Good morning, it's Paul here with the SCVR for Wednesday.

Estimated completion time - as usual, it will be mostly done by the 1pm official finish time (when the emails go out), but I might carry on adding more material after that, if there's anything interesting on the newswire.

Edit at 14:59 - today's report is now finished.

By the way, as I'm using the new site now, I don't see any thumbs down votes at all, which makes me happy!

China & coronavirus

This is still the main pre-occupation for investors right now. The quandary is that, we know this is a temporary issue, but we have no idea how serious it might become. So far, China seems to have done a remarkable job in containing it as much as they can. But the measures taken are so extreme (shutting down transport & factories in many areas) that they cannot possibly continue. Therefore, as China begins to return to work, after the extended new year holiday, the big question is whether the virus begins to spread more aggressively, or not, once people are mixing in close contact again, on public transport & in the workplace?

We only have to look at the devastation caused on the cruise ship, by confining people in close proximity. It may have quarantined the ship from the rest of the world, but it caused the rapid spread of the virus on the ship. Thus proving how contagious this thing is. I'm no expert on germs, or science, but as a layman, I can see that there still seems to be a very considerable risk to health and wealth, from this problem.

As regards shares, which is the topic here, it sometimes feels inept to be focusing on that when people are dying, but we have to. The issue for shareholders, especially in volatile small caps, is that we have to balance the fact that China supply chains are starting to be significantly disrupted. The press is full of reports that factories are running low on parts from China (Jaguar Land-Rover saying they only have enough for 2 weeks, and are rationing things like key-fobs (1 per car, not 2), and flying small items into the UK in suitcases). Complex, just-in-time supply chains are obviously the most at risk.

It's clear that we have become far too dependent on China. Not just for parts, but for parts which go into the parts - e.g. one article said that 80% of raw materials for medicines come from China, and are running low & seeing rising medicine prices in India.

There are two ways to look at it;

1. Recognise this is temporary disruption, and ride it out, or

2. Sell now, because as Tekmar (LON:TGP) demonstrated yesterday, small cap share prices are being smashed up when companies report disruption from this issue, even though it's a known issue.

It doesn't have to be binary, we can also reduce position sizes, where in doubt (e.g. sell half, keep the rest - I often do that when in doubt).

I think the worst approach is to decide now to ride things out, but then panic when a share drops 30-40%, and sell it at or near the bottom. Hence investors who decide to ride things out, really need to run through your head how you would react if one, or several of your shares plunged on China disruption? How do you normally react to profit warnings? If they cause you intense upset and pain, then it's probably best to trim positions now, before any possible damage. We can always buy back later. Ultimately each investor has to work out this stuff for themselves, dependent on your own risk tolerance, so I'm not suggesting any particular course of action, nor giving advice.

I remain very cautious, and think it's possibly too soon to be thinking about buying the dips, for China-related shares, but nobody really knows. Markets tend to anticipate events, so the recovery in shares is likely to be before there is clear news that things are getting better on the ground.

My interview tomorrow with Up Global Sourcing Holdings (LON:UPGS) should be very interesting, I'm looking forward to that. Graham's covering me here, so that I'll be free to focus 100% on my interview tomorrow.

OK, it's 7am now, so here we go...

Please see the header for today's running order.

Strix (LON:KETL)

Share price: 190p (up 10% today, at 10:48)

No. shares: 190.0m

Market cap: £361.0m

Statement re current situation in China

Isle of Man based Strix, is a global leader in the design, manufacture and supply of kettle safety controls and other components and devices involving water heating and temperature control, steam management and water filtration. Strix's core product range comprises a variety of safety controls for small domestic appliances, primarily kettles. Kettle safety controls require precision engineering and intricate knowledge of material properties in order to repeatedly function correctly. Strix has built up market leading capability and know-how in this field since being founded in 1982. [Source: "About Strix Group" from today's RNS]

Background - the last update on 23 Jan 2020 was an in line update for 2019, reviewed by Graham here. It mentioned USA/China trade tensions, but did not mention coronavirus (too early probably). The other China references, are that this group sells products in China, as well as manufacturing parts there too.

KETL is building a new factory in Guangzhou's Zengcheng district. Probably like me, many readers are starting to become vaguely acquainted with Chinese geography, for the first time. This province seems to be just north of Hong Kong, quite a long way from Hubei.

