Good morning everyone! It's Paul here.

Many thanks to Graham for adding some extra sections to yesterday's report, as I had a busy afternoon dealing with other stuff. I think we'll work that way in future - as readers seem to prefer having all our sections in the main article. My experiment with posting additional sections in the comments area didn't seem to go down well, and I understand why - as such comments could be easily missed.

On to today's news.

Lombard Risk Management (LON:LRM)

Share price: 10.85p (down 16.5% today)

No. shares: 400.6m

Market cap: £43.5m

AGM Statement - this software company has a 31 Mar 2018 year end. It is a developer of software for banks, concerning e.g. collateral management & regulatory reporting.

There's very little information about trading in today's update. This bit is the closest it gets to being a trading update;

The Company continues to see a positive market for its products with the landscape largely unchanged since we announced our 2017 full year results in May.

That doesn't sound particularly good to me.

Also this bit is somewhat worrying;

"We have historically reported full year revenues that are weighted to the second half of the year and we expect the year to 31 March 2018 to be no different.

I think the market has taken this as a veiled H1 profit warning, which is probably sensible, given this company's poor track record.

The next bit says that they have a positive pipeline, but nothing positive is said about actual performance. That again suggests to me that things possibly aren't going particularly well:

The Board is encouraged by the pipeline of new business being pursued both through the Company's direct sales force and through its relationships with its channel partners.

Lombard Risk continues to invest in its development centre in Birmingham, which will provide the Company with both time to market and cost advantages. The Board is satisfied with the progress of this important initiative and continues to look to the future with confidence."

This company is always relentlessly confident, but that means nothing in terms of performance, which has been poor for several years now.

Note that nothing is said about performance compared with market expectations. That, combined with the H2 weighting comment, suggests to me that the company is probably running behind forecasts, but hoping to catch up later in the year. They probably won't catch up, so I see a deferred profit warning being a possibility here.

My opinion - I remain of the view that there is little evidence of this actually being a viable business (i.e. one that consistently make profits). It's been promising better things ahead for years, but so far, not much has come of it.

The company capitalises a huge amount of development costs onto the balance sheet, so in cash terms, it's loss-making. That requires new equity to be issued periodically, to replenish the bank account. So investors are being steadily diluted, every time it runs out of cash.

Who knows, the company might eventually deliver? Although there's little sign of that in today's update. So it's not of any interest to me.

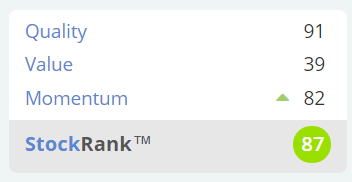

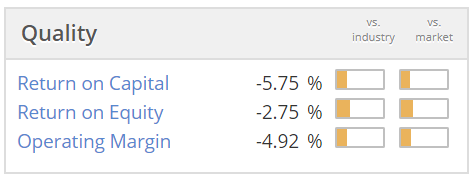

I'm perplexed by the high StockRank of 87, and the Style of "Speculative, Small Cap, High Flyer" - the high flyer bit may soon change, if the current share price weakness continues. I don't understand the high 91 score for "quality", when all the Quality scores below are negative! Ed did explain this to me a while back - I think it's because the Quality score is worked out on different variables.

To my mind, this is clearly a poor quality business, which is burning cash, and not generating any returns for shareholders. That might change in future, but I can only comment on what the position is today.

Hotel Chocolat (LON:HOTC)

Share price: 332.7p (down 1.0% today)

No. shares: 112.8m

Market cap: £375.3m

Trading update - this was one of the better quality floats of 2016. The company sells premium chocolates, from a growing chain of shops, and online.

My comments on the interim results are fairly detailed, and are here. I've just re-read that, to refresh my memory. My conclusion then was that it's a smashing business, but too expensive given the not particularly exciting growth.

