Good morning, it's Paul here!

I have limited time available today, due to preparing for the UK Investor Show this coming Saturday.

I'll be on the main stage for half an hour, from 10:26 to 10:56, chairing a discussion on small caps with Nigel Wray, and Paul Jourdan of Amati (whose main fund has been a stellar performer).

Shortly after that, at 11:05 our own Ed Croft is doing a 35 minute session called "Data mining for stock market profits". I know Ed always puts in a great deal of preparation for his sessions, which are always lively & fascinating. So I'm looking forward to this.

Then from 12:00 to 12:40, it's my time to be interviewed, for a live "bearcast", with Tom Winnifrith. I'm not quite sure why I agreed to do this, and could well end up regretting it! Tom is under strict instructions not to be too obnoxious! Also, it would be nice if he actually lets me answer the questions this year, instead of using it as a platform to harangue me with his own views.

After that ordeal, I will probably be holding court in the Westminster Arms!

I'm looking forward to catching up with SCVR readers on the day - old friends, and hopefully some new ones too.

Then of course, next week, we have the long-awaited return of Mello Derby. The 2014 event was fantastic. This is a slightly smaller, and more exclusive investment show, run by serious investors, for investors, led by renowned small/micro cap investor, David Stredder.

I befriended David at an AGM in 2000, and have since watched him go from success to success, consistently making high portfolio returns. Like a lot of successful investors, he deserves to do well because he just works so hard at it - constantly researching companies, meeting management, etc.

The community aspect of Mello is outstanding too - you couldn't meet a more friendly & supportive bunch of people. Many of us already know each other from online forums such as this, and Twitter of course. However, newcomers are also welcomed with open arms. So do come along if you can, and say hello to me & Graham.

IG Design (LON:IGR)

Share price: 417p (down 3.3% today, at 11:23)

No. shares: 63.88m

Market cap: £266.4m

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of gift packaging, greetings, stationery, creative play products and giftware, announces a trading update in relation to the year ended 31 March 2018.

A nice clear summary at the start of the announcement. Please take note, other companies & advisers - this is the way it should be done;

The Group's trading accelerated in the second half of the year with all regions delivering strong revenue growth and increased profits.

As a result the Board anticipates a full year of overall progress and financial performance in line with management expectations.

More detail is given, with this comment on dividends catching my eye;

The Board remains committed to its progressive dividend policy and is considering increasing the Company's earnings pay-out ratio in future periods, to reflect both the improved financial performance of the Group and the positive outlook of the Directors.

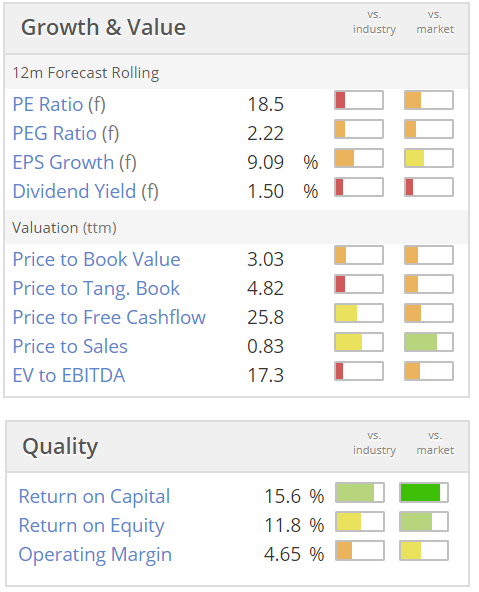

That sounds encouraging, although note that the dividend yield of 1.5% is low. So it's good to hear the intention is to increase that.

Management comments all sound positive.

Valuation - as you can see below, it's not cheap, but good companies rarely are.

