Good morning, it's Paul here with the SCVR for Wednesday.

Today's report is now finished.

.

Wincanton (LON:WIN)

Share price: 187p (up 9% today, at 11:42)

No. shares: 124.5m

Market cap: £232.8m

Wincanton plc ("Wincanton" or the "Group"), the largest British third-party logistics company...

This update today sounds excellent. Key points;

Underlying profit before tax for FY 03/2021 significantly ahead of current market forecasts, and not less than £30m. That's assuming no resurgence in covid. Various contract wins (Waitrose & Morrisons) & renewals are mentioned.

Improved demand across most of the business.

Liquidity/debt -

Cash collection and liquidity management remain strong and current net debt remains significantly below the prior year position, primarily due to the deferral of payments.

As I keep saying, companies must disclose how much tax they have deferred, otherwise cash/debt figures are meaningless & misleading. In this case at least the company admits that the reduction is net debt is mostly due to tax deferral, although I would have preferred to see the numbers in a table clearly separating out the short-term benefit from deferrals. Remember these deferred payments have to be paid up by end March 2021. Here is the Govt guidance on VAT deferrals.

My opinion - this seems a good company, clearly experts in logistics. I explained here why the balance sheet is such a mess. The pension fund in particular is an ongoing, and very large, cash drain. That rules it out for me, but for people who don't worry about balance sheets, then there's nothing to stop the shares going up. With a very good update today, this share looks like it's going higher in the short term. At some point I think it will need to do an equity fundraise to fix that balance sheet.

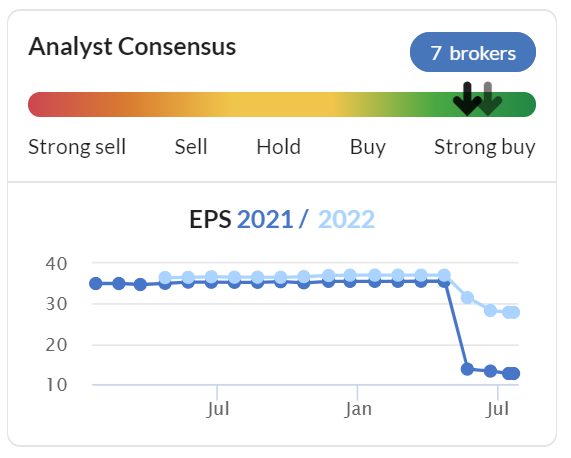

Whilst a beat against expectations is good, it seems that forecasts were reduced far too much, given that a lot of its business is defensive stuff like supermarkets. The darker blue line below is the current FY 03/2021:

.

Tristel (LON:TSTL)

Share price: 410p (down 12% at 08:26)

No. shares: 45.3m

Market cap: £185.7m

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products, provides a trading update for the year ended 30 June 2020.

A reader posted below saying that this update looks good. The market seems to disagree, with the share price down 12% at the moment. Hence I've moved it up my running order, and will see what's what.

This sounds rather good;

The Company confirms that results will be ahead of market expectations and expects to report turnover of no less than £31.6m (2019: £26.2m), a 21% increase, and adjusted pre-tax profit (before share-based payments) of at least £6.8m (2019: £5.6m), a 21% increase.

There must be a sting in the tail re outlook comments then.

Covid impact - this is a rather long-winded explanation, so here's the key bit;

Commencing in March, the Company experienced two powerful countervailing forces:

1) a decline in the use of its medical device decontamination products as hospitals worldwide postponed all but the most critical patient appointments to free up resources to deal with COVID-19 related cases, and

2) a surge in purchasing and use of its hospital surface disinfection products.

During the last four months of the year, when the impact of COVID-19 was at its greatest, global sales were £11.8m compared to £9.1m in the same period last financial year, an increase of 30%.

That sounds reasonable, but I would want to know if the gross margin is similar, or different, for the two lines of product.

