Good morning, it's Paul & Jack here with the SCVR for Wednesday.

Agenda -

Paul's Section:

Restaurant (LON:RTN) shares are up 10% on FY 12/2021 results. Current trading in 2022 looks strong. I'm not happy with the balance sheet, despite a big equity fundraise. Shares look to be a forecast PER of about 20 for 2022, which to my mind seems too high, given all the macro uncertainty & squeeze on household incomes.

Eagle Eye Solutions (LON:EYE) - decent interim results show a move into a small maiden profit. Despite correcting in value by about a third, it's still expensive. However, there's nothing wrong with the company, so I'm inclined to look at the sharp price drop as a potential long-term opportunity for growth investors.

Anpario (LON:ANP) - 2021 results are out today, and look reasonable. The way I see it, the share price has corrected from excessive, to just about reasonable now.

Jack's section:

Science (LON:SAG) - record FY results following multiple upgrades, with funds for organic and acquisitive growth. The valuation is not overly expensive, particularly when coupled with the positive trading momentum and underlying profit margins, so worth a closer look.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Restaurant (LON:RTN)

70p (pre market open) - market cap £533m

As at 2 January 2022, The Restaurant Group plc operated approximately 400 restaurants and pub restaurants throughout the UK. Its principal trading brands are Wagamama, Frankie & Benny's and Brunning & Price. It also operates a multi-brand Concessions business which trades principally in UK airports. In addition the Wagamama business has a 20% stake in a JV operating five Wagamama restaurants in the US and over 50 franchise restaurants across a number of territories. The Group employs approximately 16,000 people in the UK.

Results are for the 53 weeks ended 2 Jan 2022 (which I’ll call FY 12/2021)

As with Hostmore (LON:MORE) (I hold) which we covered here recently, FY 12/2021 was a year that was badly disrupted by the pandemic, with trading largely shut down until May 2021, but with generous Govt support measures offsetting some of the losses. Hence it’s difficult to draw much in the way of conclusions from these numbers.

Revenues £636.6m (up 38% on LY) - but still impacted by enforced closures in the early part of 2021

Adj operating profit of £42.8m, but there’s a large finance charge, so adj Profit Before Tax is only £16.6m, which doesn’t seem much.

Current trading - RTN's LFL revenue growth in 2022 (see table below) look way ahead of the disappointing -3% recently reported over the same period by MORE.

However, I’m wondering if the reporting basis is different? I’m told that MORE seems to normalise VAT over this recent period, but it’s not clear if RTN is doing the same, or letting it boost the numbers? I suspect the latter.

Revenue is always stated ex-VAT. However the 12.5% reduced rate now, against comparatives that had 20.0% VAT deducted, will significantly boost the current period's ex-VAT numbers. For example, gross sales of £100 would be revenue of £83.33 when VAT was 20%, but the same sale of £100 would b e £88.89 if VAT is 12.5% (the current rate until 31 March 2022). That's a 6.7% boost to ex-VAT revenues, for the same gross sales value. Hence to get a true LFL performance, we should be normalising VAT, by reducing the figures below by 6.7%, which for example would reduce Wagamama's LFL sales growth this year from +21% to about +14% - still excellent, it has to be said.

.

Outlook -

c.95% of electricity and gas volume hedged for 2022

o c.75% of electricity and gas volume hedged for 2023 and 2024

· Management's current expectations for FY22 remain unchanged, although we are mindful about the consequential inflationary impacts arising from the conflict in Ukraine

Balance Sheet - has always been my main gripe with RTN.

It’s still negative, once you strip out £600m intangibles, which takes NAV of £439.7m down to NTAV of £(160.3)m - which means the business is heavily reliant on debt funding, which I very much do not like.

IFRS 16 lease liabilities are showing a deficit of almost £121m. These numbers should improve over time. I’ve noticed that, at the moment, with uncertainty over site profitability, lots of multi-site operators seem to be publishing gloomy IFRS 16 numbers - i.e. a low asset figure, with much larger liabilities figures. Hence why I tend to remove the IFRS 16 numbers from the balance sheet. The old system was so much better, where an onerous lease provision was required for loss-making sites, which gave us the key information needed.

Net debt of £171.6m doesn’t sound too bad, but the gross long-term debt of £318.1m stands out as being too high. The cash pile of £146.5m could be a seasonal high, who knows?

