, MTCHi, it's Paul here.

To get you started, here is the link to yesterday's completed report, where I looked at results from Cloudcall (LON:CALL) and Blancco Technology (LON:BLTG) , plus a positive update from Pennant International (LON:PEN) .

I'm not sure about timings for Wednesday's report, as I have to hire a car first thing in the morning, and take our dogs to the other side of London to the doggie hospital, to have a few things fixed. As they'll be under general anaesthetic, I could have to hang around all day. So will take my laptop with me, and I'll try to get something posted once I find a quiet corner with a plug socket and wifi.

EDIT: Good news! The dogs survived their operations, and are recuperating well :-)

Moss Bros (LON:MOSB)

Share price: 45p (down 23.2% today)

No. shares: 100.8m

Market cap: £45.4m

Trading update (profit warning)

Moss Bros Group PLC ("the Group"), the 'first choice for men's tailoring' today issues the following Trading Update for the 52-week period from 28 January 2018 to 26 January 2019.

The first thing to note is that the current financial year has barely started, so it seems an odd time to be putting out a trading update. Particularly as full year results are due out in a week's time. So trading must have deteriorated, necessitating a profit warning.

This is clearly bad news;

Following a review of projections for the year ending 26 January 2019, the Board now anticipates that the Group will deliver profit at a level materially lower than current market expectations.

There are no changes to results for year ended 31 Jan 2018, which will be announced next week, on 27 Mar 2018.

What's gone wrong then? As you would expect, consumer confidence is mentioned for 2 of the 3 reasons given;

· Hire sales continue to be challenging, although the peak trading period for Hire is still to come. As such the Group has remained prudent in its outlook.

· The reduction in store footfall that was experienced towards the latter part of December, has continued, reflecting a more cautious consumer environment.

However, there has also been some self-inflicted pain;

· Following the consolidation of the Group's supplier base in response to Sterling weakness, there have been material short-term issues with the resulting availability of stock. This stock shortfall across all categories has had a negative effect on sales in all retail channels and will continue to do so until late Spring.

Hmmm. You just can't afford to get the basics wrong in retailing. Buying the correct amount of stock, and getting it into the right place, at the right time, really is just basic stuff. So I'm deeply unimpressed with this - it tells me that there are management shortcomings at this company.

Dividends - are being cut. This is sensible, as the existing divis were not properly covered by earnings. So people chasing the high yield were arguably not thinking straight. High yields are often not sustainable. So sometimes it's better to go for medium, but growing, and sustainable divis.

As a consequence of this revised view on FY18/19 results, the Board has reviewed its approach to dividend. The Group has a strong balance sheet but, given the more challenging trading environment, the Board is taking a prudent approach to capital management and has decided to modify the existing dividend policy to ensure that we are able to fully cover our future dividends with profits in FY20/21 and onwards.

The Board will therefore be recommending a final dividend of 1.97p, meaning a total FY dividend of 4p per share for FY17/18 (5.89p FY16/17).

That's not a huge cut in divi, and would leave the yield at 8.9% - a level which is the market telling us that it doesn't think the reduced divi is sustainable. If it is sustainable at that level, then the share might be worth buying for income. Although that looks a risky strategy to me - buying a high yielding share, in a company that is struggling with current trading, often works out badly.

Balance sheet - is it really strong? Regulars here know that whenever I read narrative from a company boasting of a strong balance sheet, I have to check it! Very often the reverse is true.

In this case, I'm pleased to report that MOSB does indeed have a strong balance sheet. Here are the key figures from the latest (interim) balance sheet;

NAV: £35.6m

NTAV: £33.8m

Current assets: £41.1m (including £21.5m cash)

Current liabilities: £23.3m

Net current assets: £17.8m

Current ratio: 1.76 - retailers can manage on a lower current ratio than most other companies, because they sell direct for cash, so don't have much in receivables. So anything about 1.0 is usually fine. In this case, the working capital position looks very healthy. This company won't be going bust any time soon, even if trading deteriorates further. Maybe the divis are sustainable then, if trading stabilises?

Outlook comments seem a bit unrealistically upbeat to me. So maybe management are trying to put a positive gloss on a deteriorating situation?

