Good morning, it's Paul here, with the placeholder for today's SCVR. Please add your comments in the usual way, and the main report should be finished by 1pm today, depending on how much news there is. Edit: predictably, I'm running late, so will finish at 3pm. Today's report is now finished.

In case you haven't seen it, Jack has published an interesting article here:

Multi-bag or bust? RTN, MAB, RBG, and OTB

.

OBR coronavirus reference scenario

This document published by the Office for Budget Responsibility has understandably caused a furore. It's a forecast of what impact coronavirus might have on the economy. Being sensible people, they are not calling it a forecast, but instead a "reference scenario".

Economic forecasting is widely discredited, because people repeatedly try to forecast, repeatedly get it (often wildly) wrong, but continue pretending that they actually can forecast the future with any accuracy, when they cannot. Former Bank of England Governor, Mervyn King, has written persuasively about this, urging economists and pundits to stop pretending that they can forecast the economy, because they can't.

There's a terrific book on this called "Super-forecasting: the art and science of prediction". This makes the same point. Dominic Cummings (Boris's brilliant adviser) spat out the name of this book to journalists doorstepping him, obliquely calling them "useless political pundits", and suggesting they read this book. It's a fascinating read, highly recommended if you haven't already seen it. The core theme in it, is that a long-running study showed that many experts & pundits are useless at forecasting, but nobody ever pulls them up on their serial failure.

The same useless forecasters repeatedly appear in the media, despite getting things mostly wrong. It also identified (through a scientific process) an unusual type of person, who presented with facts & figures and allowed to research economic or political issues independently, were proven to be amazingly good forecasters. Not experts, but smart laypeople. Yet these super-forecasters rarely had any influence or involvement in policy, or even media commentary.

The conclusion being that we need to measure the accuracy of pundits forecasts, and jettison the ones who are no good. Then recruit the unusually good super-forecasters to give us predictions instead. Very sensible, but it won't happen. Apparently, an engaging & confident manner is enough to convince media outlets that you talk sense.

Going back to the OBR report, I printed it off & skim read it last night. The numbers are so horrific, it's is clear that ending the lockdown is not desirable, it's essential. The economic cost is so vast, it cannot possibly continue for much longer. This changes risk:reward for shares. If the ending of lockdown has to happen quite soon, then more companies survive, and can begin to rebuild their operations & earnings. I think this is why the stock market has been rallying so strongly of late - recovery is being priced-in.

Other positive factors include hopes for some kind of drug therapy to lesson the impact of Covid-19, with maybe a vaccine at some later date. Above all though, the Fed in the USA, and the UK Govt here, are throwing so much money at the problem, so much economic stimulus, that recovery is more-or-less inevitable. They can keep borrowing at unthinkably high levels, because they have a guaranteed buyer for newly issued debt - themselves! (round the houses, but that's what QE is).

Anyway, here are a few key numbers from the UK's OBR report, which assumes a 3-month lockdown;

- Q2 GDP down 35% on Q1, but bounces back quickly when lockdown is lifted

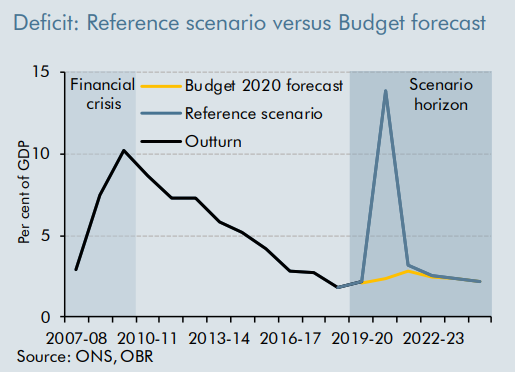

- Govt net borrowing soars to £273bn, or 14% of GDP - far higher than at the worst of the 2008-9 crisis, which peaked at roughly 10% of GDP

- Public sector net debt soars above 100% of GDP during the downturn, settling back at a still high 95% (far worse figures are being forecast in the EU, which in my opinion makes another sovereign debt crisis in the EU inevitable. Possible collapse of the Eurozone is on the cards in worst case scenarios - I see that as a very big risk, and quite likely)

- I've seen estimates that the Govt's payroll scheme alone is likely to cost £14bn per month. It's probably wide open to fraud, and there are concerns the money won't get to companies in time to save jobs

- GDP falling 13% in 2020 would be worse than not only the financial crisis in 2008, but also worse than both world wars (per the OBR report, I'm not making this up!)

.