Overall then, this is certainly not a strong balance sheet, but doesn’t look alarmingly weak either. Given our experience with covid, I think it’s better overall if companies pay down debt, so that they’re not reliant on the vagaries of Govt support measures, and the lenience of the bank manager, if something similar happens again.

Note that RTN raised £175m in fresh share capital during the year, so the balance sheet would have looked terrible without that cash injection. More shares means lower EPS of course, in future.

My opinion - current trading looks impressive, much better than Hostmore (LON:MORE) (I hold) recently reported, although it’s not clear if the figures are comparable due to VAT concessions. This is the trouble with LFL (like for like) figures - there’s no standardised definition, so different companies calculate the figures their own way, and don’t always make it clear how the calculations have been done. The glossary definition of LFL here doesn’t mention VAT treatment, which is a significant boost to ex-VAT revenues, if not adjusted for the current reduced rate. Hopefully we might get some clarification on this.

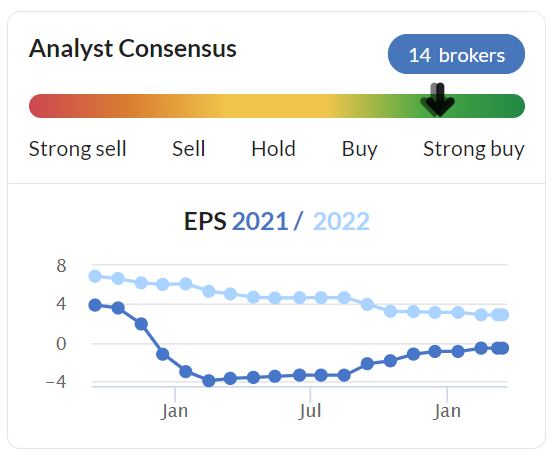

I can’t find any broker research on RTN, so that impedes any assessment of value in the shares. However, the Stockopedia consensus figures show a considerable reduction in FY 12/2022 forecasts, as you can see below. With all the additional cost pressures coming through, it’s difficult to see much value in this share.

Hostmore (LON:MORE) (I hold) is on a much cheaper rating, but its current trading figures were poor, so that puts a question mark over whether it can achieve forecasts for this year.

The whole sector has been savaged, due to the current pressure on consumer disposable income, due to higher inflation, and especially higher household energy bills. That should all come out in the wash, so it’s always worth looking at this sector when valuations are depressed, because in recent years we’ve seen how inflationary pressures tend to abate once they annualise, and incomes rise again. I’d rather buy when the sector is out of fashion, and valuations are low, rather than paying top whack when everyone’s comfortable and applying a high PER.

With consensus EPS below 4p for FY 12/2022, and a share price currently up 10% at 77p, that looks a PER of 20. How does that make sense, given that we know household discretionary spending is coming under pressure? It looks too expensive to me. You need to be very confident RTN can beat expectations, if you hold this share. I wouldn’t want to bet on that, given macro conditions at the moment.

.

.

.

Eagle Eye Solutions (LON:EYE)

434p (up 8% at 08:30) - market cap £113m

Eagle Eye, a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services, is pleased to announce its unaudited interim results for the six months ended 31 December 2021 (the "Period").

Strong financial performance and record new business pipeline

This is a decent little growth company, generating strong organic growth, and a high level of recurring/repeating revenues. The client list is very impressive too, with big supermarkets and other retailers using EYE software.

It’s just broken into a maiden, small profit (ignore EBITDA, as it’s meaningless for companies that are capitalising some of the payroll).

