Good morning!

What's on the agenda today:

- Duke Royalty (LON:DUKE)

- Quartix Holdings (LON:QTX)

- Mulberry (LON:MUL)

- Audioboom (LON:BOOM)

- Saga (LON:SAGA)

Duke Royalty (LON:DUKE)

- Share price: 47.85p (+2%)

- No. of shares: 200 million

- Market cap: £96 million

(Please note that I have a long position in DUKE.)

Duke keeps its quarterly dividend flat at 0.7p. This will be the fifth consecutive payment at this level.

Based on 200 million shares outstanding, this comes at a cost of £1.4 million annually.

For context, Duke generated operating cash flow of £1.3 million in H1 this year, from £1.8 million of royalty receipts.

At Mello, I again expressed the view to Neil Johnson (CEO) that compounding wealth inside Duke would be the best way to grow shareholder wealth. So I am happy for Duke to keep the dividends flat, even if it could afford to be more aggressive with them at this early stage.

The trailing yield based on these flat quarterly dividends is 6%. Some shareholders think that this yield should compress as the business model proves itself over time and diversifies. The share price should gradually increase to bring the yield down to 5%, for example.

If we get an increase in quarterly dividends (which should be affordable, in due course) and a compression in yield, that would be a double whammy for the share price.

I plan to wait and see what the company achieves over the next year or two, before making any change to my current position.

One of Duke's brokers recently forecast that the dividend per share for the current financial year would be 3.6p. For this to be achieved, I think the next dividend would need to be increased. 3.6p per share represents a forward yield of 7.5%.

An adventurous financial stock carrying significant risks, but I'm optimistic about this one.

Quartix Holdings (LON:QTX)

- Share price: 277p (+9%)

- No. of shares: 48 million

- Market cap: £133 million

The market loves this update.

H1 is running ahead of expectations and Quartix says it will make at least £25 million in revenue for the current financial year.

The broker has accordingly upgraded its revenue forecast from £24.2 million to £25.3 million.

On the basis that the extra earnings will probably be spent growing the business (e.g. with additional marketing spend in Poland, Ireland and Spain), EPS forecasts are left unchanged.

Fleet - this is a telematics business and the size of the fleet subscription base has increased by 11% in just six month. The value of the base in terms of future revenue has shown "accelerated growth".

Insurance - this is still being wound down, due to its lower-margin contribution.

The overall result for FY 2019 is going to be lower than FY 2018, due to the decline in the insurance segment, but this masks the fact that high-growth, high-margin business is replacing low-growth, low-margin business.

Clean accounts - I've remarked before that Quartix produces very clean financial statements. It reminds us today that its product development spending and other growth initiatives are fully expensed. It has a new 4G telematics system which is about to hit the US market.

Future reporting - we are going to get more detailed segmental information from now on.

My view - I like many things about this company. Management seem to focus on the right things and it continues to impress.

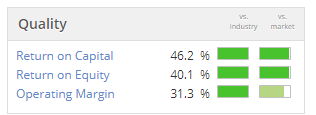

Great quality metrics:

Mulberry (LON:MUL)

- Share price: 282.5p (+5.6%)

- No. of shares: 60 million

- Market cap: £170 million

I never thought that this would fall so low! It has been on my watchlist for a while, since it rhymes with Burberry (LON:BRBY) (in which I have a long position) and is another well-liked British fashion brand.

Results

These results are in line with expectations: a small pre-tax profit on an adjusted basis, but a £5 million pre-tax loss on a reported basis.

Mulberry is making a switch from wholesaling to direct retailing and this has held back revenue growth for FY March 2019, as wholesaling revenues declined. Total revenues fell by 2%.

Underlying demand seems ok, though - digital sales are up 27%, for example. Digital sales were nearly £37 million.

Future periods will also benefit from expansion in Japan and South Korea, and development in China. The retail estate in Asia has multiplied from 6 stores to 34.

So if you only focus on the digital and international efforts, this can look like a growth stock!

Back home in the UK, it has had to deal with the impact of the House of Fraser administration. It retains 17 concessions since the Sports Direct takeover.

