Good morning, it's Paul & Jack here again today.

Mello Update - Day 1 of the main show is underway as we speak. David has said it's sold out for today, but there are few remaining tickets for tomorrow discounted to just £40, using code: M2240 - here.

Agenda -

Paul's Section -

Driver (LON:DRV) - from 2 days ago, I give my view on the Middle East region restructuring. This share looks an interesting special situation, and I see more upside than downside, a thumbs up from me. Although the tiny market cap, and concentrated major holdings, mean liquidity is probably very thin.

Eleco (LON:ELCO) - a reassuring, in line update. However, the valuation looks much too high, given that profits are now falling.

Hollywood Bowl (LON:BOWL) - as expected, very strong interim results. Outlook comments indicate strong trading is expected to continue in H2, no sign of a downturn (yet, anyway). It looks reasonably priced, has plenty of cash, plus announces an entry into the Canadian market today. In normal markets, I would give this a firm thumbs up, but due to macro worries, probably a more tentative thumbs up today!

Jack's Section:

Zotefoams (LON:ZTF) - a reassuring update which sees the company using price increases to recoup inflationary costs. The group has invested significant amounts of capex into its operations and has IP-backed products, so it’s possible that future results look much better than historic figures. Given the shares have fallen by about 60% over the past year, it could be worth re-evaluating.

Mortgage Advice Bureau (Holdings) (LON:MAB1) - strikes me as a good company, highly profitable, with a strong Quality Rank. I do wonder how market sentiment might play on the share price in the shorter term, given rising rates and the potential impact on housing demand. But there are factors offsetting that, including high employment and inadequate supply.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Driver (LON:DRV)

31.5p

Market cap £17m

This minnow has bounced from a recent low of 24p, and readers helpfully flagged up that I’d missed a positive-sounding update. So I took a look after hours yesterday, here are my notes.

I last looked at DRV here in March 2022, and despite a profit warning, I concluded that it might be worth a punt, whilst also questioning why something so small was listed on the stock market at all?

This profit warning in March flagged a problem contract in the APAC (Asia-Pacific) region, and “an unexpected drop in revenues in the Middle East regions”.

Restructuring was said to be “starting immediately”, with £1m cost savings identified, with a “significant improvement” expected for H2 trading.

The CFO resigned.

Moving on to the latest announcement, which came out 2 days ago -

Driver Group plc (AIM: DRV), the leading global professional services consultancy to the construction and engineering industries providing multi-disciplinary consultancy services including expert witness, claims and dispute resolution services, today provides an update on its operational review in the Middle East region, and in particular the UAE.

25 employees in the M.East will be moved to an unnamed counter-party on 1 June 2022, leaving 9 remaining fee earners.

This avoids employment termination costs, so seems to be a good solution for this problematic region.

Receivables book in the M.East is £3.5m, of which DRV will receive £2.0m up-front from the counter-party, and it will assist in collecting the remaining £1.5m. That sounds to me as if there must be some disputed invoices, and a third party presumably won’t be terribly motivated to collect that in for DRV, so I reckon there could be an exceptional write-off to follow, for at least some of that £1.5m.

Annualised cost savings are £3m, better than the previous expected £1m. However, bear in mind DRV will also be losing future revenues, since it’s getting rid of most of the M.East staff, so it’s not clear how comparable these numbers are, in terms of overall profit benefit.

Interim profit guidance unchanged, at £0.3-0.5m for H1.

No full year guidance, as overall benefit of restructuring will take time to work through - that strikes me as rather weak.

Working capital will reduce.

Projected net cash of £5.3m (material to the £17m market cap) will be more than required, so actively looking at returning surplus cash to shareholders (special divi, and/or buybacks). Whilst good, this also emphasises that there's not much growth potential.

Outlook - my summary -

- Higher utilisation (i.e. more fees from each employee)

- Significantly improved profits

- Improved certainty on M.East collection of receivables

- Substantially de-risked M.East region

My opinion - this update is a little vague in parts, but overall it seems a positive down-sizing of a problem region, without termination costs.

At a guess, shareholders might get say 20% of the current share price as a special divi and/or buybacks, so the business is only being valued at c.£13-14m. That looks cheap, given that historically it’s made £2-3m p.a. profits.

My worry remains that this business seems very small to be listed, and might be better off in private ownership. Although that could be a catalyst for selling the company, once it’s been restructured?