Today's update is for the 53 weeks ended 2 Jul 2017. So it's a catch up year, with an extra week. Companies with weekly reporting have to do this every 4 or 5 years, in order to stop the year end drifting further away from the calendar month end.

Revenue - has come in the right side of expectations;

Revenue for FY17 was £105 million. On a comparable basis, revenue for the 52 weeks ended 25 June 2017 was £104m, an increase of 12 per cent compared tothe prior year*, slightly ahead of market expectations.

An increase of 12% doesn't strike me as impressive, considering this company is on such an expensive rating. The company opened 12 new stores in the year, which added 5% to revenues - again, not madly exciting. Although this should feed through to a bigger increase in the following year, as new stores will then contribute for the full 12 months.

A footnote says that revenue is measured at constant currency, so there is likely to be some forex effect on those numbers. I'm not sure whether that would be positive or negative. So have just checked the last annual report, which in note 4 discloses that 97.6% of revenues were generated in the UK. So we can safely ignore currency's impact on revenues (if not on costs though - where there is likely to be some cost price inflation occurring, due to weak sterling).

Profitability - no comment is made about profitability for FY17, which seems a strange omission. It does make me wonder whether profits might be a little less than forecast? Or perhaps the accounts department hasn't crunched all the numbers yet - after all, it is only 17 days after the year end.

I would have much preferred a comment saying that, subject to audit adjustments, profitability is in line with expectations. That they didn't say this, introduces doubt.

Current trading - this is a bit more clear;

Trading since FY17 continues to be in line with management's expectations.

Directorspeak - this sounds confident;

"Hotel Chocolat has had another good year, with encouraging growth. We are excited about the progress made with our new shop+cafe format stores and our seasonal ranges continue to perform well."

Forecasts & valuation - there's an updated broker note on Research Tree today, which indicates 8.2p adj. EPS for FY2017, and 9.3p adj. EPS for FY 2018.

That translates into a (now historic) PER of 40.6, and a forecast PER of 35.8.

A very punchy rating, for forecast earnings growth of only 13.4%. So investors prepared to hold the share at this very expensive rating must believe that the company can beat these forecasts. There's some evidence to back up that view, since the broker concerned has upgraded forecast 4 times in the last year.

I suppose the other area of excitement could be expectations that online sales growth might accelerate, as the brand becomes better known?

Shareholdings - note the highly concentrated shareholder base. This makes this share illiquid, given the small free float. Investors also have to weigh up the positive side of management having plenty of skin in the game, with the potential negatives of them having too much control:

My opinion - it looks a nice business - with a lovely brand image, and very good marketing. I've not tried the product - have any readers? I'd be interested in your feedback.

As noted above, my main reservation is the very high rating of this share. It's come down quite a bit in recent months, but still looks eye-wateringly expensive, given not particularly strong growth, actual and forecast.

I'm no chartist, but it's always worth looking at the chart. An increasing number of people are using growth strategies based around Mark Minervini's writing (which has been very influential for me too), and a clear move below the 200-day moving average, as you can see above (the green line) can be a trigger for him to sell. Therefore I would worry that this might present a headwind for this share, for the time being, perhaps?

EDIT: Sorry, I got this wrong. The green line is actually the 50-day moving average, not the 200-day. Thanks to Nick Ray for pointing out this mistake in the comments below. So, as the share price has not crossed the 200-day MA (the red line!) then Minervini followers may still be bullish on the stock. Maybe I won't mention charting again, as it's clearly not my strong point lol!

Overall then, it's a nice business, but for me, it's over-priced. I would be interested at maybe 200-240p, but above that, forget it.

Eagle Eye Solutions (LON:EYE)

Share price: 235p (down 5.1% today)

No. shares: 25.3m

Market cap: £59.5m

(at the time of writing, I hold a long position in this share)

Trading update - a reader has asked me to look at this update which was issued yesterday. The trading update starts with a nice clear explanation of what the company does;

...SaaS technology company that validates and redeems digital promotions in real-time for the grocery, retail and hospitality industries

The company has an impressive client list, including ASDA. So it's a proper company, not blue sky. Although it is still loss-making.

