Good morning from Paul & Graham!

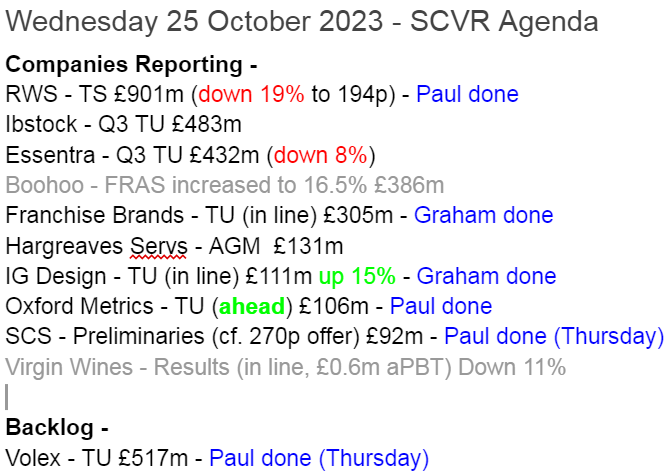

Graham was too mentally frazzled from untangling yesterday's profit warnings to be able to do a YouTube show! But he's preparing for his 11:30 live (and recorded) update today as I type this - here's the link

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Oxford Metrics (LON:OMG) - 82p (pre market) £107m - Trading Update (ahead) - Paul - GREEN

This very cash rich group is trading well, about 9% ahead of expectations, with clear guidance provided today. Bear in mind that about half the profit probably comes from finance income on the cash pile. Should be a good day today, I think this one is heading up 10-15% (and I haven't checked the price yet, no cheating!).

IG Design (LON:IGR) - up 16% to 130p (£127m) - Trading update (in line) - Graham - GREEN

I remain positive on IGR after an “in line” trading update. The key point is that the company’s aspiration to restore operating margin to pre-Covid levels is unchanged. Through cost-cutting and pricing initiatives, and exiting unprofitable contracts, this remains their goal.

Franchise Brands (LON:FRAN) - down 7% to 146.8p (£285m) - Trading update (EBITDA in line, EPS down) - Graham - AMBER

Today’s announcement includes variations of the phrase “in line with expectations” four times, but that strictly applies to EBITDA, not to items further down the income statement. Higher interest rates have impacted EPS expectations. I retain my neutral stance.

RWS Holdings (LON:RWS) - down 17% to 197p (£750m) - Year End Trading Statement - Paul - GREEN

This detailed update for FY 9/2023 strikes me as fairly solid, given tough macro. So I was surprised to see shares down 20%. Maybe there's something nasty buried in broker updates that we're not allowed to see? (I have been told Singers were unusually critical today). Today it says performance is within the broker forecast range (near the bottom, we can guess). Finances are sound, with generous shareholder returns, and still retaining net cash. RWS isn't perfect, but I'm sticking with green just because the value is becoming more and more striking, whilst performance is still at fairly healthy levels of profit and cashflow.

Paul’s Section:

Oxford Metrics (LON:OMG)

82p (pre market) £107m - Trading Update (ahead) - Paul - GREEN

Oxford Metrics (LSE: OMG), the smart sensing software company, servicing life sciences, entertainment and engineering markets, today provides the following update on trading for the financial year ended 30 September 2023.

Record Revenue and Adjusted Profit outturn for FY23

A huge sigh of relief is almost audible from OMG shareholders! The share price has fallen almost a third from a recent peak of c.120p in July, to 82p at close of play last night. I imagine it should find buyers today, and rise maybe 10-15% at a guess? (I like guessing before 8am, just for fun).

I think some investors might have been worried that the strikes in Hollywood, and a profit warning from a sector peer in high end cameras, might have impacted OMG too. Although its very large cash pile protects the downside considerably.

The general small caps market malaise at the moment, means that some investors are selling first, and asking questions later. Hence price moves are often due to panic or forced selling, not informed selling (sometimes!). This is creating buying opportunities in some cases, and traps in other cases when the selling actually is informed. Trouble is, we can’t tell which from which until companies report how trading is going.

This is the key part -

The Group expects to report revenues of £44.0m and an Adjusted PBT* of £6.3m, both ahead of current market expectations* for the financial year. The Group finished the year with a robust cash position of £64.8m and no debt.

*Oxford Metrics' compiled market consensus as at 24 October 2023 is as follows: FY23 Revenue £39.00m / FY Adjusted PBT £5.83m.

Excellent, clear reporting there - why can’t all companies do this? Tell us the actual profit (not EBITDA!), and provide a footnote saying what market expectations are.

