Good morning, it's Paul here!

I'm up early today, so thought I'd start with some brief comments on a couple of interesting company updates from yesterday, that Graham missed due to focusing on a macro ramble instead.

Estimated time of completion: 3pm

Update at 14:46 - today's report is now finished.

Sports Direct

Name change - it's now to be called Frasers. We saw a staggering rise in share price this week, to about 470p. That means if has more than doubled since the low of about 220p just 5 months ago. Whoever said that elephants don't gallop, was wrong!

The narrative with its interim results was interesting. A bit like Tim Martin of 'spoons, Mad Mike Ashley obviously revels in his outspoken, unorthodox way of doing things. Both are brilliant & talented entrepreneurs, so personally I think they've earned their stripes, and should continue saying whatever they like, in whatever style they like.

The one thing that does irk me, is that Ashley gave the impression from previous trading updates, that buying House of Fraser had been a terrible mistake, indeed he even referred to its problems as "terminal". Therefore, investors assumed that this was bad news for the company & its shares. Along with a catalogue of other bad buys - such as Debenhams (where he lost out to hedge funds, and has choice words to say about that too!), Goals Soccer Centres, and other sometimes rather stupid mistakes.

The latest update this week, seems to be now talking up House of Frasers somewhat, with green shoots and being integrated into the larger business, in IT, supply chain, etc. Changing the group name to "Frasers" does rather suggest that House of Fraser is now an important part of the group's future.

Narrative matters, but it's the numbers which matter more. There's an updated broker note on Research Tree, which I'm looking at, showing huge increases in forecasts - e.g. 43% increase in current year EPS, and EPS for next year going up from 19.3p to 30.3p, up 57%.

These are extraordinary forecast increases, for a mainstream retailer of this size. Therefore the dramatic re-rating in share price looks fully justified to me.

SDI (LON:SDI)

Share price: 75p (up 3% yesterday, at market close)

No. shares: 97.2m

Market cap: £72.9m

SDI Group plc, the AIM quoted group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing and control applications... for the six months to end October 2019.

For clarity, I like to see the company description separate from the trading performance, so I split out the first paragraph summary, which said;

... is pleased to announce another strong set of results and solid operational progress...

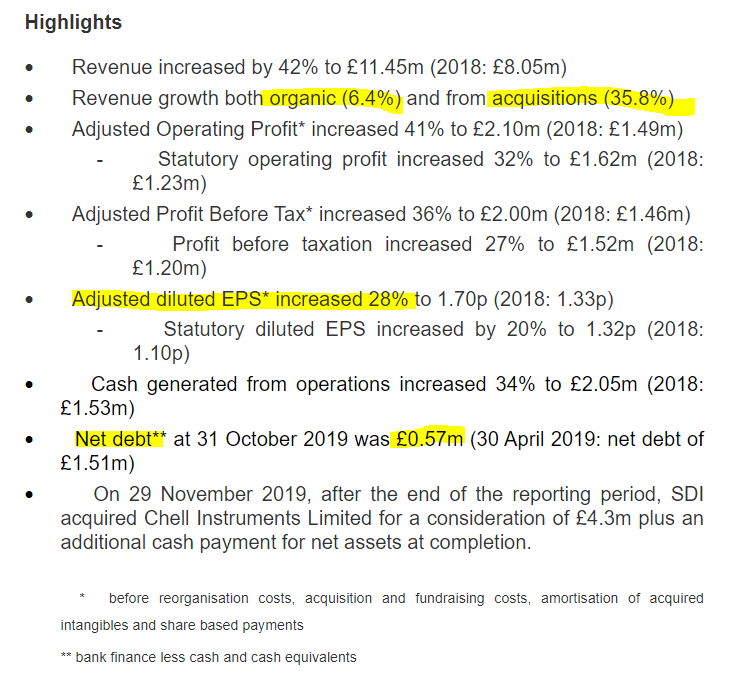

Highlights section looks good (my comments are below). We should always keep in mind that many companies let their PRs run riot here, and cherry-pick the best bits only! So we still have to check the full numbers below. I've lost track of the number of occasions where I've impulse bought shares at 8am, only to find that I missed something important further down in the announcement which negated the buy decision. It's strangely difficult to sell though, even if you do realise you've made a mistake - that's one of the nasty emotional factors that undermine our investment performance.

