Good morning, it's Paul here.

I'll be writing all afternoon, as there are no meetings today. Estimated time of completion: 6 pm. There are not many updates today, so once I've covered those, I'll circle back to a few more items of news from yesterday. Today's report is now finished.

Meeting with Revolution Bars (RBG)

(at the time of writing, I hold a long position in this share)

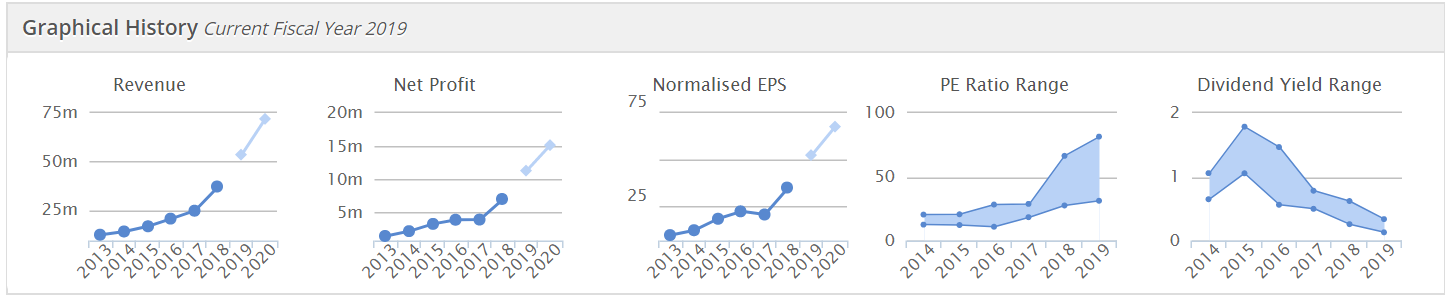

I had a very interesting meeting with the management of Revolution Bars (LON:RBG) last night. They ran through a very informative slide deck, with me asking questions along the way. With an improving sales trend during FY 06/2019, and LFL sales having moved into positive territory more recently (+1.2% in Jul - Sep 2019), it seems very obvious that the business is on the mend under the new management. This is shown clearly in slide 4.

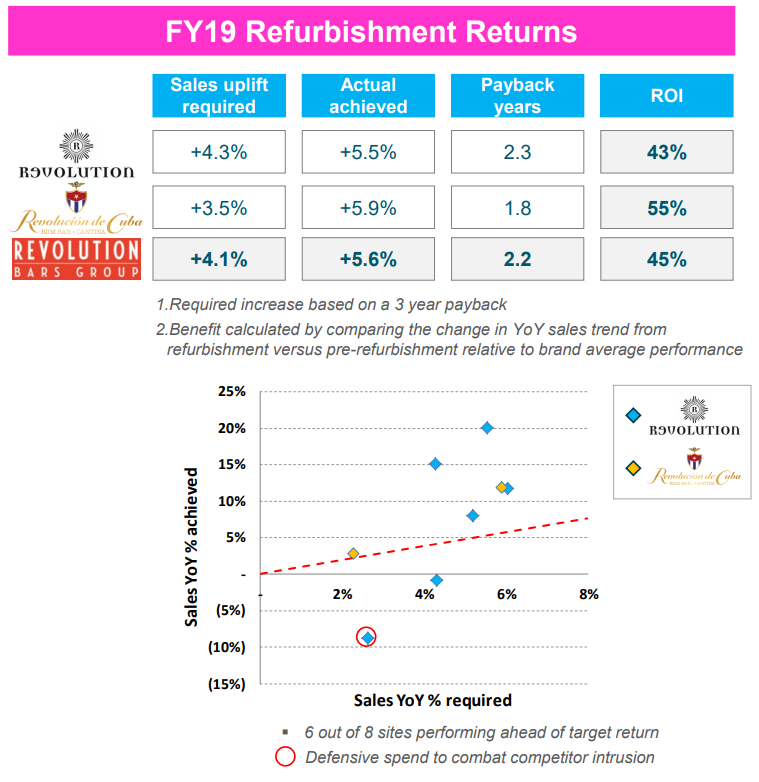

A busy schedule of refurbs is proving very effective at lifting sales, and has an excellent ROI - proving that this strategy is better than opening new sites. See this extract from slide 18:

Net debt - was £15m at the year end, and is set to reduce by £5m this financial year, now that the new openings programme has stopped. Refubs only cost about £200k, whereas new site openings cost £1m each. I think there is tacit admission that it was a mistake for previous management to fund lots of new sites with debt.

I very much like this cautious strategy, as it prepares RBG for a potential recession - which could wipe out some of its competition, so not necessarily a bad thing.

