Good morning, it's Paul here!

There's plenty of news to report on today. A reader has asked me to look at Marks and Spencer (LON:MKS) results. I'm just printing off the RNS, and will have a look at it later. EDIT: I've read the MKS results, but as it's late now, I'll type up my thoughts in tomorrow's report.

Airea (LON:AIEA)

Share price: 54p (down 10.7% today, at 10:10)

No. shares: 41.35m

Market cap: £22.3m

(at the time of writing, I hold a long position in this share)

The unsolicited takeover bid approach from James Halstead (LON:JHD) has fallen through, with no agreement reached. It's interesting to compare the nuances of the statement from JHD here, and Airea's response here.

As you can see from the candlestick chart below, there was a big initial spike down in price first thing this morning. This is because the market makers would always heavily mark down any share where bid talks have ended unsuccessfully. Then they wait to see what happens in terms of buyers/sellers, and subsequently move the price in line with demand & supply, trying to keep as near as they can to a neutral book.

There seemed to be plenty of buyers in the market, and the price seems to have settled at 54p has

Fellow shareholders that I've been discussing this share with, on Twitter, seemed to be hoping that the bid talks would fail. Why? Well it's because the company announced very positive outlook for future profitability. I reported on that here on 21 Mar 2018. That's why I'm holding this stock, not for a takeover bid.

Therefore I think today is a transition day, when shares are passing from people who were hoping for a takeover bid, to people who are more interested in the company's organic growth potential.

Also, the liquidity that happens on a day like this means that people who wanted to buy shares, but couldn't get any, might be able to pick up a few. Anyway, I'm relaxed about the situation, as this is a long-term holding for me - I've already held for over a year, and imagine that I'll stay put for the foreseeable future, depending of course on newsflow & price.

Frontier Smart Technologies (LON:FST)

Share price: 89.5p (down 40% today, at 10:54)

No. shares: 40.65m

Market cap: £36.4m

Trading update (profit warning)

Bad luck to shareholders here - with the price down 40%, this must be fairly serious bad news.

The Group has two lines of business, Digital Radio (which is long established and profitable) and Smart Audio (which operates in a nascent market that has good medium-term growth prospects).

Although it's delivering bad news, I commend the company and its advisers for updating shareholders with specific guidance. This is far preferable to the silly coded words that many companies use to describe trading;

Challenging trading conditions in Q2-2018 are likely to have an adverse impact on the Group's FY-2018 trading performance.

Consequently, the Board is revising its guidance for FY-2018. The Board now expects full year sales of approximately US$47.7 million (£34.9 million) and EBITDA1 of c. US$1.0 million (£0.8 million).

It would have been helpful to have also stated what the previous guidance was, so that private investors without access to broker notes could see the extent of the fall in guidance. I'll have to try and work it out from previous announcements, which is a waste of my time, when the company could have included that information in today's announcement.

On 8 Mar 2018 the company said;

In FY 2018, the Board expects to see modest growth in revenues and EBITDA, as the Group continues to invest in Smart Audio (from RNS, 8 Mar 2018)

EBITDA for 2017 was £1.9m. Modest growth was originally expected in 2018, so that suggests maybe £2m+ EBITDA. Today's announcement reduces 2018 expectations to £0.8m EBITDA. In percentage terms that's a big drop, but not a particularly big drop in £ terms.

H2 weighting - investors don't tend to like this kind of thing;

Given the usual seasonality of the business, the Group expects to report an EBITDA loss in H1-2018 of approximately US$2.1 million (£1.5 million), followed by a stronger performance in H2-2018 when EBITDA is expected to be approximately US$3.1 million (£2.3 million).

The trouble is that there can be an element of wishful thinking involved, when companies hope to have a stronger H2. That may or may not be the case here, I don't know, but it often is the case at many companies - commentary indicating an H2 profit weighting can often be a deferred, second profit warning.

What's gone wrong? Here's my summary of the detail;

Digital radio - customers in Norway were over-stocked in late 2017, which led to reduced orders in Q1-2018. Orders now starting to return to more typical volumes - this sounds supportive of the company's belief that H2-2018 should be stronger.

Smart audio - aggressive pricing by Google and Amazon has...

...had a negative impact on Frontier's addressable market and the Board therefore expects growth in the Group's Smart Audio revenues in FY-2018 to be slower than previously anticipated.

Prospects here for FY-2019 are "more promising", apparently.

Forex - has impacted negatively EBITDA by $0.5m, the impact of which has been included in the revised guidance.

What's being done to fix things? - cost-cutting. The (large) R&D budget is being reduced by 20.8% this year, saving $2.2m. Other costs are being reduced by $1.2m in FY-2018.

Bank facilities have been renewed and increased, to help with working capital fluctuations. Net debt is expected to be modest at 30 Jun 2018, at $2.1m.

My opinion - I always try to categorise profit warnings into;

1) Short-term, fixable problems - where I would consider buying some shares after the dust has settled, and providing there is a sound balance sheet.