That said, a key thing I look for in profit warnings, is short-term, fixable issues. The stock availability problem here ticks that box, as it looks to be sorted fairly soon;

"The beginning of the year has been hampered by short term stock delivery issues caused by the consolidation of our supplier base. The resulting stock shortage has undoubtedly driven a significant shortfall in sales, which will continue until late Spring.

Although this has been a painful experience, I am confident that the availability issues are well on track to being resolved and the margin benefits from the consolidation will flow through.

This year's poor H1 could therefore turn into next year's soft comparatives, and stronger results, perhaps?

Broker updates - I can't find anything, unfortunately. In this MiFID II world, we are now heavily restricted in what research is available to ordinary investors. Therefore, it is imperative that companies provide guidance in RNSs, as to what the expected range of profits for the current year will be. More & more companies are doing this, thankfully. However, in this case, MOSB has not given any guidance, thus leaving investors in the dark. Inevitably then, the damage to the share price is likely to be greater than if they had properly managed investor expectations by providing profit guidance in today's update.

I think it will be a long process to educate companies, brokers & PR people, that individual investors need proper information, now we often can't get hold of broker research any more. If this is not done, then liquidity will just dry up. How can investors buy this, or any other share, where we don't have profit guidance?

Woolly, wordy updates, whilst briefing research analysts on the side, is not good enough. Proper guidance needs to be provided to the whole market, at the same time, direct from companies. Just look at other retailers, in particular Next (LON:NXT) which absolutely excels in this regard - giving a specific, and gradually narrowing range of profit expectations for each year, as the year progresses. Everyone needs to get into this mindset, and there's really no excuse for not doing so.

My opinion - without updated profit guidance, it's impossible for me to accurately form a view on this share.

Having said that, I've been saying for literally years that this share was over-priced. It's now coming down to a more sensible valuation, where I would consider a purchase, if more information was available.

Bull points;

- Strong balance sheet

- Very high dividend yield - could possibly be sustainable, but I wouldn't bank on that

- Little direct competition on the High Street, and has a strong position in the wedding hire market

- Valuation has now come back down to earth - is bad news now in the price? Recovery possible

- Promising higher gross margin once supply chain issues fixed - which look like a temporary, fixable problem

- Recent very extreme weather is a bit of a one-off, so should not really affect the long-term value of the company

Bear points

- Will this be the last profit warning?

- Lowish profit margin

- All the usual rising cost pressures facing retailers - higher wages, business rates, imported goods cost (although pound now stable against US dollar)

- Subdued consumer confidence likely for 2018 (and possibly beyond, who knows?)

- Internet competition

- General problem for physical retailers of upward-only rent reviews on leasehold sites - so fixed/rising costs, versus potentially falling sales

That's not exhaustive, it's just what I could think of.

Overall, I think this is starting to look potentially interesting. I don't see any particular need to rush in and buy now, but will be adding it to my watch list.

What I find interesting, is that the squeeze on real incomes is coming to an end. The latest stats show that inflation has fallen from 3.0% to 2.7%. Whilst average wages are rising by 2.5%. Inflation should continue falling, because the impact of the devaluation of sterling is now dropping out of the figures. Also, consumers are resisting price rises, leading to a lot of discounting.

Therefore, looking ahead, I think there are potentially some excellent bargains, if you're very, very selective, in the retailing space. The market is incredibly negative on retailers right now - rightly so, as companies like Debenhams (LON:DEB) , Mothercare (LON:MTC) , and Carpetright (LON:CPR) look to be in real trouble - needing to raise more cash, and stuck with problem leases.

However, other companies with cash-laden balance sheets can ride out the current downturn, and may then end up with greater market share when consumers do start to relax the purse strings a bit, when real incomes begin rising again - probably later this year, based on the trajectory of inflation (coming down), and wages (rising).

Could investors be throwing the baby out with the bathwater? In one or two carefully selected cases, quite possibly. The key is having cash in the bank. Anything that needs to raise fresh equity, in the current very depressed environment for retail shares, is probably best avoided in my view. Why take the risk? Conviviality (LON:CVR) (in which I hold a long position) has recently given me a painful & expensive refresher course about this issue.

