Good morning, it’s Paul & Jack with the SCVR for Wednesday.

Agenda -

Volex (LON:VLX) - possible buying opportunity on spike down?

Best Of The Best (LON:BOTB) - another strong trading update. Takeover bids have been ended. Finncap upgrades profit forecast by 79%!

Angling Direct (LON:ANG) - year end trading update, and a mild profit warning for H1 for known reasons. Potentially interesting growth company.

Town Centre Securities (LON:TOWN) - resilient property portfolio trading at a discount to net tangible assets (this section from Jack)

.

Small Caps - price volatility

We’ve been having some interesting discussions here this week about the impact of IG’s decision to abruptly withdraw from offering about 900 leveraged products, mostly small caps. The reason is that they’re not making enough money offering these products, so are ditching them in order to focus on higher margin things. The problem apparently is that people like me sit on spread bets for small caps for long periods, often years, which ties up IG’s capital, for a paltry return (just a small profit margin on the funding charges).

Fair enough I suppose, it’s up to IG to decide which products they offer.

What I think is terrible, is how they’ve handled it, giving people only a week to stump up 100% margin by this Friday, on affected shares, then closing those positions anyway on Monday. Or you can buy out the share and put them in an IG owned shares account.

It’s terrible customer service, and they seem to think they’re too big and important to bother about what customers want or need.

It seems to be business as usual at Spreadex, who specialise in small caps, and hence I think a lot of people will be moving their business to Spreadex. I've done business with Spreadex for many years, and they've always been very fair, and supportive to me.

NB. I should emphasise that using leverage is extremely dangerous, and only suitable for experienced investors who know what they’re doing, and understand how to keep the gearing under control. Inexperienced punters should avoid spread betting at all costs in my view - it’s pretty much inevitable you’ll lose most, or all of your money. Probably quite quickly. I'm speaking from experience here!

Having a more general chat with my broker yesterday, he told me that market makers have been swamped with volume lately, and at times are turning off their RSPs (a system for quick & improved prices, for smaller trades in small caps). This is causing backlogs in getting deals done. When I placed an order with my usual telephone broker yesterday, he replied “I’ll try, but they’re not picking up the phones at the moment” (meaning the market makers).

So there’s definitely something funny going on at the moment, with the system seemingly struggling to cope with volumes, and large numbers of new accounts - I’m told that IG were seeing 6,000 new customer accounts being opened every day in February so far.

At some point recently, the stock market seems to have turned into a giant casino, with lots of new entrants punting on anything, and not necessarily understanding the fundamentals at all. Obviously that's happened in a much bigger way in the USA, with all this Reddit, Gamestop nonsense. There's nothing plucky or praiseworthy about anyone manipulating share prices, and they're breaking the whole system, causing brokers to withdraw products for more serious people like us. Maybe it's (at least partly) because sports betting isn't available as much at the moment?

It all sounds very much like top of the bull market stuff, just like 1999 actually. Everybody keeps making tons of money, until it all goes horribly wrong, sooner or later. I’ve no idea when that point is likely to happen, nobody knows. Maybe not for a while though, these things can run & run.

What I’m getting round to saying, is that we are seeing some peculiar price volatility, which might provide some good opportunities. Talking of which...

Volex (LON:VLX)

(I hold)

305p (down 5% yesterday, more intra-day) - mkt cap £464m

One share which caught my eye yesterday, is my 3rd largest portfolio holding, Volex . The fundamentals of the group are tremendous I reckon, with strong growth, combined with modestly priced acquisitions, meaning that the forward PER is only in the mid to high teens, despite the share price having been very strong in 2020. The share price may have tripled in the last year, but I think the fundamentals have fully justified this. It's not just soared to a bonkers PER like so many other things.

.

Despite this, in recent days, the share price suddenly plunged from where it looked stable at c.350p, to an intra-day low yesterday of about 280p. It just went into freefall. There wasn’t any news from the company, and it wasn’t on IG’s list of shares being removed from their system. For whatever reason, somebody was dumping Volex shares very aggressively, and it looked like panic selling to me. So I started buying, as I’m confident the company is a very good long term investment, hence I want to buy the dips, especially if someone is giving me the chance to buy 20% cheaper than a few days ago (when it wasn’t expensive to start with). If there's some temporary bad news, it doesn't matter to me, I'll ride it out, and buy more again.

The only reason I could find for the share price plunge, is that raw material copper price has shot up in price recently on world markets. Maybe this has spooked some investors in Volex into selling? Then I remembered something from the interim results webinar, which is still available here on InvestorMeetCompany, which talked about how the company hedges its copper exposure. So I’ve listened back to it, and jotted it down. This is what was said (in Nov 2020) - starts at 33m50s in the recording.

