Good morning, it's Paul here.

Estimated time of completion - about 3pm. Update at 14:28 - I can't find anything interesting to write about, and want to give some support to Ed & the Stockopedia team on the their stand at Mello, so will sign off early for today. Therefore this report is now finished, sorry it's a bit half-arsed.

It was great to chat to many subscribers at yesterday's Mello Investor Show. I'm walking wounded today, so probably won't be going back for seconds today (OK - some time later - retrospectively that didn't work out quite as planned)

accesso Technology (LON:ACSO)

Share price: 590p (up 13% today, at 11:40)

No. shares: 27.6m

Market cap: £162.8m

Further update on the formal sale process

accesso Technology Group plc (AIM: ASCO), the premier technology solutions provider to leisure, entertainment, hospitality, attractions and cultural markets, provides the following update on its announced formal sale process (the "Formal Sale Process") under the City Code on Takeovers and Mergers (the "Code") which remains ongoing.

There's been a 13% bounce in share price today, alleviating some of the suffering for beleaguered shareholders, who've seen their investment drop by about 80% from the peak. Amazingly, in the last year, it's scrubbed off all the previous gains since 2013. Which begs the question, was the surge to almost 3000p share largely a speculative momentum-driven bubble? It looks that way to me.

The sale process seems to still be active, so today's announcement is being seen as having increased the chances of a takeover bid;

Following receipt of a certain number of refreshed indications of interest over the last several months, the Company and its advisers are continuing to engage in discussions with several parties to determine whether a potential offer for the Company can be delivered at a value that the Board considers attractive to shareholders.

The interested parties remain engaged in financial and operational due diligence.

Due diligence normally only occurs when there is serious bid interest. That's because it's expensive to send in teams of accountants & lawyers. Or sometimes, it can be a good excuse for a competitor to run their eyes over the detailed figures that they wouldn't otherwise be able to see.

My opinion - Accesso is extremely difficult (impossible?) to value, because the accounting is unusual. Large amounts of expenditure are capitalised, therefore the EBITDA and arguably profit numbers seem meaningless.

The balance sheet is weak, with NTAV negative, at about -$15m. I don't understand why (mentioned here at the time) when the company had a market cap close to £1bn, that it didn't do a relatively small placing of say £20-40m, to eliminate debt, and make its balance sheet bulletproof. That was a big missed opportunity.

On the positive side, this company does seem to be the market leader globally, in an interesting niche. With a more reasonable market cap of £163m, this could perhaps be a buying opportunity? Why is the company up for sale though? I don't really understand why management is pursuing a sale process at all.

The problem in this situation, is that we are in the dark about what level the expressions of interest are at? I don't like that, because rumours start to swirl, and insider dealing probably occurs. Is this a distressed sale, maybe if the bank is getting jittery? We just don't know. There's always the chance of a bid occurring at a decent premium. Or it may not.

In conclusion then, I just haven't got enough information to form a view on this share. It's tempting to have a little punt on it, in case a bid does happen.

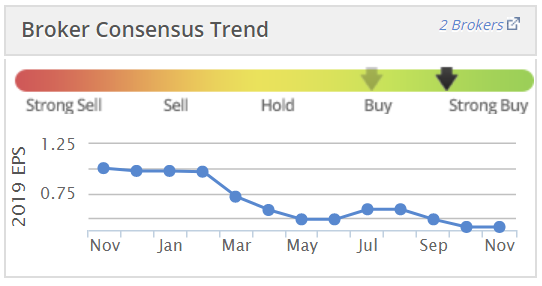

Earnings forecasts have been coming down, so it looks as if underlying trading has not been great;

Another point is that Accesso's former CEO, Tom Burnet, has just been promoted from NED to Chairman at Kainos (LON:KNOS) - which makes me wonder if maybe his interest in ACSO might be waning?

Ideagen (LON:IDEA)

Share price: 153.5p (up c.2% today, at 13:17)

No. shares: 223.6m

Market cap: £343.2m

Ideagen PLC (AIM: IDEA), a leading supplier of Information Management Software to highly regulated industries, today provides an update on trading for the six months ended 31 October 2019.

This company is appearing at Mello today, I understand.

There's a reassuring, upbeat-sounding trading update today;

The Board is pleased to report that trading has remained strong in the first half of the financial year and that revenue and EBITDA are both expected to be significantly ahead of the same period last year and in line with management's expectations.

This has been achieved through both organic revenue growth and the acquisitions of Redland Business Solutions Ltd (acquired in June 2019) and Optima Diagnostics Ltd (acquired in Oct 2019).

The Company has a clear strategy to grow revenues organically and maintain high EBITDA margins whilst transitioning from a perpetual licence to a SaaS based subscription model. The successful execution of this strategy will provide an even more robust business model and a higher quality of earnings over the medium term without impacting on the short-term profitability of the business.

More detail is given, including;

- High level of recurring revenues

- Organic revenue growth of 7% [looks good]

- 240 new customers won

- Net debt risen from £1.3m to £18.2m in last 6 months, due to a £19.8m acquisition

- Operating cashflows "robust"

Outlook comments are upbeat;

Cash generation has been good which coupled with further growth in new SaaS recurring revenues and an increase in repeat business from our growing customer base provides a strong platform for the second half.

The market opportunity remains large and long term and given the Group's position as a leader in the Governance, Risk and Compliance market, the Board is optimistic about the Group's continued growth prospects."

I would have preferred a specific reference to market expectations for the full year.

Valuation - the price reflects good performance, over multiple years. So the forward PER of 23.8 is not cheap, but I think it's justified by strong historic performance.

I had lunch with the Chairman earlier this year, and one thing in particular has stuck in my mind. He said, "We've never missed our forecasts. We always meet or beat market expectations". That is an important point, as it builds confidence amongst investors, and shows that management are properly in control, running the business well, plus forecasting the future accurately.

Bear in mind that the Thompson Reuters data used by Stockopedia reports the statutory figures, not adjusted figures, in order to be consistent in presentation of figures across many companies. Therefore this data format punishes acquisitive groups, because the goodwill amortisation is not adjusted out of the Stockopedia data.

My opinion - this seems to be one of a select group of acquisitive companies that make that strategy work well. Another stand-out performer is Judges Scientific (LON:JDG) which has created huge shareholder value through multiple, low-priced acquisitions.

I'm not keen on the balance sheet, which looks a bit stretched to me. I prefer to see NTAV positive, whereas it's negative at -£17.0m here (as at 30 Apr 2019). Given the high valuation, I think a placing of about £20m would make sense, to eliminate the negative balance sheet, and pay off debt. That would only be about 6% dilution, which is a small price to pay, to correct a stretched balance sheet, and completely eliminate financial risk.

In all other respects though, this share looks good to me.

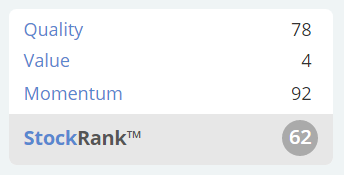

Stockopedia likes it on the "Styles" section, with a High Flyer classification;

As usual, the StockRank system summarises it well;

That's it for today. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.