The above chart shows the forecast explosion of the Govt's spending deficit, due to the current lockdown & the recession it is creating. Historically, large deficits usually take years to reduce - as shown above after the 2008 crisis. I'd be very surprised if this time it can be brought down almost vertically, that doesn't look realistic to me.

My view - these figures are so bad, that lockdown has to end by early summer, or there won't be anything to come back to, in the commercial world.

The aftermath of coronavirus is going to leave many countries with unsustainably high debt to GDP ratios. That doesn't matter so much if you can print your own currency (e.g. USA & UK), but where does it leave the Eurozone? In a much worse mess than the 2010-12 crisis. Italy could be looking at debt:GDP not far off 200%, by some estimates. There's just no way Germany is going to backstop that. Therefore, I think the next financial crisis could well be a disintegration of the Euro, into 20 separate Euros, with an instant & gigantic correction of all the Euros to the levels that they should be at, were they not artificially pegged at parity. I could be wrong, but it's a huge emerging risk that I want to start planning for.

Given the severity of the economic cost of lockdown, then it's difficult to see why many UK shares could remain at current levels. Are investors really going to just look through the worst economic downturn in living memory? I don't see that happening, because it's not happened before. Markets may rally strongly, but when faced with the actual figures, then I see individual share prices being bashed down again.

Will the economy really rebound in a V-shape, as the OBR report suggests? Again, I can't see that happening, because it's generally not what happens. When previous (smaller) economic shocks have happened, there's a partial V rebound, then growth settles down, and the lost GDP can take several years to recoup. But the bottom line is, nobody knows what's actually going to happen.

We all need to think about this, and have at least some idea what scenario we're basing our investing on. Personally, I don't want to own the market overall, as I feel bearish about the terrible short term economic outlook. But I am happy owning individual shares that look too cheap, and hedging that against index shorts after each rebound.

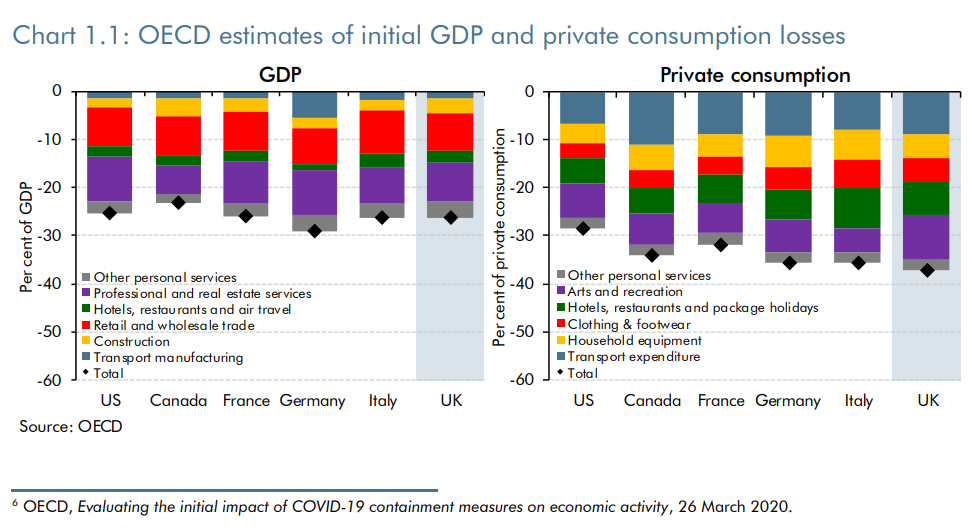

It's not just the UK that is suffering;

.

I think when investors actually see the company H1 numbers, and the reality of how this crisis must be wrecking many companies' balance sheets, then optimism about recovery could be dented. Particularly with small caps, where it only takes one determined seller to smash the share price down - recent examples of that being Keith Ashworth-Lord's clumsy exit from Revolution Bars (LON:RBG) and a similar situation with a big seller at French Connection (LON:FCCN) (I'm long of both) . In both cases they presumably decided the equity was worth nothing, so dumped in the open market at whatever prices they could get. Which will look smart if those companies do go bust, but not so smart if they survive & recover. Time will tell. It's all just educated guesswork at this moment in time in particular.

It's an evolving situation, so nobody knows how this all ends. The above is just my personal opinion, which is subject to change as the facts change.

Beeks Financial Cloud (LON:BKS)

Share price: 92p (up 2% today, at 12:02)

No. shares: 50.9m

Market cap: £46.8m

(at the time of writing, I hold a long position in this share)

Beeks Financial Cloud Group Plc (AIM: BKS), a cloud computing and connectivity provider for financial markets....

