Good morning, it's Paul here with the SCVR for Weds.

Estimated timing - I should be mostly done by 1pm, but will probably need a bit more time to get everything done, so let's say 3pm.

Update at 14:34 - sorry, I nodded off after lunch (trainee pensioner!) so will keep going until 5pm.

Update at 16:40 - today's report is now finished.

Please see the header for the shares I'll be reviewing today. I've included a couple of reader requests.

.

Vaccine hopes

Every now and then the US markets get excited about the prospects for a covid-19 vaccine. I've been glued to CNBC (American financial news channel) for months now, following events. The positive attitude there is astonishing, compared with the seemingly all pervading negativity of UK small cap investors. Whatever problems the economy and covid throw at the markets, they just brush it off as temporary and irrelevant in the USA, chasing share prices higher. The argument goes that whatever problems emerge, the Fed and the Govt will just keep throwing ever more stimulus, and back-stopping borrowings to enable even normally insolvent companies to continue trading (the one exception so far being Hertz). Plus a vaccine is supposedly going to eradicate covid, so why worry about it? Doesn't this strike you as overly optimistic? It does me.

Last night after hours, vaccine hopes caused the futures to gap upwards. I got stopped out again. It's proving very expensive taking a bearish view on the US markets, so think I'll have to just admit defeat there. However, I'm seeing so many similarities with 1999-2000, it's uncanny. E.g. the Robinhood (a free dealing app) traders, who are chasing momentum shares ever higher, and buying every dip. The experts are scoffing at their naivety, but (so far anyway) they're making money.

With casinos & sports shut, the assertion is that people are instead gambling on the stock market, concentrating into wildly speculative valuations on things like Tesla (where I'm still short). This is clearly the euphoric last stage of a bull market in my view, I think conditions are setting up for a market crash, or at least a very big correction - at least in the pockets of crazy over-valuation. IPOs are booming across the pond, and generally going to a big premium. Again, another feature of a manic bull market. Yet it feels completely different here in the UK.

As one CNBC commentator said yesterday;

It's not a stock-pickers market any more. It's a day trader's market.

I've never seen such an extreme dislocation between economic conditions, and the stock market. There again, as many commentators keep saying, the stock market is not the economy. It's highly concentrated in truly remarkable tech companies, which arguably do justify their high valuations, e.g. Facebook, Google, Apple, Amazon, etc.

Its all so confusing. If I'd told you that the US markets would rapidly recover all their losses, and even make new all time highs, within 3-4 months of the crash back in March, you'd have thought I was out of my mind. Who predicted that? It feels dangerously like a bubble to me.

.

Garment sector - sweatshops

The controversy over Boohoo (LON:BOO) (I'm long) rumbles on. The allegations are that some of its suppliers (or a supplier?) was operating a sweatshop and possibly paying staff as little as £3.50 per hour - which of course is illegal, as it breaches minimum wage regulations. I'm not sure if it's actually been proven, so we have to be careful what we say.

Clearly, anyone not paying minimum wage needs to be prosecuted. There's no point in having regulations like that, if companies are going to flout them.

Is BooHoo's business model shot to bits then? Of course not. If they can't buy garments in the UK at an attractive price, then they'll source them overseas. Reality check to everyone virtue signalling on social media about this issue - practically every garment that you've ever worn, was made by someone who was paid peanuts. That's how this (and many other) sectors work. There's a reason why clothing has barely changed in price (or even gone down) in the last 30 years - it's because globalisation has seen the production move to low wage economies. Therefore I suspect we'll see BOO move production elsewhere, or it could manufacture in small quantities in the UK (test and repeat model), then place a larger repeat order with a low wage overseas factory.

Boycotting BOO just means that lots of people who need the work are going to become unemployed. Of course it's not right to (allegedly) pay machinists £3.50 per hour. But there's a reason people work for that money - they can't get better paid work. The alternative is unemployment. The overall effect of boycotting BOO is to make poor people unemployed here, and to move production to sweatshops in somewhere like Bangladesh or Vietnam. How is that a positive outcome?

This is the (admittedly uncomfortable) truth. Is BOO unethical? I don't know. But its protestations of innocence look a bit weak, given that this Guardian article linked a former BOO Director to an apparently dodgy garment manufacturer in Leicester.

