Good morning!

Agenda -

Intercede (LON:IGP) (I hold) - wins an impressive contract, but it's already in the forecasts. So it's helpful, but not likely to move the price much.

Cambridge Cognition Holdings (LON:COG) (I hold) - a big contract win, coming on top of a positive trading update last week. This company is on a roll, and looks cheap to me.

Beeks Financial Cloud (LON:BKS) (I hold) - making it a hat-trick for positive updates from my small software holdings today. Revenues ahead of expectations, after a big contract win, but it's ploughing back the extra revenues into higher overheads, to drive growth - the right strategy in my opinion. This company looks quite special, but it's not cheap.

Chamberlin (LON:CMH) - I'm flagging the 31% discount on a placing announced today for this tiddler. I'm worried about market conditions getting a lot more difficult for fundraisings right now, so want to warn readers to be careful about holding shares with weak balance sheets, too much debt, and a funding requirement. Because you might wake up one morning and find you're being heavily diluted in a discounted fundraising, which also clobbers the share price. Do be careful!

Jack's section:

Wynnstay (LON:WYN) - I hold - record revenue and profit ahead of expectations for the agricultural supplier. It’s been around for more than a hundred years now, and has grown dividends consecutively for the past 18 of those. Low margins and sector cyclicality are risks, but the group has a strong balance sheet and a good track record of cash generation, leaving it well-placed to consolidate in a fragmented market.

Wandisco (LON:WAND) - good Q4 means full year results should be in line. It’s heavily loss-making though and has a history of equity dilution, while broker forecasts have been reduced recently. Market cap of nearly £200m on about £8.6m of annual revenue and £37m of net losses. Perhaps sector specialists might be able to identify an opportunity, but I’m not convinced.

Market comment from Paul

I see that US markets (especially tech) have put in a very powerful rally in recent days. The trouble is, we don't know yet whether a bottom has been put in, or whether this is one of the big rallies that typically punctuate bear markets, before another leg down. Although it is encouraging that some of the mega tech companies have put out blockbuster Q4 earnings releases - e.g. Alphabet (Google) is up 11% overnight on a positive update. Apple was similar a few days ago. Another one we were discussing here was Netflix, which fell a lot on disappointing subscriber numbers, but is now bouncing strongly.

Looking at the more speculative, over-valued US tech shares, many have rallied, but remain deep in bear territory. So it looks as if valuation is still firmly in focus. The US sets the tone for us here in the UK. As usual, in small caps, we seem to have a big lurch down when the US wobbles, then just a half-hearted rally when the US storms back more strongly. it's frustrating, but there we are - there's not enough liquidity in the UK small caps space, so it doesn't take much volume to move prices a lot. That creates opportunities, so we shouldn't complain. Recent volatility has made me realise I need to be much more agile, and take advantage of this volatility, rather than just sitting & holding for the long-term (although I'll still do that on core positions).

With the pandemic now seemingly over, then re-opening trades look an obvious place to be looking for opportunities, especially after we've just had a panic/indiscriminate sell-off. Hence travel/hospitality/leisure still looks like a good hunting ground. Although it's very important to check how much each company's share count has gone up by. Just looking at the chart, and assuming it will recover to pre-pandemic highs will not necessarily work, where a company had to enlarge the share count a lot, in order to survive during the pandemic. There are also plenty of companies out there which still need to fix their balance sheets, becoming more pressing as Govt support measures gradually unwind. Banks may be less forgiving as interest rates rise - so watch out for highly geared, precariously financed things in your portfolios.

I also think it probably won't be long before people start to factor in easing of supply chains. Getting goods in for Christmas was obviously a major bottleneck, more so than usual. Now we're over that hurdle, plus a lot of companies have been stockpiling components (which also puts pressure on supply chains short term), then I think as investors we should be factoring in supply chains beginning to ease, and looking at the upside on share prices which should feed through from that. It surprises me that markets don't seem to be anticipating this factor yet, so there's an opportunity to get ahead of the curve there, I reckon.

There are always macro headwinds & worries. Even inflation, whilst a big factor for now, should moderate in 2023, as supply chains ease, and prices of some goods could even fall (e.g. secondhand cars), offsetting rises elsewhere. However, for now, I'm keeping my focus on companies that can pass on higher prices to customers with relative ease. Hence we should be carefully scrutinising trading updates for comments on price rises & otherwise mitigating higher costs. Labour is costing more, so companies need to be more efficient. So things like automating warehouses, etc, are important to look for, I think. Which brings with it risk, that projects could go wrong of course.

