Good morning, it's Paul here with the SCVR for Wednesday.

Timings - I think this is going to take most of the day, so I'll say finish time of 5pm but there should be plenty up by official finish time of 1pm. I have to take a longer lunch than usual, as the dogs need to be taken to the groomers for noon.

There are lots of trading updates today, so I can't cover everything. It's really helpful when readers who have a good understanding of particular companies post your own summaries of their results in the comments. Here are the ones that look most interesting to me today;

Agenda

Loopup (LON:LOOP) (I hold) - Half year results - this follows a very strong recent trading update, hence why it's top of my list.

Sdi (LON:SDI) - Trading update & IMC webinar

Zoo Digital (LON:ZOO) - AGM Statement

Ten Entertainment (LON:TEG) (I hold) - Half year results, 6 months to 28 June 2020

Cloudcall (LON:CALL) (I hold) - Interim results, 6 months to 30 June 2020

Joules (LON:JOUL) - Trading update

Warpaint London (LON:W7L) - Interim results

.

Loopup (LON:LOOP)

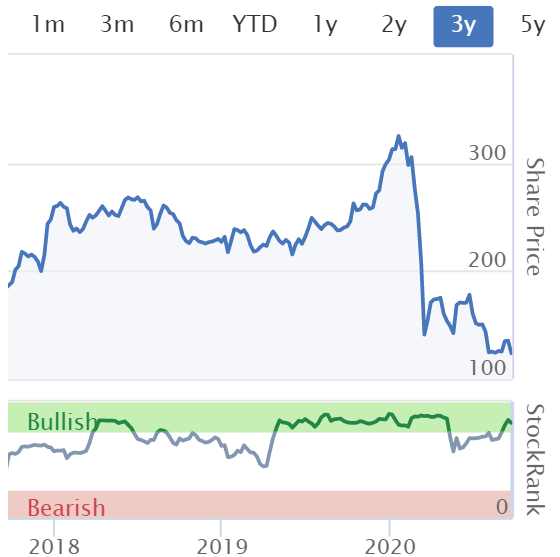

Share price: 228.5p (up 4% today, at 08:36)

No. shares: 55.4m

Market cap: £126.6m

(I hold)

LoopUp Group plc (AIM: LOOP), the premium cloud communications provider, is pleased to announce its unaudited interim results for the period ended 30 June 2020.

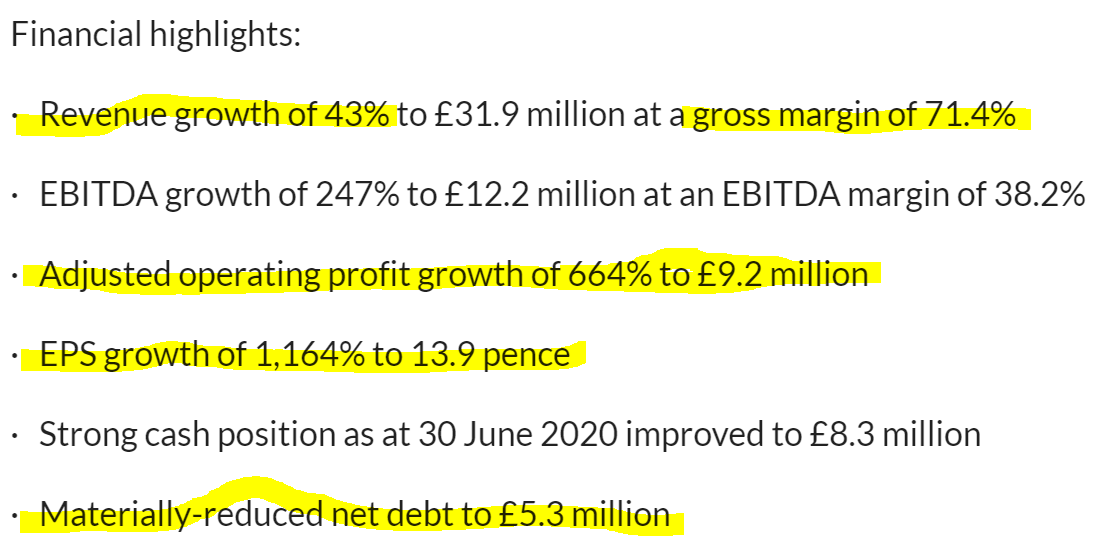

The financial highlights below look pretty stunning, but remember that the market has already been given these numbers, in a previous trading update which I reported on here, on 16 July 2020. That's worth revisiting actually, because I point out things like capitalised development spending (which flatters EBITDA).