Should we all sell our BOO shares then? That's up to each investor to decide. I'm not. I'm in the markets to make money, not to virtue signal. Customers want cheap clothes, and it's not my job to police the working conditions of people who make them. That's what Governments and their various agencies are there to do. What seems to be happening is that ethical funds are selling out of BOO, creating a buying opportunity for the rest of us. Like all previous scandals in this sector, it's all likely to blow over quite quickly, and the share price is likely to recover over time. That's a buying opportunity in my book.

Before chastising me for being so ruthless, have you ever owned shares in tobacco companies, drinks sector, etc, which kill their customers? How about the supply chains for the electronics or car sectors - how many sweatshops provide components for them? Or as someone pointed out here, that nice shiny iPhone in your pocket was made in a factory where they had to install suicide prevention nets outside the building. The process by which poor people & countries achieve economic development, is by making stuff for richer people/countries. That can be an unpleasant process.

Quiz (LON:QUIZ) (I'm long) put out an announcement earlier this week expressing surprise and abhorrence that it too apparently used a sweatshop in Leicester. It's made no difference to the share price, because (a) was anyone surprised?!, and (b) it's too small to have ethical funds invested in it. That reinforces my view that the BOO share price is only temporarily depressed.

Bear in mind that BOO's brands sell internationally, so those overseas sales are not likely to be impacted by the allegations made in the British press. Hence I reckon BOO is probably facing nothing more than a temporary hit to profits this year. It's still delivering stunning growth, and bolting on brand after brand to its machine. Hence why I'm happy to hold my nose, and keep buying.

.

Portmeirion (LON:PMP)

Share price: 362p (up 1% today, at 10:32)

No. shares: 13.97m

Market cap: £50.6m

(I'm long)

Portmeirion Group PLC, the designer, manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester, Pimpernel, Wax Lyrical and Nambé brands, updates on trading for the first half of the year.

Portmeirion has a 31 Dec 2020 year end. Note that it has a strong seasonal bias towards H2 in a normal year, because some of its key products are Christmas related. Therefore H1 is normally comparatively weak, plus of course this year we have the covid disruption to contend with, which would have impacted sales from Q2.

H1 Sales - this is much better than I was expecting;

Our sales for the six months to 30 June 2020 are approximately £32 million (2019: £34.9 million), representing a decrease of 8% compared to the previous year. Our like-for-like sales, excluding the sales from our Nambé division acquired in July 2019, were down 20%.

Sales in June show an improving trend, being down 9% vs last year, on a like-for-like (LFL) basis - not bad.

E-commerce - this is interesting. The renewed focus on online sales is what tempted me to dip my toe in with a small purchase of Portmeirion shares recently. It seems to be working well;

Our own ecommerce sales in our core UK and US markets increased over 90% in the first half and over 100% in Q2 against the prior year. Growth in ecommerce sales has played a core role in our strategy in recent years and we expect to see continued strong growth in the second half of this year.

As previously mentioned, I tried out the online ordering process, and was impressed with the product, delivery, etc.. Once a customer has purchased a small set of plates & bowls, as I did, from the attractive Botanic Garden classic range, then Portmeirion can tempt them to buy additional pieces, matching cups & saucers, etc, by email. I get rather too many emails from Portmeirion offering good discounts. With the wholesale and retail margin rolled together, this should be good, profitable business for the company.

Profitability - this is also much better than I feared;

We expect to report a low single digit £ million loss before tax for the first half of 2020 (2019: £0.5 million profit). Our business has a significant second half weighting in sales and particularly profit generation.

We are currently seeing good order intent from customers for our key seasonal trading period and assuming no further Covid-19 disruption and the trend of improved month on month trading continues, we are confident that we will return to profitability in the second half of 2020.

As you can see, H1 last year was not much above breakeven, so I think a "low single digit £ million loss" in H1 this year seems a creditable performance, and will have benefited from the furlough scheme.

Fundraising - my worry at the time, was that the group might have been bleeding cash badly, so I was sceptical about the reasons given for the fundraising in June. Today's update reassures me that my fears were misplaced. Although I still suspect the bank might have encouraged the company to raise fresh equity. £11.2m (net of fees) was raised at 380p, which wipes out net debt of £10.0m, taking it to a £1.2m net cash position after the fundraise. With £15m unutilised bank facilities - that looks very comfortable.

