a mistake to buy on the day of a profit warning. However, when the price is falling, then you have better liquidity - so it's often the only time you can actually buy a stock like this in decent size.

I've no idea what the exact low point will be in the share price, and don't really care particularly - because the price now looks sufficiently cheap on (revised) earnings forecasts, and with a very attractive yield, that it's cheap enough for me. I accept the risk that there could be another profit warning - that risk is why the share is now so cheap.

The key points for me are that the main reason for the profit warning seems to be a one-off factor outside their control - the insolvency of Toys R Us. Also, the new products in the pipeline give good grounds for optimism in H2 of 2018 and into 2019. Therefore I see this as being a possibly bumpy ride, but where I should be paid nice divis, and see a decent capital return in say 1-2 years.

It should be said that I generally tend to be a bit too willing to give companies the benefit of the doubt! Also note that the stock market has never really attributed a generous valuation to this company - it always looks cheap.

As always, please remember that I'm only giving a personal opinion, and reporting what I'm personally doing with my portfolio. I might possibly add some to BMUS, but haven't decided yet. The onus is on readers to do your own research, and take responsibility for your own trades. Hence why I never give recommendations. If something in your portfolio goes wrong, you're to blame, not me! That's why I never give recommendations - because I don't want the responsibility or hassle of people blaming me for stock ideas that go wrong, as inevitably many will.

I'm particularly keen to hear from anyone who's bearish on CCT - it's vitally important to consider the negative case on a share. Obviously I reserve the right to change my mind at any time, on any share.

QUIZ (LON:QUIZ)

Share price: 183.5p (down 1.9% today)

No. shares: 124.2m

Market cap: £227.9m

(for the avoidance of doubt, I no longer hold a position in this share)

Pre-close trading update - for the six months to 30 Sep 2017.

This is a clothing retailer, both from physical stores and on the internet (like a lot of other companies - so its emphasis on being "omni-channel" is not unique at all).

This update is unsatisfactory, in that it only mentions revenues and gross margins. It doesn't give the key piece of information, which is how the company's overall profit compares with market expectations. Failing to be clear about this just introduces doubt, and makes me wonder whether costs might might be running ahead of forecast? That's the only explanation I can think of, as to why the update only mentions sales growth, and gross margins, but not net profit.

QUIZ, the omni-channel fast fashion womenswear brand, is pleased to announce a 35% increase in Group revenue to 56.1m (H1 2016: 41.5m) for the six month period to 30 September 2017 ("H1 2017"), compared to the same period last year. Gross margins remain in-line with expectations.

QUIZ's strong growth in H1 2017 reflects the brand's continued expansion in the UK and targeted international markets across the Group's omni-channel model.

Online growth is excellent, but coming from a low base;

The QUIZ brand has continued to grow rapidly online with Group online revenue increasing by 204% to 13.8m in H1 2017 (H1 2016: 4.5m) reflecting the benefit of opening the new 180,000 sq. ft. Distribution Centre in the summer 2016, increased and effective marketing spend, particularly through digital channels, and the broadening of the product ranges available to customers.