There's also a H1 seasonal bias, and the company has benefited from the work from home ("WFH") trend. Worries that WFH was temporary have receded since yesterday's U-turn, in that the Govt is now telling people who can to work from home again, reversing what they told us a few weeks earlier that it was time to return to work.

LOOP has carved out a niche for high security conference calling. It is widely used by firms of lawyers & accountants.

Looking to the future, where I suspect people might tend to WFH for several days, then go into the office for the more collegiate experience for several days. Will LoopUp's service still be required then? Quite possibly, because you only need 1 key person to be working from home, and you would then need to use LoopUp, instead of having a physical meeting, even if everyone else is in the office.

.

.

It seems to me that the share price of LOOP has not properly reflected this stunning improvement in performance. I bought some shares personally after the last very strong update, and am now worried that I didn't buy enough.

There are some good facts & figures in the narrative, e,g,

|

Outlook comments - the narrative today seems dripping with positive energy, whilst also recognising that the macro picture is uncertain. I suppose we have to be mindful with all WFH type shares, that if/when covid is defeated with treatments/vaccines, hopefully in 2021, then business could go into reverse. That said, I've tried out LOOP myself, and can see that when the features are properly used, it gives a level of control and security which may not be possible with other, mass market products like Zoom - coded in China, so not ideal if you want to discuss something sensitive.

Management sounded particularly excited about offering a telephony service within Microsoft Teams, in a webinar they did in July.

The narrative also talks about "investing for growth", so I think that means a big increase in overheads. Mgt has not always spent wisely in the past, with over-rapid expansion of sales teams being a problem a couple of years ago. Let's hope they strike a good balance between profitability, building up a cash pile, and expansion spending.

Balance sheet - greatly improved, but still weakish. NAV: 65.5m, less intangibles of c.£70m, gives negative NTAV £(4.5)m. I'd like to see cash retained within the business, and the NTAV to move into positive territory.

The working capital position looks fine, but I don't like the £11.9m in long term debt, and would like to see that paid off from cashflows in future.

Cashflow statement - a genuinely very cash generative half year, although note that about a third of cashflow was spent on capitalised development spending.

My opinion - I think the market cap is lagging behind developments here. The unknown factor is what happens post-covid, and will services like this be used so much afterwards?

In the meantime, LOOP has delivered an astonishingly good half year, and mgt sound optimistic about the future too. I'm very positive about these numbers, and will be adding to my long position when funds permit.

.

.

Sdi (LON:SDI)

68.3p (up 12%) - mkt cap £66.8m

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing control applications, is pleased to announce an update on trading for the current year.

[this covers FY 04/2021]

It's a reassuring update, in line with expectations, so it's surprising to see this trigger a 12% rise in share price, when logically it shouldn't really have moved the price at all.

The Group has made a very good start to the new financial year. Despite the ongoing economic headwinds, the Board is comfortable with current trading and in delivering financials in line with market expectations for the year.

Maybe people have interpreted this as meaning that the group might be ahead of expectations now, and keeping something in the bag in case there's a slowdown later in the year?

AGM online - bravo to the company for using the IMC platform to hold its AGM, and Q&A. We need to see more of this from all companies, not just small ones.

As described in the Company's announcement of 26 August 2020, existing and potential shareholders may listen to the formal AGM proceedings, and immediately following the formal business of the AGM participate in Q&A, via the digital platform Investor Meet Company at 11.00am today. Investors can sign up to Investor Meet Company without charge and add to meet SDI Group plc via: www.investormeetcompany.com/sdi-group-plc/register-investor

There's usually a recording put up on IMC later, for us to watch. I'm delighted the IMC platform was created, and am finding it a tremendously helpful additional resource, on top of the existing excellent output from PIWorld, and others. Unfortunately IMC doesn't put its videos on Research Tree, which is a pity. I've just emailed IMC to suggest they do so, as I'd like everything in one place to browse for interesting company reports.