So we have a nice beat here in adj PBT, with £6.3m actual, vs £5.8m forecast, about a 9% earnings beat.

Net cash of £64.8m is c.61% of the market cap! So what the company does with that cash in future is key. Also note that this cash pile should be earning interest income of (my estimate) about £3m pa. That’s almost half the reported profit.

Bear in mind that inflation of c.7% will have eroded about £4.5m of the purchasing power of that cash pile, which of course does not get accounted for. So I would say that accounting methods mean that arguably cash rich companies are overstating their real profits at the moment through finance income that is not even offsetting inflation. Worth bearing in mind.

EDIT: mammyoko makes a great point in the reader comments below, that whilst OMG's cash pile may have fallen in real terms when measured against general price inflation, it's not being spent on buying general goods. It's earmarked for company acquisitions, which might have become cheaper given macro conditions. That's such a good point, I think it deserves inclusion here, with a hat-tip to mammyoko. End of edit.

But I think most investors will probably ignore this. It’s also something to think about if central banks begin reducing interest rates - investor interest in cash-rich companies may wane, as their finance income recedes again maybe?

Outlook - also sounds good -

Following the Group's strongest-ever first half performance, momentum continued into the second half driven by a particularly strong contribution from the Engineering and Life Sciences segments. Vicon continues to see ongoing demand for smart sensing into yet more applications from new and existing customers alike and the new Vicon Valkyrie system launched late last year continues to stimulate demand.

The Group as a whole remains in a strong financial position which enables the business to pursue its organic growth and M&A objectives in the year ahead.

The Group starts a new financial year with a solid order book.

More detail will be provided when Oxford Metrics announces its Preliminary Results for the financial year ended 30 September 2023 which is expected on Tuesday, 5 December 2023.

Paul’s opinion - expect a pleasant day today if you’re holding OMG shares, and well done for not bottling it during the recent price fall.

We’re very keen on OMG here, I’ve viewed it as GREEN in all 3 times we’ve reviewed it in the last year, and today’s update certainly reinforces that. So it’s GREEN again.

Very nice risk:reward on this, although do bear in mind that the sparkling profit might have come (about half of it) from finance income on the cash pile.

Long-term chart looks nice, and a fairly high StockRank too -

RWS Holdings (LON:RWS)

Down 17% to 197p (£750m) - Year End Trading Statement - Paul - GREEN

RWS Holdings plc ("RWS" or "the Group"), a unique world-leading provider of technology-enabled language, content and intellectual property services, today provides an update on trading for the year ended 30 September 2023 ("FY23") ahead of the announcement of its preliminary results on 12 December 2023.

The story so far, according to previous SCVRs -

27/4/2023 - 266p (after a sharp fall earlier in the week) on a mild profit warning. Attractive valuation, 9.8x fwd PER, 4.9% yield, net cash. AI worries? It looked attractive value on the day, so I went with GREEN.

8/6/2023 - 240p (up 6%) on solid interim results, and news of a £50m buyback. Again, it looked good value to me so I went with GREEN again.

Remember that our traffic lights don’t necessarily have predictive ability. We’re just reviewing the 3 F’s on the day (facts, figures, and forecasts). Things obviously then change over time, sometimes in unexpected ways.

Generally though, companies that have sound finances, which are trading well, and reasonably priced, should do well over time, unless something goes wrong (as it often does!). Plus we’re seeing loads of takeover bids too for (mostly) good companies.

On to today’s FY 9/2023 trading update from RWS, which starts off with a positive headline that clearly the market doesn’t believe is giving the full picture (as shares are down 17% as I type this) -

Encouraging progress with growth initiatives, new client wins and continued strong cash generation

Performance for FY 9/2023 looks OK (in the context of a bombed out share price) -

The Group expects to report adjusted profit before tax within the range of market expectations1.

1. The latest Group-compiled view of analysts' expectations for FY 2023 gives a range of £738.1m-£757.4m for revenue, with a consensus of £748.8m and £116.5m-£129.0m for adjusted profit before tax, with a consensus of £125.8m.

That ties in with the StockReport’s forecast net profit of £94.7m (ie PAT). If I divide this by 0.75 (to add back an assumed 25% corporation tax), then it’s £126m adj PBT, almost bang on the consensus figure of £125.8m provided by RWS’s footnote above. It would be easier if the StockReport also showed the pre-tax profit, not just post-tax (“Net Profit”), so we could tie the numbers together more easily with trading updates and broker forecasts, without having to do any manual calculations. Hopefully a future update might address that?

“Within the range…” is more likely to be at the lower end, as others have commented this morning.