Note that the surface disinfection products rose from 9% of revenues pre-covid, to 27% of revenues during covid. This looks to have proven an excellent cushion for reduced sales in the other, main product line. I'm wondering if this could be maintained long-term, alongside a recovery in the main product line, which could be a nice driver for increased profits?

FDA approval - as I would expect, there's been a delay due to covid. This is part of the high valuation of the company, i.e. hopes for FDA approval and the opening up of a large new market.

Outlook - rather long-winded again, but maybe this bit has spooked some investors?

We have some concern that the UK, which will account for approximately 35% of our global medical device decontamination sales this year, might lag behind our other markets in catching up with the patient throughput...

"We are cautiously optimistic for the Company's prospects in this financial year and beyond."

Maybe cautious optimism isn't enough to support a high rating?

Forecasts - there's an update note out today, this is how the figures look, which I've adjusted for the current share price of 410p;

FY 06/2021: fc EPS 12.3p, and divi of 6.3p = PER of 33.3, yield of 1.5%

FY 06/2022: fc EPS 12.7p, and divi of 6.5p = PER of 32.3, yield of 1.6%

That looks pricey to me. However, if you think the company could beat forecasts, and price in the future benefit of possible entry into the USA market, then I can see how this valuation could be justified.

My opinion - I've followed this company for years, and think it's a decent, growing, high margin, niche business.

My concerns relate solely to valuation, which has looked very rich for some time. I'm not attracted to this share at the current price.

If you like the company, then today's drop could be a long-term buying opportunity maybe? I personally wouldn't pay more than say 20 times current year forecasts, so about 250p is the level where I'd get interested.

EDIT: Many thanks to blueskyventurer for providing this link to Tristel's presentation slides. End of edit.

.

Cloudcall (LON:CALL)

Share price: 75p (up 5% today, at 09:39)

No. shares: 38.8m

Market cap: £29.1m

(I'm long)

Investor presentation online is today at 14:30 - signup link here. I wanted to submit a question, but cannot find the "ask a question" button. I usually watch the recorded version in the evening, as too busy during the day.

CloudCall (AIM: CALL), a leading cloud-based software business that integrates communications technology with Customer Relationship Management (CRM) platforms, announces the following trading update for the six months ended 30th June 2020