Finally, interest rates. Nobody seems to be talking about huge increases here, and in the past, central banks have backed off from big rises. So it seems to me that fears here look overblown, but who can say? Nobody knows.

Paul's Section:

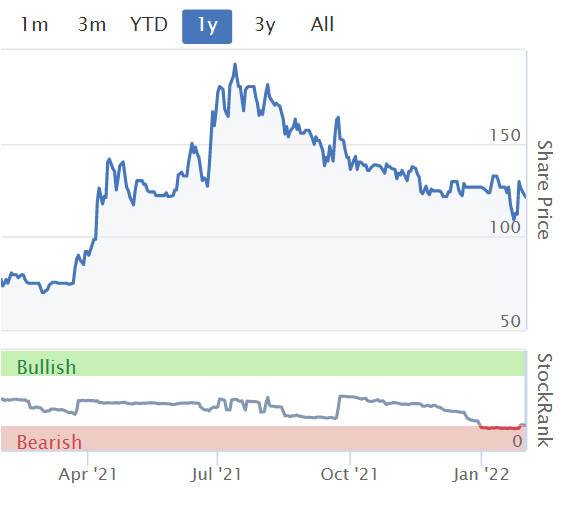

Intercede (LON:IGP) (I hold)

Contract win - a fair size at $0.5m, and with upside for follow-on orders. With a "prestigious independent US Federal Agency". Linked to Microsoft. Clearly good news. IGP has a stunning client list, so I'm pleased to see it win new contracts. Before we get too carried away though -

The contract was included within the directors' expectations for the current financial year ending 31 March 2022.

My opinion - encouraging news. Maybe this might stop the rot, in the long drift down in share price in recent months? IGP is now profitable, and has a debt-free balance sheet. So historic problems comprehensively sorted out. Contracts are with major organisations, especially in the US, and produce reliable & long-term recurring revenues. IF it can step up growth from new contracts, there could be nice upside here.

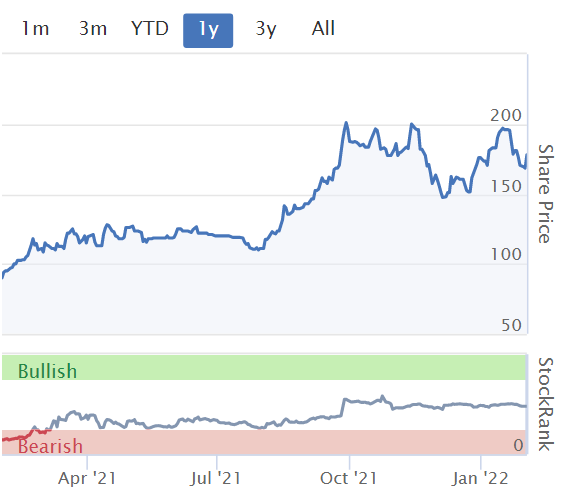

Cambridge Cognition Holdings (LON:COG) (I hold)

Another pleasing announcement (I reported here on 27 Jan 20222, with a positive 2021 trading update from COG).

Cambridge Cognition Holdings Plc (AIM: COG), which develops and markets digital solutions to assess brain health, is pleased to announce that it has been awarded contracts worth GBP2.1 million to provide cognitive assessments, electronic diaries, and third-party hardware for two clinical trials in neurodegenerative disease. Revenue is expected over the next three financial years.

That’s quite significant, since total revenues were £10.1m in FY 12/2021, so winning a £2.1m contract over 3 years would add about 7% extra revenues p.a. COG contacts are high margin (c.80%), so each notch upwards in revenues is great for the bottom line.

I don’t recall contracts of this size previously, so this is certainly at least one of the largest contracts to date.

My opinion - today’s announcement gives more detail, which is worth reading, and reinforces my view that COG is clearly in a sweet spot, with a big industry tailwind now driving increased use of its cognitive testing software. there are barriers to entry here, as the key data & expertise has been accumulated over decades. Cognitive testing is a small part of the overall cost of new drug development, so the big pharmas tend to stick with a tried & tested provider like COG, and there's little competition.