Annoyingly, we pond life private investors don’t get access to any broker notes through the only bore hole in the ice available to us, the marvellous Research Tree. Given that the share price opened down around 20%, then I think it’s safe to assume that professional/institutional investors who do receive broker notes might have seen something negative first thing.

Hopefully something might come through later.

Other points, I’ll summarise -

Improved efficiency (cost-cutting) to maintain profitability, with more planned.

Forex hedging helped.

Challenging market environment.

Revenue down 2%, or down 6% at constant currency, and ignoring acquisitions.

Slightly improving revenue trend (down 7% H1, down 5% H2)

High client retention & satisfaction scores, plus some new customers.

AI is positive for RWS (did a “Teach-In” [yuck!] recently on AI)

Recent acquisitions have started well.

Strong cash generation.

Net cash was £23m end Sept (down from £72m a year ago), despite £31m paid for acquisitions, and £66m in divis & buybacks.

Outlook - there’s not really any specific guidance provided, and I don’t have access to any broker notes. The last paragraph says it remains confident about the “long-term prospects”, which investors often interpret in bear markets as meaning they’re not particularly confident about the shorter term outlook. So I imagine we might see further reductions in earnings forecasts, possibly continuing this trend below maybe? Although to be fair, the forecast reductions haven’t been as severe as the share price decline (down from c.700p in summer 2021, to 190p now). Could this be an over-reaction possibly?

Paul’s opinion - I’m in a quandary here. I keep reviewing it as GREEN, but the price keeps dropping! Yet the value metrics keep improving - we’re now on a fwd PER of 8.8x, and a forecast yield (plus buybacks remember) of 5.6%. The balance sheet is OK, and it has net cash, and remains highly cash generative.

So ignoring market sentiment, I see a good, still highly profitable business here.

We’re seeing signs of strain in many B2B sectors, as companies anticipate a slowing economy, so they cut back or delay some non-essential spend. I don’t see anything more serious or structural in evidence at RWS. It’s just seeing a bit of a downturn due to the same macro factors that are affecting lots of companies at the moment.

Performance is far from disastrous, and it’s saying in line with probably the bottom end of analyst forecasts today, again not a calamity.

Taken together, I think this share’s cheapness, financial strength with net cash, and an OK update today given the tough macro environment, means I have to stick with GREEN. That’s more down to the valuation though, If it was on a PER of 15x, instead of 9x, then I’d be amber.

As regards the commentary about AI. I don’t have the knowledge to ascertain whether the many companies that wax lyrical about AI in their commentaries are just AI-washing with buzzwords, to be perceived as being at the cutting edge of technology, or are actually embracing this area? It’s not actually intelligence anyway, it’s just sophisticated computer programs using vast amounts of data, and producing generally impressive results, but in RWS’s field it would still all need checking, as computers that don’t actually understand the content will make mistakes that a human should spot. That’s already beyond the limits of my knowledge, it’s just what I’ve heard clever people saying, and they sounded convincing! The fact that RWS did an AI teach-in at all, suggests to me that maybe there's more substance to their claims than at some other companies maybe?

RWS was already twitching away on my watchlist as a possible oversold bargain, and I think today’s update and c.20% share price fall has probably made me a little more positive about the value on offer.

Although I’ve not seen broker notes, other than an excerpt from an unusually critical Singers note, which a friend sent me, which sounded sceptical - very rare for a broker note, as they usually give a universally positive perspective.

Interesting one, have any readers looked into RWS?

I see from the YTD chart below, that RWS still has a very high StockRank all this year -

Graham’s Section:

IG Design (LON:IGR)

Share price: 130p (+16%)

Market cap: £127m

This is “one of the world's leading designers, innovators and manufacturers of Gift Packaging, Celebrations, Craft & Creative Play, Stationery, Gifting and related product categories”.

Today’s H1 trading update is in line with expectations for profitability, but let’s take a look at some of the details.

Key points:

“Significant growth in profit and margin” compared to H1 last year.

“Net debt is significantly lower than a year ago, reflecting strong cash flow”.

The company says that debt and cash flow are both better than expectations for H1, but I presume this is just a temporary boost that is set to unwind in H2, as full-year estimates are unchanged.

Other key points:

There is “a return toward normal ordering seasonality” (recent years were disrupted, with H2 orders getting pulled into H1 due to supply chain concerns).

There is also “lower consumer demand for Everyday products in some markets and reduced order quantities guided by lower customer expectations of the forthcoming Christmas season”.

The result: lower sales in H1 vs H1 last year.

That might sound disappointing in isolation, but there are several other factors to consider:

a) we already had lower sales expectations for the current financial year (FY March 2024) vs FY March 2023, as the company has exited unprofitable contracts.

b) normal seasonality should provide a boost to numbers in H2.

c) strategic initiatives (cost reductions, higher pricing, etc.) have “more than offset the effect of lower sales”. So H1 profitability this year is higher than H1 profitability last year. I look forward to more detail with the interim results.