My opinion - SDI seems a nice little acquisitive group. As with all acquisitive groups, you do have to keep a close eye on debt, and balance sheet strength, because the temptation is to load up on cheap debt, and see the balance sheet become too top heavy with intangibles.

Having confirmed guidance is in line with expectations, the PER of high teens for SDI looks about right to me.

.

Zoo Digital (LON:ZOO)

60.5p (up 6%) - mkt cap £45m

There was a lot of hype about this company a couple of years ago, but it subsequently didn't live up to expectations. It provides services for dubbing and subtitling video content, which sounds a pretty generic service to me, but Zoo claims to have technological advantages.

Today we get an AGM trading update. I'll summarise the main points;

TV/film sector is struggling, with new production suspended for almost 6 months

Zoo is benefiting from a focus on re-hashing existing content

We expect to deliver double-digit revenue growth in the six-month period to 30 September 2020 compared to the same period last year.

Sector uncertainty likely to continue into 2021

Rate of growth in subtitling and dubbing is less than expected, but still attracting new customers

Digital packaging has been a "major growth area" but no figures are given

Presentation slides that will accompany an investor update following the AGM will be available on the Company's website later today.

My opinion - neutral, because we're not given any figures, nor any guidance for performance against market expectations.

It sounds as if the company is managing well in the downturn affecting its sector, and it appears to be adaptable.

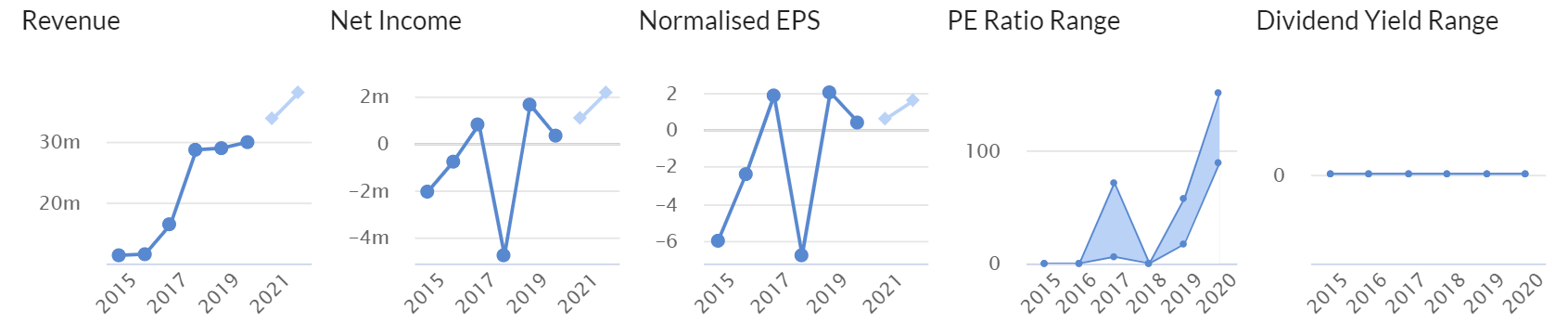

Looking at its historic track record, reliable profits seem elusive, and there are no divis. So it doesn't appeal to me. Maybe there's been too much hype, and not enough delivery?

The historic graphs below emphasise that it's a small, only marginally profitable business. Performance would need to transform to the better to get me interested, and even then would higher profits be sustainable? I can imagine that dubbing and subtitling must be very competitive services, and everyone can do things over the internet these days, with probably plenty of people in the film/TV sector desperate for work and prepared to undercut on price.

.

.

Joules (LON:JOUL)

98p (up 7%) - mkt cap £106m

Joules, the premium British lifestyle brand, provides a trading update covering the 13 weeks from 1 June 2020 to 30 August 2020

[this is Q1 of FY 05/2021]

This strikes me as a good performance, in a very difficult period;

The Board is pleased with the Group's encouraging performance during the Period despite the highly challenging trading backdrop. Group revenue performance during the Period was ahead of the Board's expectations at £39.6m, with revenue from the Group's own e-commerce channels increasing 63%.