Most of the growth has come from acquisitions, but 6.4% organic (revenue) growth isn't too shabby either. I would like it if the profit growth were also split out re organic & acquired, as they're not necessarily the same thing.

EPS growth of 28% is lower that 36% profit growth. That's either because more shares have been issued, or the tax charge has risen disproportionately high. Checking the StockReport, it does seem as if SDI is quite fond of issuing new shares. The average share count has risen from 24.5m in 2014, to 97.2m now. Although since the share price has risen 10-fold since the low in Apr 2015, then it seems as if SDI management has used the new equity very wisely, in what must have been some excellent acquisitions.

Net debt - is minimal, which is reassuring. So many acquisitive groups load up with too much debt, and come a cropper. No such worries here, even allowing for the post period end acquisition noted above.

Outlook - is only in line, so that probably means limited scope for further share price appreciation, perhaps? Once the PER is knocking on the door of 20, then I feel companies really should be beating, rather than just meeting expectations.

The Group has made a good start to the financial year. Despite the potential for economic variability, influenced by political conditions (including Brexit) and currency fluctuations, the Board is confident that our diversified portfolio of businesses is on course to deliver a full year financial performance in line with market expectations.

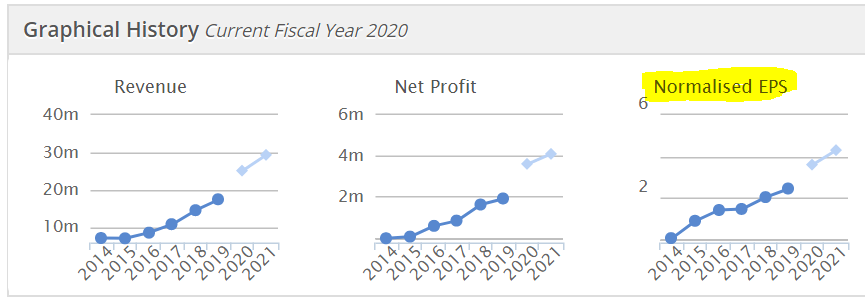

Valuation - forecast EPS is 3.6p for FY 04/2020, for a PER of 20.8 - getting a bit warm. Although, given the excellent track record on EPS growth (see graph below), then I can see why investors have rewarded the company with a higher rating.

That in turn allows the company to issue more paper at a decent price for future acquisitions. After all, if you can acquire a company on a PER of 12, and pay for it using paper you've just issued on a PER of 20, then that's good business, and drives up the share price further - providing none of the acquisitions go wrong.

Balance sheet - looks OK overall. However, one criticism is that the company has adopted IFRS 16, and lumped lease liabilities in with bank debt, calling it "Borrowings". That results in net debt looking as if it's £3.08m.

Of course, in the real world, lease liabilities are not debt at all. They don't carry interest, don't have covenants, and cannot be withdrawn (unless the tenant defaults on rent payments). Lease liabilities are actually future rental costs of buildings, as we all know. That is completely different in nature to bank debt, hence if we must have IFRS 16 figures, then they should at least be clearly marked on the face of the balance sheet, in my view. Many companies are displaying them separately, which is good.

Here, we have to rummage around in the notes to get the real world picture, in note 6.

Cash is £2,727k, and bank debt is £3,300k (drawn from a £5m facility with HSBC expiring in April 2023. This has been increased to £9.8m post period end). Therefore net debt is £573k, which ties in with the net debt figure shown in the highlights section of the RNS.

My opinion - I like the look for the figures, and the excellent track record of this group.

The latest acquisition looks sensibly priced, and is profitable.

Overall, it looks good, and warrants a thumbs up from me. Obviously, that's just my personal opinion, it's not any kind of recommendation. Subscribers should always do your own research, as I don't have time to go into the detail that a purchase would require.