Airea (LON:AIEA)

Share price: 44.5p (up 27.1% today)

No. shares: 41.35m

Market cap: £18.4m

(at the time of writing, I hold a long position in this share)

This is a small company, based in Yorkshire, which makes niche floor-coverings. I've just noticed that its address is "Victoria Mills", so wonder if it historically had anything to do with Victoria Carpets?

I bought a small long position in this company over a year ago, and it's been lying dormant in my portfolio ever since. My reason for purchase, was that it came up on a value share screen that I run from time to time - looking for low PER, decent yielding, sound balance sheet companies. The thorn in the side with Airea was that it had a pension deficit. Even so, it looked cheap to me.

The share has sprung into life today, with a couple of announcements, this one from yesterday afternoon;

Proposed closure of Ryalux - this is a high quality carpet business, owned by the group, which has been loss-making. So they are closing it down;

...The closure which is anticipated to be completed by 30 April 2018 is likely to be cash generative and proceeds will be distributed to shareholders.

Obviously this is bad news for employees, although the company says that some may be able to find alternative employment in other parts of the group. For shareholders though, who fund the losses, the closure of a problem division clearly provides upside - not just with a cash distribution, but also that group profits should rise significantly.

Final results - for the 18 month period ended 31 Dec 2017 came out this morning, and have really put a rocket under the share price. I really dislike non-comparable results periods, as you don't really know how the business is performing, particularly if it has a lot of seasonality. So an 18-month period could contain 2 buoyant halves, and 1 quiet half year, thus presenting an overly favourable impression. It's helpful when companies produce pro forma 12-monthly comparisons, but that hasn't been done in this case. Never mind, I'll have to work with what we've got, and with the share price up 27% today, giving my portfolio a much-needed boost (as all my retail shares are being hammered), I won't complain too loudly!

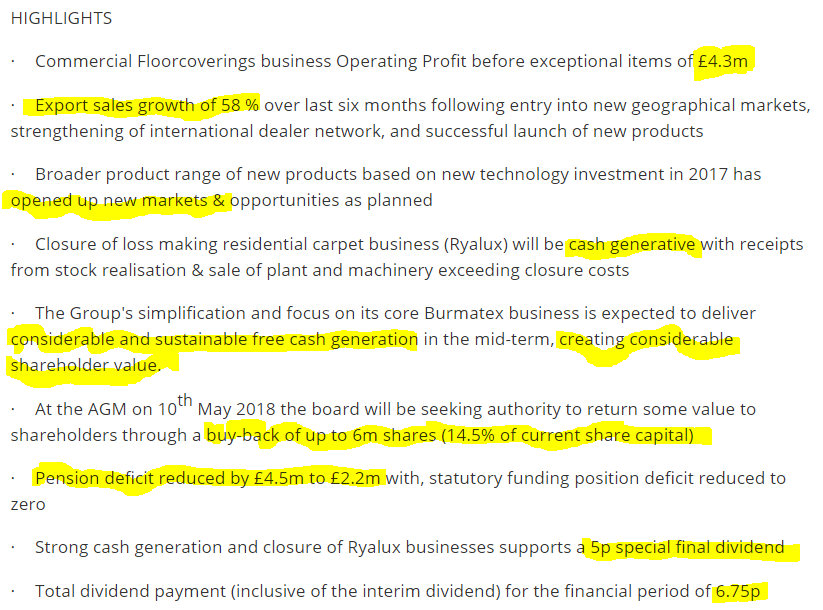

The highlights list is pretty spectacular;

That all looks self-explanatory to me. I think it warrants a complete re-assessment of what this company is worth.

The losses at Ryalux have obscured a highly profitable core business, as explained in this section of the narrative;

In the 18 months to 31 December 2017 Ryalux Carpets Limited generated an operating loss before exceptional items of £3.1m on revenue of £9.9 million. The Company has incurred exceptional costs of £1.7m, inclusive of £1.1m of asset impairment and provisions, associated largely with a reduction in working capital and impairment of assets. Overall, the closure is likely to be cash generative, with receipts from the realisation of assets being greater than closure costs.

