Good morning from Paul & Graham! All done now. Have a nice afternoon!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

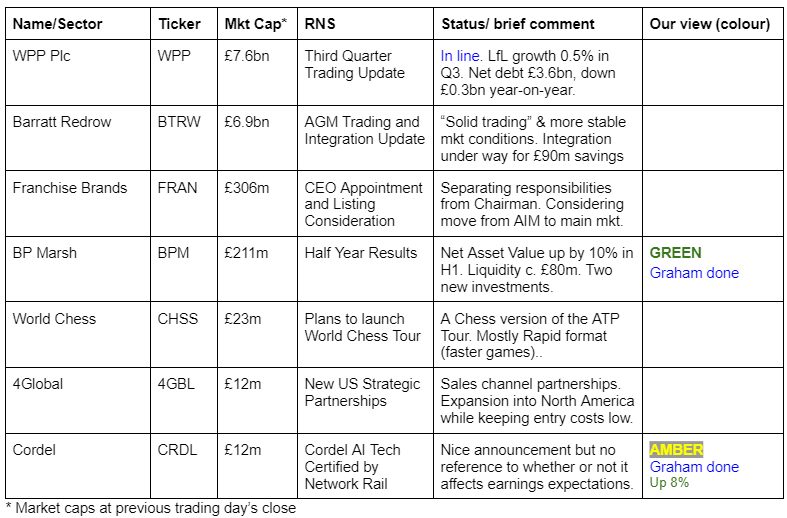

Companies Reporting

Summaries

B.P. Marsh & Partners (LON:BPM) - up 1% to 574p (£213m) - Half Year Results - Graham - GREEN

I’m happy to stay positive on this high-performing investor in insurance startups. This is the type of investment vehicle I like: they invest in a niche which we can’t easily access, and they do it well. The discount to NAV is still over 10%.

Short Sections

Cordel (LON:CRDL)

Up 8.5% to 6.2p (£13m) - Cordel AI Technology Certified by Network Rail - - Graham - AMBER

This calls itself “the AI platform for transport corridor analytics”. It automates railway line inspections and surveys using video systems and LiDAR (the laser technology that’s increasingly being used in cars).

Today’s announcement signals progress: “Network Rail has provided a Certificate of Approval for Cordel's AI-powered outputs for Electrified lines.”, with approval for the Cordel system throughout Network Rail infrastructure.

CEO comment:

Cordel achieved this approval for capturing and processing data from trains running at full speed in passenger service. Network Rail has some of the most stringent infrastructure monitoring standards in the world, and we believe this approval consolidates our position as the most advanced supplier of AI-driven railway infrastructure insights.

Estimates: Cavendish have left their forecasts unchanged on the back of this morning’s announcement, which says to me that this approval was already baked into forecasts. Estimates suggest that adj. PBT will be close to breakeven in the current financial year (FY June 2025: £0.4m adj. pre-tax loss estimate).

Graham’s view: Paul gave this “AMBER/GREEN (speculative)” back in April. I share his view that this looks like a nanocap with a real, innovative product that works - which is more than can be said for many nanocaps!

I also note that the company recently raised £1m at 6.5p. Its cash balance had fallen to £1m (as of June 2024). So it should have enough cash to keep the wolf from the door for the time being.

I’d like to maintain the AMBER/GREEN stance but for me this is too early-stage so the best I can do is AMBER.

Franchise Brands (LON:FRAN)

Up 4% to 165p (£320m) - Group CEO Appointment and Listing Consideration - Graham - AMBER

We’ve been neutral on this one (Oct 2023, June 2024) but the company has been a decent performer and remains highly ambitious with two changes announced today.

Firstly, the CEO of FRAN’s Waste & Water division has been appointed Group CEO and a member of the Board. The idea is to split off some responsibilities from Exec Chairman Stephen Hemsley, who co-founded FRAN back in 2008 with Nigel Wray (they were both heavily involved with another small franchising operation, Domino's Pizza (LON:DOM) ).

With the new Group CEO taking charge of day-to-day leadership, Mr. Hemsley will be able to focus on “the strategic and corporate development of the Company, including Group finance and future acquisitions”. He will remain Exec Chairman, i.e. he is not downgrading to a non-Executive function.