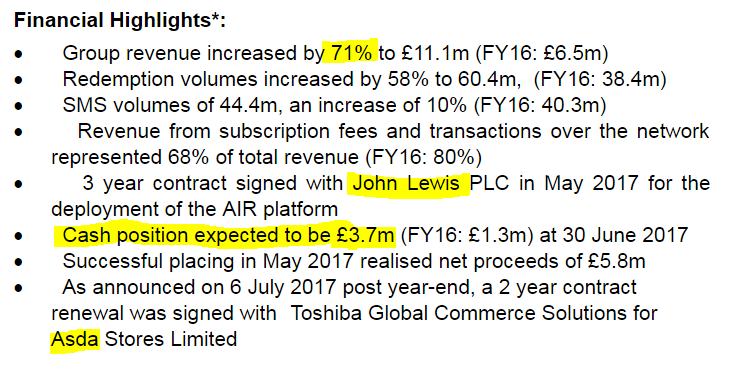

Here are the highlights from yesterday's update, which relates to the year ended 30 Jun 2017:

Revenues - I'm impressed with that 71% increase in revenues.

Cash - the company is still cash-burning. It raised £5.8m in a placing in May 2017, but only had £3.7m left a month later. So clearly it had moved into a net debt position, prior to the placing. Checking back my notes from Nov 2016, this is flagged - there was a £1.5m loan facility from Barclays.

EBITDA losses - are flat year-on-year:

Reflecting our planned investment, group-adjusted EBITDA loss for the Period is expected to be £1.8m (2016: loss £1.8m). To provide a better guide to the underlying business performance, adjusted EBITDA excludes share-based payment charges along with depreciation, amortisation, interest and tax from the measure of profit.

The key thing that EBITDA losses exclude, is the capitalised development spend. As I pointed out in Nov 2016, the company capitalised £1.2m of development spend. So in cash terms, the EBITDA loss is really £3.0m p.a.. Therefore it has just over a year's worth of cash in the bank. I think this means another cash call looks likely, in my opinion. That's not necessarily a problem though, as the share price has been buoyant, and investors receptive to putting in more cash.

Also, the market cap is high, so raising another (say) £6m would only be about 10% dilution for existing holders - hardly a disaster. The problems with this type of situation only emerge when the share price plummets. Having to raise more cash into a weak share price is the nightmare scenario, which destroys shareholder value. So far though, that's not been a problem here.

Outlook - the Directorspeak sounds upbeat:

"The Group has continued to trade well, whilst accelerating its growth.

"This reflects a period of strong operational progress where we have won new customers, increased transactions through the platform and continued to deepen our tier 1 customer relationships. Looking forward, following the successful placing in May 2017, the Group is in a strong position to capitalise on the business momentum and market opportunity.

I would argue that making losses similar to last year, is not trading well! However, this is a growth company, and the top line growth is excellent.

My opinion - this share looks very expensive, based on the performance to date. There again, that's what I said in Nov 2016, and the share price has doubled since then.

I foolishly bought some right at the recent top, at 300p. Then got cold feet, and reduced my position size down, at a loss. That was clearly a cock-up, but it doesn't really matter. What matters is simply whether the share is a decent bet at this point in time, and at the current valuation? I have no idea, is the only sensible answer to that question, it's a speculative share which is almost impossible to value right now.

The revenue growth is really impressive, and having a platform which is delivering rapid growth, and presumably high margins on sales increases, could become very interesting. Overall then, I'm happy to retain a small position here, and await developments. There's an obvious advantage for its clients using digital vouchers, in terms of administrative cost savings, and being able to track what offers customers respond to. Revenues are growing fast, so there could be decent upside if the growth continues. On the flipside, it's horribly expensive for a loss-making company.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.