This is a small acquisition, which broadens Beeks' product offerings (or I should say, services), and brings cross-selling opportunities. It's interesting to note that RBS has provided a £1.5m borrowing facility to make the acquisition. More evidence that taxpayer-backed RBS is the best bank to be dealing with right now.

More importantly, there's a Covid-19 update as follows;

· Minimal impact on current trading from measures implemented due to COVID-19, with continued operational cash generation, increased Annualised Contracted Monthly Recurring Revenue ("ACMRR") and recurring revenues of c.95%

· Continued growth in new business, however new customer implementations may be delayed

That's encouraging. I increased my personal holding in BKS a few weeks ago, on the basis that the company has strong recurring revenues, that should hold up well in this crisis. The spread betting companies have been doing well in recent volatility, hence it stands to reason that Beeks, being a provider of cloud-based trading connectivity would probably also be seeing demand hold up.

Outlook - despite the reassurances, it sounds like there is going to be some impact;

... therefore while we are unlikely to be entirely unimpacted, we believe we are in a strong position to withstand the current challenges."

I'm not madly keen on the double-negative there.

Broker update - there's a note on Research Tree today, which lowers forecast EPS for FY 06/2020 by 16% to 1.9p which is well down on last year's 2.6p. Forecast is for strong growth to 3.1p the following year.

Therefore, in reality, this looks like a nicely disguised profit warning. There again, why would anyone be surprised by forecasts being lowered, since we're in the middle of an unprecedented (in living memory) health & economic crisis.

My opinion - I like the business model, and exceptional management. Recurring revenues are proving very valuable at the moment - in cushioning the blow to financial performance & share price.

The share price looks about right to me, I don't see it as one to chase higher from this level.

I'm happy to hold BKS for the next c.5 years (providing nothing changes). It's the sort of niche company that is highly likely to be considerably bigger, and more profitable over that timescale. Hence I see it as something to tuck away & largely forget about.

Castleton Technology (LON:CTP)

This used to be called Redstone, and it provides software & services to the social housing sector mainly.

There's a 95p cash, agreed takeover bid, so congratulations to holders.

This is a respectable 43% premium to last night's share price. With 47.3% support already, then this looks a done deal.

It seems an unusual time for a takeover bid, hence why I'm flagging it. I wonder if there will be other takeover bids, with cash-rich buyers taking advantage of lower valuations maybe?

This comment from the bidder is interesting, and should give us pause for thought as to whether many smaller companies should be listed at all?

Finally, MRI also believes that in order to maximise its future potential, Castleton would be better suited to a private company environment, where initiatives to improve the performance of the business can be implemented effectively, with appropriate support, capital and assistance from MRI, free from the requirement to meet the public equity market's shorter-term reporting requirements and expectations, and the costs, constraints and distractions associated with being a publicly traded company.

Solid State (LON:SOLI)

Share price: 458p (up 2% today, at 13:04)

No. shares: 8.54m

Market cap: £39.1m

Solid State plc (AIM: SOLI), the AIM listed manufacturer of computing, power and communications products, and value added distributor of electronic components, announces a trading update for the 12 months to 31 March 2020 and a further update on the impact of COVID-19 on the business.

There's a strong update for the FY 03/2020, but of course that's only really of passing interest now that we have an economic crisis underway;

The Board expects to announce revenue close to the consensus forecast of £68m and adjusted profit before tax is expected to be approximately 10% ahead of current consensus forecast of £4.2m, which is a record year for the Group.

Net cash - is £3.0m, benefiting from good cashflows, including some customers paying £2.5m up-front.

Has unused, renewed bank facility of £7.5m, so headroom looks OK.

Order book - up 11% on a year earlier, at £39.9m. Although the company says it expects some orders to be deferred.

COVID-19 -

- All 4 UK sites are operating, and some staff working from home.

- SOLI has been designated a critical supplier by some customers, a good thing.

- Softness in demand for some products (e.g. batteries for aircraft & oil/gas sector).

- Inventories increased to 2.5 months to smooth over any supply chain problems.

- Cash conservation measures similar to what everyone is doing.

- Acquisitions & capex both suspended.

Outlook - uncertain visibility, guidance can't be given at the moment.

My opinion - it sounds like the business should survive, and that management has taken sensible steps to conserve cash.

With no guidance, and an uncertain outlook, I cannot see any reason why this share should be any higher than it currently is. The rebound has probably run its course for now, in my view.

Why would I want to buy now it has almost doubled from recent lows, and is back to the level of last summer/autumn? Yet we have no visibility on earnings now. Risk:reward doesn't look great to me at the moment. Longer term, it should be OK, I imagine.

.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.