Good morning!

These are on my radar today.

- Ab Dynamics (LON:ABDP)

- Boohoo (LON:BOO)

- Taptica International (LON:TAP)

- Loungers IPO

- Frontier Developments (LON:FDEV)

Mello 2019

A quick plug for this event, where I'm sure many of us will meet again, and some of us will meet for the first time.

Some recent additions to the list of companies appearing at this event:

- Judges Scientific (LON:JDG)

- Character (LON:CCT)

- Angling Direct (LON:ANG)

- RA International (LON:RAI)

- Pelatro (LON:PTRO)

... along with other favourites such as Sosandar (LON:SOS), Duke Royalty (LON:DUKE) (where I have a long position), Zoo Digital (LON:ZOO), Beeks Financial Cloud (LON:BKS), Scientific Digital Imaging (LON:SDI), etc. Click here for the company list.

The speaker list isn't bad either!

I've been informed that there are 50% discounts available with the code EB50.

Ab Dynamics (LON:ABDP)

- Share price: £20.55 (+7.6%)

- No. of shares: 20 million

- Market cap: £405 million

Some remarkable H1 growth figures from this company, which provides "advanced automotive test and measurement equipment", focusing on safety and autonomy features.

It has boosted its manufacturing capacity over the past year or so, enabling a tremendous increase in revenues. Operational leverage means that profits are turbo-charged:

- Revenues +69% to £25.8 million

- adj. PBT +95% to £6.4 million

Despite this strong growth, the interim dividend increases by just 10%. The company has been pretty clear about its desire to invest to take advantage of the opportunities it enjoys at present, so I guess this is not a big surprise.

Indeed, the company says today that the adjusted operating margin in H2 2019 will be similar to the FY 2018 result, due to "planned investments in resources, overseas facilities and infrastructure". It has new facilities in Germany and the USA, and wants to commence operations in other key markets.

Net cash increases to £18.9 million.

Order book provides "full visibility for the remainder of FY 2019 and into FY 2020".

Management - some turbulence at the top, as the company has a new CEO and the CFO is leaving.

Gross margin - we have a reminder that financial accounts are often a matter of opinion, as a reclassification of costs sees gross margin boosted to 50% (versus 35.6% under the old method).

Outlook - positive.

The second half of the financial year has started positively, and our order book visibility gives the Board confidence in the outlook for ABD for the remainder of 2019 and beyond.

Overview

This is an interesting company for me to look at right now, given that I have been processing claims by a certain manufacturer that it will soon have autonomous vehicles.

ABD produces driverless robots used in the testing of Advanced Driver Assistance Systems (for example, systems which brake to avoid a collision, if the driver fails to do so). Driving robots accounted for more than half of ABD's revenues in H1. Other major contributors to revenue include soft targets and driving simulators.

Vehicle manufacturers who seem to be happy with ABD products include Toyota, GM, Ford, Mercedes and Chrysler.

It's hard to disagree with ABD's view that the surge in demand for driver-assistance and autonomous vehicle testing is a great environment in which it should continue to grow. I have no specific information in terms of whether or not it has a relationship with Waymo.

Here's an article published last month by ABD, "How close are we to fully autonomous cars?". The author writes:

In my opinion, we're not going to see full (level 5) automation by 2021, it will certainly take much longer than the media will have us believe. But there is such heavy investment in this technology that it could be sooner than we think.

Today's update repeats this view with the statement that "the drive towards full autonomy... is proving to be far more complex than has been speculated on and publicised in the media." ABD expects a prolonged period of testing for ADAS and autonomous systems.

My opinion

With compound annual growth in ADAS-related sales expected to be greater than 20% for the foreseeable future, ABD could very conceivably grow into its current valuation of c. £400 million.

It has partnered with an impressive range of blue-chip OEMs, who speak in glowing terms of its products.

So there is a lot to like here.

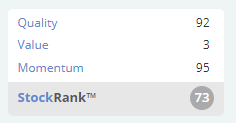

This is how Stockopedia sees it:

Quality is excellent - the company has achieved its growth without excessive capex and without taking on financial risk.

For example, spending on property, plant and equipment amounted to just £1.8 million in H1, versus £6.9 million in operating cash inflows (before tax and working capital movements). The balance sheet is strong.

So there is little doubt that it is outperforming the average business. Congratulations are due to the company itself and its shareholders, who are sitting on very impressive capital gains.

And the next few years are probably going to be excellent, too, with continued growth looking very likely.

But is it a buy-and-hold investment, with open-ended growth prospects, or will it run out of steam at some point, after the current wave of ADAS/autonomy testing is complete?

My problem is that I don't really understand what the end-market for ABD's products is going to look like in a few years. With a forecast earnings multiple in excess of 30x, I think the valuation does require a very good answer to this question.

To underline the point: revenue does not seem to be recurring in nature - visibility depends on the strength of the order book - and management's confidence in the future is based on its belief that autonomy/ADAS testing will be needed for "an extended time period". Maybe that period of time is 5 years, for example? After that, I wonder what might happen?