Although we do need to be careful to remember that the covid crisis has allowed companies to stretch their creditors, particularly VAT and payroll taxes, and rents. Hence all net debt/cash figures need to be treated with caution right now. Those stretched creditors will need to be paid in early 2021. Hence we need to adjust the figures accordingly to arrive at the true underlying picture.

My opinion - I'm really pleased with this update, and am surprised the share price has not responded more positively today.

We can buy at 364p today, which is a better price than the recent placing at 380p, yet today's buyer has the benefit of a very reassuring trading update. Whereas buyers in the placing were buying blind (no financial information was given about current trading). I attended a virtual meeting re the placing, and was impressed with the clear strategy for growth via new product ranges, accelerating online sales, and expansion into Canada. Whereas in the past, I found the strategy too sluggish, and was plodding along using acquisitions for growth rather than developing the great brands they already had.

I think today's update has given me the confidence to add to my position when I have some spare funds (a fully committed elsewhere at present).

It gets a thumbs up from me. I don't see this share shooting the lights out, but do see it as likely to be higher in a couple of years than it is now, if management execute well. It's got through the covid crisis better than I expected.

.

.

Galliford Try Holdings (LON:GFRD)

Share price: 108p (up 7% today, at 11:40)

No. shares: 111.1m

Market cap: £120.0m

Galliford Try Holdings plc ("Galliford Try"), the UK construction group, today provides the following update on trading for the year ended 30 June 2020. The Group expects to announce its results for the full year in September 2020.

I'm very rusty on this one, not having looked at it for 4 years. So readers probably know the company a lot better than I do.

This bullet points really jumps out at me;

Well-capitalised, with cash at 30 June 2020 of £195m (2019: net debt £57m) and average month-end cash during the six months to 30 June 2020 of £140m.

Even the lower monthly average cash of £140m, is higher than the market cap of £120m. It's not often you see that. Although there could be corresponding creditors, if e.g. the cash has come from customers paying up-front? I'd need to see the full balance sheet to properly assess it.

I've just been looking at the last reported balance sheet as at 31 Dec 2019, but there's a problem with this - the big disposals didn't complete until 3 days after the balance sheet date, and no pro forma balance sheet is provided. I don't have time today to plough through the numbers, and try to reconstruct the balance sheet after the disposals.

Covid - seems to have had a nasty impact, as you might expect;

As expected, the combination of site closures and reduced productivity significantly reduced revenue in the final quarter of the financial year. Along with the cost of implementing our new operating procedures and lengthened site programmes, this has led to a material reduction in gross margin in the financial year to June 2020, with divisional operating margins expected to show a loss of c5%. Productivity levels on our sites have gradually increased since the beginning of the lockdown, and we start the new financial year with productivity close to normal and operating margins expecting to improve in line with our target.

Operating at a loss of 5% for the year, on quite large revenues, sounds pretty bad.

The group's strategy seems to have been disposal of the best bits, leaving a pile of cash, and a loss-making building business.

My opinion - neutral. There's not enough information for me to form a view. The cash pile does interest me though, so I'll have a proper nose through the next results when they're published in Sept 2020.

After the big disposals in early 2020, the remaining business seems to be a construction group targeting large mainly public sector contracts. That type of business often seems to go wrong - low margins, on large complex projects, just is not an area I would want to invest in.

.

Mccarthy & Stone (LON:MCS)

Share price: 74.75p (up 0.5% today)

No. shares: 537.8m

Market cap: £402.0m

This might take me a while to plough through the accounts, as it's the first time I've looked at this developer of retirement properties.

McCarthy & Stone (the 'Group'), the UK's leading developer and manager of retirement communities, announces its financial results for the six months ended 30 April 2020 (2020).

This company floated in Nov 2015. As you can see from the chart, it has been a lousy investment so far;

.