Tristel (LON:TSTL)

Share price: 362p (up 4% yesterday, at market close)

No. shares: 44.7m

Market cap: £161.8m

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products...

At the AGM, this update was given;

"We expect unaudited pre-tax profit (before share-based payments) for the first half to be no less than £2.8 million, compared to £2.4 million for the same period last year. The expected pre-tax profit includes a positive contribution from our operations in Belgium, the Netherlands, France and Italy which were all acquired during the past year.

The Company is performing in line with management's expectations and our United States regulatory approvals project is progressing well."

A fairly modest rise in profit, at least some of which has come from acquiring its overseas distributors, doesn't strike me as particularly good. Not for a stock which is now rated very highly, on a forward PER of about 30. I would have wanted to see more than that, if I held this stock, at such a high rating.

Don't get me wrong, it's a very nice little business, with a strong track record of growth. I'm just questioning why it's valued so highly, when the products seem very niche (only small sales in each country)?

USA market - this is probably the answer, as it would clearly be a huge addressable market, once regulatory approvals are granted.

My opinion - nice company, but looks very expensive. There's no scope for any disappointment at this level. The US market is obviously very interesting. In such a litigious environment, I can see why a specialist disinfecting product might have more appeal, and achieve higher sales than the small amounts achieved in other geographies. Maybe, who knows? I wonder what the company's sales strategy in the USA is going to be? Presumably it will have to be via a distributor, due to the marketing costs otherwise being too high to sell direct.

Staffline (LON:STAF)

Share price: 106p (at close last night - likely to fall considerably today)

No. shares: 68.9m

Market cap: £73.0m

(for the avoidance of doubt, I do not currently hold this share)

Staffline, the recruitment and training group, provides the following update on Group trading and outlook.

Directorate change - whenever I see trading update, and a directorate change RNS come out at the same time, then it's nearly always a profit warning & either the CEO or CFO being fired.

In this case, Mike Watts, the CFO, has been fired. He is thanked - to borrow MrContrarian's phrase! Looking at the other RNS out today, the profit warning, I can see why the CFO had to go - more accounting irregularities are disclosed, as well as a profit warning.

He joined as a divisional CFO in 2017, and went up to Group CFO in Jan 2018.

Trading update (profit warning) - poor trading in Q4 means reduced profits for FY 12/2019. Helpfully, the damage is quantified, so we can work out revised valuations;

Given the challenges to trading in Q4, the Board now expects the Group to deliver full year adjusted operating profit (being profits before interest, tax and non-underlying charges) for the period ending 31st December 2019 of approximately £10 to 12 million.

The most recent forecast I can find, from Sept 2019, is in a broker note on Research Tree. This shows forecast adj EBIT (which is another name for adj operating profit) of £18.0m. Therefore this is a £6-8m miss, or 33-54% miss. Coming late in the year, that means that Q4 would proportionately have been worse than this. On the other hand the percentages look large because the company is now not that much above breakeven.

Another lurch down in share price today looks inevitable.

Is it going bust? That's the key question whenever companies repeatedly warn on profits. STAF has a weak balance sheet, but it did an emergency fundraising earlier this year, at 100p, which improved things somewhat, but not enough in my view.

Today's announcement reassures to some extent;

The Board expects year end net debt to be approximately £50 to £55 million, in line with current market expectations.

Staffline maintains a constructive relationship with its lenders and consequently the Board does not anticipate any covenant issues over the year end.

Furthermore, the Company is considering certain strategic options which may significantly reduce net debt during H1 2020.

I reckon that last paragraph probably refers to doing some kind of deal with its large Singapore-based shareholder, which operates a highly profitable & cash-rich staffing business. Perhaps a placing, convertible loan, or some other fundraising, to shore up Staffline's finances? The trouble is, that may be disadvantageous to other STAF shareholders, particularly small investors. After all, why would the Singapore investor want to be kind to other shareholders?

EDIT: Liberum points out that Staffline could sell its Irish business, to reduce gearing, in a fresh note that's just come out. End of EDIT.

Notwithstanding the current short-term trading challenges, Staffline remains a cash generative business, is one of the most financially robust operators within its immediate peer group and continues to benefit from considerable liquidity headroom.