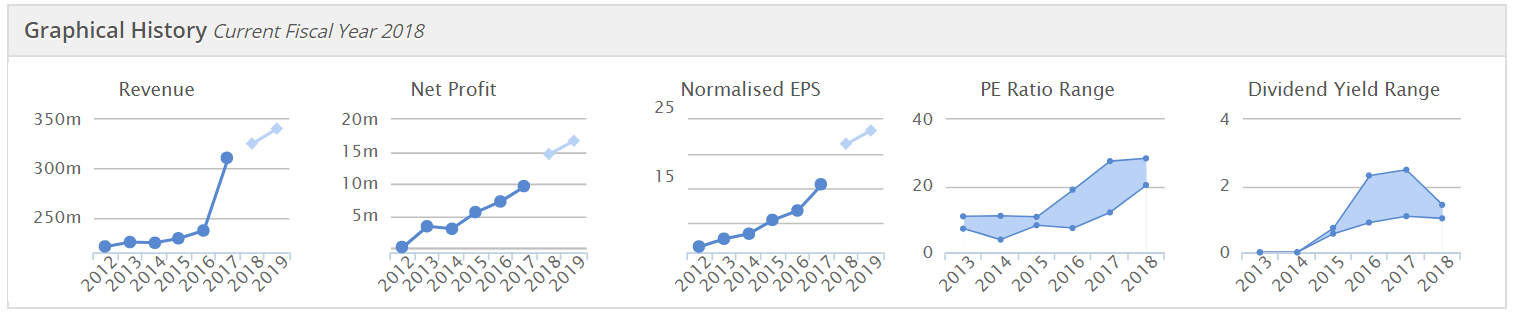

As you can see from the Stockopedia graphs below, this group has established an excellent track record of profits growth;

The big jump in revenues in graph no.1 suggests a large acquisition in 2017. So I would want to check the balance sheet, to ensure it's not too top-heavy with intangibles.

As you can see from graph no.4 above, the group's excellent performance has been rewarded with a re-rating upwards of the PER valuation. That's great for shareholders, but of course it does increase risk - if anything goes wrong, then highly rated shares have further to fall.

My opinion - I always write positively about this share, because it looks a very well managed company, performing consistently well.

The current valuation looks fully justified, in my view. So it gets a thumbs up from me.

Vianet (LON:VNET)

Share price: 129p (down 6.9% today)

No. shares: 28.27m

Market cap: £36.5m

(for the avoidance of doubt, I no longer hold a position in this share)

Vianet Group plc (AIM: VNET), the international provider of actionable data and business insight through devices connected to its Internet of Things ("IOT") platform, today provides the following trading update ahead of the Group's preliminary results for the year ended 31 March 2018, which are expected to be released on Tuesday, 5 June 2018.

As readers "wildshot" and "Gromley" point out, in the comments below, this sounds like a slight earnings miss;

Trading for the second half of the year has been largely as anticipated and, as a result, the Group's full year profits will be broadly in line with market expectations and ahead of last year's outturn of £3.32 million.

As such, the Board intends to recommend a maintained final dividend of 4.0 pence per share.

The divis have been the main reason to hold this share. It would be interesting to re-plot the share price chart, adding in dividends. The total shareholder return would probably look quite good on that basis.

Other points;

- Vendman acquisition is going well. When I last met management, which I think was last summer, they seemed very enthusiastic about Vendman.

- Material contract with a coffee company is also going well.

- Move towards SaaS revenues is suppressing short term performance.

- Smart Zones division (i.e. Brulines) profit is "slightly down year on year". Outlook sounds solid.

Directorspeak - is self-explanatory;

James Dickson, Chairman, commented: "The Group will again deliver good year-on-year profit growth. Importantly, this has been achieved whilst shifting the balance of Smart Machines sales from capital to recurring annuity based income.

The Group's medium to long term prospects are exciting, particularly for telemetry and payment solutions for the coffee vending market, where momentum is being boosted by good progress integrating the Vendman acquisition, and better visibility on delivery of the material contract win with a global coffee company."

My opinion - I regularly review my portfolio, and cull positions where I don't have big conviction. This is especially important when the stock market overall is going wobbly, and I need to reduce gearing, which happened earlier this year.

For these reasons, I took the decision to dispose of my Vianet shares. Also, I formed the view that the share price looked up with events at around the current level. The dividend yield of over 4% is attractive, although the fact that it has been static since 2013 indicates that the company has struggled to maintain this level of payout. I generally prefer rising divis, as they are less likely to be cut.

Overall, I see this as a solid, but unexciting share. I was hoping that by now the group would have diversified into other sectors, applying its considerable expertise in data management & analysis, but that hasn't happened yet.