COG is now profitable, has plenty of cash in the bank, good visibility from a £17.0m contracted order book at 31 Dec 2021 spread over several years, that should be up to c.£19m now after today’s news - almost double 2021’s revenues. So there’s very good visibility here, hence low risk of profit warnings.

The market cap of £38m looks low to me, so I see plenty to go for. £100m+ market cap is my medium term target.

With positive newsflow, and a share price that has drifted down, this looks a good time to buy, I 'll see if I can scrape up any pennies to top up.

.

Beeks Financial Cloud (LON:BKS) (I hold)

177p (up 5% at 08:13) - mkt cap £100m

$2.2m Proximity Cloud Contract Win and Trading Update Significant contract secured for recently launched offering, revenues for FY22 now expected to be ahead of current market expectations

Key points -

This new contract is spread over 4 years.

Another impressive client - “one of the world’s largest Foreign Exchange brokers”.

Proximity Cloud offering is new, only launched in Aug 2021 - so all the more impressive that it’s winning big clients - augurs well for the future, I suspect.

“Substantial pipeline continues to build” for this new offering.

Revenues for FY 6/2022 ahead of market expectations, but this is being ploughed back into growing the business, so no change to profit expectations.

Beeks occupies a very interesting niche, which is why I find this company very interesting - this provides some flavour -

With the ability to now offer fully hosted, or private cloud solutions, from the Company's network of global data centres or on client site, Beeks is positioned to cater to the requirements of all financial institutions, no matter their size, and capitalise on the rapid acceleration of Cloud deployment in financial services.

These latency sensitive environments need to be built, connected and analysed and Beeks is one of the few companies in the world that can provide this.

As a result, the Group's addressable market is extensive, with up to 20,000 financial institutions around the world, a large percentage of which maintain their own IT infrastructure and are yet to move to the Cloud computing model…

"The rate and size of new contract wins demonstrate the potential for Proximity Cloud, addressing a significant part of the Financial Services market for whom the public cloud is not sufficiently secure. "The successes with our tier 1 clients mean we are now recognised as an established technology provider to financial markets, with a track record and compelling reference clients, providing us with a strong foundation to drive our business forward.

"The prospects for Beeks have never been more promising and with a growing pipeline we are excited by the opportunity ahead."

My opinion - stock markets have turned against growth shares recently, so we have to be very careful about shares on toppy valuations. Do they really deserve a PER of 40?

In this case, I think Beeks does deserve a premium rating, because it’s achieving superb organic growth, and seems to be carving out a lucrative niche, in potentially huge markets.

Many thanks to Canaccord Genuity, which has provided us with an update note via Research Tree. It is now forecasting a fantastic growth rate of +55% for revenues - a big acceleration in growth, which reinforces my feeling that BKS is almost pushing on an open door with its superb service offering, which then produces high quality recurring revenues.

It’s not being run for profit, but for growth, but even so, forecast EPS is 3.2p FY 6/2022, and 4.5p FY 6/2023, hence the PERs are 55.3 and 39.3 - so make no mistake, this share is expensive. It’s very unusual for me to be prepared to pay that kind of multiple, but in this case, I think the high margin, recurring revenues, and very high organic growth, plus the large market opportunity & growing pipeline, do justify this type of valuation.

Any wobble in growth though, and it would get mercilessly smashed in price, so there are risks to paying up for growth.

Other downside risks which worry me are key personnel/expertise, rising salaries, and the nightmare scenario of hacking/data breach/system outages. Since this service is mission-critical for clients, it has to be totally secure, and have 0% unplanned down time.

Overall, I think there’s something special here, and very rare in the UK markets. Hence I’ll sit tight, and run this one for the long-term, without worrying too much about valuation. When you find something special, it can sometimes pay to just run with it, rather than obsess about valuation. Not something you hear often in a value/GARP column!

.

.

Chamberlin (LON:CMH)

5.1p (down 29%)

No. shares: 69.6m before, +36.0m placing = 105.6m after placing

Mkt cap £5.4m after placing

This company is too small for us to normally cover here, but I want to flag it today as an example of one of my main worries at the moment - that the equity fundraising window seems to have slammed shut (as it normally does from time to time, in bearish market conditions).

Therefore any companies which need to raise fresh equity, often from a position of weakness, are not likely to get a positive reception from the institutions who participate in these things, and it’s the instis who set the price of placings too. If there’s not much appetite, then the price for support can be a deep discount, and hence big dilution for existing holders.