Accounting irregularities - remember that Staffline shares were suspended in early 2019 due to discovering accounting irregularities re minimum wage regulations.

Today it announces that more problems have emerged - of £4m, this time relating to costs not being correctly booked. So possibly an error, but possibly fiddling the figures, as that's a lot of costs to overlook.

It creates the impression that STAF's internal controls are still not up to scratch. It's quite a sprawling business, with lots of moving parts. But even so, it's the finance department's job to keep properly on top of everything. And the CFO's desk is where the buck stops.

My opinion - I think it looks too risky now, for me to want to revisit it.

The downside is that existing shareholders could be diluted heavily in the next fundraising. Look what happened last time! there's no doubt in my mind that the business is likely to survive, but the question is more about who will own it?

Given that the UK economy is operating at very high levels of employment, and low unemployment, then staffing agencies appear to be under pressure - from employers wanting to take on good people as full-time directly employed, rather than temps through an agency. STAF doesn't seem to mention this factor in its update today, although it did mention this issue earlier in 2019. Today it talks about macro factors for the disappointing Q4. I don't buy their explanations. In particular, this section below, indicating a 16% drop in demand in Nov 2019, is far too large to be attributable to the macro picture, in my view;

During November, customer demand was down approximately 16% from the prior year which the Board believes reflects high levels of consumer uncertainty across the UK.

Whilst trading in December has improved, trading performance for the month is also anticipated to be below the Board's expectations.

For the sake of balance, I should report some positive noises made about the PeoplePlus division, despite a poor end to 2019;

...Despite significant growth within the year, Q4 performance is expected to be below the Board's expectations, principally due to the impact of the general election purdah on short term procurement opportunities.

However, following a first half of transition and multiple new contract implementations, the second half has evidenced the potential of the business with operating profit in each of October and November reaching £1 million.

PeoplePlus has built a significant platform for future growth and with the majority of 2020 revenues already contracted, the Company maintains a positive outlook for PeoplePlus in 2020 under its new operating model.

Maybe they should sell or shut down the rest of the business, and concentrate on PeoplePlus, if it's going to make £1m per month profit?

600 (LON:SIXH)

Share price: 14.0p (down 26% today, at 11:36)

No. shares: 115.4m

Market cap: £16.2m

Trading update (profit warning)

The 600 Group PLC ("the Group"), the diversified industrial engineering company (AIM: SIXH), today announces a trading update.

Its year end date is c.30 March 2020.

There's something funny about this company - it might be a massive pension scheme, and/or debt. I'll check that after looking at its profit warning today.

What has gone wrong? - once again problems in the automotive sector are causing problems in its supply chain. I think investors need to be particularly careful right now about owning shares in companies which supply the automotive sector;

As noted in our interim results, the Group has been experiencing certain macro-economic and political uncertainties across our end markets which it anticipated might create some short-term disruption to trading.

Consequently, order intake for the fourth quarter [Paul Scott: Jan-Mar 2020] is now expected to be significantly below originally predicted levels, with orders for Germany and the Far East, in particular, suffering delays heavily influenced by the global automotive slowdown.

Some positive comments -

There has been good progress in the UK business, where orders remain over 100% up on the prior year as well as continued good performance at the newly acquired CMS business, driven by its focus on healthcare and pharmaceuticals.

Gross margins across the Group are also holding up well.

Overall it's not good -

However, these positive factors will not be sufficient to make up the shortfall from the likely revenue reduction and as a result, the outturn for the full year is expected to be significantly below the Board's previous expectations.

Revised forecasts - the house broker has slashed its profit forecast by 43% for FY 03/2020, which seems a huge drop, considering it's only lowering revenue forecast by 7%. It must be very high margin business that has fallen away.

The revised EPS forecast is US cents 2.1 (about 1.6p in UK money), down from 3.69 cents in a previous forecast published very recently, on 2 Dec 2019. One of our subscribers comments below that they cannot understand how forecasts can be reduced so much, in such a short space of time. A very fair observation.

I make that a FY 03/2020 PER of 8.8 - which doesn't strike me as cheap, considering this company has substantial net debt.

