Good morning!

Plenty of companies to report on today. I may need to work through the afternoon to cover them all:

- Nichols (LON:NICL)

- Ted Baker (LON:TED)

- Beeks Financial Cloud (LON:BKS)

- Avingtrans (LON:AVG)

- Arcontech (LON:ARC)

- Image Scan Holdings (LON:IGE)

- Science in Sport (LON:SIS)

Nichols (LON:NICL)

- Share price: £15.80p (+3%)

- No. of shares: 37 million

- Market cap: £585 million

The secret is out that this soft drinks company is rather high-quality. Let's see how recent performance stacks up:

- sales +7%

Geographically: led by UK sales. Held back by weakness in the Middle East (Yemen).

Product-wise: led by fizzy drinks, particularly by its core brand Vimto.

- operating profit +10%, although only +3.6% on an underlying basis (2018 benefited from a lack of exceptional items).

- final dividend +14.5%.

Operationally:

- Vimto still outperforming the wider soft drinks market

- Has been buying regional distributors, "consolidating route to market".

- Fine weather in 2018 was offset by Co2 shortage.

- Achieved distribution to 100 US stores (Walmart).

Outlook: "well-positioned".

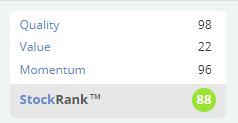

My view: in some ways, this company's financial characteristics are dream-like. I'm not in the least bit surprised that it enjoys a Quality Rank of 98.

Is it worth accumulating at the current valuation? I would guess that it probably is. The StockRank of 88 agrees. Nichols is a "High Flyer", one of Stockopedia's winning styles:

One of my personal ambitions is to own more high-quality drinks companies in my portfolio. So far, I only have Britvic (LON:BVIC) and the rather speculative Distil (LON:DIS).

Nichols (LON:NICL) will be near the top of the list when it is time for me to increase my position size in this industry. The key risk from my perspective is that Vimto is still being enjoyed in another 110 years, but I never got to participate in it!

Ted Baker (LON:TED)

- Share price: £17.84 (-11%)

- No. of shares: 44.6 million

- Market cap: £796 million

Update on profit expectations for Year 18/19

Very curious update from this luxury fashion group.

It turns out the company's internal reporting systems had missed a few items with an adverse impact on the numbers. Perhaps the leadership style of Ray Kelvin allowed a few things to be missed?

The impact of these items on FY 2019 (year ending January 2019) is worth about 15% of adjusted PBT.

The company's broker insists that the items are one-off and non-cash in nature and that they have "no impact on the investment case, and the outlook". There is no change to forecasts for FY 2020 (the current year) or FY 2021.

Let's quickly review the items that were missed:

- "product costs" of £2.5 million had been missed, but were identified by recent systems upgrades

- aged stock needs to be written down, with a hit of £5 million.

There is also a £2.5 million hit from FX translation effects.

My view

I can't quite accept the claim that the items are "non-cash" - they might be non-cash in the immediate period, but I think there must be a cash impact at some point in the future (for example, if the aged stock could have been sold at its book value at some future date, then the company would have received £5 million in cash!).

On the other hand, I do agree that the items are probably one-off in nature, and I think it's positive that they have been discovered and acknowledged. The level of disclosure is quite good.

The bigger questions around Ted Baker concern its future management: is Ray Kelvin coming back? He founded the company and owns 35% of the shares, so it's a crucial detail.

There might also be a small question mark around the trustworthiness of the accounts, as it is confirmed that some things were missed. It is probably worth discounting the shares because of this - and that it is indeed what the market has done today, even though FY 2020 estimates are unchanged.

I admire Ted Baker's track record but the risk around future leadership is not something I feel able to bet on, so I'll remain on the sidelines for now.

And despite the negative publicity and the uncertainty hanging over it, the shares aren't yet trading at what I would consider to be bargain levels. If it had a big net cash position instead of more than £100 million of net debt, then it probably would be a bargain.

Beeks Financial Cloud (LON:BKS)

- Share price: 111.5p (-12.5%)

- No. of shares: 51 million

- Market cap: £57 million

Beeks Financial Cloud Group plc (AIM: BKS), a niche cloud computing and connectivity provider for financial markets, is pleased to announce its unaudited results for the six months ended 31 December 2018.