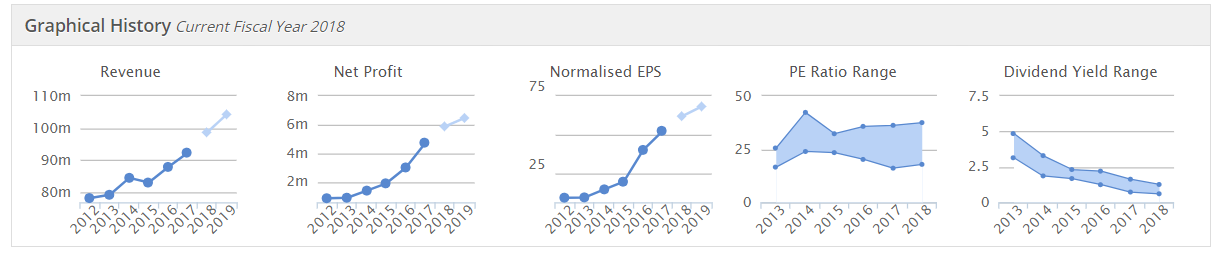

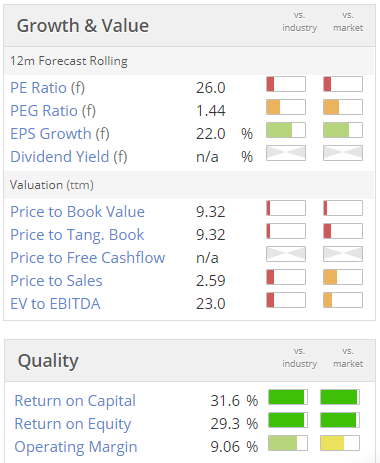

Valuation - I'm waiting for my broker to email me some research. In the meantime, the valuation shown below on Stockopedia is based on the broker consensus figures supplied by Thomson Reuters. As you can see, this share has a fairly aggressive PER of 26.0. On Stockopedia this is calculated as a blend of the current, and next financial years forecasts, which makes all shares comparable, irrespective of their financial year end date.

So the deal here is that above average growth commands a relatively high PER.

My opinion - I was really impressed with management at a pre-IPO meeting, so I participated personally in the IPO. Although very soon afterwards, my nagging doubts became more at the forefront of my mind, so I ditched my shares into the initial price surge.

Overall, my current view is that it seems a fairly good business, but that it operates in a crowded market, and isn't sufficiently special to make me want to hold it long term. Also I feel the IPO price was high, with investors being prepared to over-pay for an online fashion retailer, given how spectacularly well Asos & BooHoo have done. The trouble is, online retail is only a small part (although growing rapidly) of Quiz.

So for now, I'm happy to sit on the sidelines. It's the type of business that I would consider buying back into if it misses profit targets, and drops to a more realistic valuation.

Vertu Motors (LON:VTU)

Share price: 46.25p (down 1.6% today)

No. shares: 393.5m

Market cap: £182.0m

Interim results - for the 6 months to 31 Aug 2017. This is a car dealership, operating from 124 sites in the UK. Car dealers seem to be very out of favour with investors currently - due to new car sales falling, cost headwinds (e.g. from forex), Brexit fears, plus longer term issues of how electric & self-driving cars will change the sector. So could there be a value opportunity with these shares, or are earnings likely to fall in future?

Performance looks pretty good;

Adjusted profit before tax up 7.2% to £20.9m

Adjusted EPS of 4.24p (up from 4.06p). Remember these are only 6 month figures, so if you double them to crudely annualise, then the PER is amazingly low, at only 5.4.

LFL new car sales are down heavily, at -14.7%. That's awful - it's what you would expect in a deep recession. However, used sales, and aftersales are both up - which has clearly taken up the slack from lower new car sales. Used sales & aftersales contributed 71.7% of gross profits.

Costs seem to have been well controlled, with £0.8m in like-for-like cost savings overall - so other cost increases have been more than fully absorbed by savings elsewhere.

Outlook - the company confirms that it's trading is consistent with full year market expectations. I am also delighted to see the company include a very helpful footnote as follows. All companies should do this;

2 The Board considers market expectations for the financial year ending 28 February 2018 are best defined by taking the range of forecasts of adjusted profit before taxation published by analysts who consistently follow the Group. The current consensus of adjusted profit before taxation as at 11 October 2017, based on the published analysts' forecasts of which the Board is aware, is £31.8m.

Note that as the company achieved £20.9m in H1, then this implies a much lower lever of profitability in H2, of £10.9m adjusted profit before tax. So that invalidates my comment above of just doubling H1 profits to estimate full year forecasts.

Forecasts - several broker notes have hit my inbox today. They're reducing future profit forecasts by 7-10%. For example, one broker is forecasting 6.3p adj EPS this year and next year. Another is forecasting 6.3p this year, and 6.4p next year.

Therefore, brokers are basically telling us that the company won't be growing its profits any time soon. To me that makes me worry that profits might have already peaked, and could be heading downwards. This explains why the sector is on such a low rating - based on today's updated broker forecasts, Vertu is on a forward PER of 7.3.

Asset-backing - the low PER obviously reflects the wobbly outlook for new car sales. It seems logical to assume that lower new car sales would feed through to lower aftersales revenue, after a time lag?

However, the market cap is also rather well supported by net assets.

