Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

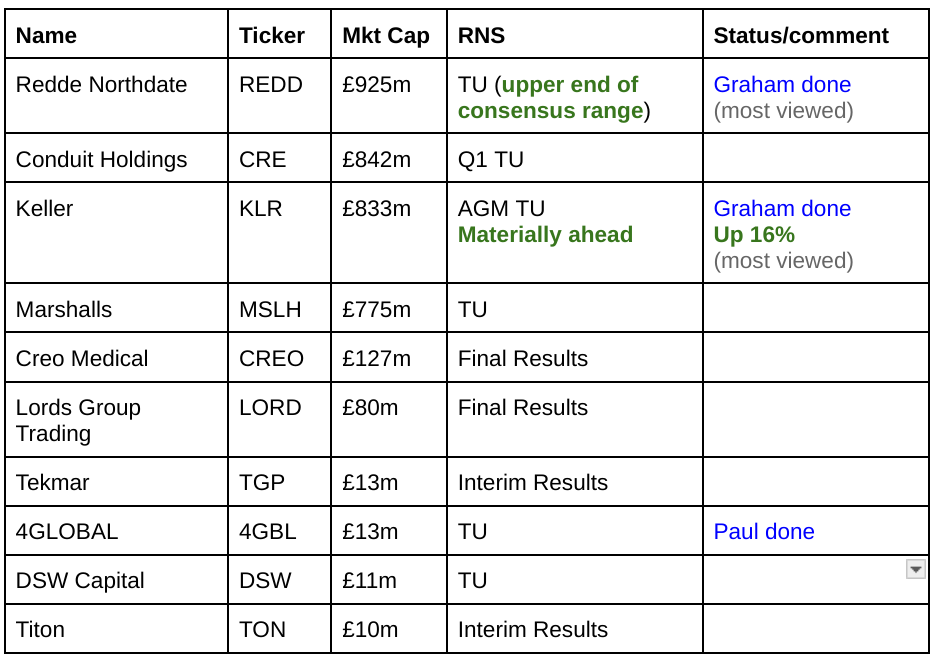

Agenda

Other mid-morning movers (with news)

Hunting (LON:HTG) - up 15% to 430p (£706m) - Major OCTG Order - Paul - GREEN

The RNS mentions OTCG 15 times, but doesn’t say what it means. Googling it comes up with various options, but the most relevant one seems to be: Oil Country Tubular Goods. It’s described as a “record” order of $145m from Kuwait. Some revenue will be recognised in FY 12/2024, but I assume most in 2025. Order book is at a record $665m (including this deal). Guidance - “ Given the quantum of this order, management now expects EBITDA to be towards the top end of its current guidance of $125-135 million for 2024.”

Paul’s view - we flagged HTG on 24/8/2023 (amber) as a potential oil & gas recovery trade, and moved up to amber/green on 29/2/2024 on impressive FY 12/2023 results and a notably strong balance sheet impressed us. HTG had a bad patch in 2000-2022, but seems to have now roared back into a convincing recovery. It’s still fairly good value I think, so I remain bullish. With a record order book too, I think we need to move up again from amber/green to GREEN.

ITIM (LON:ITIM) - up 13% to 39.5p (£12m) - Contract Renewal - Paul - AMBER

SaaS software for retailers. Majestic Wine renews for 5 years, in a “multi-million-pound” deal. It was already in the forecasts though, so shouldn’t be price sensitive - “This is in line with management expectations for the current financial year.”

Paul’s view - see SCVR 1/3/2024 when I gave it the once over. Not a bad little business, but I’m not convinced it can scale up. Still loss-making, and ignore EBITDA due to high development spend being capitalised (thus costs by-pass EBITDA). Weakish balance sheet, could do with a placing I think. We’ll keep an eye on it though, the software seems relevant since it’s set up for omnichannel retailing, and covers most other functions such as back office, warehouse, promotions, etc. Majestic Wine is a good reference client. Majority owned by the founder, increases risk of de-listing in future perhaps? Moderately interesting.