I'm also worried about the apparent lack of earnings visibility, given that expectations can change so much when the company is already 3/4 of the way through its financial year.

Capital structure - A helpful note from WH Ireland reminds me of the unusual capital structure - namely £8m of loan notes, and 44m warrants exerciseable at 20p. The warrants don't matter so much, now the share price is well below that, at 14p. But the warrants could cap the upside going much above 20p share price, because warrant holders would then be incentivised to exercise their warrants (i.e. turning them into newly issued equity), and then flip them for an instant profit. 44m potential new shares is very considerable dilution, compared with 115.4m existing shares in issue. Potential investors here should therefore carefully investigate the terms of both the loan notes, and the warrants. In particular, what is the expiry date of the warrants (if they lapse soon, then they disappear as a problem), who owns the warrants, why were they issued, etc? The Annual Report is your first port of call to look into that.

My opinion - when I last looked at 600 Group, I came away feeling that it has some good quality businesses. However, this update today has really put me off. The warrants effectively limit the share price upside to about 20p. Why would I want to buy shares in something where my upside is capped like that?

Therefore, it's not for me, but good luck to holders.

GRC International (LON:GRC)

Share price: 17p (down 28%, at 12:15)

No. shares: 64.5m

Market cap: £11.0m

GRC International Group plc ("GRC International" or the "Group"), a leading supplier of IT governance, risk management and compliance products and services, is pleased to announce its unaudited interim results for the six months ended 30 September 2019.

This floated on AIM in Mar 2018. Yet another high quality offering on AIM I see, from its chart. Dear oh dear;

Kudos to our Graham, who spotted that this was a crock, a year ago in this article, specifying exactly why he thought it wouldn't be any good. The share price was 117p when Graham wrote that a year ago. It's since lost the 1 on the front of the share price, and is now 17p!

Balance sheet - it's insolvent.

My opinion - there's a long going concern note, which makes clear that this company is in serious financial trouble. Its creditors will need to take a big haircut before anyone in their right mind would be prepared to put in fresh equity. And why would anyone want to invest in a heavily loss-making business anyway?

... In light of the above, the Directors have identified a material uncertainty that may cast significant doubt over the Group's ability to continue as a going concern for the foreseeable future.

The equity is clearly worth nothing. Therefore if I held shares in this, I would ditch them for anything I could get.

As mentioned in Monday's report, my message for 2020 to UK brokers is this;

"Stop floating over-priced crap!"

Midwich (LON:MIDW)

Share price: 565p (down 7% today, at 13:15)

No. shares: 80.0m

Market cap: £452m

Trading update (profit warning)

Midwich, a specialist audio visual distributor to the trade market, is today providing a trading update for the year ending 31 December 2019.

There seem to be a lot of companies putting out updates, complaining of a soft Q4. I'm starting to wonder if that might create some buying opportunities, since the general election created much greater macro uncertainty than Brexit alone. With a decisive result, I think there's a good chance that at least some business confidence might return in Q1 2020. We'll see. Anyway, that's the specific reason why I think mild profit warnings around now from fundamentally sound companies, might be opportunities in some cases.

Midwich complains of a tough Q4;

Following strong trading through the first three quarters of the year, the Group has seen a slowdown in demand in recent weeks in both the UK and across key territories in Continental Europe.

In particular, we have seen fewer larger projects, which in turn has held back progress in gross margins. Hence, while we anticipate delivering total revenues for the year in line with expectations, the product mix effect on gross margins means adjusted profit before tax in 2019 is now expected to be in the range of £30 million to £31 million.

I don't quite understand how that hangs together - slowdown in demand, but revenue still in line. But lower margins. Maybe they had to discount prices to get sales closed by the year end?

Broker updates - nothing that I can get hold of.

Last year's results showed adjusted PBT of £29.1m. Therefore the revised figure for this year of £30-31m is a slight increase against last year - so hardly a disaster.

Interim results for this year showed an increase of adj PBT from £12.9m LY to £13.7m this year.