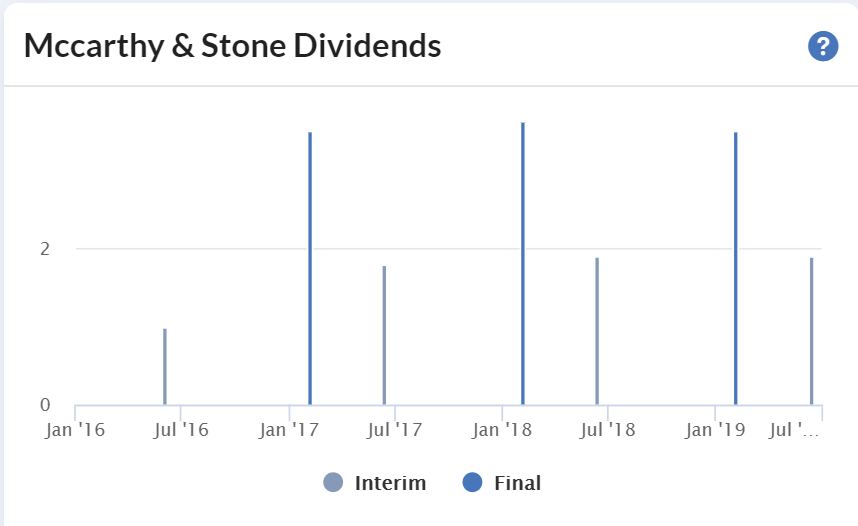

Although it has paid 17.2p in total dividends since floating;

.

Given that covid only really impacted the last month and a bit of this H1 (ending 30 April 2020) then I'm surprised it's had such a big impact on the numbers. Maybe that's because I imagine April would normally be a busy month?

A few snippets to give a flavour;

- Completions down 44% to 471

- Revenues down 64% to £101.1m

- Underlying profit before tax - a loss of £(26.9m) versus a H1 prior year profit of £18.9m

- There must be a ton of exceptionals, as the statutory loss is much larger, at £(91.3m). Yes, it's £60.4m impairment of brand & goodwill.

The above suggests to me that things probably were not going well before covid struck.

Covid impact - the financial impact is one thing, but the human impact is just as important here. I can see that, as a (probably the) leading brand for retirement homes, it's a key issue how it managed its sites. Sadly, care homes were not properly protected, with the NHS discharging elderly patients into care homes during the start of the pandemic, without testing them for covid, thereby introducing the virus into many care homes, killing large numbers of frail people. We experienced that in my family. It just swept through a dementia ward, killing nearly all the residents, including my sister-in-law's father.

Independent living is clearly a much better solution to protect the elderly, rather than communal living in a care home. Therefore I can see that MCS could be a big future beneficiary of this seismic change. These are very strong statements;

Responded early to Covid-19 with absolute focus on our customers and our people resulting in Covid-19 infection rates being 27% lower than the over 65's UK population and four times lower than the over 85's

o Currently only one confirmed case on our developments

That alone makes this share potentially interesting - this could provide a positive tailwind in future. Assisted living is clearly a much better option than a care home, where possible. It's not always an option though, if someone is too frail, and needs round the clock care.

Balance sheet - looks strong to me. NAV is £695.1m, with most of the assets being inventories (i.e. land & unsold properties in various stages of build, I imagine). Intangibles are only £4.3m, giving NTAV of £690.8m. This compares very favourably with the market cap of £402m. Why is it trading at a 42% discount to NTAV? That looks a very pessimistic valuation. Does anyone know why?

Outlook - some interesting stuff in here, although I'm worried about the H2 financial impact bit below, which sounds ominous;

Early activities demonstrate that sales leads and gross reservation rates are increasing in line with this gradual ramp up plan. While we are passed the peak of the crisis, the financial effect will be weighted towards H2. However, given the significant level of ongoing uncertainty, the Board currently have little visibility as to the expected FY20 outturn.

Guidance therefore remains suspended until we have greater clarity of the Covid-19 impact on the business and wider UK economy.

Throughout the pandemic, the independent retirement living sector has proved to be a safe and happy place for older people, and it is clear that it has an important role to play in the post Covid-19 world. It provides an alternative 'Third Way' for those needing assistance and there is now a real opportunity to redefine how we support our ageing population in future. Our unique proposition, unrivalled capability, strong brand and new land opportunities, along with the heightened focus from policy makers, ensures that we are well-placed to capitalise on this exciting opportunity.

It should also get a decent boost from the Stamp Duty holiday on under £500k properties. Therefore, H2 might turn out better than currently expected, I speculate.

My opinion - too early to form a firm opinion, as I've only just started looking at it. I like the strong balance sheet, and I particularly like the deep discount to NTAV. In normal circumstances this business makes a high profit margin, because it can charge more for retirement properties.

From what I've seen so far, this share looks interesting, and worthy of a closer look.

.