Zotefoams (LON:ZTF) - up 13% to 487p (£238m) - Update on ReZorce - Paul - GREEN

Zotefoams, a world leader in cellular materials technology…

One of my favourite value/GARP shares, now the 4th best performer in my top 20 2024 shares ideas list. The attraction with ZTF is that the main business is good, and still reasonably priced. Its performance shrugged off the pandemic and the energy crisis, which tells me it’s a decent business, and well managed. The excitement (in for free really) is the fully recyclable drinks carton development project, ReZorce. Today’s update sounds encouraging, with cartons now being produced for testing, by its development partner, Refresco. It’s not in the bag yet, but ReZorce sounds as if they’re making progress.

Paul’s view - I remain bullish on ZTF, so a continuing GREEN.

4Global (LON:4GBL) - up 13% to 54p (£15m) - Trading Update - Paul - AMBER/RED

4GLOBAL, a UK-based data and technology company focused on providing customers in the sport and fitness sector with business-critical insights about their customers, operations, and investments, is pleased to announce a trading update for the year ended 31 March 2024 ("FY23/24").

FY 3/2024 revenues up 14% to £6.4m, below expectations of £6.7m.

However, it’s ahead of expectations at adj EBITDA level -

…adjusted EBITDA2 for the period is expected to exceed market expectations3 - increasing by approximately 30% to c. £1.6m (FY22/23: £1.2m - audited).

3Market expectations are defined as covering analyst forecasts prior to publication of this announcement. These were revenues of £6.7m and adjusted EBITDA of £1.3m.

Is adj EBITDA real profit? Checking previous accounts, 4GBL is not capitalising anything significant in development spend, so that’s OK. It did make a genuine profit of £0.5m (PBT) in FY 3/2023, and revenues this year are usefully higher. Canaccord’s update today (many thanks) shows adj EBIT flat at £0.9m but unfortunately doesn’t show adj PBT which is the figure I want. The last balance sheet shows cash was tight, and receivables much too high, so that needs further investigation.

Today’s update says cash rose to £0.5m by end April, and that receivables are still too high at £3.9m - so there seems to be a problem here with collecting in cash from customers.

Paul’s view - at first glance this looks a small, but reasonably good business that is already profitable. I’m not sure how scaleable its activities are though? My balance sheet concern over inadequate cash, and receivables being persistently much too high, forces me to raise a warning flag at AMBER/RED.

Summaries

Keller (LON:KLR) - up 16% to £13.18 (£958m) - AGM Trading Update - Graham - AMBER/GREEN

This is an excellent update with underlying momentum and high visibility giving the company confidence to say that 2024 will be materially ahead of the Board’s previous expectations. Most geographical segments are doing well. The balance sheet also appears to be strong with a very low leverage multiple.

Redde Northgate (LON:REDD) - up 3% to 420.4p (£953m) - General Meeting & FY24 Trading Statement - Graham - GREEN

I’m happy to reiterate Paul’s GREEN stance after a positive update which reveals that FY April 2024 results will be “at the upper end of the consensus range”. The company’s leverage multiple remains modest despite the company nearing completion of its latest share buyback. Will soon be “ZIGUP plc”.

Graham's Section

Keller (LON:KLR)

Up 16% to £13.18 (£958m) - AGM Trading Update - Graham - AMBER/GREEN

Keller Group plc ('Keller' or 'the Group'), the world's largest geotechnical specialist contractor, issues a trading update for the first four months of the year (the 'period') ahead of its Annual General Meeting to be held at 10.00am today.

These shares have been on a great run over the past year, and are threatening to break out of their long-term range if this continues:

Here are the highlights from today’s AGM trading update:

Strong momentum has continued, performance “materially ahead of prior year”.

With a strong order book and recent contract wins, Keller has “good visibility and enhanced confidence” for 2024.

Full year performance is therefore anticipated to be materially ahead of the Board’s original expectations.