Key points:

- H1 revenue +36% to £3.5 million

- "annualised committed monthly recurring revenue" is £7.45 million.

There are some very small numbers given in relation to underlying EBITDA and underlying PBT which are probably irrelevant versus the £57 million market cap.

- net cash reduces to below £2 million

- maiden interim dividend announced, value is £100k. Sounds fine versus statutory PBT of £340k.

Operationally:

- three new data centres opening, total number of sites will soon be twelve.

- institutional clients up from 170 to 210 over twelve months

- contract value at entry of new institutional clients is up 100%

Outlook

- FY 2019 (ending June 2019) to be "broadly" in line with expectations, i.e. there is a sales miss for the current period. Brokers cut their forecasts by 5%, from £8 million to £7.6 million.

- We have a H2 weighting forecast, which the company says is a historic trend.

- Acquisition opportunities being assessed (not sure how they would be paid for).

My view

I'm aware that many readers believe in this company, and I wish you well. From my own point of view, this sort of technological infrastructure is very hard to predict - servers will be getting smaller, more powerful and cheaper for the foreseeable future, so price deflation and disruption feels inevitable to me.

I understand that Beeks operates a niche service with close proximity to financial exchanges, so there is the potential for it to generate strong returns for an extended period of time. I just feel unable to predict whether it will remain at the forefront of this infrastructure for the long run.

A more pressing concern could be expressed in relation to the capital intensity of the business: based on existing technology, Beeks' servers are already operating not that far off their full capacity.

According to a broker note published today, the 11 data centres at period end were running at 75% capacity. Additional annualised revenue of £2.5 million could be achieved from them, resulting in annualised revenue from existing data centres (excluding Brazil) of £10 million. Let's call it £11 million in total. That's not far off the official forecast for £10.4 million of total revenue in FY 2020.

Based on the cost structure that is currently envisaged, this might translate to net income of £2 million.

That would be a fine result in terms of the existing asset base and ROCE but for the company to really scale up would require a lot more data centres. I'm not saying it can't be done, but I just wonder if there could be a point not that far into the future when all the easy locations have already been established, and the opportunities which are left are riskier or less attractive. Indeed, perhaps we are already at that point, with the company opening up in Brazil?

I do admire Beeks, but I'm leaning towards the view that a valuation of nearly £60 million is, in my opinion, too adventurous at this stage of its development.

The StockRanks agree with me, awarding Beeks a ValueRank of only 3. I don't hate the idea of investing in it - I'm simply priced out at this level.

Avingtrans (LON:AVG)

- Share price: 212.5p (+1%)

- No. of shares: 31 million

- Market cap: £67 million

Avingtrans PLC (AIM: AVG), which designs, manufactures and supplies original equipment, systems and associated aftermarket services to the energy and medical sectors, today announces its interim results for the six months ended 30 November 2018.

This is a greatly enlarged engineering group following an acquisition which took place at the end of November 2017. So comparisons with H1 in the previous financial year are difficult.

It acquired Hayward Tyler, designer and manufacturer of "performance-critical motors and pumps".

Organic revenue growth is 11% for the period, while total revenue growth is 77%.

There are a lot of moving parts - nine business units in total. This is a "buy and build" type of organisation, after all.

End markets include oil & gas and nuclear. These aren't markets I understand, and I try to steer clear of buy-and-builds, so this isn't a share I would ever buy, but I respect that the track record at AVG has been quite good overall.

Note the extreme cylicality. Hayward Tyler (HAYT) also had a highly uneven share price progression, prior to its acquisition.

There is too much detail around past performance for me to get into here. If you're interested in the company, they certainly don't short-change you on commentary!

Skipping ahead, the Outlook statement provides a generally optimistic view on market positioning:

With attractive structural growth markets, durable customer relationships and long-term contracts, we remain optimistic about the future of the Group.

Brokers are forecasting adjusted EPS of 13.3p for FY 2020 (ending May 2020), which would imply an adjusted P/E ratio of 16x at the current share price.

ROCE is expected to be modest, c. 6% - 7%, after taking into account the heavy intangibles balance that is carried by the company. Thankfully, it has been careful not to borrow too much and net debt is very modest at £7 million.

