Morning everyone, Ben here. Just stepping in to get today's SCVR rolling... bring on the comments and anything else that's on your mind this morning. Roland has joined in further down the report to help out, too.

(The last time I tried this, it did eventually crossover with Paul so forgive me if it's a bit of a bumpy ride).

I’m a bit late to the party with this news (what with holidays etc, *eyeroll*) but I do like the occasional updates from advisers like UHY Hacker Young, picking apart some of the trends on the Alternative Investment Market. Cutting to the chase, it looks like the very long and gradual trend towards better quality companies on AIM is continuing.

Perhaps a little unfairly, most of UHY’s comparisons look back to what was going on 10 years ago. Back then, of course, the financial crisis had sent AIM into a spin and things were only just starting to recover. But the figures are still quite interesting. A decade ago there were 275 delistings from AIM, as the market haemorrhaged firms that couldn’t justify the fees or raise new money. By comparison, in the last year, there were 66 delistings, which… I don’t know… still feels quite high.

Another interesting figure is that the average market cap of an AIM stock has risen nearly four-fold over the past 10 years to £98.9m in 2018, up from £24.3m in 2008. Those averages will be skewed by some of the very large groups that have emerged on the index over that time - Boohoo, Fevertree, Abcam, Hutchison China. But of course, big doesn’t necessarily mean safe. Until recently, Burford Capital was up there as one of the largest-cap stocks on AIM - before the recent ‘bear attack’, which slashed its share price.

As someone who used to interview the management teams of oil and gas companies back in the early/mid-2000s, I can vouch for how different things were pre-financial crisis. That makes me sound very old, but it is quite striking how the balance has changed. Back then, the oil price - and mining/ commodity prices generally - had quite an influence on the trajectory of the index. Obviously those sectors are still important, but far less so now.

So while the quality seems to be improving - size is up, delistings are down, trading volumes are up - the nature of the market and general small-cap risks haven’t gone away, they’ve just changed.

Costain (LON:COST)

Share price: 163p (up 12.3% today, at 11.30am)

Market cap: £156.9m

On the subject of risk, there are interim results today from Costain. Now, I can stand on the shoulders of a giant with this, because Paul gave Costain the hairdryer treatment in June, when he reported on a profit warning from the group. He - it’s fair to say - probably wouldn’t touch it.

So far Costain’s profit warning has played out at the more extreme end of what we found was the average trend in our Profit Warning Survival Guide. The shares slumped around 43% on the day, bounced slightly shortly afterwards and then fell away. That’s a classic example of what we saw in our research. The bad news if you were a holder or potential buyer - if the trend plays out - is that the price probably won’t do much for the next 12 months.

But the price is up 12% today, and based on Stockopedia’s algorithms, this is a Contrarian play. So what’s going on? Well, the interim results put some more colour on the profit warning... perhaps the bad news is out and it's not as bad as many thought.

Costain calls itself an “infrastructure solutions” company, which means it’s involved in a range of engineering contracting work. In recent times, this has basically become an investment byword for 'wafer thin margins'. Talk of order books can be impressive - although contract delays are what led to the profit warning in the first place - but the fact is that Costain and groups like it have to do a lot of work to make a profit and things do go wrong.

In today’s update there’s an emphasis on this.

Improved H1 margins: underlying operating profit of £21.2 million (H1 2018: £23.2 million*) with an overall divisional operating margin of 4.0% (H1 2018: 3.5%*).

New 'Leading Edge' strategy in place: accelerating the Group's deployment of higher margin services through leveraging our strong client relationships and reputation for complex programme delivery.

Hmm. There are signs of small margin improvements but is the management-speak off-putting? This sounds like the company knows what it needs to do - and it’s saying it - but it’s perhaps too early to draw conclude that things might genuinely be on the up.

A forecast yield of 8% suggests this is a stock that's having a hard time convincing the market that the payout is intact and its valuation is safe. The forward PE stands at just 5x.

Costain is arguably in one of the most hated sectors in the stock market; it’s a graveyard of low margin firms that fell by the wayside. Most investors are not going to like what they see, but contrarians out there might look twice.

Good afternoon folks, it's Roland here. I'm stepping in to help out with today's SCVR.