What I dislike about placings, is that it’s all done behind closed doors, with the shares still trading, which creates a false market. Instead, the rules really should be changed, so that shares are suspended once a fundraising begins, and all existing holders should be able to participate, not just favoured institutions. Sometimes there is an open offer added to placings, but it’s usually small, so a fig leaf.

The argument in favour of placings, is that they are relatively quick, and can allow companies to move fast if a good acquisition opportunity arises. Also, private investors can buy in the open market, if we want to increase our positions - although often the placing price will be lower than the subsequent market price, so all too often instis get an unfairly favourable entry price. That said, instis suffer from liquidity problems and can’t exit if something goes wrong, whereas we can. So there are arguments either way.

I won’t go into all the detail, but Chamberlin is raising fresh money at a 31% discount to the 7.25p share price yesterday. The share count will increase by 52% - quite heavy dilution, so existing holders will now have considerably less upside, if the share price recovers in future.

I don’t have any particular view on Chamberlin itself, as it’s too small. However, I do want to wave a warning flag to everyone here, that placings are likely to be more difficult to pull off, and at deeper discounts, in these more difficult market conditions. Therefore we need to be more careful than usual about buying/holding shares which have balance sheet issues, e.g. excessive debt, or could be in danger of breaching banking covenants, etc.

.

.

Wynnstay (LON:WYN)

Share price: 582p (pre-open)

Shares in issue: 20,311,177

Market cap: £118.2m

(I hold)

Final results for the year to 31 October 2021

Record results for the agricultural supplier, helped by improved farmer sentiment post Brexit, strong farmgate prices, and ‘exceptional’ gains from fertiliser blending activities.

- Revenue +16% to £500.39m, with ‘significant’ commodity price inflation,

- Underlying profit before tax +37% to £11.44m and reported PBT +57% to £10.99m,

- Basic earnings per share +60% to 44.4p,

- Net cash +10% to £9.24m and net assets +8% to £105.72m (£5.25 per share),

- Total dividend +6% to 15.5p.

That’s the 18th year in a row of dividend increases.

Wynnstay itself has been operating for more than a century now, with an excellent track record of cash generation and profitability despite the low margins and sector cyclicality, so it presents itself as a good dividend payer for long term income investors.

The group has a balanced business model and tends to benefit more than some others from inflation, as is borne out by these results. The earnings per share figure of 44.4p appears well ahead of consensus of 37.9p, and values the stock at 13x earnings.

I view that as reasonable value, but these results will likely have a positive impact today.

Wynnstay has two divisions.

Agriculture - revenue here is up 19% to £358.96m and operating profit is up 47% to £4.22m. Total feed volumes are 6.5% ahead year-on-year although operating profit is in line due to higher production and distribution costs.

Arable benefitted from a return to normal harvest tonnages and there has been a good Autumn 2021 planting season.

Glasson, which supplies raw feed materials and produces and manufactures fertiliser and added value feed products, has outperformed. This is due to a three-fold increase in fertiliser raw material prices in H2.

Specialist agricultural retail - revenue up 10% to £141.43m and operating profit +24% to £7.15m. Helped by increased farmer confidence and a return to farm investment after a period of uncertainty following Brexit.

Two bolt-on acquisitions, this is an important part of Wynnstay’s growth strategy, as it operates in a fragmented market in which it acts as consolidator. These have been integrated well, adding new customers and expanding the group’s trading area.

A new digital portal was launched in the first half, growing Wynnstay’s routes to market. Investment programmes to increase manufacturing and processing capacity are progressing. New senior hires have also been made, including Commercial Sales & Marketing Director, Group Engineering Manager and Environmental & Sustainability Manager.

The group’s three joint venture businesses (Bibby Agriculture, WYRO Developments and Total Angling, and Celtic Pride) have also performed well, contributing ahead of expectations.

Outlook - trading in the new year has started in line with expectations. There are challenges with rising costs but the group is ‘well-positioned to achieve its growth objectives for the year’.

Conclusion

I had an inkling Wynnstay was doing well based on previous updates, the general inflationary environment, and introduction of the landmark UK Agriculture Act reducing Brexit-related uncertainty over future financial support to farmers, so these record results in both revenue and profit are good to see.