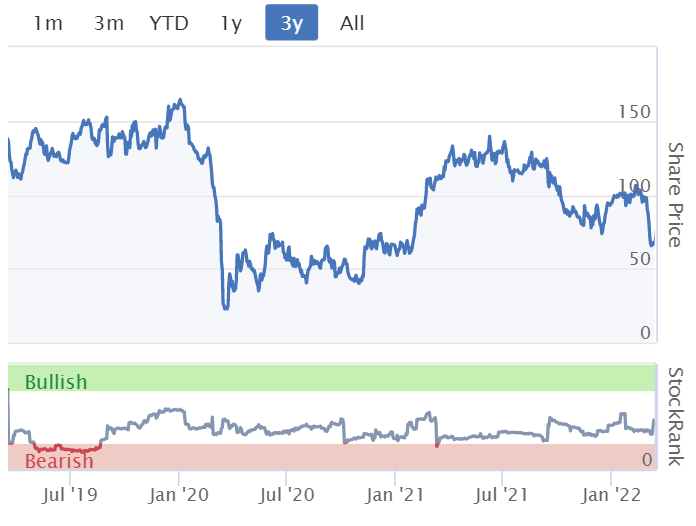

So there’s no doubt the company is doing well, as always the question is what’s it worth? Historically the valuation got way ahead of itself, like pretty much all growth shares. After a large correction, is it now a bargain at £113m market cap?

.

.

Outlook - sounds good -

· Entered the second half of the year in a strong position, as shown by the considerable increase in ARR

· Positive trading in Q3 to date, in line with the Board's expectations

· New business pipeline continues to grow at record levels, both in the UK and internationally

Forecasts - many thanks for Shore Capital for an update note today, available on Research Tree. It pencils in 4.8p EPS FY 6/2022, rising to 8.2p and 10.4p in subsequent years. Therefore on a conventional PER valuation metric, at 434p per share, you’re being asked to pay a heroic multiple of possible future earnings. The hope must therefore be that it beats these numbers.

My only thought on that, is I’ve noticed habitually loss-making small caps, when they do finally break into profit (as EYE has just done), have often been operating on a shoestring, and tend to have multiple pent up demands on expenditure - e.g. deferred pay rises, staff having to multitask to save money, outdated equipment needing replacement, etc. Also management often like to “invest” the proceeds of growth in higher sales & marketing spend, etc. Therefore the much vaunted operational gearing can prove to be somewhat elusive, in my experience, with costs often rising almost as fast as revenues.

For that reason, it wouldn’t surprise me if EYE out-performs at the top line in future, but might not become as profitable as investors imagine. That’s just a guess of course, outside investors don’t have a clue what’s really going on at any of the companies we invest in. You need to be an insider to really understand any company properly, there’s so much hidden below the surface.

My opinion - even after a market-wide correction in growth company valuations, EYE still doesn’t look good value, let alone cheap.

However, I think it’s an unusually impressive organic growth story. Therefore, if you like the business, which is performing well, then it makes a lot more sense to buy now at 434p, than the optimists who paid as much as 660p in the excessive bull run in 2021. The story hasn’t changed, but it just got a third cheaper.

Overall then, for growth investors I do think this share is worth considering. Although in a bear market, it might get cheaper again, if there's another panic market-wide sell-off. So buyers now have to be be steely-nerved. I like the idea of buying in 3 tranches over time, so that there's some dry powder to deploy when other people are irrationally panic selling.

.

.

Anpario (LON:ANP)

537p (up 5% at 09:43) - market cap £124m

Anpario plc (AIM:ANP), the independent manufacturer of natural sustainable feed additives for animal health, nutrition and biosecurity is pleased to announce its full year results for the twelve months to 31 December 2021.

These numbers look respectable -

Note that the gross margin fell, with the company not able to fully pass on cost increases -

...however gross margins were lower at 48.7% (2020: 51.9%) compared to the same period last year impacted by increased logistics costs and significant raw material price inflation, which was partially mitigated with sales price increases during the year.

Profit rose mainly because Anpario was able to hold administration costs level with last year.

Overall it looks a beat against expectations, with consensus showing 21.5p, and actual coming out at 23.0p. I can’t see any updated broker notes today.

Ukraine - sales to Russia/Belarus/Ukraine have ceased (insignificant, at <1% of total).

“No dependency” of supplies from these countries.

Outlook - some interesting points in this, and overall strikes me as reassuring -

The Company is maintaining the progress of last year and the priority is to pass on raw material price inflation through planned sales price increases. We are seeing some encouraging signs that cost price inflation has begun to stabilise but given the very live events in Ukraine there could be further challenges in global supply chains and energy markets which may affect raw material prices. The significant increases in grain prices will also present difficulties for our customers, however, Anpario's products improve animal feed conversion rates through natural gut health improvement making the animal more efficient in nutrient utilisation.