Overall, it feels more like an investment holding company to me, rather than an operating company. The broker describes it as a "mini-conglomerate".

It seems like a good business that has potential to do well for shareholders, but it's not one where I feel qualified to understand the risks.

Arcontech (LON:ARC)

- Share price: 141p (+10%)

- No. of shares: 13.2 million

- Market cap: £19 million

Arcontech (AIM: ARC), the provider of products and services for real-time financial market data processing and trading, is pleased to report its unaudited results for the six months ended 31 December 2018.

Another market data company. While Beeks Financial Cloud (LON:BKS) provides infrastructure, Arcontech (LON:ARC) provides platforms and utilities.

The run-rate of revenue at December 2018 was £2.8 million, up 14% on the prior year.

For the six-month period, it made a tidy profit of £500k on revenue of £1.4 million.

There fact that the annualised run-rate of revenue is only 2x the actual revenue for six months is a clue that revenue growth must not be too large.

Indeed, the forecast visible on Stocko is for FY 2019 sales to be just 7% bigger than FY 2018 sales. For small companies like this, we usually want to see more exciting sales growth than that!

It appears to be run conservatively with cash of more than £3 million.

Checking the shareholder register, it looks like insiders have a lot of skin in the game, including the Chairman and the CEO. So that would help to explain why management are acting in a risk-averse kind of way (if that is indeed in the case).

Outlook

Things are moving in line with expectations:

"...we remain mindful of the long and unpredictable sales cycles we often face and the challenges this brings in predicting the timing of contract wins. Nevertheless, the Board views the long term future for the business with optimism and in the short term expects results for the full year to be in line with expectations."

My view

I'm coming at this from a position of ignorance, since I don't have a great understanding of the company's products. But it does show slow and steady progress over the years and I can get behind the £16 million enterprise value, as net income is forecast to be £900k in FY 2020 (year ending June 2020).

I also like companies where insiders have a lot at stake.

Business does look a bit lumpy and progress is based on small numbers of contract wins. Checking the FY 2018 annual report, I see that 59% of sales were derived from 3 customers.

Avoiding customer concentration is an important part of my current investment strategy, so I would not add this share to my personal portfolio. For those who can tolerate customer concentration risk better than I can, this share may be of interest.

Image Scan Holdings (LON:IGE)

- Share price: 1.81p (-21%)

- No. of shares: 168 million

- Market cap: £3 million

Image Scan (AIM: IGE), the specialist supplier of X-ray screening systems to the security and industrial inspection markets, provides a trading update ahead of its Annual General Meeting to be held at 13:30 today.

This company had a failed acquisition last year after its largest shareholder objected to it, and is now focused on organic growth instead.

Today's update gives us the dreaded H2 weighting. Full-year expectations will only be met based on a recovery in H2, after contract delays in H1.

It sounds like governmental customers are a big component of sales.

Sales look lumpy and the FY 2018 annual report again confirms that 46% of sales were to two customers. This is too concentrated for a scaredy cat like me.

Science in Sport (LON:SIS)

- Share price: 51p (-1%)

- No. of shares: 122 million

- Market cap: £62 million

It has been a while since I looked at this sports nutrition business.

SIS has received wonderful support from shareholders, raising by my calculations in the region of £55 million over the past 5 years.

It's on the periphery of my watchlist on the basis that some day it might come good and spill over into profitability. Up until now, however, it has burned a lot of money on expensive marketing campaigns. While sales have grown in response to the marketing spend, losses have also widened.

In November, shareholders supported it to make a £29 million acquisition, doubling its size. The target company has similar revenues to Science in Sport and might be marginally profitable (it was said to have generated adjusted EBITDA of £2.8 million on sales of £20.8 million for FY 20218).

Anyway, the point of me mentioning all of this is just to acknowledge that SIS is issuing shares to pay for a sponsorship deal, according to today's announcement.

The amount involved isn't huge (£100k), but I think this sort of highlights management's attitude to the share count. At any rate, it is consistent with a management philosophy that is very comfortable with dilution.

I will keep an eye on progress and hope for the best. Based on the track record, however, I would treat SIS shares with great caution. Everyday bills should be paid in cash, not in equity!

I'll call it a day there, thank you for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.