Taking one from the other, gives H2 adj PBT as follows:

This year adj PBT: H1: £13.7m H2: £16.8m FY: £30.5m

Last year adj PBT: H1: £12.9m H2: £16.2m FY: £29.1m

That looks OK doesn't it? Hence I think why the share price is only down 7%, because it looks a mild profit warning only.

Polite message for Berenberg & Investec - in future it would be very helpful, and save investors (and humble shares bloggers) a lot of time, if you could include a little asterisk in the RNS, and a footnote explaining what the existing market expectations were. Lots of other companies do this, and it's helpful. Then we can instantly see what the extent of the profit miss is, rather than having to spend ages ploughing through the last year's and most recent interims, to quantify it. Thank you kindly.

My opinion - this mild profit warning doesn't look serious enough to frighten off investors who are already in the stock. Although I can't see any compelling reason for me to want to buy the stock either.

Time is running short now, as I've already spent about 6 hours on this report, so let's move to quick comments format;

Bidstack (LON:BIDS) - a small speculative concept share, that is trying to embed adverts into computer games.

Profit warning today - 2019 revenues are not expected to be significant. Revs were £30k in H1.

Discussions continuing;

Bidstack has also been working closely with some of the world's largest names in computer game development and publishing. Access to a number of well-known games is expected in Q1 and Q2 2020.

When's it going to run out of cash? Nothing is said about that today. It had £6m cash at 30 June 2019. The operating loss was £1.8m in H1, so assuming a similar level of cash burn in H2, then it should have c.£4.2m in cash now - enough to keep running into early 2021. So no immediate concerns re cash.

The market cap is down to about £18m after today's 37% fall - which still looks expensive for something that has to date not generated any significant revenues. However, if the concept is proven, and sales soar, then it could get exciting again.

Therefore very much a share for gamblers!

Pressure Technologies (LON:PRES) - results out yesterday look good.

However, it's uninvestable for me, given that the company was found guilty re a fatal accident;

In November we announced that a trial had commenced in respect of the prosecution by the Health & Safety Executive (HSE) following the fatal accident at CSC in June 2015. At the conclusion of the trial, in late November, the jury delivered a guilty verdict pursuant to Section 2 of the Health and Safety at Work Act 1974 and we await the sentencing hearing which is now expected to take place in the New Year.

The outcome of the sentencing hearing is uncertain and whilst the range of possible outcomes is significant, the Directors are satisfied that the Group can continue to prepare its financial statements on a going concern basis. Further details are in Note 11 of this preliminary announcement.

I'm conscious of the fact that it seems crass to be talking about investments when someone has tragically died. According to google, the fines for corporate manslaughter (assuming that's what this is?) are based on an organisation's revenues, and could be up to a maximum of £7.5m for a group of PRES's size.

Note 11 gives more information. This sentence concerns me, although I'm not entirely sure what it means - can any readers shed any light on this?

Given the nature of the contingent liability the Directors' have determined that the exemption given in IAS 37 from providing all disclosures where disclosure can be expected to prejudice seriously the position of the entity in relation to the sentencing hearing is appropriate.

My opinion - Given that PRES has quite a weak balance sheet, and a potentially large compensation/fine liability looming, then I think it makes sense to steer clear of the shares for now.

Our condolences go to the family & friends of the poor man who died, John Townsend, a long-serving employee of PRES.

Symphony Environmental Technologies (LON:SYM) - profit warning for 2019, issued yesterday;

... revenues for the full year 2019 will be below market expectations resulting in an operating loss of approximately £0.5 million.

This company seems to bump along with revenues between £6-8m every year, never really gaining much traction.

I'm embarrassed to admit that I got caught up in the speculative bubble in May 2018. A mate rang me up to say it was super-exciting, so like a fool I bought some despite not liking the fundamentals. I assumed he'd done painstaking research on it. Anyway, it later transpired that it was a total punt & he knew almost nothing about the company! So that cost me £10k, but was entirely my own fault for ignoring the fundamentals. He can buy the drinks next time we meet up for a chat! (and I'll ignore whatever hot stocks he pumps!)

That's it for today, my brain has ground to a halt!

Graham's looking after you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.