Talking of Chinese geography, my grandparents visited China in the 1980s. They brought me back a small metal globe, as a present. Clearly the designer thought that the British Isles were so small & insignificant, they didn't appear on that globe at all! You could only just make out France & Spain, as pimples on the Western edge of Europe, which was just a wiggly line.

Today's update - seems to have reassured investors, as the price is currently up 10% on the day.

The Company's manufacturing operations, which are located near Guangzhou, resumed on 10 February 2020 which was only a one week delay from the planned opening and in line with the government policy for an extended and mandatory closure over the Chinese New Year holiday period. Strix's facilities have experienced minimal impact to date.

Currently two-thirds of the workforce have returned to the facility and whilst others have been hampered by travel disruption this remains sufficient to fulfil the customer commitments for February and the Company are now focussed on securing March and April to minimise any disruption.

That sounds reassuring to me, so I can see why the share price is rising. Contrary to media reports of an almost complete economic shutdown, it sounds as if things are returning to normality. Although clearly, the part of China that companies are operating from, seems of key importance. Therefore Strix's quite positive experience, with "minimal impact to date" being the key phrase, may not be applicable in other regions of China, especially those in, or close to Hubei (the epicentre of the outbreak).

Customers - a mixed bag here, but again sounds reassuring;

The Company remains closely in touch with all of its largest OEM customers. The majority have either resumed production or are expected to imminently. Strix has seen some customers increase order sizes due to disruption elsewhere in their supply chain.

The importance of regions is emphasised. Apparently China has regional clusters for particular sectors, so that's an important consideration for investors to consider when assessing the risk for each company;

There are also no immediate concerns regarding Strix's supply chain, given over 80% are based in a same area near Guangzhou and were able to restart production last week.

Finally, there's a plug for KETL's most recent acquisition, HaloSource, which coincidentally has a disinfection product.

.

My opinion - a notable omission from today's update, is any comment on performance versus market expectations. The implication being that the company probably didn't want to explicitly confirm that it is in line with expectations, just in case things get worse. Also, we're only near the start of FY 12/2020, so it's difficult to predict this early, I suppose.

Looking at the chart, KETL shares were only starting to fall (presumably on China worries), therefore today's reassuring update seems to have nipped things in the bud & restored confidence.

.

Therefore in this case, so far the best action to have taken would be nothing - to sit tight & ride out any China worries. That could change of course, if the virus starts spreading more rapidly, and further shutdowns are required. Then we would be into different territory altogether. So I feel there are still considerable unknowns out there. We're apparently still a long way from sounding the all clear over coronavirus risk. Hence why I don't see risk:reward here looking particularly good. If the share price had plunged to say 150p or less, then it might have been worth considering a purchase. It doesn't interest me at these levels.

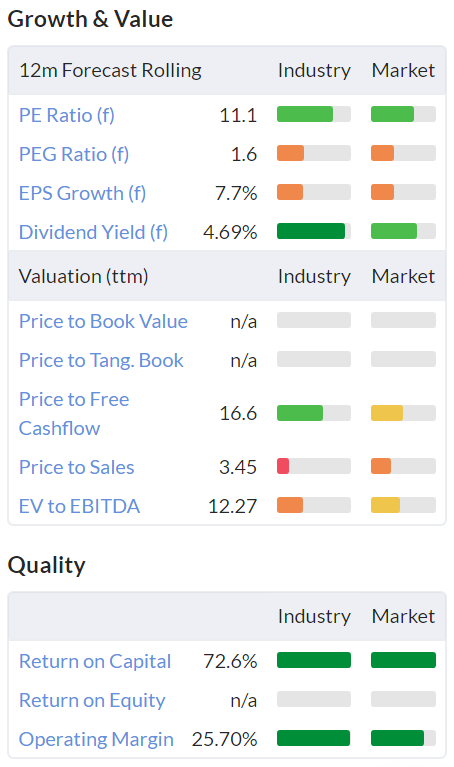

Having said that, looking at the Stockopedia stats, it does look reasonably priced, and good quality. So perhaps I've overlooked that? It might be worth a fresh look, with a StockRank of 92, and plenty of dark green on the graphics below.

Perhaps this might be an interesting share to ignore the China risk, and concentrate on the value & quality? Tricky one, I can't make up my mind, so will declare myself neutral.

.

.