Question - How does the forecast increase in copper prices impact on margins? To what extent can you use pricing power to pass on those cost increases to customers?

Answer (Jon Boaden, CFO) - H1 (Apr-Sept 2020) benefited from lower copper prices. We had budgeted for $6k per tonne, but it fell as low as $5k in Q1.

We do hedge some (not all) of our copper exposure.

We also pass on a lot of our copper exposure to our customers.

Most customers have contracts that will re-price either quarterly or annually.

In a relatively stable market, this isolates us from most of the risk re copper, without being too onerous for our customers.

When the copper price is moving very significantly, with lots of volatility, that does mean we’re left with some risk.

In H1 we had risk of $0.3m to $0.4m, with quite large copper price movements.

We’re predicting high global demand for copper, and there are still some supply restrictions, especially in parts of The Americas.

So we’re expecting the copper price to be higher in H2, which will impact margins, but it’s quite hard to quantify, because it depends where prices settle.

[Source: InvestorMeetCompany presentation, 12 Nov 2020, from 33m50s]

I also remember that the CEO indicated some time previously that Volex can pass on copper price rises to its customers, but with a time lag. Hence it seems that the large rise in the copper price would hurt Volex’s margins only temporarily.

My opinion - this looks like it might possibly be an interesting opportunity. Volex has bounced a bit, and settled at about 305p. Broker consensus is for 20.9c in FY 03/2021 and 25.6c in FY 03/2022 (driven by the big recent acquisition kicking in for a full year). That’s sterling equivalent of 14.9p EPS and 18.3p. So at 305p per share, the PER is 20.5 and 16.7 - to my mind that’s attractive value for a business which is on a very good upward trajectory for earnings, is cash generative, and has a strong balance sheet. Plus there are 3 more acquisitions in the pipeline we’re told on the webinar, with management emphasising they don’t overpay for any acquisitions.

Another possible issue is that Volex provides the charging cables for Tesla cars. Hence the share price of Tesla taking a recent knock might impact sentiment re Volex? That would be completely irrational though, because Tesla's share price doesn't impact its purchases of charging cables at all! Also the thing investors like about Volex is the likely proliferation of electric vehicles with many other manufacturers, meaning Volex has a rapidly growing, potentially huge growth market in front of it.

I could be wrong, as it’s always educated guesswork with shares, but it seems to me the sudden spike down in Volex is probably more of an opportunity than a threat. Crucially, higher copper prices were already planned for, partially hedged, and the residual impact can be passed on to clients with a time lag under existing contracts. Therefore it really shouldn't be a problem at all for longer term investors. It might spook some short term traders though.

Therefore, even if H2 figures do disappoint, it doesn’t really matter because everything seems to be in place to recoup any lost profits from customer price increases.

I'm interested to hear what readers think, so as always please do add a comment if you have a view on this.

.

Best Of The Best (LON:BOTB)

(I hold)

2450p (pre market open) - mkt cap £230m

Trading Update & Conclusion of Formal Sale Process

Best of the Best plc, (LSE: BOTB), the provider of online competitions to win cars and other prizes, is today pleased to provide an update to shareholders on the continuing strength of trading through the third quarter of the financial year ….

Trading update - Strong trading continues, following staggeringly good interim results which showed H1 PBT of £6.8m (up 393% on £1.38m in H1 LY). It made 59.8p EPS in H1. Therefore the existing forecast for FY 04/2021 of 69.8p looked far too low.

Finncap has this morning upped profit forecast by 79% to £14.0m for FY 04/2021, or 125.2p EPS. That shouldn’t surprise anyone who was paying attention to the RNSs! It implies no incremental profit growth from H1 to H2, so could still be beaten. The company does tend to hold something back.

This means that BOTB must have one of the strongest trajectories of profit growth of any company on the market right now. Yet the PER is only 19.6 times the upwardly revised (and probably still cautious) forecast for this year.

The only question is how much lockdowns have boosted business, which is entirely online these days (no airport sites remain)? This management comment suggests that they don’t see strong trading as a one-off -

The Board is confident in the Group's position and outlook for strong, sustained returns….it remains on track to outperform its previous management expectations driven by the traction of the pure online model and increased confidence in marketing investment.

Strong trading and ongoing efficient cash conversion are reflected in the Group's increased cash balances which remain in excess of £10 million following the payment of the special dividend totalling £3.75 million on 5th February 2021.

Takeover bids - these are off, no great surprise there, as the process had dragged on for so long, there can’t have been many people who expected a bid approach to turn into an actual bid. Also, with performance so strong, why would we want to sell out? I’d rather the company remain independent.

I wish the company had given some indication of what price level the possible bids had been at. This is not stated in today’s update.