Going forward the increase in free cash generation arising from the proposed elimination of losses previously incurred by Ryalux will enable increased investment in the highly profitable commercial flooring business operated under the Burmatex brand ("Burmatex"). In the eighteen months to 31 December 2017 the commercial floorcoverings division generated an operating profit before exceptional items of £4.3m on sales of £26.9m.

Clearly then, the core business of Burmatex is excellent - that's a 16.0% operating profit margin.

It sounds as if Burmatex has good growth potential too;

The investment in new technology made earlier in the period is now coming to fruition with the launch of a series of new products, which will open up new higher value markets.

This adds to the successful launch of a competitively priced entry product, which has already established a significant market share in its own right as well as opening up new opportunities for the rest of the product range.

Burmatex now has a range of products to profitably compete across the broad spectrum of price points. We are already seeing the benefit in sales growth both in the UK and internationally.

(I'm taking some time now to read the full 2017 Annual Report, which is on the company's website. I've just spotted the remarkable news from CarpetRight, so will do a section on that now)

Later: I'm too tired to read the Annual Report, so have printed it out to read at some point in the future. Just a final quick point, re the;

Pension deficit - this was a big deal in the past for this company, but 2 factors have made it far less of a worry now;

- The deficit has greatly reduced, as announced today.

- The scheme doesn't need more company contributions, but the company has decided to continue paying in, to help reduce the riskiness of its assets (I assume that might mean rotating out of equities into high quality bonds). So an end is in sight for the deficit, the way I look at things. That means it is less of a detriment to the valuation of the shares.

- Earnings looks set to significantly increase once the carpet business has been shut down. Therefore the pension scheme will be diluted by much higher earnings. So again, less of a valuation worry.

My opinion - I've seen enough from today's update to be enthused by the outlook for this share.

Sadly it's very illiquid, so difficult to buy or sell. However, I've seen enough from today's announcement to want to sit tight, very firmly, on my existing shares.

I'll do more research to try to ascertain what they might be worth in future. As is so often the case though, there's a lack of broker research. I hope the company might get some decent research put out by the house broker, or better still by a decent quality commissioned research company.

Carpetright (LON:CPR)

Share price: 41.0p (up 1% today, at market close)

No. shares: 67.9m

Market cap: £27.8m

Shareholder loan & strategy update

The unravelling of share prices in weaker retailers is fast becoming the biggest story of 2018. Just look at the chart for CarpetRight to see how quickly this one fell apart;

Today the company announces;

Shareholder loan - of £12.5m, from Meditor European Master Fund. The latest RNS indicates that Meditor owns 12.29% of the equity, worth only £3.4m at present. So this is a substantial loan compared with its equity holding.

It's just a short-term bridging loan, is unsecured, with a repayment date of 31 Aug 2018, and modest interest of 3% p.a.. The huge 15% arrangement fee, of £1.875m, is mainly being used to subscribe for new shares, which doesn't seem so bad in the circumstances. Also note that they haven't demanded a discount on the new shares - it's at the current share price. This suggests to me that Meditor seems to want to protect & rebuild the share price, perhaps? (as opposed to diluting everyone else to oblivion - although that might come later, who knows?)

[Arrangement fee of] ... £1.875 million (of which c.£1.379 million is to be applied by Meditor in subscribing for 3,396,200 new ordinary shares of 1p each in the capital of the Company at 40.6 pence per share (being the closing price per share on 20 March 2018) (the "Subscription Shares"))

Given that beggars can't be choosers, this arrangement looks pretty reasonable to me - the company probably had few to no alternative offers. Every company would wish to have shareholders prepared to step up and bail them out, if things go pear-shaped. It's a pity that large shareholders in Conviviality (LON:CVR) (in which I, unfortunately hold a long position) didn't display similar support when needed, before those shares got suspended, and existing shareholders look likely to be almost wiped out in that case.

Possible CVA - this is massive news. CVAs are really the only way for struggling retailers to ditch their onerous property leases, so this looks a very sensible move to me, if it can be pulled off. The trouble is, if landlords refuse to back the CVA, then the company is almost certainly bust.