2) Structural, more serious problems - in which case I'd deploy my bargepole.

I don't know enough about this company to be sure either way. The issue with digital radio over-stocking sounds like a temporary problem, which would fall into the first category above.

However, the issues with the smart audio products sounds more serious. If you want a voice-activated device in your home (and personally I don't - Google & Amazon already control/monitor far too much of my life!), then you just buy a Google smart home device or Chromecast, or an Amazon Alexa or Firestick device. They're dirt cheap, and look nice. So I don't really understand why Frontier feels that it's worthwhile chasing a (probably small, maybe non-existent) future market for third party companies, designing more upmarket voice-controlled devices?

Therefore, I think this share is possibly best assessed as being a special situation where the smart audio business is probably worth nothing, and might even be a liability in terms of its future cash burn.

Accordingly, I would value Frontier shares purely on its digital radio business, and then deduct from that a provision for the shutdown costs of the other business. The digital radio business looks highly profitable, but mature. So that might see its profits decline in future?

Overall, this looks quite an interesting special situation. I like it when a highly profitable business is being obscured by a heavily loss-making fellow subsidiary. This was one of my themes at Mello Derby recently. A lot of us did tremendously well from Avesco which was this type of situation. French Connection (LON:FCCN) and Airea (LON:AIEA) (I hold shares in both) are similar situations where there's a heavily loss-making part of the business, which will be disposed of, or shut down in due course. As a result, group profits would soar, once the problem division has gone.

The 2-year chart below for Frontier seems to show that the froth in the share price, over hopes for smart audio, has now disappeared, which looks justified. The danger is that the company just keeps throwing money at something that probably won't work, or generate an acceptable return on investment.

I'll put this on my watchlist, but I don't see any rush to get involved. When growth companies go wrong, it can take quite a while for disappointed holders to (a) realise /admit that things have gone wrong, and (b) unwind their long positions if it's illiquid.

Best of the Best (LON:BOTB)

Share price: 270p (up 11.1% today, at 13:01)

No. shares: 10.07m

Market cap: £27.2m

(at the time of writing, I hold a long position in this share)

Best of the Best PLC, (LSE: BOTB) the organiser of weekly competitions to win luxury cars and other products wishes to make the following update on its VAT claim.

There are several elements to this, so here's my summary;

A long-running VAT dispute has settled in BOTB's favour, with £4.5m (before costs) being paid to the company by HMRC.

HMRC has told the company is liable to pay 4-years' back-dated Remote Gaming Duty - the company is disputing this, so overall this issue is not yet resolved in full. It seems to only be the back-dating of RGD payments that BOTB is dipsuting, as it now pays RGD on its current operations.

The wording of this bit suggests that the overall outcome should be positive for BOTB, once the RGD issue is settled. Although professional fees could end up being very large - this type of tax dispute work is an open chequebook job with most firms of accountants.

While the question of retrospective RGD remains unresolved with HMRC, the Company is unable to announce the full extent of the net positive contribution to the Company, following the payment of its £4.5m VAT claim from HMRC.

So we know BOTB will end up with a windfall, we just don't know how much.

Historically the company has paid out surplus cash in special divis, so I expect that to happen in due course with this too.

OptiBiotix Health (LON:OPTI)

Share price: 68.5p (down 5.5% today, at 13:23)

No. shares: 80.5m

Market cap: £55.1m

Audited results - for year ended 30 Nov 2017.

This is a jam tomorrow company, which has so far produced nothing of any commercial substance. Revenues are only £191k, and the operating loss was £2.1m.

Why has it taken almost 6 months to produce these results, given that the company doesn't really sell anything yet?

There was a £4.1m profit booked in 2017 for the disposal of a subsidiary, which now has its own AIM listing, called SkinBioTherapeutics (LON:SBTX) . I see that share price has put on a nice spurt recently. I've had a look on its website, and OPTI is shown as owning 41.9% of SBTX. So some of those shares could be sold to raise cash for OPTI.

OPTI itself looks to be nearly out of cash by now, based on it having only £1.25m at 30 Nov 2017, and cash burn of roughly £150k per month. Whilst investor sentiment is this high (evidenced by the £55m market cap), then I imagine raising more cash would be fairly easy - and I imagine is imminent.

Why am I mentioning this company at all, given that it's a jam tomorrow story stock? Well, only because the newsflow from the company appears to be impressive. There have been lots of announcements about contract wins, collaborations, etc, with apparently credible partners. Although the announcements I've looked at didn't seem to give any financial details of the deals done.

My opinion - the share price seems to entirely rest on punters bigging up the prospects for the company, "Just one product could be HUGE, and other projects are thrown in for free".

In my roughly 20 years in the market, I've heard so many stories like this, and only a tiny fraction of them actually work out anything like originally planned. For this reason, I don't punt on anything like this, because I have no way of knowing, or guessing at, whether the company will commercially succeed.