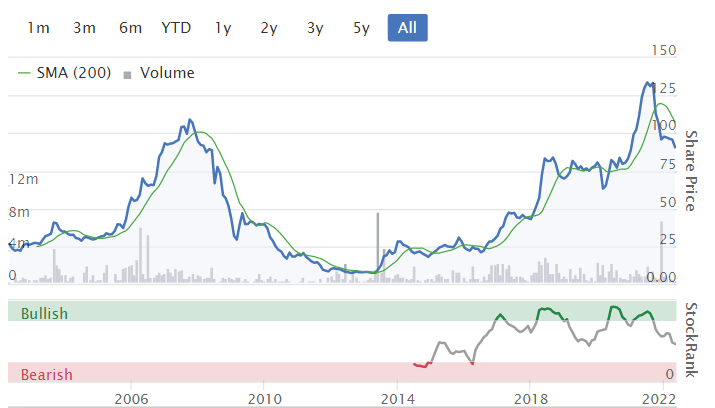

At the current tiny market cap, and a concentrated shareholder register, maybe the “for sale” sign might go up? I think there could be reasonable upside here, so it gets a thumbs up from me, as a recovery situation, and possible takeover target maybe? Probably not one to hold long term though, as it's gone nowhere in 16 years, as you can see below. This looks more of a trade, for a re-rating or takeover bid, I would say.

.

.

Eleco (LON:ELCO)

88.5p (little changed today at 08:50)

Market cap £74m

Eleco Plc (AIM: ELCO), the AIM-listed construction software specialist…

The current financial year is FY 12/2022.

Today’s update is nice and clear, and looks OK -

.

Actively seeking acquisitions.

Transition to SaaS is causing temporary softening of revenue growth - that’s fine, lots of software companies are doing the same thing, which makes future revenue/profit more stable, in return for a short-term reduction in one-off licence fees.

Outlook - reassuring -

The board remains confident in delivering results in line with market expectations for the full year."

Valuation - this is the difficult bit. Forecasts from Finncap (many thanks) and Equity Development show a considerable fall in profitability from c. £5m in 2020 and 2021, to just c.£3m in 2022 and 2023.

That’s about 3.0p EPS this year, so a PER of 29.5 - that’s too expensive in my opinion, given that we’re in a bear market, and the macro environment is unclear. Although the business should be more protected from any downturn, from recurring, SaaS revenues. Whereas in the 2008 recession, the ELCO share price collapsed, and lost 90%+ of its value until bottoming out in 2013.

My opinion - given that we’ve seen so many share prices plunge hugely in the last 9 months or so, I’m being super-selective for any new purchases.

ELCO looks really expensive to me, for a non-growth company, that’s seeing falling profits. Why would I pay a PER of nearly 30 times, and then sit and wait for several years for earnings to start rising? When there are so many other bargains around?

It doesn’t make sense to me, so in the harsh new environment we find ourselves in, I think we need to be much more sceptical about valuations, and this one looks like it could drop by a third to a half from current levels before even starting to look good value to me.

Remember that tech companies are facing big rises in staff costs, so with no revenue growth, that’s not a good situation to be in. The last balance sheet showed NTAV of only about £2m, but like most software companies it has favourable working capital, getting paid up-front, hence the cash pile.

Hopefully some growth can be bolted on via acquisitions.

On the upside, software companies are often acquired for their strategic value, and client relationships, so a takeover bid might come along, who knows? But on a standalone basis, I don’t see this share as good value.

.

.

Hollywood Bowl (LON:BOWL)

247p (up 4% at 09:53)

Market cap £422m

I remember writing something positive about this bowling chain recently, and have looked it up in the archive - it was here on 8 April, with a very good (ahead of expectations) H1 trading update, benefiting from pent-up demand. It also had a strong balance sheet with plenty of net cash, expansion plans, and looked reasonably priced on an estimated (by me) PER of about 14.

There are 2 announcements today -

Of Teaquinn Holdings Inc, a Canadian bowling operator. I think it’s correct that BOWL currently only operates in the UK. The acquisition is only small, at £10.6m, 80% payable now, and 20% deferred. This can be funded from BOWL’s existing cash pile. It operates 5 large sites (2 are freehold), with potential for 10 new sites over the next 5 years. It made a 22% EBITDA margin prior to covid. It’s now trading above 2019 comps. The price is 6.3x EBITDA for FY 12/2021, which looks a good deal. BOWL says the Canadian market is fragmented & ripe for consolidation.

This strikes [geddit?!] me as an interesting deal, with a credible explanation, and some limited figures provided today. Canada seems to open up a new growth avenue, and I can’t imagine there being much difference between how bowling sites operate in the UK and in Canada. Especially as existing management are staying on, and incentivised with a 2025 earn-out.

