Good morning, it's Paul here.

It's very quiet for news today, so I'm going to run some errands now, then come back later to report on what looks like a profit warning from Low & Bonar (LON:LWB) and an update from Avation (LON:AVAP) . IQE (LON:IQE) looks interesting too, although it's probably too large for me to be covering it here (although have done in the past). I think expectations for IQE were already baked in for out-performance against existing forecasts, hence the muted response to a good update today.

Quiet days are handy, as it gives me a good chance to catch up with some reading of broker notes, etc. Plus of course battling the ongoing daily burden of vast quantities of incoming & backlogged emails!

Low & Bonar (LON:LWB)

Share price: 54.0p (down 20.3% today)

No. shares: 329.7m

Market cap: £178.0m

Directorate change (and a profit warning) - this is really out of order, to bury a profit warning in an announcement about a Directorate change. There clearly should have been 2 separate RNSs, one to inform that the CEO has resigned, and another RNS to give a trading update. This is a "performance materials" group.

The CEO has stepped down from the Board immediately, so clearly something must have gone wrong. However, as the CEO is remaining with the company as an employee until 30 Apr 2018, that suggests there's nothing scandalous (e.g. gross misconduct) about his departure.

A NED called Trudy Schoolenberg is taking over as interim CEO.

Trading update - I like that specific figures are given;

Whilst market conditions for the Group as a whole have remained stable since the trading update on 16 October 2017, full year outturn will reflect a weaker than expected final quarter in the Coated Technical Textile business unit as a result of an adverse product mix and sales timing.

As a result, the Board expects to report full year adjusted profit before tax (before amortisation and non-recurring items) for the year ended 30 November 2017 of between 30m and 31m and net debt, as at 30 November 2017, of approximately 138m.

Low & Bonar will announce its final results on 31 January 2018.

So now I have to work out how this compares with market forecasts, in order to determine the seriousness of the profit shortfall. All I've got to go on at the moment, is Stockopedia's broker consensus figure of £22.4m net profit (i.e. after tax), and 6.65p normalised EPS.

If we take the £30-31m adjusted PBT figure from the RNS, take off say 20% tax, that gives us adjusted net profit of about £24m, which is actually above the broker consensus net profit figure of £22.4m. So I'm a little confused! The trouble is, without seeing the detail of the broker forecasts, I may not be comparing apples with apples.

I've put in a request for updated broker forecasts, and will have to park this until those figures hit my inbox. So I'll come back to this once I get the detailed figures through.

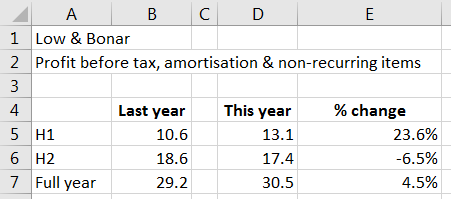

On second thoughts, I can work out some numbers using the most recent interim results. Here's a simple table I've constructed, to figure out H2 performance this year versus last year;

All I've done here is to look up the last interim figures, and plug the adjusted profits figures for this year & last year into cells B5 and D5. Then I plugged the full year actual into B7, and put today's estimate of £30-31m profit into cell D7. Then the spreadsheet works out the H2 figures. Simple, but effective!

This has now quantified the slowdown (in column E), showing that the 23.6% uplift in profit in H1 seems to have reversed into a -6.5% drop in profit in H2. Not great, but not a disaster either. The full year is still up 4.5% on last year.

Balance sheet & net debt - the debt has always concerned me about this company. It's a capital-intensive business model, as you would expect for a manufacturing company. So the last balance sheet as at 31 May 2017 had £156.1 in property, plant & equipment, which is effectively funded with £176.5m in long-term debt. Debt is high at the interim period end, and has reduced to net debt of £138m at end Nov 2017. That's still rather a lot, for a company making about £30m pre-exceptional profits.

Dividends - are attractive, and growing. After today's fall in share price, the yield would be well over 5%, if divis are maintained at the expected level. I imagine divis are probably fairly safe, as they're still well covered by earnings.

My opinion - this share has fallen quite a lot lately, and could be entering value territory perhaps, if the debt position doesn't scare you off.

I'm not really sure that the market is terribly interested in this type of company at the moment, especially after a profit warning.

The 10 year chart below seems to show a pattern of recoveries, punctuated with sell-offs, when earnings disappoint. That said, buying the dips at 40-50p would have been a moderately successful trading strategy. The company has paid decent divis too, so the total shareholder return is better than the share price chart suggests.

With the CEO departing unexpectedly today, I'm minded to steer clear of this share, just in case more problems emerge when a new CEO is in place permanently. New CEOs often kitchen-sink the next set of numbers.

Avation (LON:AVAP)

Share price: 225p (up 2.3% today)

No. shares: 61.4m

Market cap: £138.2m

Trading update - covering the period from 1 Jul 2017 to today. This is an aircraft leasing company, headquartered in Singapore (for tax reasons), with Australian management, and has a (full) UK stock market listing. I imagine that most of us have met its affable FD, who has certainly put in plenty of time & effort to meet private investors at numerous events.

Various facts & figures are provided, which I won't repeat here. However, I can't find any reference to how the company is performing in terms of profits against market expectations - which is the key bit of information that the market wants to hear.

Forecasts - a broker note has come through, which helps me make sense of things. It says no change to forecasts today. EPS is forecast at 23.7c for 06/2018 (a PER of 12.4), and 32.4c for 06/2019 (a PER of 9.1) (US currency). The growth is obviously being driven by increasing the size of the aircraft fleet.

Discount to NAV -

"The Board observes that Avation's ordinary shares are presently trading at a discount to the net asset value. The Company will endeavour to narrow this discount by utilising capital management techniques when conditions permit. We would like to thank our shareholders for their continuing support."

I presume that means share buybacks?

Investors have to decide whether the discount to NAV is a pricing anomaly, or whether perhaps the assets are in the books at too high a level?

My opinion - I'm not really up-to-speed on this company, so don't really have a view either way. I looked into it in some detail a couple of years ago, and thought it looked quite good. Management seem to have addressed the main risks inherent in a leasing business.

Let me point you in the direction of a comment posted by Carcosa below - comment no. 16. He sets out some interesting detail about Avation. The discount to NAV looks attractive, as he points out. Many thanks for posting this Carcosa.

I'll leave it there for today, as it's very quiet for newsflow today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.