Graham’s view

I’ve touted this as a possible recovery stock for the post-Covid economy. Remember that valuation used to be far higher, over £700m:

The company made an ill-timed acquisition at the start of 2020. Since then it has been battling with a range of difficulties, particularly the problem of inflation.

An investment thesis I’ve suggested is that as inflation feeds through from costs to prices, the company might ultimately be able to recover its old profitability metrics: it used to comfortably earn an operating margin of over 4%.

With sales of over $800m and a market cap today of still only £127m ($154m), perhaps you can imagine that it could prove to be substantially undervalued at that operating margin.

So for me this is the best part of today’s trading statement:

This represents a strong year-on-year improvement in profit and cash flow compared to the prior financial year, albeit sales will be lower for the reasons given. It demonstrates continued delivery of the Board's aspiration to return the Group to pre-pandemic operating margins by the end of FY2025.

The end of FY2025 is only seventeen months away. Maybe it’s not that long to wait for shareholders, for what would be an extremely valuable achievement? Of course it’s still only an aspiration, but I’ll optimistically retain my positive stance on these shares.

Franchise Brands (LON:FRAN)

Share price: 146.8p (-7%)

Market cap: £285m

This is another update that’s in line with expectations (*asterisk required).

Franchise Brands is the franchising business founded by Nigel Wray and others in 2008 (Wray previously made an extremely successful investment in Domino's Pizza (LON:DOM) ).

Share price performance has been quite good over the years:

The last time I looked at FRAN I was neutral on it, noting net debt of £79m and plentiful adjustments to the profit figures. At the same time, I couldn’t rule out the possibility that this was the next Domino’s!

Here are the key points from today’s update.

B2B (Metro Rod, Metro Plumb, Pirtek) - “all trading at record levels despite some softening in demand over the summer period”.

Investors may be a little downbeat about this news:

Whilst the type of reactive services provided have resilient underlying demand whatever the macroeconomic conditions, demand naturally reduces when customers' equipment or facilities are not being used as intensively. Consequently, Q3 was a little softer than in H1, but we saw a modest increase in activity at the start of Q4.

Pirtek was acquired for £200m using both debt and equity. It “is integrating well and has met our expectations at the time of its acquisition”. Indeed, integration is being “accelerated” due to the cross-selling opportunities and the “significant opportunities to build a much larger business”. Sounds good!

Filta - mixed news, overall seems ok.

B2C (ChipsAway, Ovenclean, etc.) - “continues to operate in a challenging environment, although profitability is being maintained in line with expectations”.

Net debt has reduced by £3m in three months, to £76m. Unfortunately the interest charge is running at 8% on gross debt of £92m, “which is higher than projected”. Of course interest rates have risen since the time of the Pirtek acquisition. So FRAN is paying around £6.5m annualised on this debt load.

Outlook - adjusted EBITDA for 2023 remains in line with expectations at £29.3m. The Executive Chairman notes that “the trading environment has become more challenging as the year has progressed”.

Estimates - it’s easy to imagine that there is no downgrade to forecasts, but the RNS is clear that the adjusted EBITDA forecast is unchanged, not necessarily profits or earnings per share!

Indeed, brokers have been cutting forecasts this morning, including a 7% EPS cut at Allenby Capital (many thanks to Research Tree). This reflects the higher interest rate being paid on FRAN’s debt.

The new EPS forecast for 2023 is 8.7p. The EPS forecast for 2024 is reduced by a more modest 4% to 10.6p.

Graham’s view

I tend to agree that this company has good defensive characteristics - e.g. plumbing services are rarely considered a discretionary spend.

I also like the franchise business model, which the founders of FRAN have previously turned into enormous success for them and their co-investors.

So I remain open to the possibility that FRAN is a high-quality and attractive share that private investors should be trying to add to their portfolio. On the other hand, its earnings remain highly susceptible to adjustments: adjusted EBITDA of £12.1m in the most recent interim results converted to adjusted PBT of only £6.5m and a statutory loss of £1.2m.

On top of that, the balance sheet is not too healthy after the Pirtek acquisition: the interest bill has grown significantly and that means it will take longer to deleverage (i.e. the company will suffer from negative compound interest - paying more interest for longer!). The net debt to EBITDA multiple is about 2.5x which should still be comfortable but is at the upper end of the spectrum.

Therefore I feel that my neutral stance on this share remains the right one for now.

The StockReport also doesn’t see any reason to get too excited about it just yet.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.