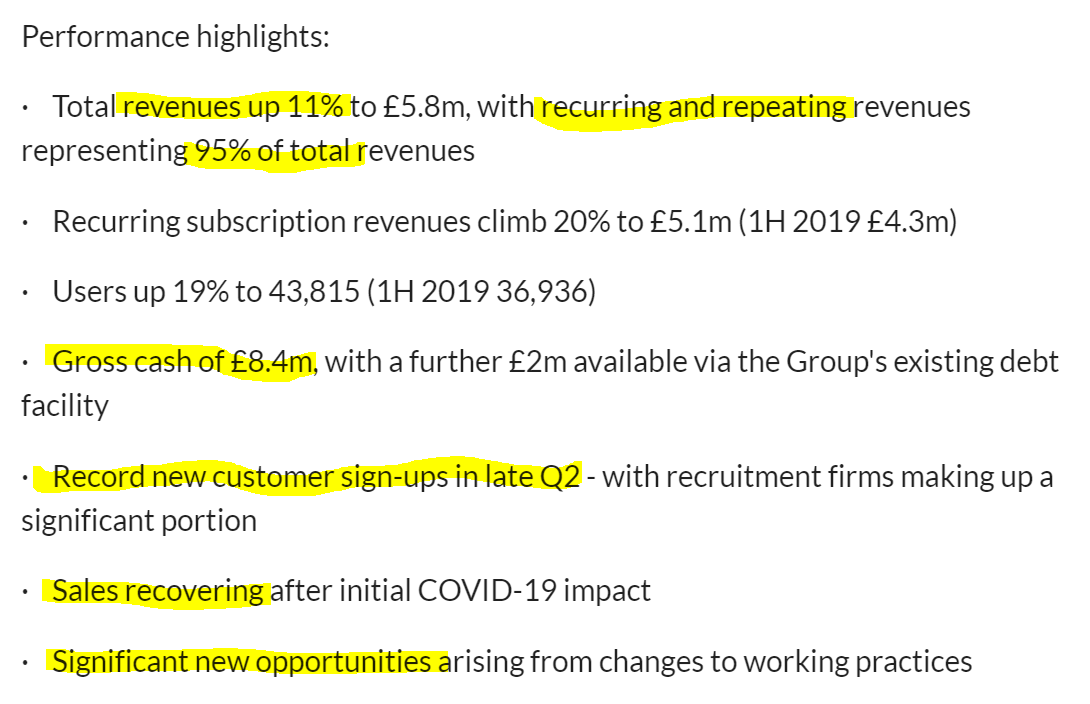

To save me some typing, here are the main points, with my comments below;

.

.

Covid has obviously had an impact, which is as I would expect, so the slower growth rate in H1 doesn't concern me. That's a known factor, and is already in the price.

What's more important is that things are now recovering. Hence I think the market is likely to focus more on the positive current trading "record new customer sign-ups in late Q2"

Plenty of cash, following the big fundraising last year, so cash burn of £250k per month is fine for now, it won't need to do another placing for a while, if at all. The change in strategy from lots of small, sometimes botched, fundraisings, to one big fundraising last year, was sensible, and the timing lucky.

The market is supposed to be forward-looking, so a one-off hit from covid is something we should be looking through. Although that memo doesn't seem to have reached a lot of AIM investors! That provides buying opportunities I think, so one person's poor results are another person's buying opportunity. Take your pick.

Work from home trend should be good for CALL. The integration with Microsoft Teams is beta launching in August. There's some good stuff in today's update, although we always get exciting-sounding updates from this company.

Guidance - 2020 revenues in line with 2019. Without covid we would have been looking at 20-30% growth, so it's been unhelpful but not disastrous. No guidance given for 2021.

My opinion - AIM just isn't the right place for this share. There's a massive tech boom going on, especially in the USA, where CALL would be valued at multiples of the current valuation, with so much private equity money chasing up growth stocks. Given that CALL has a good chunk of it business in USA, it's encouraging that a couple of US tech investors have cropped up with major shareholdings, and apparently were keen to properly fund the company in the last placing. American investors are far more ambitious, and longer-term in their thinking. It's a pity we can't get some of that to rub off on the UK markets, where all too often growth companies are starved of cash, and miss big opportunities due to a focus on achieving breakeven/profits too early.

I think this share looks dirt cheap, if you look at it in the context of tech valuations elsewhere. I'm hopeful of a premium priced takeover bid at some stage. In the meantime, it's taken a hit from covid, and is now recovering.

The bearish argument for this share, is that it's taken years to grow, and is a constant cash burner, usually missing forecasts. So I can see why some investors are tired of it. If so, then just sell up & move on. As you can see from the 5-year chart below, it's been disappointing but not disastrous so far. Of course that doesn't matter in the slightest. It's the future that matters.

.

.

Bigdish (LON:DISH)

Share price: 2.4p (up 14%)

No. shares: 364.2m

Market cap: £8.7m

(I'm long, disclosable stake)

Statement re share price movement

This share is wildly speculative, so should come with giant, flashing neon warning signs!

I've taken quite a big stake in it, because I like the potential multi-bagger potential, and am perfectly happy with the elevated risk.

It's in the process of adapting its business model for the umpteenth time, to morph into a booking platform (not just discounting), offered free (initially) to restaurants and takeitaways, in order to disrupt the price-gouging platforms like JustEat, Deliveroo, UberEats, etc.. A very ambitious goal, for sure! The idea is to get restaurants to sign up by offering it free (don't laugh, plenty of successful online businesses started that way), thus incentivising the restaurants to promote BigDish to their customers, in order to boost their profits. That should in theory reduce the need for a big marketing budget to end customers.

BigDish has an existing IT team in the Philippines, and a proven telesales team in Manchester. Therefore, it should have what it needs to roll out the revised business model.

