Good morning/afternoon, it's Paul here.

I hope everyone has had a smashing Christmas break.

As you would expect, there's very little news today. A couple of items caught my eye.

DFS Furniture (LON:DFS)

Share price: 198.25p

No. shares: 211.7m

Market cap: £419.7m

Acquisition - this is only of passing interest. DFS has bought 8 stores, and the intellectual property of MultiYork, a smaller competitor which went bust not long ago.

This sector is looking quite interesting, as there are several up and coming new entrants. Plus, Harveys & Bensons Beds are reported to be in financial trouble, due to a reduction in trade credit insurance. People often forget that it's not just banks which extend credit to many companies, but also trade credit insurers can be even more important. If the trade credit insurers lose confidence in a company, and refuse to insure its suppliers against bad debts, then that can kill a business, as supplies dry up. An example was the original Game Group (now in a new incarnation of Game Digital), which went bust in Mar 2012, when suppliers refused to supply products due to withdrawal of credit insurance.

For me, its awful balance sheet rules out DFS as an investment, even though it is a decently cash generative business.

Halosource Inc (LON:HAL)

Share price: 3.0p

No. shares: 338.0m

Market cap: £10.1m

Trading update (profit warning)

HaloSource, Inc. ("HaloSource" or "the Company") (HAL.LN, HALO.LN) the clean water technology company, today provides an update on trading ahead of the year ending 31 December 2017.

Looking at the market price of this share, the bid price today is 1.0p, and the offer price is 5.0p - so valuing the company at the 3.0p mid price is pretty meaningless.

Today's profit warning is caused by a temporary regional shutdown in China, ordered by the government, for pollution mitigation reasons.

2017 revenues are now forecast to be between $2.6m to $3.0m, resulting in a net loss of between $5.0m to $5.5m. So an absolutely horrendous performance, worse even than the $4.16m net loss showing on Stockopedia's broker consensus forecast figures.

Amazingly, the company has found investors prepared to refinance it, with a $2.8m fundraising apparently in progress. That was priced at 1.25p.

It's quite remarkable that this company still exists, given its terrible track record of generating heavy losses every year. Why would anyone in their right mind invest in something like this?

D4T4

Share price: 136.5p (up 8.3% today)

No. shares: 38.2m

Market cap: £52.1m

Net contract wins - a rather gimmicky heading to today's RNS proclaims, "It's all about the data". I don't like that.

D4t4 Solutions Plc (AIM: D4T4), the AIM-listed data solutions provider, is pleased to report a number of new contract wins in its Data Management and Data Collection business areas.

Following the release of D4t4's half year results to 30 September 2017, the Company has converted four significant opportunities from its strong pipeline of potential business...

More details are given. However, what is noticeable by its absence, is any comment on performance against market expectations. A listed company CEO told me a few years ago that contract win announcements are meaningless, unless they state that the company is exceeding market expectations. I tend to agree. Although it's reassuring to know that pipeline is converting into sales. So today's announcement does at least reassure that a profit warning is unlikely, and that the company seems to be on a roll. Maybe forecasts could be increased in future, who knows?

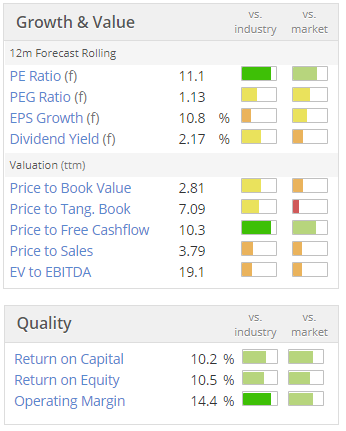

An upbeat-sounding update, together with attractive growth & value stats below, make me feel this share could be worthy of a closer look;

My opinion - I can't remember much about this company, so have re-read my notes here from Apr 2017. I liked the share then, and it's a bit cheaper now. So this does indeed look interesting. Although I don't really understand the company, so am a bit wary of investing for that reason. The numbers look attractive though, and a positive update today can only help.

Wey Education (LON:WEY)

Share price: 34.4p (up 3.9% today)

No. shares: 104.0m

Market cap: £35.8m

(at the time of writing, I hold a long position in this share)

Wey is an online education group.

It had previously announced here in Nov 2017 a possible acquisition, together with a discounted placing at 22p, to raise about £5m.

Today there is a confirmation announcement, that the acquisition has completed, at a cost of £1.6m. The acquired company, Academy 21 Ltd, is a complementary online education business, which provides tuition for short term (c. 6 weeks). This looks a good fit with Wey's existing business, which is longer term online school, called InterHigh. The plan is to integrate sales forces for both businesses, which sounds logical.

Sales & marketing update - the company gives more detail today about its planned increase in sales & marketing spend. This will be based online (google, facebook, twitter, and others), plus physical advertising on large digital billboards - Waterloo station is mentioned, so look out for those in Jan 2018.

Investor evening - if you would like to attend this, on 10 Jan 2018, then booking details are in today's RNS.

My opinion - I did quite a bit of digging in the autumn, via Google, and was increasingly impressed & excited by the potential for online education. It has tremendous advantages for some pupils, e.g. those with medical conditions, and who have been taken out of traditional schools due to bullying, or are in remote locations. Also there is demand overseas for, e.g. children of ex-pats. The fees are reasonable at around £3k p.a. Another aspect is that online education allows smaller schools to offer a wide range of subjects, without having to employ lots of teachers. So it can supplement traditional education.

It seems very obvious to me that online education is likely to become absolutely huge in the future. Therefore I definitely want exposure to this disruptive sector. The valuation of Wey looks pretty crazy, considering that it's such a tiny business at the moment. However, I think that's missing the point. It's the future potential which is exciting. I think it is perfectly valid to attribute value to the track record, and reputation of InterHigh (Wey's online high school) .

This share won't appeal to value investors of course.

Clear Leisure (LON:CLP) - this £2m market cap minnow has joined the increasing list of chancers that are trying to cash in on bitcoin mania. Its share price has just doubled, due to an announcement stating that it intends investing the princely sum of E0.2m in a Malta-based bitcoin mining company, powered by renewable energy.

Crypto-currencies - it's all going to end in tears - only a matter of time.

I think it's extremely important to differentiate between the promising, exciting technology of blockchain, and the imaginary value of crypto-currencies (which ultimately will be worth nothing, once the speculative bubble has burst, in my opinion).

CLP notes today the relevance of blockchain technology to our world of shares;

“We believe this is confirmed by the Australian Securities Exchange, which has recently become the first major bourse in the world to announce the adoption of blockchain technology - the same kind of technology which underpins the bitcoin cryptocurrency - to record shareholdings and manage the clearing and settlement of equity transactions.”

Will we still need stockbrokers in the long run? They do seem to be arguably superfluous intermediaries. So I suspect that blockchain could disrupt many areas of business in future, so is very much something to follow & think about. However, that doesn't alter the reality that crypto-currencies are a disaster waiting to happen, as they have no actual value, other than the current speculative mania.

That's me done for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.