My opinion - I’m hoping for a spike down in price today, because (as mentioned before here) I want to buy more BOTB shares. There’s also the issue of it being on IG’s list of stocks that it is ceasing to provide spread bets on, on Monday coming. So I’m in the unusual position of hoping for a sharp spike down in the price of one of my holdings today! I won’t be the only one trying to buy, I suspect.

.

Angling Direct (LON:ANG)

74.5p (down c.6%, at 13:26) - mkt cap £57m

Here are my notes from the last trading update on 21 Dec 2020. This guided us towards >£3.8m EBITDA (equivalent to 2.8p adj EPS) for FY 01/2021. The balance sheet is very good at this share, so I’m starting off this latest section with a mildly positive overall opinion.

Trading Update today -

Angling Direct plc (AIM: ANG), the leading omni-channel specialist fishing tackle and equipment retailer, provides the following update in relation to trading for the financial year ended 31 January 2021 ("FY21"), ahead of announcing its Final Results on 11 May 2021.

- Revenues of £67.6m for FY 01/2021 (up 27% on LY despite lockdown disruption of intermittent store closures)

- Online revenues are 52% of the total at £35.3m (up 40% on LY)

- Stores LFL sales (a key metric) were only down 8%, which I think is good considering 30% of the time was impacted by lockdowns.

- Operational improvements are explained.

Overall -

As a result of these actions and the strong trading performance in line with recently upgraded market expectations, the Board expects to report a pre IFRS-16 EBITDA of at least £3.8m for the year, a significant improvement on the prior year (FY20: pre IFRS-16 EBITDA loss of £0.5m).

That’s the same EBITDA figure as mentioned above, from the 21 Dec 2020 update. It’s a little dressed up, to sound more positive than it is, so important to emphasise this is in line with expectations.

Cash position - at year end is strong: £15.0m. I’d want to see the full balance sheet, and see if there’s been any creditor stretch.

Current trading & outlook -

Lockdowns still in place, as we know, but I see this as temporary so can be looked through.

Logistics - post-Brexit, and Far East supply disruption mentioned.

H1 profit warning, but not quantified -

Notwithstanding the current abnormal trading conditions which will impact the first half….

No guidance provided for FY 01/2022 at this stage.

My opinion - this is a bit of a mixed bag. There shouldn’t be any surprises about logistics disruption, that’s a widespread problem currently, and lockdowns are hopefully just temporary. Overall then I see this update as being neutral.

Many thanks to Matthew McEachran of N+1 Singer, for publishing today a research note with forecasts for FY 01/2022 and next year. The numbers look quite cautious, with EPS of only 1.8p and 2.1p, so I imagine there might be upside on those, if as we hope, covid is finally sorted out this year through vaccinations. On the downside, we have to remember that in the future businesses probably won’t have the support of furlough or business rates support, and possibly higher corporation tax too, which means that revenues & margins will need to rise a lot just to stand still on profits.

Overall, at £57m market cap, with plenty of cash on the balance sheet, I think ANG shares look quite good. I like the split of sales, half physical stores, half online. Also it has some European online sales too, which might be tricky in terms of fulfilment at the moment. There isn’t much profitability at the moment, but that’s normal for smaller, growing companies. Once better scale has been achieved, then profit margins can rise, as things like online marketing spend deliver better results at a lower % of sales. That has been successfully achieved by Gear4music Holdings (LON:G4M) (I hold) for example.