On 1 March 2018, the Company announced that it was examining a range of options to accelerate the turnaround of the business and strengthen its balance sheet. Further to that announcement, the Company announces that it is currently exploring the feasibility of a company voluntary arrangement (the "CVA"), the objective of which would be to address the legacy property issue inherited from the previous leadership by rationalising the Company's property portfolio in order to improve the long-term prospects of the business. The Board believes that a CVA would not adversely affect the Company's ability to serve its customers.

Following the CVA, the Company intends to raise between £40 million and £60 million through an equity issue. If launched, the Company expects that the proceeds of the equity issue would be used to fund the Group's on-going strategy, reduce indebtedness and cover the costs associated with the CVA.

As part of this process, the Company remains in discussion with its lenders and will seek to agree amendments to the terms of its banking facilities, including a relaxation of the Company's covenants and an extension of the facilities. It is anticipated that the approval of the CVA will be a condition to any extension of the facilities.

To my mind that all makes complete sense. I imagine that the landlords would probably agree a CVA, as it's better than letting the whole business fail. Once that's done, the bank maintains support to give enough time for the company to raise fresh equity. Investors are likely to be prepared to put in fresh equity, because the loss-making property leases would have been ditched in the CVA, so the cleaned up company would be a lot more profitable - hence a more attractive investment.

At the end of the process, there should be a clean company, which is much more profitable, because it's jettisoned loss-making sites - arguably giving it an unfair advantage in future.

My opinion - this totally makes sense to me. I previously wondered whether CarpetRight's buffer of freehold property might enable it to survive without such a restructuring. Clearly though, the problem leases must have been worse than realised.

The trouble is, we simply don't have the information we need to assess how situations like this work out. What is needed is to find out individual site P&Ls, together with the terms of each individual lease. If problem leases only have a year or two to run, then they're not so much of a problem. If it's say 15 years, then those leases could pull down the whole company.

Carpetright's CEO comments today reinforce this point, as this excerpt shows;

"The aggressive store opening strategy pursued by the Company's previous leadership has left Carpetright burdened with an oversized property estate consisting of too many poorly located stores on rents which are simply unsustainable.

The Company has worked hard over recent years to address this legacy issue and reduce the size of its property estate, however many of these poor performing stores still have long leases to run, which has limited our ability to exit a meaningful number in the short-to-medium term.

I think this situation raises questions for the auditors. It seems that the reality is that a far larger onerous lease provision should have been made in the accounts. We need to be wary of this issue at other struggling retailers. It's too easy for management to pull the wool over auditor's eyes, by giving them unrealistically positive forecasts for struggling sites, thus reducing onerous lease provisions far below what is actually needed.

I suspect we might see a wave of CVAs amongst household name retailers this year. It's frightening how a relatively small drop in sales, can end up crippling retailers with inflexible leases, and rising overheads. No wonder investors are panic selling many other retail shares.

The quandary now for CPR small shareholders, is that the outcome is out of your hands. If landlords reject CVA proposals, then the shares would probably be a 100% loss.

I suspect that the CVA is likely to succeed, which is good for shareholders, but you don't know at what price you'll be diluted in the subsequent equity fundraising. Raising £40-60m in a distressed situation, with a current market cap of £27.8m, means existing holders are going to be heavily diluted. However, what if there's little appetite to refinance it, and the new shareholders will only stump up fresh equity at say 10p per share? Or less? In that case, existing holders would be all but wiped out.

Overall then, I reckon Carpetright is likely to survive, and should be much more profitable after the mooted CVA. How much of the cleansed company is actually owned by existing shareholders, is the big question mark. On balance, if I had already lost 90%-ish of my money on this share, and with a credible route out of its current problems, I'd probably just stick with it, making a mental note that it could be a total loss if things don't go smoothly.

My commiserations to shareholders here. It's a real eye-opener just how quickly a situation can unravel. It won't be the last one either.

The other question mark is who the landlords are, of all these retail properties that are going to have to be re-let at substantially lower rents? The only thing that can give, in the current retail crisis, is rents - they have to come down, substantially. There are no other costs that can be reduced. So holding shares in property companies which own retail sites, is not something I would want to entertain.