Rps (LON:RPS)

Share price: 147p (down 14% at 11:22)

No. shares: 227.2m

Market cap: £334.0m

I don't seem to have ever looked at this consultancy group, not sure why, but possibly because the share price used to be higher, so it might have been above my maximum market cap size?

RPS, a leading multi-sector global professional services firm, today announces its Final Results for the year ended 31 December 2019 ('FY 2019').

The results have been given one of those little summary titles;

'FY 2019 in line with expectations, continued strategic progress'

It's quite helpful to flag that results are in line, in a header, as that saves me time having to work out if they're below, in line, or above. We can then just skip to the outlook statement, and then we have a quick overview.

My initial notes from first thing this morning are that RPS achieved 12.3p adj EPS, which looks a small beat against Stockopedia's consensus forecast of 11.87p. The company says its in line, so they must be using a higher consensus forecast figure - not stated, it would have been helpful to put the figure in the footnote, which is incomplete, just saying;

(2) The Board considers market expectations to be the consensus fee income, PBTA and fully diluted adjusted earnings per share published in the notes of those analysts who regularly follow and interact with the Group.

Broadcasting the analyst meeting - is a great idea, I wish more companies would do this sort of thing;

A meeting for analysts will be held at the office of Buchanan, 107 Cheapside, London, EC2V 6DN commencing at 9.30am. Attendance is strictly limited.

A video webcast of the meeting will be available from 12 noon via the following link: https://webcasting.buchanan.uk.com/broadcast/5e31691cb9710760e292473b

Profit is well down on last year, and note that broker consensus has also been reduced considerably. Therefore the in line result is stepping over a lowered bar.

- Adjusted profit before tax of £37.3m is down nearly 26% on 2018.

- Statutory PBT is only £4.8m, down 88% on LY. This would need closely looking into, for anyone considering a purchase here.

- Note the substantial exceptional costs this year, of £23.4m.

- There's a big, £12.3m exchange loss that by-passes the P&L, but reduces net assets directly (see the usually overlooked "Consolidated statement of comprehensive income" statement)

Balance sheet - wowee, this group has been on a major acquisitions spree by the looks if it. Intangible assets of £378.7m. If we write off this, as I usually do, then NAV of £348.5m becomes NTAV of negative -£30.2m - not good.

Debt looks too high to me, with £110.5m borrowings in long-term creditors. Net debt of £94.1m looks too high for me to be comfortable owning this share. It's stated as 2x (EBITDA, presumably).

Outlook comments seem a bit limp;

As we enter 2020, trading conditions in our markets are generally satisfactory and we anticipate more stable results from our segments. We will continue to invest, especially to deliver better connectivity, but we will do so in a measured way. We remain focused on building a business that in due course is capable of delivering mid-single digit rates of organic growth and a double-digit operating margin. The Board remains confident in the medium term outlook for the Group and anticipates that the year ahead will be broadly in line with 2019 with growth accelerating in 2021.

That doesn't make me want to rush out and buy this share.

My opinion - a PER of 12.9 looks superficially good value, but less so once you take into account the debt pile, and lack of growth in the short term.

Consultancy businesses have proven attractive bid targets in recent years, so maybe there could be upside there?

Otherwise, I can't get excited about this share, based on the information provided today.

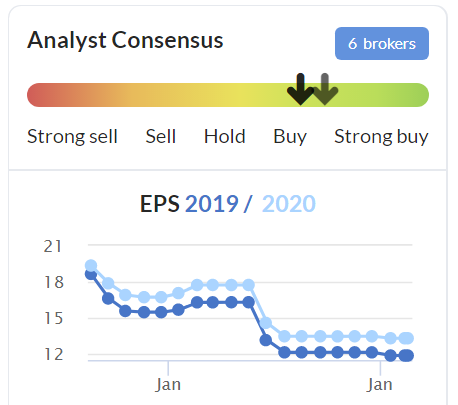

Stockopedia likes it though;

.

Gooch & Housego (LON:GHH)

Share price: 1350p (up 5.5% at 11:59)

No. shares: 25.0m

Market cap: £337.5m

Trading update (AGM)

Gooch & Housego PLC (AIM: GHH), the specialist manufacturer of photonic components & systems...

Background - I reviewed its last interims results here on 4 Jun 2019. The price dropped by nearly a quarter on the day, but soon recovered - this seems to be a share where the market gives it the benefit of the doubt over disappointments.