On the downside, it needs to raise more cash (I'm confident that can be done, from a strategic investor, not from the UK stock market - note it has a full listing). It last raised money at 7.2p from a US investor, last year.

What's all the excitement this week then? The share price began rising yesterday, and someone on the advfn board (a nest of nutcases & vipers) posted a link to BigDish's Twitter account, which teased that it had signed up a national pizza chain. A bit naughty, but this company's communications are often quite chaotic & counter-productive! That's just the way it is.

Today's RNS was probably prompted by the trigger-happy Tweet. It confirms that Pizza Hut has signed up for the BigDish platform;

The Company notes that Pizza Hut has registered for the government's Eat Out To Help Out scheme. Pizza Hut have agreed to join BigDish in order for BigDish to amplify Pizza Hut's participation in the initiative. The Company will be seeking to add more restaurants who are participating in the initiative. As previously announced, the Company is not charging restaurants to join BigDish in order for BigDish to amplify participation in the Eat Out To Help Out initiative.

My opinion - I'm fully aware of all the bear arguments against this company - pre-revenue, cash burning, needs a fundraise, etc.

However I also see potentially multibagger speculative upside. Restaurants and takeitaways desperately need a yield management platform, to spread out business more evenly throughout the week. This is exactly what BigDish is designed to do. By widening the concept into disrupting existing intermediaries like JustEat, there's a potentially nice outlook. The telesales team is already in place, so hopefully we might see progress resume, after the hospitality sector slowly comes to life again.

Signing up Pizza Hut is an undoubted coup, and is a nice reference client, to help the sales pitch to other chains, plus independents of course (desperate to try anything to survive, so I'm expecting recruitment of restaurants to accelerate).

This is far too risky for most investors.

The share price seems to be in the hands of day traders, and volume is consistently very high, considering how tiny the market cap is.

.

Stagecoach (LON:SGC)

Share price: 54p (up 7% today)

No. shares: 550.2m

Market cap: £297.1m

Preliminary results

Stagecoach Group plc - Preliminary results for the year ended 2 May 2020

Several readers have asked me to look at this, so I'm working on it now. As I'm not familiar with the company, it's going to take me a bit of time to plough through everything, so this section should be up by 13:00 to 14:00.

Here are my initial notes / to do list so far;

Focused on bus operations now (8,300 vehicles) - rail franchises have ceased, and not bidding for new ones

Available liquidity of £800m - sounds a lot. Key issue is terms & availability of debt funding - more work needed on this.

Will lenders force it to raise equity? Dilution level/price?

Current trading is EBITDA positive, due to Govt support measures - how come? Subsidies increased for routes? What is subsidy formula?

Was performing well prior to covid. Little point in analysing P&L, since it's now historic/irrelevant due to covid causing plunge in customer numbers

Pension deficit - look into this, how significant?

No divis for now, as I would expect. Scope to resume future divis?

Recovery potential, if covid is beaten? Time needed for customers to return? Permanent loss of custom? (or will things return to normal over 2 years, as typically happens with air travel/terrorism, etc?)

Outlook - what I like about this, is that it sounds like the business is operating around cashflow breakeven. That should buy time to survive & come out the other side of the covid crisis. That's a much more appealing investment proposition than say airlines, where the business case could be permanently broken, and they're burning cash on an epic scale in the meantime.

With the continuing uncertainty of the COVID-19 situation and the UK's recovery, it remains difficult to reliably predict profit for the new financial year ending 1 May 2021. In the short-term, the actions we have taken and the continuing support of government should ensure we continue to generate positive EBITDA (earnings before interest, tax, depreciation and amortisation) and avoid significant operating losses, and we are working to re-build profitability over time....

We expect a lasting effect of the COVID-19 pandemic on travel patterns with an acceleration in trends of increased working from home, shopping from home, telemedicine and home education. We anticipate that it will be some time before demand for our public transport services returns to pre-COVID levels and we are planning for a number of scenarios. We are continuing to review our cost base, to reduce overheads and plan for adjustments to direct and semi-direct costs across a range of scenarios....