I think in more normal markets, the share price would definitely be recovering by now. As with many other shares though, there's a buyers' strike, because people are too nervous to buy before Brexit is resolved, I suppose. Plus there's macro-economic uncertainty everywhere right now. That's definitely creating some pricing anomalies, in my opinion.

People are probably sick of me talking about RBG at the expense of covering other shares, so I'll park this to one side for now.

As an aside, I got caught up in the London rush hour, when the meeting finished at 5:15 pm. What a nightmare, how do people do this travelling every day? I got caught up in an over-crowded Moorgate tube station, so ended up deciding to escape back to street level. Thankfully I discovered a very nice (almost empty), wood-panelled bar upstairs at The Globe pub, which I recommend as a sanctuary to anyone also caught up in rush hour in the City.

That gave me a couple of hours to go through my notes again from the meeting, and make a list of the key points.

Topps Tiles (LON:TPT)

Share price: 64p (down 7.2% today, at 11:54)

No. shares: 194.9m

Market cap: £124.7m

Topps Tiles Plc (the "Group"), the UK's leading tile specialist, announces a trading update for the 52 week period ending 28 September 2019.

Not a bad outcome for the year;

Adjusted pre-tax profits for the year ending 28 September 2019 are expected to be within the range of current market estimates.*

* The current range of analyst forecasts for adjusted pre-tax profits for the 52 week period ending 28 September 2019 is £15.5 million to £16.0 million, with a consensus of £15.8 million.

That sounds like code for nearer £15.5m than £16.0m, but given that it's a tight range, that's fine.

Q4 was soft, with LFL sales turning negative at -1.9%

LFL sales for the full year were better, at +0.6%

With flat LFL sales in the prior year, this effectively means sales haven't budged in 2 years, but of course plenty of costs will have risen, squeezing profit.

My opinion - the accompanying commentary sounds quite upbeat. I like the fact that Topps is not sitting on its laurels, but is;

- progressing its online offering (crucial in this age), and

- has entered the commercial tile market - doubling its potential market size

The PER is 10, and there's an attractive 5% yield. Is that attractive enough to be tempting? That depends on what's going to happen to the UK economy. At the moment Topps is fighting to stand still, in terms of profitability. In a recession, profits would undoubtedly plunge. On balance then, I'm thinking it's probably best to watch from the sidelines.

Ab Dynamics (LON:ABDP)

Share price: 2218p (up 2% today, at 13:15)

No. shares: 22.42m

Market cap: £497m

AB Dynamics plc (AIM: ABDP), the designer, manufacturer and supplier of advanced testing systems and measurement products to the global automotive market, is pleased to provide a trading update in advance of the publication of its final results for the twelve months ended 31 August 2019.

The share price has been dipping of late, but it's still held on to the bulk of the gains from the bull market in 2016-2017, unlike many other highly rated growth companies. Is that good or bad though? I can't help feeling that it might be better to look for things to buy that have already been smashed down in price, rather than looking at the ones which have managed to avoid that (so far) but could be the next one on the list to see a drop in investor confidence. After all, it doesn't take much to move prices these days, when there are not many buyers around.

Trading - there's nothing to worry about hear though, this sounds very good;

The Group continued to perform strongly in the second half and expects to report growth in revenue and adjusted profit before tax1 for the financial year ended 31 August 2019 that exceeds market expectations.

Outlook comments are also upbeat;

... Market conditions remain favourable, driven by significant structural and regulatory tailwinds...

We have an unmatched market position with exceptional technology and products, and the outlook remains positive across the Group."

Valuation - I can't find any broker note updates today. Given that trading has exceeded market expectations, combined with upbeat outlook comments, then I imagine forecasts would be increased on this news.

It's not cheap, but given this level of performance since it floated in 2013, why would it be cheap?!

My opinion - this is a terrific company, and its performance speaks for itself.

Well done to anyone who spotted the potential here a few years ago.

Kin and Carta (LON:KCT)

Share price: 82.4p (up 1.7% today, at 12:02)

No. shares: 153.3m

Market cap: £126.3m

Kin + Carta, the international digital transformation ("DX") Company, today announces preliminary results for the period from 4 August 2018 to 31 July 2019.

I've been reading some of the commentary, and it really grates on me. Lots of fancy, trendy management speak, which obscures what the company actually does. So I've abandoned the commentary, and will just look at the numbers.