Whereas with Sosandar (LON:SOS) (in which I hold a long position), which is from the same company promoter as OPTI, Adam Reynolds, I do understand the sector they operate in, and trust my judgement in deciding whether or not it is likely to work. That is not the case in the sector where OPTI operates, where I haven't got a clue if products are credible or not!

For that reason, I'll happily sit on the sidelines with no position in OPTI. I would only get involved if and when it is able to demonstrate commercial success, rather than jam tomorrow promises, which is all we've got at the moment. The price might be higher once commercial success is a fact rather than an aspiration, but so be it.

Sanderson (LON:SND)

Share price: 112.5p (up 7.1% today, at market close)

No. shares: 59.8m

Market cap: £67.3m

(at the time of writing, I hold a long position in this share)

Sanderson Group plc ('Sanderson' or 'the Group'), the software and IT services business specialising in digital retail technology and enterprise software for businesses operating in the manufacturing, wholesale distribution and logistics sectors, announces Interim Results for the six month period ended 31 March 2018.

The market has responded positively to these half year results, which are "slightly ahead of management's expectations"

- H1 Revenue up 34% to £14.6m, but this is nearly all down to an acquisition (called Anisa). Organic revenues were only up 1.7%

- Recurring revenues are 56% of total revenue, and this rises to 90% if you include incremental sales to existing customers. I like the sound of that, as it suggests that customers have confidence in the software, if they buy more of it.

- More "selective" acquisitions are under consideration.

- Cash generation is good.

- Like-for-like operating profit grew over 12% to £1.74m in H1.

- Net cash of £1.4m at 31 Mar 2018.

- Strong order book of £8.6m

- IFRS 15 might become an issue in future. Note 1 in today's accounts says;

The Group is in the process of assessing the impact that the application of these standards will have on the Group's Financial Statements.

I've not looked into IFRS 15, has anyone else?

Outlook comments - key points;

- Not detected any major loss of confidence amongst its customers (suggests that there has been some minor loss of confidence!)

- Sales cycles can be protracted

The company's conclusion is;

... the Board has a good level of confidence that Sanderson will make significant further progress during the current financial year ending 30 September 2018.

Balance sheet - this is where it goes wrong for me. The company claims to have a strong balance sheet, but that's not true in my view. On my key balance sheet tests, it's weak, e.g.

NAV: £31.5m, but this is dominanted with intangible assets of £43.2m. Take that off, and;

NTAV: is negative, at -£11.7m. That latest acquisition of Anisa hasn't helped, because Anisa had a ropey balance sheet (negative NTAV of £6.1m at the time of acquisition), including some debt, which Sanderson has now taken on. No equity was raised to fund the acquisition, although £2.8m of new Sanderson shares were issued as partial consideration, with a 3-year lockin, which amounts to the same thing as issuing new equity, I suppose.

Trade receivables looks too high, even allowing for the fact that Anisa's balance sheet figures are fully consolidated, after only 4 months trading in the P&L.

The whole business is run on deferred income - i.e. customers paying up-front. This is reflected in £9.0m deferred income - which is a lot larger than the £5.1m cash pile. So the company spends almost half of the client cash before having provided the service that they're paying for.

There are various other sundry creditors which add up to a fair bit - e.g. £1,047k loan notes, £1,138k deferred consideration, £916k bank loan/overdraft, in current liabilities.

Then there's another £2.75m in bank loans, and £500k in deferred consideration in long-term creditors, plus a £6.1m pension deficit (that requires cash injections of £360k p.a.). It all adds up, and paying these liabilities means less cash for dividends.

The current ratio of 0.78 is very low - which reflects the favourable working capital nature of the business, in that customers pay up-front.

I'm not saying there's anything to be alarmed about, as it's a decently cash generative business, which should be able to operate fine with a rather stretched balance sheet - providing nothing goes wrong with overall trading. In the next recession, management here might regret that they didn't strengthen the balance sheet by raising a bit more equity along the way.

Cashflow statement - looks fine. Note that the company capitalised £321k in development spending in H1, which is quite modest. So no issues here.

Valuation - the house broker update is available today on Research Tree. It maintains a current year forecast of 6.5p EPS. That gives a current year PER of 17.3, which strikes me as probably fully priced.

My opinion - I quite like this company. The detailed commentary today contains lots of interesting detail, and things seem to be going well, with a decent outlook.

I'm less keen on a stretched-looking balance sheet, but I don't think that necessarily presents any immediate problems.

A product worry is that clients might decide to re-platform, to a bigger competitor. There seems to be a trend towards some big American platforms becoming almost industry standards, e.g. Spotify, Magento.

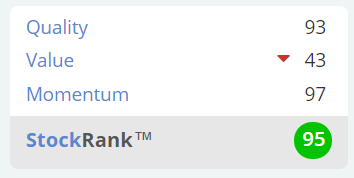

Given the recent share price surge, 'm tempted to bank my profits and move on. Although the very high StockRank and the general "run your winners" catchphrase, are pulling me in the other direction! Decisions, decisions...

That's all for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.