Hollywood Bowl, the UK's largest ten-pin bowling operator, is pleased to announce its Interim Results for the six-month period ended 31 March 2022 ("H1 FY2022").

I’ve not seen this before, but BOWL provides a very useful table showing the benefit of temporarily reduced VAT during the pandemic. This is great transparency, as it allows us to see the underlying profitability now that VAT has returned to normal -

.

As you can see, there’s a substantial £8.9m benefit to statutory revenue, which was money that would otherwise be payable to the Govt. This doesn’t tie in with a reduction in VAT from 20% to 12.5%, so I googled it, and discovered (I’d forgotten!) that leisure had a deeper reduced VAT rate of just 5%.

This £8.9m benefit should just flow straight down to profit before tax, which it roughly does, boosting statutory profit before tax by £8.6m.

My only query is why the EBITDA numbers are only boosted by £3.0m, which doesn’t look right to me. I’ve just emailed the company’s advisors to ask why the EBITDA figures show a much lower VAT benefit, only for it to reappear at the profit before tax level. It’s just a detail point, nothing too important.

Revenue growth of +26.8% on pre-pandemic, on a LFL (same store) basis is outstandingly good, but previously reported in the 8 April trading update, so not a surprise.

Dividend - resumption, with a 3.0p interim divi.

Outlook - we know H1 was superbly profitable, but the big question is whether that’s sustainable, especially given the growing disposable income squeeze, which is particularly hitting poorer households, less so for the middle class who can get decent pay rises, and who have a lower rate of inflation because food/energy are a lower proportion of their outgoings.

So any downturn may not necessarily be as gloomy as investors currently seem to think.

Add in another package of support measures from Govt which seems imminent. Let’s hope they’re a bit more decisive this time, rather than tinkering around the edges. The core problem is that energy bills are rising too much, and fast, so it seems to me direct policy measures to get those bills down, is the best approach. That would also have the knock on benefit of trimming the overall rate of inflation, thereby reducing the Govt’s index-linked cost increases (e.g. benefits & public sector salaries). They don’t seem to have thought about that yet!

Here’s BOWL’s all-important outlook statement today -

While we are mindful of the challenges many of our customers are facing in this higher inflationary environment, we continue to provide great value for money. This clearly resonated with our customers in the first half of FY2022 and I am confident this momentum will carry into the second half of the year.

We will continue to invest in all areas across the business which, coupled with our sustainable growth strategy, gives the Board confidence in the outlook of the business.

I am encouraged by the progress we are making with our key strategic priorities, and we are on track to meet Board expectations for the full year.

That sounds good to me. We always have to read between the lines with outlook comments, and take into account management track record of being realistic, or delusionally positive! I get the impression mgt at BOWL seem pretty straightforward.

Bear in mind that Restaurant (LON:RTN) (also discretionary spending) said something similar this week - demand is holding up well.

Therefore I’m leaning towards the view that, so far anyway, the much vaunted spending crisis doesn’t seem to be impacting the best in class operators.

Also, I think surveys where consumers say what they’re going to cut back on, are pretty worthless. The reason being that people tend to answer surveys in line with what they think they’re supposed to say. What they actually do, can be very different indeed.

From all the information that we get bombarded with, it seems to me households still want to enjoy experiences, especially holidays, and leisure. Maybe they’re cutting back on buying other stuff? So a reversal of what happened in the pandemic, when we couldn’t enjoy experiences, so people sat on the internet buying all sorts of things (guilty as charged!).

It’ll become clearer in time, but my only conclusion is that it’s incredibly difficult to predict which companies are going to blame the spending squeeze for under-performance, and announce operationally geared plunges in profits, and which companies will sail through the choppy waters with barely a scratch. That’s making me think more in terms of focusing on quality operators, rather than companies that are already struggling, but blaming external factors.

Valuation - the forward PER is about 15-16, but that’s based on forecasts which I reckon are still light. So the actual PER could turn out to be lower.

My opinion - BOWL shares have held up very well, in a nasty bear market - with a couple of spikes up, but essentially sideways over the last year. Very good, considering the carnage in most consumer-facing shares.

So it gets a tentative thumbs up from me again, but obviously holders will be fully aware that macro developments could prove difficult in the short term.

It's unusual to see a consumer share which has not wilted in the last 6-9 months -

.

.