We look forward to delivering profitable growth for the year, capitalising on the investments made in new products and significant market opportunities such as aquaculture. Investment and development in our sales and marketing channels will continue with the recruitment of local sales teams which will be helped by the improving international travel situation enabling our sales teams to drive business development initiatives in person.

Our geographic and product diversity does help the Group smooth out these disruptions and our strong balance sheet enables us to invest not only in innovative natural product solutions but also support our delivery service levels with good local stockholding. We remain confident in capturing the opportunities to grow the business both organically and by acquisition, should the opportunity arise, for the long-term benefit of all stakeholders.

Balance sheet - is superb, very strong for the size of company. It includes a cash pile of £15.5m, with no interest-bearing debt, just small trade creditors.

There’s scope for the company to do something with its cash pile, even take on a bit of debt, given its reliable profits & cash generation.

So hidden value here.

Note that inventories rose substantially in the year, which seems to be linked to ensuring continuity of supply.

My opinion - in the past I’ve questioned why Anpario was rated so highly by the market, despite profits having been essentially flat around the £4m level since 2015. The price has come down in the recent general small caps sell-off, which is encouraging for anyone considering a purchase. Not so nice for existing holders though.

Its products seem very niche (revenues must be a negligible proportion of a huge global market), but high margin.

If we assume modest earnings growth to say 25p in 2022, then the PER is about 21.5 - and we can knock off say 10% for the surplus cash pile, so a n adj PER of about 19.5 - not exactly a bargain, now that we’re in more bearish market conditions.

That said, I’ve always quite liked the potential at Anpario. Imagine if one of its products really starts to grow rapidly. Then it could hit that golden patch, where earnings start to rise rapidly, and the PER expands as it’s perceived as a growth company. In that upside scenario, the share price could conceivably double, or more. Yet the downside looks reasonably well protected by solid performance. So risk:reward looks reasonably good, providing nothing goes wrong.

Overall then if you understand the sector, it might be an interesting one to investigate in more detail.

.

.

Jack’s section

Science (LON:SAG)

Share price: 396p (+4.21%)

Shares in issue: 45,615,876

Market cap: £180.6m

Results for the year to 31 December 2021

- Revenue up 10% to a record £81.2m,

- Adjusted operating profit +49% to £16.3m (another record),

- Adjusted basic EPS +47% to 28.5p,

- Recommended dividend increased by 25% to 5p,

- Cash of £34.3m and net funds of £19.0m.

Science Group is an international science, technology and consulting organisation. The Group comprises three divisions: R&D Consultancy; Regulatory & Compliance; and Frontier Smart Technologies ('Frontier'), together with significant freehold property assets and a strategic shareholding in TP Group plc.

R&D Consultancy - provides science-led advisory and product/technology development services, applying science and engineering capabilities to the medical, consumer, food & beverage, and Industrial, Chemicals & Energy markets. Revenue here grew from £32.2m to £34.3m and the new, unified brand approach (‘Sagentia Innovation’) should bring additional cross-selling opportunities.

Regulatory & Compliance - provides scientific and regulatory advice together with registration and compliance services for the Chemicals and Food & Beverage sectors. This division generated revenue of £21.4m (2020: £20.1m), of which around 25% is recurring. Management says increasing scale and reputation is attracting larger opportunities.

Frontier Smart Technologies - the market leader in DAB/DAB+/SmartRadio technology chips and modules (formerly listed on AIM and acquired in 2019).

The Frontier division had a strong year in 2021 reporting 21% growth in revenue to £24.9 million (2020: £20.5 million) and an adjusted operating profit margin of 21% (2020: 16%), producing a 59% increase in adjusted operating profit. This success was achieved despite the global semiconductor and other supply chain constraints.

Conclusion

Another record performance, the company is clearly doing well at the minute which makes the recent share price pullback more interesting.

The balance sheet is strong, with cash resources and an undrawn new debt facility providing the potential for further acquisitions. This positive update follows several upgrades made over the past year, with strength reported across all parts of the business.

The forecast PER multiple of 14.1x isn’t overly demanding given the operational momentum and good profitability metrics.

I’ve not spent much time on SAG in the past and so am not too familiar with the business model. Things are clearly going well though, with healthy margins, and an undemanding valuation, so it’s putting itself forward as a strong candidate for further research, I think.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.