Overall Group revenue was down 18% reflecting the impact of Joules' stores, and those of many of our wholesale partners, not being open for a large part of the Period.

To be fair this doesn't cover the worst of the lockdown period, from late March, April & May, when all the stores would have been shut. But even so, to be only down 18% revenue, when we know that High Street footfall was low, and must mean that online has recouped a lot of the shortfall from the shops. Remember that Joules is very successful online, with about half all sales coming from that channel before covid. It's a very distinctive brand, with high customer loyalty, so it makes sense that some customers will have switched to buying online. That's one of the things I like about this brand, and why I see it as a long term success, not a problem retailer stuck with a load of uneconomic store leases, like so many other fashion chains.

The rest of this announcement is hopelessly confusing, giving a lot of different statistics, which don't seem to tie together. Instead of a lot of confusing text, why didn't they just provide a table, clearly setting out sales by channel?

From what I can make out, the key points seem to be;

Stores re-opened strongly, with sales down only 10% vs LY (ahead of expectations)

Wholesale seems to have have taken a much larger hit, with Q1 sales down heavily, at -59% vs LY

Liquidity - looks fine, with £8.5m net cash, and headroom of £57m (i.e. lots of available bank facilities)

Inventories - under control, and 16% lower than LY - so no worries about over-stocking

Outlook - cautious

My opinion - this update gets a D minus from me, for being so badly set out, and baffling me with an array of stats which don't properly explain the overall picture. If I've understood correctly though, it seems the stores are trading well since re-opening, which is good because the fixed costs are high. Whereas wholesale is lower margin, and has low fixed costs, so it doesn't really matter too much if wholesale revenue is poor for a while. Wholesale is only a worry re potential bad debts, if customers go bust, but nothing is said about that today.

With a very distinctive brand, and high online sales, this is a quality business, that should recover fully in time. So it should not be seen as a retail basket case at all.

Overall, it's potentially interesting. I just wish the company could get the hang of updating the market in a more clear, understandable way. Its updates are always badly worded & confusing.

There's a helpful update note available on Research Tree.

.

Ten Entertainment (LON:TEG)

(I hold)

126p (up 2%) - mkt cap £86.4m

Half Year Results

There was a reassuring update slipped out here on 8 Sept, indicating that re-opening of most (ten pin bowling) sites had gone very well, and they're already cashflow positive. I'm quite surprised the share price has remained so depressed. Maybe investors are fearing another lockdown, although that had been avoided for now.

Ten Entertainment Group plc ("Ten Entertainment" or "The Group"), a leading UK operator of 46 family entertainment centres, today announces its half-year results for the 26 weeks to 28 June 2020.

The results reflect a period of very significant disruption as a result of the enforced Government closure of all leisure and hospitality venues ("Lockdown") from 20 March 2020 as a result of the Covid-19 pandemic.

For this reason, the historic figures are not of great interest. All I'm looking for is that - losses are not too bad, the balance sheet is strong enough to survive, and that current trading is OK/improving.

H1 revenue almost halved, unsurprising since sites were forced to close for more than half of H1

Adj loss before tax of £(5.7)m - ouch, that's a hefty loss for the size of company

Modest net debt of £6.7m, and plenty of headroom on bank facilities

Profitable & cash generative since re-opening - that's fine, I just want to see the company not losing money at the moment, and it's achieving this whilst operating at 50% capacity

Balance sheet - is very badly presented, lumping together bank borrowings and IFRS 16 lease liabilities. This is ridiculous, as they are completely different in nature, so should be shown separately. Overall, NTAV is £15m, which is adequate, but not strong. The main risk here is obviously if covid were to get a lot worse, and the Govt once again required bowling alleys to close.

My opinion - as things stand at the moment, everything is fine - the sites are open, and are profitable & cash generative, at reduced capacity. I think that is perfectly satisfactory, because it means the business should be able to tread water until the covid crisis is over, hopefully at some point in 2021, then return to full capacity and enjoy a resumption to previous levels of profitability.

I'm quite surprised that investors can't see this, which strikes me as the most likely scenario. The current price is little above the March lows, which doesn't seem to match the reality of successful re-opening. Maybe people are terrified of a further lockdown?

.

.

.

Work-in-progress -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.