It is making progress, but at a slow pace. Hence why I decided to sell up & move on, in the search for more rapid gains. There's a chance that this share could be re-rated at some point, if it manages to accelerate growth. So I'll keep it on my watchlist, and might re-enter at some point in the future, depending on how the newsflow & valuation develop. There's nothing wrong with this share, but I can't see any reason for it to rise in price, in the short term anyway.

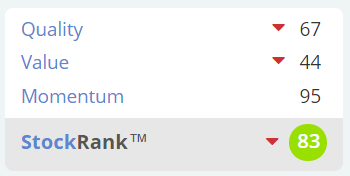

Stockopedia is positive, with a high StockRank;

Animalcare (LON:ANCR)

Share price: 211.7p (down 20.9% today, at 12:10)

No. shares: 59.9m

Market cap: £126.8m

Animalcare Group plc is a UK AIM listed veterinary sales, marketing and product development company resulting from the merger of Animalcare and Ecuphar NV.

I'm not familiar with this company, but Graham has covered it several times here.

Graham was previously positive about the company, but turned negative on it after a big acquisition/merger was done in 2017. Graham wisely concluded here in Jan 2018 that the situation was too uncertain to consider buying the shares.

The group seems to have changed its year end from 30 June to 31 December.

2017 results are slightly below expectations - because the phrase "broadly in line" is used, in the last sentence below. So it seems contradictory for the paragraph to be headed "2017 expectations unchanged". You can't simultaneously be a bit behind expectations, and also have unchanged expectations! Someone wasn't thinking when they wrote this;

2017 expectations unchanged

Expectations for the Group's first financial period ended 31 December 2017 remain unchanged, and as previously announced total revenues will show a year-on-year increase of c. 9.5% to £91.9m, slightly ahead of management expectations, and earnings for the period will be broadly in line with management expectations.

Profit warning - performance in 2018 is being hit by lower gross margins;

Sales growth is expected to be stronger across the Group during the current financial year as the integration of the businesses continues to progress throughout the year.

The Company is expected to deliver further incremental growth in underlying EBITDA, underlying net earnings and EPS against 2017 results, maintaining at least double digit growth at these levels.

However due to the impact on gross margins of a changing sales mix and competitive pressures, these levels of earnings, whilst still significantly ahead of the prior year, will be below market expectations for 2018.

Of course 2018 profits are going to be up on 2017, because the group did a massive acquisition (classified as a reverse takeover, where the target is bigger than the acquirer) part-way through last year.

Outlook - benefits from the big acquisition look to be deferred into next year;

In addition further synergies and cross-selling opportunities will start to take effect during 2018 as integration progresses, but will deliver a more meaningful impact on profit margins during 2019.

Dividends - current dividend policy will be maintained.

Balance sheet - the company says today that it has a strong balance sheet, which I treat as a potential warning sign. So the next balance sheet will need to be carefully checked.

My opinion - I don't really have a strong view either way. It's not really my type of share, and the newsflow seems disappointing. So why get involved?

The inverted-V shape chart rather suggests that, so far, management seem to have screwed up last year's big acquisition.

SysGroup (LON:SYS)1

Share price: 320p (up 6.7% today, at 13:00)

No. shares: 12.48m

Market cap: £39.9m

System1, the marketing services group, today releases the following trading update for the twelve months ended 31 March 2018 ("2017/18").

The Company changed its year-end last year and its previous audited financial statements relate to the 15 months ended 31 March 2017. To ensure like-for-like comparisons, percentage changes shown below have been calculated using, as the base, unaudited results for the twelve months ended 31 March 2017 ("2016/17", and where mentioned "last year" refers to 2016/17).

The company gives clear guidance on its profit for 03/2018;

... As a result, the Company now expects Profit before Tax to be in the range of approximately £1.6m to £2.0m for the year.

The above range is a long way below the net (i.e. post-tax) broker consensus figure shown on Stockopedia of £3.68m. That figure doesn't look right to me, and might be out-of-date, as there's hardly any broker coverage of this stock. It doesn't seem to tie in with the forecast EPS of 2.66p, which translates into PAT of just £330k. So I'm afraid it's not clear how the company's performance compares with expectations.