That's quite a balanced commentary, which gives me confidence in the diretorspeak.

Bus support grants - this answers my question about how it's managing to achieve EBITDA breakeven, when so many buses seem to be nearly empty;

COVID-related government payments have been available to bus operators in respect of periods from mid-March. In each of Scotland, England and Wales, we have seen a continuation to a large extent of payments to regional bus operators of concessionary revenue, tendered revenue and Bus Service Operators Grant at pre-COVID levels. Regional bus operators in England have also been able to access COVID-19 Bus Services Support Grant ("CBSSG"). The amounts receivable by bus operators for periods from mid-March are subject to a reconciliation process, which has not yet been completed and therefore gives rise to some uncertainty in estimating our income for the year ended 2 May 2020 and thereafter.

My opinion - I've only scratched the surface of this, and have already twigged that this is highly complex. I'd have to spend a whole weekend on this, to make any sense of all the issues. That's way beyond the scope of these articles.

Therefore I have to conclude that I'm neutral. Although I can see the logic in just taking a small punt on this share, on the basis that Govt will want to keep the buses running, far more so than e.g. bailing out airlines. I see it secured £300m of funding under the Govt CCFF scheme. There seems plenty of liquidity, so little to no risk of insolvency any time soon. Could be worth a punt, maybe?

.

A couple of quickies to finish off.

Quixant (LON:QXT)

115p (up 2%) - mkt cap £76m

Quixant (AIM: QXT), a leading provider of innovative, highly engineered technology products principally for the global gaming and broadcast industries, is pleased to provide an update on trading for the six months ended 30 June 2020

Densitron subsidiary is doing well & upbeat outlook (especially for products aimed at medical market)

Gaming market sounds grim;

Gaming, which is the key market for the Group, has seen only minimal orders during the past three months, with most of the Group's gaming clients closed due to the Covid-19 pandemic...

Improved activity in June from gaming market.

Liquidity - sounds fine, but no indication is given on how much deferred tax payments has boosted this;

... solid net cash position at 30 June 2020 of $14.2m (31 December 2019: $16.1m). The Group also has additional unutilised lines of credit of over $12.4m, including a new $9.4m UK Government-backed Barclays revolving credit facility, should additional facilities be required.

Therefore there seems little to no insolvency risk. Receivables collection has been good.

My opinion - neutral. I like the strong balance sheet here. However, checking back I see that it issued a profit warning before covid.

The key gaming market should gradually recover, but over what timeframe? On balance, I'd like to see the interim results, before forming a view on this group. The problem with trading updates, is that companies can say what they like, there's no structure or consistency to it. Hence we rarely get the full picture. That's why I'm wanting to see interim figures later this year, to properly assess things.

.

Blancco Technology (LON:BLTG)

184p (down 6%) - mkt cap £138m

Trading update today - sounds quite reassuring, in line, for FY 06/2020;

Blancco has continued to benefit from strong structural tailwinds which have supported continued revenue and profit growth in FY 2020. Although the COVID-19 pandemic lengthened sales cycles in the second half of FY 2020, the Board expect results for FY 2020 to be in line with current market expectations with revenue of approximately £33.4m (FY19: £30.5m) and Adjusted* Operating Profit of approximately £4.0m (FY19: £3.5m). As anticipated at the time of the Group's interim results in February 2020, cash generation has continued to improve in the second half of FY 2020 and the Group ended the year with £6.7m of net cash (30 June 2019: £0.1m).

It doesn't seem to say how much cash has been boosted by Govt schemes - a glaring omission.

Outlook comments are a bit cautious, hence the 6% drop in share price today;

In the short term, the challenges created by the pandemic of lengthened sales cycles are expected to temper growth in the early months of this new financial year. However, our pipeline is strengthening and the widespread implementation of remote working has led to a noticeable increase in the purchase of IT equipment which is likely to lead to increased demand for our services in the medium term....

My opinion - neutral. Given its past, I don't particularly trust this share. The valuation looks pricey too. So it's not for me.

.

That's me done for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.