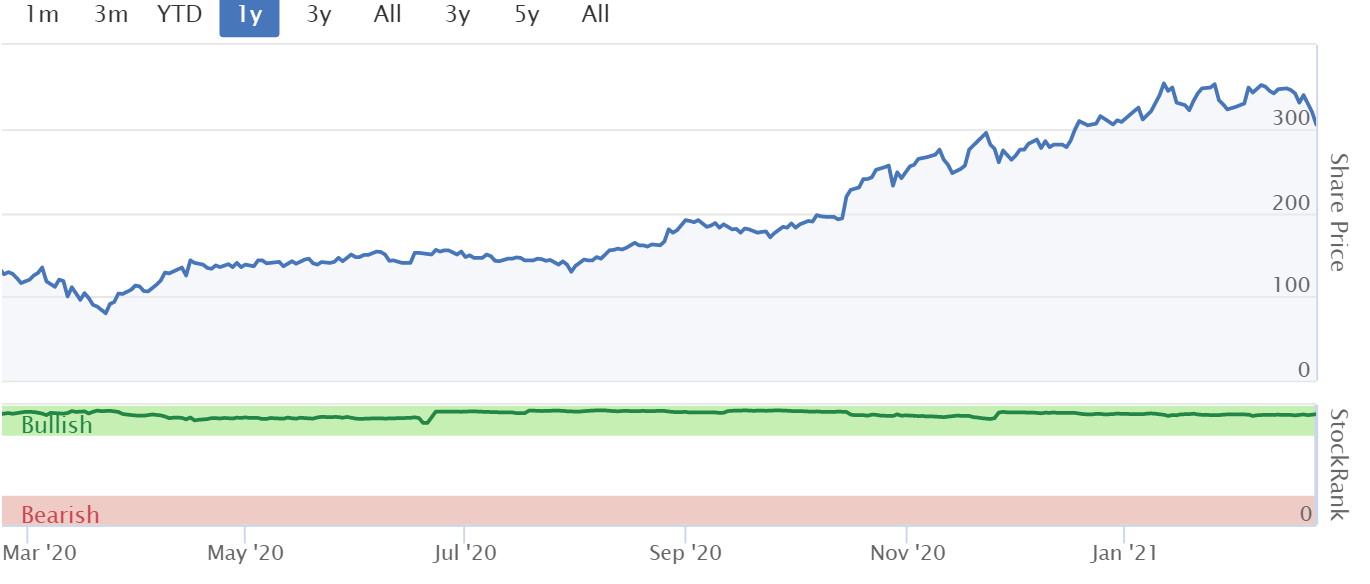

Note below how over 3 years, the StockRank seems to have decisively moved from low rank, to high rank, which seems to be the Stockopedia computers signalling to us that this has moved from a bit of a punt, to a proper business with potential.

I’ll take a look at the next set of numbers, when they’re published, but am broadly positive on this share at the moment.

.

Jack's section

Town Centre Securities (LON:TOWN)

Share price: 110.35p (+0.32%)

Shares in issue: 53,162,000

Market cap: £58.7m

Here’s an off-the-radar stock: Town Centre Securities (LON:TOWN) . It develops properties and runs car parks in Leeds, Manchester, Scotland, and London. It focuses on mixed use developments close to transport hubs in these areas.

With all this talk of reopening economies, this company continues to languish. Net asset value is quoted at around £150m but the group’s market cap is closer to £60m.

It’s a family business, run by the Ziffs. Head over to Major Shareholders and you’ll see the name pop up a few times.

The chairman and CEO is Edward Ziff. He’s been at the company since 1981, on the board since 1985, and CEO since 2001. Ben Ziff is the managing director of CitiPark. He joined TOWN in 2008 and was appointed to the board in 2015. Then you have Michael Ziff as a non-executive director. So this is certainly a dynamic to be aware of.

There’s long-term vision here, although that can sometimes translate into an overly cautious approach for those hoping for substantial capital gains. Nevertheless, value is on display. The group trades at a substantial discount to net tangible assets and free cash flow is resilient.

Stockopedia classifies it as a Value Trap, lacking in Quality and Momentum. But, then again, it qualifies for the Momentum-focused Bold Earnings Revisions Screen and brokers have it as a Buy to Strong Buy.

Highlights:

- Portfolio valuation down 0.8% from June 2020

- Statutory net assets of £152.0m or 286p per share down 2.3%

- EPRA (European Public Real Estate Association) Earnings before tax of £0.2m (HY20: £4.1m), driven by an estimated £3.2m COVID-19 impact. £2.3m of this comes from lost car parking income and fixed costs.

- Statutory loss before tax of £3.5m (HY20: loss of £0.2m) and statutory loss per share of 6.6p (HY20: loss of 0.4p), including an unrealised £2.5m portfolio valuation and impairment movement

TOWN has been selling assets to reduce its debt level. £41.2m of targeted retail asset sales during the first half has reduced absolute borrowing levels 20% to £147.6m at December 2020. Loan to value has come down from 53.2% to 48.6% as at 31 December 2020. The group is paying an interim dividend of 1.75p, although this is down from 3.25p.

Rent receipts ‘remain robust’ but have come down slightly, from 89% to 87%.

Conclusion

Tricky conditions, but TOWN has managed to sell the assets it wants to sell at close to June 2020 valuations. That bodes well for the remaining portfolio, which is presumably of higher quality.

Meanwhile, the group’s pipeline has an estimated gross development value (GDV) of over £600m and ‘is a valuable and strategic point of difference for TCS’.

The chairman and CEO comments:

Overall, we remain committed to delivering on our accelerated four pillar strategy of: actively managing our assets, maximising available capital, investing in our development pipeline and acquiring and improving investment assets to diversify our portfolio.

So it could be worth investigating for those looking towards a recovering economy. You might need to be patient though. TOWN has a resilient and diversified portfolio of property assets, is prudently run, and looks to have a significant development pipeline.

Shares are now 110p and as recently as 2019 the group was paying out 10p in total dividends. These payments are forecast to recover.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.