It's in my "too difficult" pile at the moment, but I hope it keeps going from strength to strength, for the benefit of shareholders.

Boohoo (LON:BOO)

- Share price: 229.8p (+6%)

- No. of shares: 1163 million

- Market cap: £2,673 million

This old favourite returns with strong results for FY February 2019, as many will have expected.

Revenue at £857 million (up 47% at constant FX) is ahead of the £843 million consensus forecast that is visible to me. Profitability measures all look strong, too.

Some highlights:

- excellent progress internationally (ex-UK sales up 64%).

- gross margin firm at 54.7%

Pretty Little Thing / Boohoo

I'm going to have to repeat myself and point out that the group seems to be driving forward very deliberately with PLT and potentially doing so at the expense of Boohoo.

Boohoo customer numbers are up by just 9% on the prior year to 7 million, while PLT customers are up 70% to 5 million.

Is it a coincidence that the Boohoo/PLT founding family still directly owns 33% of PLT? I would have my doubts about that.

Anecdotally, there has been a very prominent PLT poster advertisement outside my gym for several weeks, and I have noticed other PLT ads in public spaces where I have never seen a boohoo ad.

Because of the mismatched growth, "non-controlling interests" (i.e. minority shareholders in PLT) are entitled to 20% of the group's total profits for 2019, up from 12% in 2018:

When you look at it this way, profits attributable to boohoo shareholders increased by just 19% in 2019, only half the growth rate in overall PBT.

To see the effect of the minority (or non-controlling) interests, you have to ignore most of the profitability numbers and instead focus on diluted EPS (up 19%).

Outlook - first few weeks of the new financial year are "encouraging". Long-term:

...we will continue to make investments across the group as part of our vision to lead the global fashion e-commerce market. Whilst this will require continued investments in people and infrastructure, we believe that the benefits of our multi-brand platform will continue to generate economies of scale, allowing us to target sales growth of 25% per annum, with an adjusted EBITDA margin of around 10% over the medium term.

My view

Overall, I have a positive impression of boohoo and its prospects - it's hard not to! It is still taking business away from the High Street, and should continue to do so.

However, it won't surprise any of you that I am currently priced out of this share (there is a reason why I was asked to help with the "Small Cap Value Report"!).

Specifically, I think that 19% diluted EPS growth is perhaps as good as it's going to get here in the short to medium-term (given how much of the growth is owned by the minority PLT shareholders), and therefore a forecast rolling P/E ratio of 44x (according to Stocko) looks difficult to justify, to me. The share price is more than 70x the EPS figure which has just been reported.

Taptica International (LON:TAP)

- Share price: 145p (-9%)

- No. of shares: 134.7 million

- Market cap: £195 million

Launch of Secondary Placing in Taptica

A large group of insiders are getting out of Taptica to the tune of 14.3 million shares, i.e. more than 10% of the company. An accelerated bookbuild is underway, so there should be news about the destination of shares soon.

It's yet more discomforting news for small shareholders who have seen the TAP share price dribble lower over the past 18 months.

Note that the forecast P/E ratio is allegedly just 5x. Why would all of these insiders want to sell at such a ludicrous valuation, with the company enjoying plenty of cash on the balance sheet and about to complete a "transformational" merger?

I have no interest in studying this, as it continues to stink badly.

Note that shareholder cash will probably end up being used to help the insiders offload, through the share buyback programme.

Loungers IPO

Placing and Proposed Admission to AIM

More details on the IPO by Loungers, with the publication of an admission document.

I don't have the time to read this document but I wouldn't be in a hurry to buy this anyway. The proposed enterprise value after admission (after outstanding debt has been repaid) is £212.5 million, or nearly £1.5 million per existing site. It currently has 146 venues.

Between 20 and 25 sites have been opened per year in the last few years, and the company is targeting another 25 p.a. in the medium term.

That sounds realistic for a couple of years maybe, but the potential it sees for 500 sites looks a bit far-fetched, given that:

1) the company will be in a net debt position after the IPO, so it would need a lot of consistent, internally-generated cash flow to fund all of those openings (or a lot of borrowing).

2) finding 350 new locations which are as attractive as the c. 150 they already have will not be straightforward.

As far as its competitive positioning goes, I've noted elsewhere that Loungers competes "with every element of the trade of a pub chain, coffee shop, or restaurant, whereas each of those operators only competes for a part of Loungers' sales" (the company's own words).

This doesn't sound like a strong competitive position to me. Indeed, it sounds more like a community centre than a money-making opportunity to me - community centres tend to be non-profit enterprises!

I'll watch this safely from the sidelines.

Frontier Developments (LON:FDEV)

- Share price: 1036p (+1%)

- No. of shares: 38.7 million

- Market cap: £401 million

People have been wondering what the next video game franchise from Frontier might be - now we have our answer.

It's called Planet Zoo - and here's the trailer. It looks fun! Maybe a bit like my old favourite Theme Park, except about 1000x more advanced.

Thanks everyone, that's all for today.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.