Hostelworld Group (LON:HSW)

Share price: 153p (-5.4%)

No of shares: 95.6m

Market cap: £147m

This hostel booking website has issued a profit warning today, along with its half-year results.

This is a company I've previously followed and owned shares in until recently. However, as Paul has pointed out previously, the business seems to have gone ex-growth. As is often the case, the IPO seems to have been well-timed for the sellers:

The investment case is now increasingly dependent on management's ability to return the business to growth. Management warned earlier this year that demand for the peak summer season was lower than expected.

Today’s profit warning confirms that the company doesn’t expect to claw back this weaker performance during the current year. Management now expect 2019 EBITDA to be below the level reported in 2018.

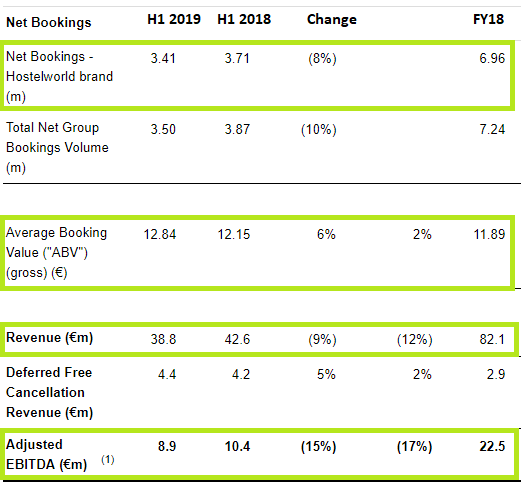

Let’s take a look at the figures to see how serious things might be:

I thought these figures were disappointing when I saw the RNS this morning. An 8% fall in bookings for the core Hostelworld brand suggests a possible loss of market share to me. Although average book value rose, this didn’t offset the fall. I see this as a business that it relies on high volumes at relatively low prices. So volume is key here.

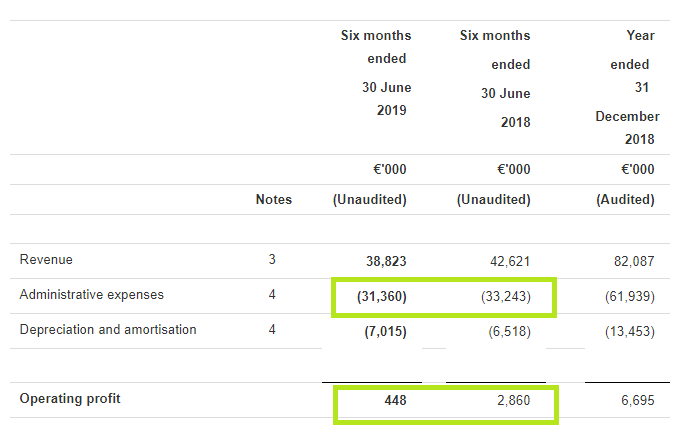

Things get even worse at a statutory level. Although Hostelworld has cut costs, the fall in revenue caused operating profit to fall by 84% compared to the same period last year:

My view: Hostelworld shares have bounced somewhat today, suggesting that the market doesn’t expect a huge downgrade to earnings forecasts. This probably reflects the modest valuation. After today’s fall, I estimate that the shares are trading on a forecast P/E of 10 with a dividend yield of about 7%. The balance sheet looks fine, too, with £25m of cash and no debt.

I can see potential value here.

However, in my experience, it can be hard to reverse declining sales and market share for online businesses of this kind. Today’s management commentary doesn’t suggest to me that the company has any ground-breaking ideas lined up -- merely an improved payment platform and increased sales of add-on products, on which Hostelworld can earn commission with minimal expense.

I don’t have any insight into the outlook for this business, but it’s clear that competition is tough. I will be staying on the sidelines for now.

Brady (LON:BRY)

Share price: 34p (-39%)

No of shares: 83m

Market cap: £28m

This tech firm makes software for energy and commodity traders. It has issued a nasty profit warning today.

This isn’t a company I’ve followed in any detail, but looking back over the SCVR archives I can see that Graham took a cautious view back in May, when the chairman reported “substantial progress”at the firm’s AGM.