Mothercare (LON:MTC)

Share price: 16.4p (up 4.5% today)

No. shares: 170.9m

Market cap: £28.0m

The banks are being co-operative. Of course they will, because they want shareholders to stump up more cash & rescue the business.

Much like the other distressed retailers, this one is now a special situation, where there's quite a high likelihood that either insolvency, or a highly dilutive rescue fundraising might be the only feasible outcomes.

The trouble is, these days people are buying things on Amazon. There's not really any reason for Mothercare to exist any more, other than as a showroom, or perhaps for affluent areas where people like to physically see the goods, in an aspirational environment, before buying. I saw a Mothercare in Abu Dhabi a while back, in a glitzy mall. These days, though, those previously highly profitable overseas areas, are becoming less profitable.

I think investors might also baulk at refinancing Mothercare again, since the ambitious turnaround plan of Mark Newton-Jones hasn't worked, and a lot of fresh funding was just wasted in exiting loss-making sites.

A CVA here looks the only feasible option. Or perhaps putting the UK business into Administration, and keeping the overseas/franchise business? A market cap down to just £28m tells us that, sadly, Mothercare is very much in the last chance saloon.

It's not that we're in a recession, it's just that the internet has changed everything. People are buying stuff online now, and Amazon seems to be taking over. Only the best physical retailers are likely to survive - the ones that offer something unique, and scarce, that you can't buy online, and retailers that offer a genuine experience, that recognise non-food shopping is now an experience, that should be enjoyed.

Again, it all boils down to fixed costs. If 20% of your business disappears online, then a once-affordable set of fixed costs (rent + rates + utilities) suddenly becomes burdensome. Watch out landlords, I think another CVA may be coming your way. One of many, probably. The rents are just far too high now.

LPA (LON:LPA)

Share price: 173p (up2.1% today)

No. shares: 12.38m

Market cap: £21.4m

(at the time of writing, I hold a long position in this share)

This was issued at 11:49 today, when the AGM started at noon. That's not right. I appreciate that they are trying to announce information at the same time, but in practice it means that people at the AGM cannot take action if good or bad news is announced, whereas people in the City behind their screens can act immediately, and have 11 minutes advance warning. People don't usually leave AGMs to urgently issue buy or sell orders to their brokers, but it does happen - I know of several people who have texted or phoned their broker to dump their entire holding during an AGM.

The solution is that an AGM statement text should always be announced at 7am, so everyone can see it before the market opens. Then the Chairman should just read it out at the meeting.

Why, oh why, are basic things like this done so badly?

The first paragraph of the announcement has done a good job of tying me in knots - is it good, is it bad, who can say!

"In my statement included in the Annual Report published in January, I reported that output during the first quarter of the current financial year was at record levels. I am pleased to report that this has been sustained during the first half of the financial year, and the order book for delivery during the remainder of the year should present us with an excellent result.

While this performance should be at an exceptional level, well above recent historical levels and not necessarily sustainable in the immediate future, it has established the Company at a new level and in a very strong position to exploit many opportunities for major future growth in the medium and longer term.

If you can make sense of that, you're a better man than me! It sounds like it was written by the script writers of Father Fed!

The next paragraph also leaves me befuddled;

"The UK rail market is enjoying unprecedented, and quite possibly unsustainable, demand for improved infrastructure and new rolling stock, much of which may be satisfied in the short term by imports and in the longer term potentially by the establishment of new assembly facilities in the UK by international companies. We are seeking to establish ourselves in the supply chains of these new, mainly European, suppliers, but this is challenging because it requires us to displace existing members of their supply chains. As an established exporter, we are used to this challenge; to which our response is to work hard at building new relationships with those new customers whom we believe will be here for the long term while sustaining our relationships with our existing export customer base.

What the hell does that mean?!!!

I think they're basically saying that things are great, but might not be that great. It depends.

My opinion - I tried to buy some shares in this a while back, but found it too illiquid. So only a scrap of my buy order was filled.

It looks potentially interesting - with a StockRank of 90, Stockopedia seems to like it.

Suggestion - perhaps the company could find someone with more mental clarity to write the RNSs in future?

All done for today. Graham's relieving me of my duties for the rest of the week, and next week. So you might get some reports on time, hopefully!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.