Jack’s section

Zotefoams (LON:ZTF)

Share price: 302.12p (+6.01%)

Shares in issue: 48,621,234

Market cap: £146.9m

Trading update for the four months to 30 April 2022

Zotefoams owns and licenses cellular materials technology, which it develops and sells for industrial uses, recyclable barrier packaging, and more.

In line with the outlook statement in our 2021 preliminary results announcement, we have experienced good demand in the first four months of 2022, resulting in Group revenue for the period being approximately 13% ahead of the comparative period.

Polyolefin Foams sales increased by 20% with volumes up by 5%, so the majority of the sales uplift has been driven by increased prices

High-Performance Products (HPP) sales increased by 6%. Within this range, Footwear sales were at similar levels to last year, Aviation sales improved ‘from a low base’, and T-FIT® insulation products sales increased by 18%.

On the challenging macro environment, Zotefoams comments:

The macroeconomic environment remains difficult, with input cost inflation both significant and unpredictable and supply chains prone to disruption. We have been reacting to input-price movements by increasing our selling prices as well as focusing on internal efficiencies and controllable costs, while proactively implementing actions to mitigate supply chain risks. There has been no material disruption to the Footwear supply chain or to our major facilities in the UK, USA and Poland, although there was a 5-week enforced shutdown of our China T-FIT facility due to COVID-19.

I’m not surprised that Zotefoams has been able to push through some price increases given its intellectual property and patents over some of the lightweight foam products, but it’s good to see concrete evidence of its ability to do so.

Outlook

While it is still early in the year, we anticipate Group revenue to be ahead of market expectations for the full year, with demand in line and higher prices recovering cost inflation. Current foreign exchange rates, net of hedging, may also provide some additional benefit. Consequently, we are comfortable with expectations for growth in profit and remain confident about the long-term prospects of the business.

Higher revenue and in line profits - that sounds in keeping with the group’s use of price increases to recover cost inflation.

Conclusion

The shares remain well off their all time highs, set in 2018 under altogether more bullish market conditions.

But this update strikes me as decent and, although current year earnings forecasts have come down, I suspect the quality of Zotefoam’s products and technology will put it in a better position than some other firms out there.

So at c17x forecast rolling earnings it is becoming more interesting, although I wouldn’t say it is cheap. The group has been investing heavily in its operations in recent years, which has impacted ROCE measures but this period of investment appears to be tailing off. Relying on solely on a PE ratio does not reflect medium term growth prospects.

Higher revenue and less capex should lead to higher returns on capital in future, assuming Zotefoams can handle what is no doubt a difficult and evolving macro environment. It has intellectual property and patents and has also invested in a significant operational expansion, so I think that at these lower levels the shares are worth looking at more closely.

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Share price: 981p (unchanged)

Shares in issue: 57,014,144

Market cap: £559.3m

Adviser numbers have continued to grow since the final results on 28 March and are up 9% year to date to 2,046.

The current pipeline of incoming new Appointed Representatives and advisers is strong, as is our pipeline of written new business that will complete over the coming months. New customer leads are up, which should deliver further market share growth.

MAB's mortgage completions for Q1 2022 were £5.8bn, representing an increase of 11% on a notably strong Q1 2021 (which in no small part was driven by stamp duty relief) and 44% on Q1 2020. We are pleased with this performance, especially when compared to the exceptional market performance we saw in the first half of 2021.

… As expected, increases in interest rates have stimulated more refinancing activity, with mortgage borrowers now more motivated than ever to secure the best rate possible to help their household budgeting.

Conclusion

The property market is hugely important, so this is a good opportunity to get some commentary on this part of the economy. People are still moving homes, despite macro concerns. Consumer demand for housing remains high and activity is strong.

The resilience shown by people who continue to move home is helped by the fact that employment is high, household savings are high and for those who are subsequent movers, housing equity levels have also risen over recent years. Although interest rates have risen and will most likely continue to rise over the next 12 months, current interest rates remain near historical lows. Lenders also have strong liquidity levels, meaning mortgage availability is now close to pre-pandemic highs, thereby helping the market to remain buoyant.

I’ve highlighted possibly the most important dynamic that could lead to some form of housing market slowdown. This must be balanced, though, against high levels of employment and a strong supply-demand picture. It’s an area that requires some deeper thought as the effects of how this all plays out could be profound.

Mortgage Advice Bureau itself is a highly profitable company with a Quality Rank of 98 and a share price that remains well above its pre-pandemic highs.

Its ROCE measure is among the best in the market, but the company has also been operating in an historically unusual interest rate environment which is set to change. A good company, but I wonder if rising rates and future property market headlines will at some point make for a better entry point?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.