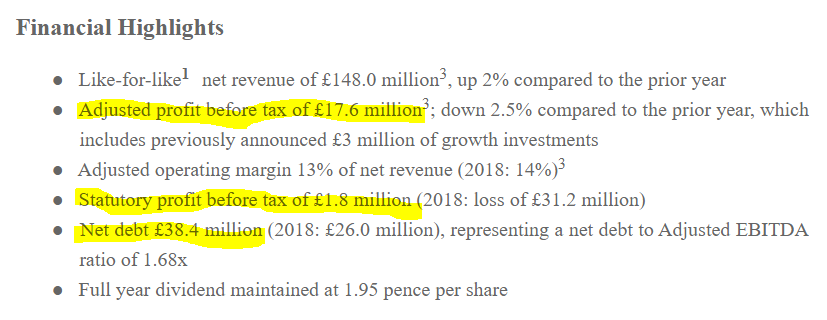

Note the huge difference between adjusted profits, and statutory profit or loss;

Wherever there are lots of adjustments to the P&L, I tend to find my attention moving to the cashflow statement, to find out what's actually going on. Cash is kin after all! (geddit?!). Talking of this company's new name, Kin + Carta, my brain reads it as Cath & Kim, my favourite Australian comedy.

Valuation - assuming you accept all the adjustments, then adj EPS fell from 10.1p last year, to 9.22p in FY 07/2019. What sort of multiple should be value that at? Given that it's falling, and the group's operations seem to be in marketing (a bad sector if the economy is entering a downturn), then single digit PER would make sense. The market agrees, at 84p per share, the PER is 9.1

The dividend yield of 2.5% is quite low, because the company has a weak balance sheet, so doesn't have a lot of scope to pay divis. Note the history, where the divi was dropped by about three quarters in 2017.

Pension scheme - is absolutely massive, dwarfing the market cap.

It worries me that the deficit or surplus is the difference between 2 huge numbers. Thus it carries a lot of risk, which ultimately shareholders could be on the hook for;

On an IAS 19 basis, the net surplus on the Scheme was £6.7 million (2018: surplus of £1.9 million) before the related deferred tax liability. The value of the plan assets increased to £385.9 million (2018: £353.5 million) due to the strength of investment returns. Approximately 65% of the plan assets are invested in return seeking assets providing a higher level of return over the longer period. Plan liabilities increased to £379.2 million (2018: £351.6 million) due primarily to the decrease in the discount rate used, partially offset by the impact of a reduction in assumed rates of future improvement in life expectancy. The increase in the accounting surplus is primarily attributable to the reduction in the assumed rate of future improvement in life expectancy of scheme members.

The Scheme's actuarial valuations determine the cash deficit recovery payments by the Group and the Scheme's triennial valuation as of April 2019 is currently in progress. The Group currently makes deficit funding contributions of £2.6 million per annum and a contribution of £0.4 million per annum towards the costs of administration of the Scheme.

Balance sheet - not good.

NAV: £88.0m, but it's dominated by £111.2m of goodwill & other intangibles, which I always write off, to get to;

NTAV: is negative, at -£23.2m . Normally I try to avoid investing in anything with negative NTAV. The only exceptions are if a company is so highly & reliably cash generative, that the balance sheet doesn't matter.

Cash is £22.0m, but there's £60.4m loans in long term creditors. That seems too much debt to me.

My opinion - there are lots of things present with this company that are on my list of things to avoid where possible:

- Huge pension scheme

- Too much bank debt (in my opinion)

- Cyclical activities that are cut back in a recession

- Weak balance sheet

- Large adjustments to the accounts

It's not even particularly cheap, despite all the above.

Therefore I see no attractions at all to this share, so a firm thumbs down from me.

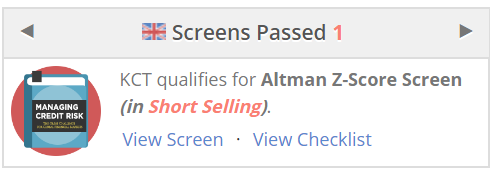

It's interesting that the only Stockopedia screen that it qualifies for is this one;

This could be a good time to focus on the Altman Z-Score - a system which identifies financially weak companies which are best avoided, or for shorting, especially when the economic outlook is uncertain or negative.

Ten Entertainment (LON:TEG)

Share price: 239p

No. shares: 65.0m

Market cap: £155.4m

Ten Entertainment Group plc, a leading UK operator of family entertainment centres, today announces its half year results for the 26 weeks to 30 June 2019.

A reader has asked me to look at recent results which were missed previously here.

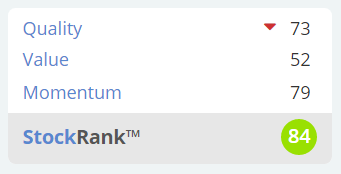

It's got a high stock rank, lowish PER, and a nice dividend yield, so I'm happy to look into it further.

A bit of history - this company was floated in Apr 2017. Previously, it was a listed company called Essenden. Christopher Mills (an outstanding investor/deals man) bought up a stake in Essenden, then somehow managed to persuade management & instis to accept a low ball takeover bid from him. I remember that because I was livid at having my Essenden shares whipped away from me at a significant under-valuation.