Secondly, FRAN is considering a move away from AIM and onto the main market:

Given the scale and growth ambitions of the Group, the Board is beginning to consider a move from the AIM market to the Official List and Main Market of the London Stock Exchange. Today's announcement of the appointment of a Group CEO and separation of management responsibilities for the strategic development of the Company and the day-to-day leadership of its businesses is the first step in that journey. These considerations are at an early stage

Graham’s view

First, I think it’s usually a good idea to have both a Chairman and a group CEO, rather than a combined role in one individual. Corporate governance 101 says this. So splitting off some responsibilities away from the Exec Chair makes perfect sense to me.

Ideally, I’d want the CEO to also be in control of strategy and financing, and for the Chair to provide oversight of this. FRAN haven’t achieved that yet, but perhaps they will down the line.

As for moving from AIM, I don’t think it matters too much at this stage. FRAN is too small to get into the FTSE-350 Index (you need about £500m to qualify) and if they are in the FTSE Small-Cap Index on the Main Market, I don’t think that will attract many more investors compared to an AIM listing.

If or when their market cap gets over £500m, that’s when the big reward of a Main Market listing is inclusion in the FTSE 350.

I’m happy staying neutral on FRAN.

Graham's Section

B.P. Marsh & Partners (LON:BPM)

Up 1% to 574p (£213m) - Half Year Results - Graham - GREEN

I’m a long-term fan of this investor in the insurance sector. It has truly compounded wealth for its shareholders over the years:

Today’s half-year results to July show continued excellent progress:

10% growth in Net Asset Value per share over six months (to 691p). Including the effect of options, diluted NAV per share is 658.5p.

Total return 12% over six months, including dividend payments.

Chairman Brian Marsh OBE welcomes a new CFO and says:

"We are pleased to report another strong set of results, delivering growth in portfolio value, investment realisations and shareholder returns.

"The completion of the disposal of Paladin during the period showcases the success of B.P. Marsh's investment model, our ability to identify opportunities and to back successful management teams.

"We remain committed to maintaining this momentum, leveraging our expertise to drive further sustainable growth via new investment opportunities and follow-on funding.

New investments: three investments were made in H1 and so far in H2, two new investments have been made. Both new investments are in underwriting agencies. In my experience, BPM typically risks small amounts of funds on new investments but is very likely to provide further funding as the investee grows.

There is great emphasis on the track record of investee management and since BPM focuses on a narrow niche within the insurance industry, it seems to be highly skilled at assessing management teams in this niche.

Cash: BPM has been drawing in cash thanks to two large disposals that have brought in over £90m.

It has paid out the first £4m of a planned £12m in dividends, with another £4m planned during FY Jan 2026 and again in FY Jan 2027.

Whereas the company previously bought back its shares when it could do so at a 20%+ discount to NAV, this summer it started buying back shares at only a 15%+ discount.

More recently, it has been buying back shares with the requirement of just a 10% discount.

While the buyback programme has only been for £1m, which isn’t really material, I think the willingness of the company to take advantage of the remaining discount is positive for shareholders.

On today’s figures, the current share price is a 17% discount to NAV (using the higher NAV estimate that ignores potential dilution).

New CFO role: BP Marsh has hired its Group Management Accountant as the CFO.

I have the impression that BPM likes to hire internally and that its senior people tend to stay at BPM for many years (the new CFO has been with the company since 2013). Is this a good thing? I would say yes! It’s good for stability and culture.

Graham’s view

I’m happy to stay GREEN on this one as usual.

Even on a fully diluted basis, the discount to NAV is currently over 10%.

Given BPM’s track record, I’m inclined to think that it’s worth its NAV.

I should point out that calculating NAV for BPM means putting a value on unquoted investments whose value isn’t guaranteed in the same way that the value of a portfolio of liquid investments is guaranteed.

However, BPM’s calculations of values were verified by its recent large disposals.

Therefore, after another strong six months, I’ll continue to give it the benefit of the doubt.

The StockRanks agree with me:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.