NAV £264.6m

NTAV £168.6m (which compares with the market cap of £182m)

There is net cash, of £20.8m. Although note that, whilst it may not need to borrow from its bank, the group does effectively borrow heavily from the car manufacturers. So trade payables is gigantic.

Therefore current assets are £609.8m, which is mainly inventories of new & used vehicles, and current liabilities is a similar number, at £612.8m - which is mainly trade payables (i.e. money owed to the car manufacturers).

The other main assets are freehold & long leasehold property - which is a very nice position to be in.

Therefore, arguably this company has 2 supports for the share price - one being earnings, the other being its property portfolio. This should provide decent downside protection, even if earnings decline.

My opinion - sentiment feels very poor towards this sector, and valuations reflect that.

I'm quite tempted to buy some shares, for a possible future recovery. The property asset backing interests me too - as there could be potential upside from that, e.g. selling under-performing sites to developers.

Overall, it looks moderately interesting to me as a possible value share. My main worry is that the sector might have already reached peak earnings, and could now see declines. That's what the very low PER is suggesting to us. So the downside risk is that an apparently cheap share could end up being not so cheap after all, if earnings do fall significantly in future. On balance, think I'll probably steer clear. I'm more interested in companies & sectors where earnings are rising strongly.

Proactis Holdings (LON:PHD)

Share price: 163.5p (down 4.4% today)

No. shares: 92.7m

Market cap: £151.6m

Preliminary results - for the year ended 31 Jul 2017. This is an acquisitive group of companies focused on spend control software and services.

The problem we have in analysing the figures, is that a significant acquisition (Millstream) was made during the year. Then a huge acquisition was made just after the year end (Perfect Commerce LLC) - which was classified as a reverse takeover due to its size (involving a £70m placing at 165p, and £45m of new debt facilities).

Therefore the composition of the group as things stand today, is very different to how it was during the year end 31 Jul 2017 - rendering the historic figures to be almost meaningless.

I can't even rely on EPS calculations, as this is obviously based on the average number of shares in issue during the year, being 48.8m on a fully diluted basis. Here we are, just a few months later, and the share count has almost doubled to 92.7m. Therefore earnings have to almost double this year, to achieve the same EPS.

The acquisition of Perfect was justified by the expectation of £5.0m in group cost savings.

Balance sheet - looks very weak. Although substantial new equity was raised after the year end, in a £70m placing at 165p, this was used to part fund the Perfect acquisition. So the next set of accounts will probably also look weak - with intangibles getting larger with every acquisition.

FinnCap has published a new note today (available on Research Tree), in which it forecasts balance sheet NAV of £99.4m at 07/2018. However, intangible assets is £138.7m within that, meaning that NTAV would be negative at -£39.3m. Personally I don't normally invest in any company with negative NTAV. So for me, the balance sheet is a deal-breaker here, hence I wouldn't invest.

Earnings forecasts - FinnCap forecasts adjusted EPS of 11.4p in the current year 07/2018, and an increase to 13.7p in 07/19. Assuming we can rely on those figures, the next question is what level of PER does the group deserve? I would have thought a PER of 15-20 would make sense. Therefore that targets a share price of 205p to 274p. This compares with the current share price of 163.5p - so there's some upside if things proceed according to plan, but it doesn't look madly exciting to me. Plenty could go wrong along the way, as the growth is nearly all coming from acquisitions & restructuring - fraught with risk.

My opinion - I tend to steer clear of highly acquisitive groups - there's just too much scope for something to go wrong. Also, I don't like the weak balance sheet here - with significantly negative NTAV forecast. So overall it's not for me, but I wish shareholders well, and hope things work out for the company.

I note that a highly-regarded tech analyst has raised question marks over the wisdom of the Perfect acquisition. That's another reason which is adding to my caution here. I think I'd like to revisit this in a year's time, once we have a full year's trading of the enlarged group.

James Cropper (LON:CRPR) - there's been a sharp correction in the share price here. The company has responded today with a reassuring-sounding update;

...Overall, therefore, the Board expects the Group to achieve management expectations for the current financial year and remains confident of the Group's prospects over the medium and longer term.

More detail is given. To summarise, higher pulp prices have been absorbed by improved performance in other divisions.

My opinion - I don't really understand why this share is rated at over 20 times earnings.

The progression of profits has been quite good, but note how the divi yield has been reducing steadily, and is now only 1%.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.