The current level of financial support from the UK Government will remain unchanged until 2024, with a transition period thereafter, which will provide stability to the industry over the medium term. Following Brexit, the UK Government has agreed a number of trade deals with non-EU countries. Although some of these deals may also have increased the opportunity for agricultural food imports to enter the UK, they have opened up new markets across the world, at a time when global demand for food is continuing to increase.

The industry is cyclical though, so that might temper enthusiasm somewhat, but the group has been around for more than a century and understands what it has to do to grow and deliver shareholder value in the long term. It continues to invest in its business, is expanding its trading area, and is returning cash to shareholders.

A lot has gone right in order to facilitate these results, and the share price can be volatile. So if you hold the stock for a period of years then some downward pressure at some point is probably inevitable. There’s always the short term risk that poor weather or some other factor might lead to poorer harvests and performance.

The low operating margins, single digit ROCE, and cyclicality will likely always deter some investors.

But the group has a very strong balance sheet and is asset-backed. This is a significant strength and, alongside its balanced business model (which, management says, contains ‘natural hedges’ due to the breadth of activities) leaves it well-placed to weather tougher conditions and emerge from them in a position of strength.

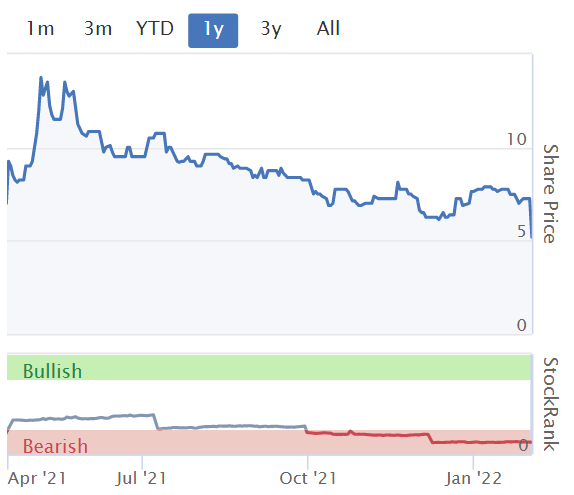

Wandisco (LON:WAND)

Share price: 314.7p (-0.1%)

Shares in issue: 61,463,254

Market cap: £193.4m

Trading update for the year to 31 December 2021

Strong Q4 trading following significant contract wins both directly and with key cloud channel partners. Q4 bookings increased 30% to $8.4m and are up 17% to $11.9m for the year as a whole.

Revenues are expected to be in line with current market estimates.

Toward the end of FY21, the Company took steps to realise efficiencies in its business model through prudent sales reorganisation and effective cost management. The Company has a strong balance sheet, with WANdisco's year-end cash position expected to be approximately $27.8m, a 32% increase on the prior year, with $1.2m in trade receivables.

That sounds like forced cost cutting to me, rather than prudent business management. And the balance sheet does have a healthy net cash balance, but this is a result of sustained equity dilution rather than retained earnings. The fact WanDisco touts a 32% increase in cash suggests its ability to raise yet another $42m from long-suffering shareholders is some kind of operational highlight.

There are some signs of progress though: the transition to a cloud-centric, consumption-based model is leading to more predictable revenues, reduced discounting (metered pricing), and increased upsell opportunities. The cloud platform model of the "Commit to Consume" contract structure (where a customer is obligated to move a minimum amount of data over a given time) is now the standard. This helped drive strong RPO (remaining performance obligations) and bookings growth in H2 2021.

Conclusion

This is not the type of investment I tend to dig into. It sounds like some progress is being made, and perhaps the prospects are bright, but there are lots of loss-making companies that can make a persuasive pitch to investors.

The long term share price chart shows how speculative this stock is. Many will have got quite badly burned in that time frame. And even at these lows, WanDisco has a c£200m market cap on about £8.6m of annual revenue and a Value Rank of 3.

It remains loss-making. Cash burn and equity dilution are significant risks.

Shares in issue continue to rise, with money raised from equity holders pretty much every year for the past decade. See annual net issuance on the left and the cumulative total on the right below. This is a dream company for fee-chasing brokers and investment banks.

All the data points I’m seeing here suggest the company could continue to disappoint. Brokers have been revising down estimates.

I don’t have a view on WanDisco’s services, so I’d welcome any input from subscribers more familiar with the company. There are several points here that set the alarm bells ringing, statistically speaking, so I’m not convinced.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.