Graham had a quick look at its in line update here on 7 Oct 2019

.

.

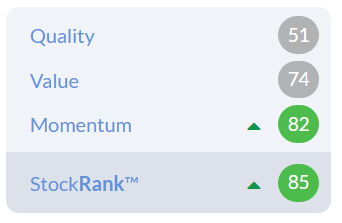

As you can see from the choppy 2-year chart, this business seems to regularly disappoint, but is quickly forgiven by the market, and it remains on quite a punchy valuation of a forward PER of about 25 after today's price rise. Clearly investors feel confident about the future, because the past doesn't really justify that type of rating, in my view.

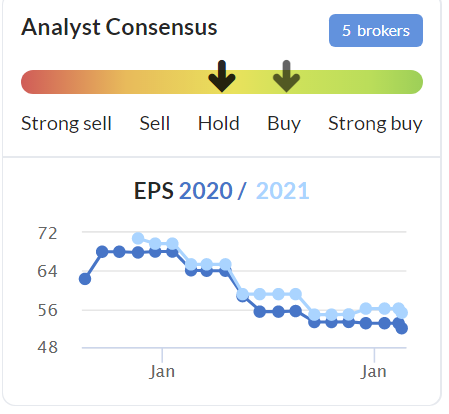

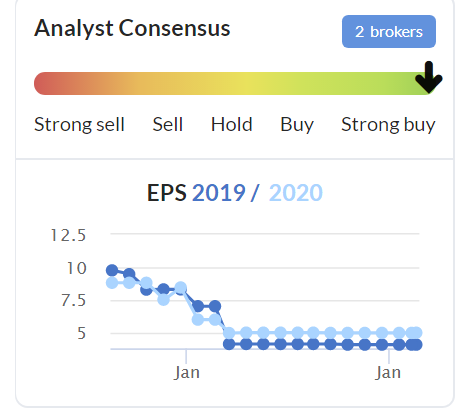

It's all the more surprising, given how earnings forecasts are repeatedly going down, not up;

.

.

Update today - it has a 30 Sept year end, so this covers the first 4 months.

During the first four months of the financial year trading reflected previously reported trends.

A challenging macro-economic environment for our industrial laser sector contrasts with high levels of demand for fibre optics, hi-reliability fibre couplers used in undersea cables and our A&D and life science capabilities.

Coronavirus is mentioned as a potential drag on performance, but "difficult to quantify".

More detail is given, but the company doesn't pull things together adequately. We should be told how performance is going compared with expectations. The company declines to say. Instead we get this waffle;

Overall we expect to show progress on last year's result and we will continue to monitor the potential impact of the coronavirus on our industrial laser products. We will provide further updates throughout the year.

Order book is up 3% vs a year earlier.

Outlook - is more about aspirations, than guidance;

"Technical innovation, such as 5G and new laser-based industrial manufacturing techniques will ultimately drive improved demand in the industrial laser sector.

We remain confident in the long term growth potential for our chosen photonic technologies in all of our target sectors.

"G&H will continue to pursue further progress on our long term goals of greater diversification and moving up the value chain".

My opinion - I find this a rather hesitant, and vague update. It side-steps the key issue (of performance vs expectations) like a politician on Newsnight. That's just not good enough.

Why the share price is up 5% today, is a mystery to me. Perhaps there has been some positive broker commentary that I'm not aware of? Or perhaps people were worried that its China exposure might be more serious than appears to be the case?

Overall, I cannot see why the share price is this high, based on the numbers.

Ebiquity (LON:EBQ)

Share price: 31.5p (up 21%, at 12:58)

No. shares: 75.9m

Market cap: £23.9m

Ebiquity plc ("Ebiquity" or the "Company"), a leading independent marketing and media consultancy, announces a pre-close trading update for the financial year ended 31 December 2019, ahead of the preliminary results announcement planned for 26 March 2020.

Background - I last wrote about this here in Nov 2014. I haven't missed much, as it doesn't seem to have made any commercial progress since then, and the share price has fallen heavily;

.

.

Not a great shareholder return, over 20 years, is it? Dividends have been negligible over this period. I wonder how much management remuneration has extracted from the business over that time?

An optimist might look at the chart, and say the current level has twice provided a good springboard for a price recovery - a spectacular, if fleeting one in 2004-2006.