He then restructured the company, and floated it again at about 3x the price he paid for it! For that reason, I wouldn't buy shares in TEG, as the same thing could happen again - i.e. private investors taking the risk, but once it becomes undervalued, then the upside is taken away in an opportunistic takeover bid.

The trouble is, institutions often agree to small cap takeovers, because it opens the liquidity window for them to exit from a stale position, even if it is under-valued.

A similar situation arose with FDM (Holdings) (LON:FDM) - whose shares I also have a personal embargo against, for the same reason - we wuz robbed in a lowball takeover bid, then shrewd or unscrupulous (depending on your viewpoint) management subsequently re-floated it and made a fortune.

Anyway, enough of my embittered views about this company's history, the present is looking very good;

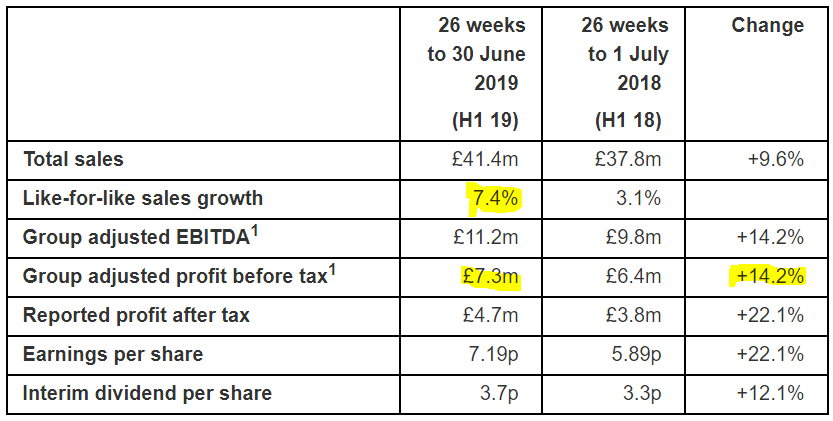

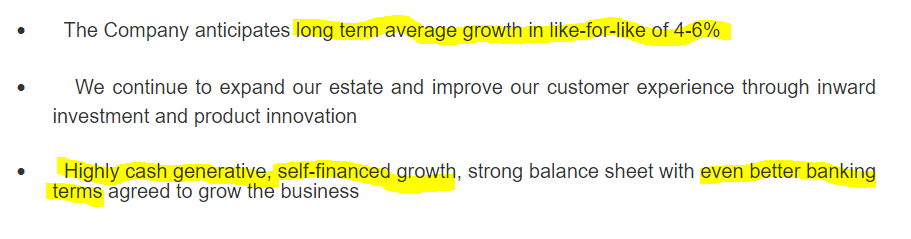

Sales growth - excellent LFL sales growth, of 7.4% - possibly partly weather-related (the notes say 2% was helped by weather). But also I think people want to spend more on leisure activities, and less on buying actual stuff that we don't need. Hence I think leisure operators are an interesting sector to look at - but not if you think we're going into a recession, as that can cause people to cut back on discretionary spending.

Adj profit before tax - a good increase, at +14.2% for H1.

Also, note that £7.3m adj profit, divided by £41.4m revenues, is a very good 17.6% profit margin.

Outlook comments sound good, although note that the growth is an aspiration, not necessarily a fact yet;

Escape room - I like the comments about TEG getting involved in this latest craze. What a good idea, given that it has lots of large existing sites, probably with some capacity to add another revenue stream from creating some escape rooms.

Balance sheet - bank debt is quite low, and appears in current liabilities, which makes the current ratio appear weak at 0.42 . The commentary indicates that new facilities have been agreed, at lower cost, so that should look better on the next balance sheet.

IFRS 16 has yet to play havoc with the figures, but I am hearing that institutions & banks are ignoring the revised figures, and sticking with the old ones. That's exactly what I'm doing - as I view IFRS 16 as a ludicrous accounting standard that has made figures much harder to understand. It should be abolished, and replaced with more meaningful disclosures in the notes to the accounts, which should highlight where leases are problematic (e.g. when trading at a loss from a site, or where there are potential problems (e.g. large anticipated rental increases, on rent review, or RPI increases, etc). That is what investors need to know, not unintelligible & often irrelevant, huge figures on the face of the balance sheet.

Cashflow statement - looks good. I particularly like that the company has split out maintenance capex, and expansion capex. Everyone should do this.

My opinion - I think this looks a very good share. Growth at reasonable price. It looks well managed. For anyone not bitter about having their Essenden shares pinched off them (like me), then this could be a nice share to research in more detail.

Therefore, it gets a thumbs up from me, as being worth a closer look - providing you are comfortable with the macro-economic risks.

All done for today! Thanks for reading & for your comments.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.