Current trading

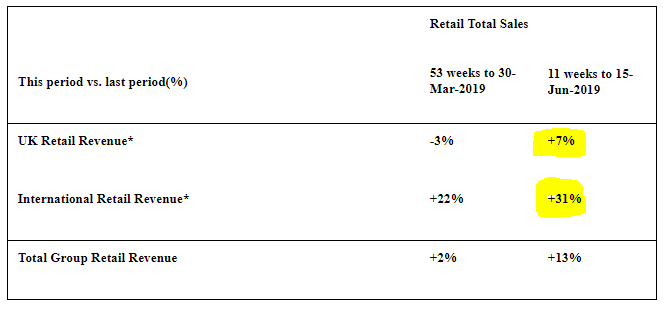

The announcement includes this table for the most recent 11-week period, but I'm not sure how useful it is, since it's not a like-for-like retail comparison. It includes digital sales, too. So unfortunately I think investors need to do a lot more work to judge how good the recent performance really is.

All we can say for sure is that international growth is taking off:

IFRS 16 - the new accounting standard will bring c. £120 million of lease liabilities onto the balance sheet.

Dividend - the dividend is unchanged at 5p, representing management's confidence in the medium-term outlook. This costs £3 million annually.

Balance sheet - the NCAV (net assets minus non-current assets) is about £40 million, which seems strong. Net cash of £11 million.

My view

I'm interested in this, and tempted to open a starter position at these bombed out levels. I've been watching it from a distance for a few years, always thinking that it was too expensive.

It's now trading at a price to sales multiple of less than <1x, versus Burberry (LON:BRBY) which trades at 2.7x sales (although Burberry's gross margin is about 500bps better than Mulberry's, and it's a much stronger business).

The adjusting items look reasonable to me. They include:

- House of Fraser-related bad debts and extraordinary costs.

- Costs relating to the John Lewis conversion from wholesale to a retail concession model.

- Korea launch costs.

The only cost that I wouldn't allow as exceptional is the sub-£1million impairment of retail stores. This cost also showed up last year and the year before.

Overall, Mulberry did not massage its results very much with adjusting items during the previous two years. The results have been reasonably clean.

Stockopedia classifies it as a Falling Star - very high quality, but still not representing Value or Momentum. Ideally, I would find an entry point where the Value was a little bit more clear than a cheap price/sales ratio!

Audioboom (LON:BOOM)

- Share price: 2p (+3%)

- No. of shares: 1.4 gazillion

- Market cap: £28 million

New podcast in collaboration with Studio71

Audioboom has roped in a couple of big YouTube/Instagram names for a new podcast.

I've used Ctrl+F (the search function) on its final results statements for the past couple of years - the word "content" has more than doubled since 2017, because this is an area where Audioboom is massively ramping up its spending.

In a nutshell, Audioboom is paying for content and hoping to make the money back on ads.

It doesn't appear to have any technology edge, so there is just the hope that it will be able to create network effects by having a lot of users on its platform.

Unfortunately, I don't expect this company to ever generate economic value.

Saga (LON:SAGA)

- Share price: 32.7p (-13%)

- No. of shares: 1122 million

- Market cap: £367 million

How the mighty have fallen!

This is Saga's last week in the FTSE 250 Index, at least for the foreseeable future. It is relegated from next Monday.

You can see all the upcoming changes in the FTSE June 2019 Quarterly Review.

It has two primary divisions: insurance and travel, both aimed at the over-50s.

Travel, in particular, sounds very rough at the moment. Revenues from Tour Operations are trailing last year by 4% and the company additionally warns investors that competitive discounting is hitting margins.

As far as the Cruise business is concerned, Saga describes it as "resilient", but still expects a small loss there in H1.

My view

I'd be selective before making any investment in the travel industry. The position at Thomas Cook (LON:TCG) springs to mind.

This share doesn't particularly interest me but perhaps it would reward those who are willing to hunt for value in it at these levels.

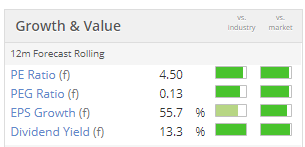

Stockopedia calls it a Value Trap. Indeed, these metrics look unrealistic:

Ok, I'll call it a day there. Cheers everyone!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.