By my rough calculations, it looks as if 03/2018 is likely to be EPS of about 11.5p. So if that's right, then the PER is 27.8 - not a bargain, but it's based on a poor year. So the market seems to be anticipating an improvement in trading in 03/2019 and beyond.

This whole announcement is excellent for its clarity. That's very unusual for marketing/PR companies. Normally companies in this sector seem to go the opposite way, and try to deceive readers with overly optimistic narrative, and often spurious adjustments to the figures. So it's really refreshing to read the honest, and straightforward reporting from SYS1.

How about this for being completely straightforward;

As previously announced, trading during 2017/18 has been disappointing...

The company has cut costs, in response to poor revenues.

New products have been introduced, but no detail is given on that.

Net cash of £5.7m at 31 March 2018 is indeed "healthy", as the company says.

Outlook comments - none.

My opinion - I very much appreciate the honest reporting from this company. It has said in the past that it has little revenue visibility, and that's the fundamental problem, which makes it impossible to accurately value this share, as we have no idea what future earnings are likely to be.

In the past, the company has been highly successful, and paid generous divis.

So the share might have some attraction, as a punt on management delivering a return to previous form. There's too much guesswork involved, for it to interest me. I certainly think management should be applauded for their plain-speaking in RNSs. There are many companies and advisers who should take note, and change their approach to be more like SYS1.

Far too many PR people seem to think their job is to deceive people. It really shouldn't be like that. Their job is actually to communicate clearly & honestly, and to thereby manage expectations and build trust between investors & companies. Even though SYS1 has performed poorly, I feel that I can trust the company's announcements. Hence I'm more likely to buy the shares, if the company does begin to perform well again.

The chart looks interesting - somebody seems to be hoovering up sellers at around the 300p level. Could that now be a floor for the price?

STOP PRESS

Koovs (LON:KOOV)

Share price: 10.5p (up 21.4% today, at 13:56)

No. shares: 175.4m

Market cap: £18.4m

Share price movement & interim funding

The share price of this Indian eCommerce fashion business has been very volatile of late, and spiked up about 60% earlier today, to a peak of about 14.4p. This has forced the company into making an announcement. It seems the price spike was spurious;

Koovs plc ("Koovs", or the "Company") (AIM: KOOV) notes the recent movement in its share price and would like to inform the market that it knows of no specific reason for this price movement.

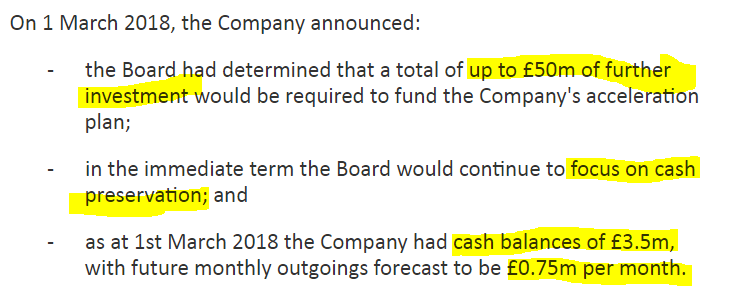

It reiterates the last update, showing that it's almost out of cash, and has a massive requirement for future cash injections;

Lord Alli is propping up the company until end Aug 2018;

The Company expects shortly to announce that it has secured interim funding via a loan of £1.5m from Lord Waheed Alli, a director of the Company. This interim funding will provide the Company with cash resources until the end of August 2018. On the basis this loan is entered into, it is expected to be classified as a related party transaction.

The company is still trying to raise more funding;

The Board actively continues the previously announced dialogue with potential new investors in respect of the £50m funding requirement and will update the market in due course.

My opinion - as regulars know, I've been consistently negative about this share, based on its lamentable financial track record. It's sad to see Lord Alli throwing more & more money at a concept that has failed to get off the ground.

In 5 years it has failed to generate meaningful sales, and has incurred heavy losses every year. At some point, sadly, it's just necessary to admit defeat, and pull the plug. I think there's a very high likelihood that we're nearing the end game. However, the company has almost gone bust before, and new funding was found, so who knows?

Existing shares are extremely risky, with a very high likelihood of a 100% loss. Hence this one comes with massive risk warnings, it's for gamblers only, at this stage.

OK, that's all from me today. Thanks for dropping by!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.