Today’s update suggests that this earlier progress may have slowed. Brady says that while recurring revenue from existing clients remains in line with expectations, “the pipeline of revenue from new customers forecasted will not materialise during fiscal 2019”.

This sounds to me as though a number of expected new contracts may have been delayed or perhaps lost altogether.

No extra detail has been provided. But checking back to the group’s 2018 results, I can see that Brady reported revenue of £23.2m, adjusted EBITDA of £2.6m and a net loss of £1.8m. Net cash at the end of 2018 was £4.6m.

Today’s update suggests to me that consensus forecasts for adjusted earnings of 1.5p per share this year could turn negative. However, I note that on Research Tree, an updated broker note suggests new business has been deferred, not lost. The broker in question is maintaining a positive outlook for 2020.

My view: Although Brady’s revenue has been stable at c.£24m for a number of years, the business has remained loss making. The combination of flat revenue and a lack of profitability looks discouraging to me.

However, changes are afoot in the boardroom. A new chief executive, Carmen Carey, took charge in February 2019. And on 12 August, an existing non-executive director, Iain Greig, was appointed as interim chief technology officer.

This isn’t a stock I’d invest in. But for investors with insight into this sector, I guess Brady could be worth further in-depth research.

Just a couple of quick comments to finish off with today.

Gulf Marine Services (LON:GMS)

Share price: 8.3p (-8%)

No of shares: 350m

Market cap: £29m

Today’s profit warning from this debt-laden firm is a useful reminder of why it’s rarely a good idea for equity investors to get involved in companies with debt problems.

This UAE-based firm owns a fleet of jack-up platforms used mainly by oil and gas firms. The fleet itself is said to be modern and is also used by renewable energy operators for work offshore. But GMS went into the oil market downturn in 2015 with far too much debt, at the tail end of a major capex programme to upgrade its fleet.

Trading has not recovered as quickly as hoped and net debt has remained stubbornly high, at about $400m. That’s roughly 10 times the current market cap -- I believe this should be seen as a major warning sign for equity investors.

Today’s update tells us that the firm’s new CFO has conducted a detailed review of the group’s existing contracts. He now believes that 2019 EBITDA is likely to be lower than in 2018. Previous guidance was for a flat performance.

The long-serving CEO Duncan Anderson has resigned with immediate effect.

Gulf Marine does not expect to meet its covenants with respect to the 30 June 2019 half-year results. Discussions are underway with lenders, but the firm has not yet secured a waiver or amendment to these covenants.

My view: I suspect the equity here will end up being worthless. I’d stay well away.

Hansteen Holdings (LON:HSTN)

Share price: 88.9p

No of shares:

Market cap: £380m

Disclosure: Roland has a long position in HSTN

Property stocks don’t get much coverage in the SCVR, but this industrial property REIT is a stock I own and regard quite highly.

Hansteen is run by co-chief executives Morgan Jones and Ian Watson, who previously had another property venture, Ashtenne.

They have a successful track record in this sector and sold £1.5bn of Hansteen’s European property in 2017 and 2018, when they judged market conditions were more favourable to sellers than to buyers. More than £720m was returned to shareholders.

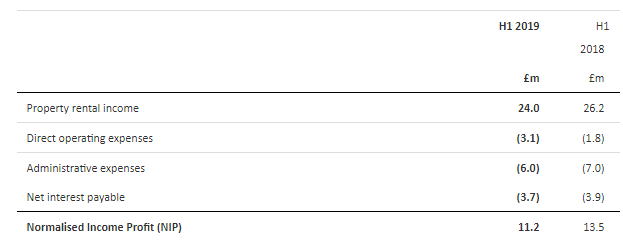

Hansteen’s remaining portfolio is built around a portfolio of UK “urban multi-let industrial property”, currently valued at £605m. Like-for-like rental rates rose modestly during the first half of the year, although overall rental income fell slightly due to the shrinkage of the portfolio over the last year:

Demand for warehouse property appears to remain strong, which the firm said is led by internet retail growth:

My view: Hansteen shares are trading at a discount of about 13% to NAV of 104p after today’s results, and offer a yield of about 5.7%. I remain happy to hold at this level and might consider a small top up.

That’s all I’ve got time for today. Thanks for stopping by.

Roland

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.