North America: strong trading. Driven by infrastructure spending. Suncoast is ahead of prior year, but softness in the residential segment is expected to hold back its momentum this year.

Europe & Middle East: weak demand in residential and commercial sectors in Europe, infrastructure more resilient.

Brief updates also provided for Nordics, APAC, India.

Balance sheet:

The Group's strong cash performance continued in the period and we expect the Group's net debt/EBITDA leverage ratio to be at the bottom end of the 0.5x - 1.5x range at the half year (H1 2023: 1.2x).

Granted that this ratio is likely to be volatile for Keller, it’s still reassuring to see such a low leverage multiple.

Graham’s view

StockRanks love this one:

I’m inclined to reiterate Paul’s AMBER/GREEN stance on this one. The company is clearly trading well, with parallel momentum both in the business itself and in the stock.

EPS estimates were rising even before today’s upgrade:

Why not go full GREEN? Perhaps I should. But I tend to be a little cautious when it comes to low-margin engineering businesses, and a high single-digit earnings multiple seems about right to me (these numbers calculated based on last night’s close)::

That said, Keller’s profit margins have improved quite a lot in recent years - is this due to temporary factors or has there been a permanent improvement in the quality of the business? More in-depth research would be needed to figure this out.

But congratulations to shareholders - it’s hard to argue against the doubling of the share price here, or to argue against the positive trends continuing.

Redde Northgate (LON:REDD)

Up 3% to 420.4p (£953m) - General Meeting & FY24 Trading Statement - Graham - GREEN

Redde Northgate will soon be no more (subject to shareholder approval).

The company will instead be known as “ZIGUP plc” - a name that “will allow the business to better reflect the strength and depth of an enlarged group of businesses undertaking various forms of integrated mobility”. Is that what ZIGUP says to you?

All of the operating businesses will keep their existing names: FMG, NewLaw Solicitors, Northgate, Van Monster, etc. But for those of us who study the parent company, we will need to get used to this strange modern brand name. Later this month, the ticker will change to ZIG.

Trading update is positive:

The business finished FY24 positively, continuing the trends we saw at the half year and with vehicle supply continuing to improve. Our Spanish business continues to enjoy strong market conditions and our recent UK&I re-organisation is helping us to deliver an increasingly seamless service to customers. As a result of the continued momentum in the business, we would expect to report full year results in early July towards the upper end of the consensus range.

Unfortunately there are no recent research notes for this company on Research Tree; Stockopedia estimates suggest EPS of 56.6p for FY April 2024, dropping back to 52.9p for FY April 2025.

Net debt at the end of the year is forecast at c. £740m, for a leverage multiple of 1.5x. A £30m share buyback programme is ongoing.

Graham’s view: I’m happy to leave Paul’s GREEN stance unchanged, as Redde/ZIGUP continues to perform better than its cheap rating suggests that it should:

Would I ever put this on a high (say 20) PE Ratio? Of course not. The range of services supplied here - vans and cars for hire, vehicle repair and accident claims management - would never scream to me that a high rating was justified. The phrase “Integrated mobility” used by the company seems to be an attempt to paint a picture of something more advanced or more complicated than it really is.

But I can’t fault the company’s historical financial performance, which is very good. I can’t fault their dividend policy. And I can’t fault their reduction of the share count through buybacks. Whenever I see a mature company in a “boring” industry trading on a modest single-digit PE multiple, but which has confidence in its future, I am very happy for it to buy back its own shares.

The current buyback programme brings the total to £90m repurchased since 2022. That’s a material reduction in the share count.

The company is carrying some debt but (barring an extreme downturn) the leverage multiple is reasonable.

They disclose a variety of risks faced, including vehicle residual values, although this topic isn’t mentioned in today’s update. Fortunately, existing forecasts do appear to price in at least some softness in future periods. And at the end of the day, the single-digit earnings multiple allows for quite a high degree of uncertainty.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.