Update today - it's only in line;

Ebiquity's trading for the year ended 31 December 2019 was in line with the Board's expectations. Its performance in the second half of the year was consistent with the trend reported in the first half...

What are expectations? The only forecast I can find is a note from Edison, showing £5.3m adj PBT, and 4.0p adj EPS for FY 12/2019. Stockopedia shows after tax forecast of £3.65m, and 4.05p EPS. Therefore, about 4p seems to be the ballpark for EPS.

At 31.5p share price, I make that a FY 12/2019 PER of 7.9 - not expensive, but why would you pay more, for a small, people business? That said, digital marketing is a great growth area to be in.

Continuing a theme of today's companies, this is another one where broker forecasts have fallen a lot, so achieving the reduced forecasts is not impressive in the wider picture;

.

Net debt is down. £5.8m at 31 Dec 2019, down from £7.0m 6 months earlier, and a huge reduction from a year ago, when it was £28m - a disposal cleared most of that debt. Interesting.

Closure of a rival is said to create opportunities.

Balance sheet - I'm looking at the last reported balance sheet, at 30 June 2019, and note that gross bank debt looks high, at £14.0m. However, a new bank facility of £24.0m was agreed in Sept 2019, with a 4 year term. So it looks like the bank is happy with everything.

I'm not keen on the balance sheet overall. NAV is almost all intangibles, and receivables look extremely high.

My opinion - it looks quite cheap, and could bounce a bit from here, but it's not something I would want to hold long-term, due to its long-term track record of not creating shareholder value.

Cambridge Cognition Holdings (LON:COG)

Share price: 24p (down 20%, at 14:20)

No. shares: 24.2m before placing + 7m placing = 31.2m

Market cap: £7.5m (after placing)

Trading update

Cambridge Cognition Holdings plc (AIM: COG), which develops and markets digital solutions to assess brain health, announces a trading update for the year ended 31 December 2019.

Background - this company has quite an interesting, and innovative product, with a lot of history & extensive data behind it. The problem is that, to date, the business has not been able to scale up. It just chugs along doing £5-6m revenues each year, and the StockReport numbers section is just a sea of red.

Wave after wave of optimists have funded the cash burn, with lots of small placings. I might have even taken part in one myself, it rings a bell. It hasn't worked commercially so far, but that doesn't mean it never will. If it does spark into life, and investors get excited again about potential growth, then you can see the potential from the chart;

.

The share count has risen, but not drastically, from c.13m in 2013, to 31m shares today, so some strong newsflow could take it to say £30m mkt cap - c.100p per share, or a 4-bagger from here. How likely is that though? Answers on a postcard please, as I haven't got any view on that. Investor sentiment can turn on a dime. People hate a share one minute, then when some better news comes out, they suddenly love it - e.g. Bigdish (LON:DISH) which was 1p at Xmas, and is now 4.5p (I'm long of this one, my most speculative holding). Some of the best % gains can come from situations where investor sentiment is totally bombed-out, but not very often.

Update today - summarising it;

- H1 & Q3 weak

- Q4 & early 2020 "seen a return to significant growth"

- Orders - £4.1m already in the pipeline for 2020 {not bad, so early in the year, given that it usually achieves £5-6m in an average year)

- Poor 2019 results - £5.0m revenues, £2.9m loss - clearly can't carry on like that, so I think the company is probably now drinking in the last chance saloon

- Cash - down to £0.9m at 31 Dec 2019, hence the need for a top-up placing today, of £1.4m before costs (probably about £100k costs, as even small placings tend to be ridiculously expensive)

- Cost-cutting done, and profitability expected in Q4 2020.

My opinion - I've tried to set out the dismal track record, but also the potential opportunity above.

It could go either way. If sales accelerate, then you could double, triple or quadruple your money here. If not, then it could just grind down further in price, with de-listing a possibility.

It's just a punt now really, but one I find moderately interesting at this level. It's the sort of share that I would put say 10% of my profits from something else into, as a fun punt.

The product is real, and has won some big contracts. If it can scale up, then it's a multi-bagger potentially. But people have been saying that for the last 7 years, and it hasn't yet managed to achieve scale.

Let's leave it there for today. I dropped National Milk Records from the list, because it doesn't have a proper listing, and I cannot see why it's listed at all. Also profits are down, and it had a cyber-attack. What a weird company!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.