Air Partner (LON:AIR)

Share price: 85p (down 13% today)

No. shares: 63.6m

Market cap: £54.1m

AGM Trading Update

There's not a lot new in this update. We already knew from the previous updates that H1 performance was exceptionally strong, due to one-off work related to the covid crisis (e.g. moving PPE, and repatriation flights).

Outlook comments sounds more cautious today, but we knew this was coming, so I'm not sure why anyone would have sold today. Maybe sellers were hoping the bumper profits would continue for longer, or possibly they weren't paying attention to previous updates?

To date, the Group's trading in July has been more normalised and we have seen fewer emergency freight flights and less repatriation work. However, as previously reported, we are encouraged by the level of enquiries we are receiving from our customers returning to our Private Jet and Safety & Security products and we are anticipating a profitable month.

While we are very pleased with our performance to date in the current financial year, visibility for the second half remains limited, with economic and regulatory uncertainty from the impact of the COVID-19 pandemic. In line with this, we have undertaken a number of cost saving initiatives to reduce our cost base to reflect the likely future demand patterns for our aviation services.

That doesn't sound great, does it?

There's a separate announcement today about another contract win for its security division, which looks an interesting growth business.

My opinion - I feel positive about this company, but wouldn't be interested in buying at this level, because the bumper profits this year are a one-off.

That said, this could be an interesting share to hold if you think a second wave of covid is coming. Also, people who can afford it are likely to want to use private jets, to avoid hanging around in airports. So I can see this being a good sector to invest in. With a bumper H1, and a placing, then the cash position looks very comfortable. That increases the likelihood of decent divis in future. So it could be a good share for income seekers maybe?

Set against that, the outlook comments, and cost cutting do suggest that the future isn't particularly rosy right now.

Hence why I'll stay neutral on this one for now.

.

Carr's (LON:CARR)

Share price: 113p (up c.4% today)

No. shares: 92.5m

Market cap: £104.5m

Trading update & confirmation of dividend

That's quite clever, putting "confirmation of dividend " in the title of the RNS, eye-catching for income seekers.

Carr's (CARR.L), the Agriculture and Engineering Group, announces a trading update for the 19-week period ended 11 July 2020.

It's an in line update - remember them?! All the companies I've ever asked, have confirmed that "Board's expectations" and "market expectations" are the same thing.

Overall, trading remains in-line with the Board's expectations for the current financial year.

The Group continues to trade through the COVID-19 pandemic with no material financial impact seen to date.

That sounds excellent.

The agricultural division is doing better than expected, but the engineering division less so, being affected by temporary delays to projects, and less work from the oil & gas sector.

Cash is also ahead of expectations.

Divis - a 2.25p interim divi will be paid in October - a nice expression of confidence.

Outlook -

The Group remains well placed owing to its strong and diverse businesses, robust financial position and the ongoing demand across the majority of its markets for the provision of essential products and services.

Valuation - since we've just had an in line update today, then that's the only situation where I would rely on broker estimates. at the moment Hence these figures are probably reliable, and it's a sea of green;

.

My opinion - looks a really nice value share, assuming nothing goes wrong in the future.

And finally, a reader has asked me to look at this;

Arcontech (LON:ARC)

Share price: 184p (up 13% today)

No. shares: 13.2m

Market cap: £24.3m

Trading update

This sounds positive;

Arcontech (AIM: ARC), the provider of products and services for real-time financial market data processing and trading, is pleased to announce that profit for the year ended 30 June 2020 is expected to be in line with market expectations.

Unaudited net cash at 30 June 2020 amounted to £5.01 million (at 30 June 2019: £4.06 million).

The Company has continued to invest in sales and marketing resources and confirms that no staff have been furloughed, and that the Company has not drawn on any publicly available funding or delayed payment of PAYE and VAT.

Subject to shareholder approval at the Annual General Meeting, the Board anticipates paying a dividend in line with the Company's dividend policy.

I've had a quick look at the StockReport, and it looks quite good - only tiny revenues of c.£3m p.a., but making a profit of c.£1m p.a. - a huge operating margin. In this type of (rare) situation, I find it always pays to check that Director remuneration is not artificially low. That can be a way of producing great profits, but on an unrealistically low cost base.

Growth - this is the crux here. If a business making a bumper profit margin can start generating strong growth, then profits can go through the roof.

Overall - looks potentially interesting.

All done for today. Sorry this report took a while to gestate, but I got there in the end.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.