Good morning!

I didn't get around to covering requests yesterday but have now taken a look at Cenkos Securities (LON:CNKS), which did receive many requests. I'm posting my review of that stock first of all. And then it will be time for Wednesday's updates.

Cheers,

Graham

Cenkos Securities (LON:CNKS)

- Share price: 115.5p (+12%)

- No. of shares: 56.7 million

- Market cap: £65 million

This is a stockbroker in the small and mid-cap space which provides corporate finance, market-making, research, etc. It acts as Nomad to AIM stocks, where it's one of the most active fundraisers.

I traded in and out of these shares back in 2015. It's one of those companies with lumpy revenues from occasional large, one-off transactions which are difficult to predict until they materialise. It is furthermore exposed to cyclical movements in equity fundraising activity, which are completely beyond its control.

Its stock market listing is very useful for it, however, since shares are a heavy part of overall staff compensation. So it can conveniently buy shares in the open market for its employees, who then also have a convenient place in which to sell them, should they choose to do so.

The company's staff compensation model is one of the best in the industry: base salaries are relatively low, but they come with high variable compensation. This results in motivated staff and a track record of never generating a loss in its entire history, all the way back to 2005.

Anyway, on to Tuesday's results. The cyclicality is evident:

The profit after tax and EPS increased by even larger percentages. This was thanks to a lower effective tax rate.

Funds raised for clients in H1 increased to £982 million from £529 million the prior year, helped by the £386 million Eddie Stobart Logistics deal.

Costs rose 82% to £25 million, reflecting variable staff compensation. It's a people business, so you don't get operating leverage working the same way as you do with other stocks!

The interim dividend recovers strongly to 4.5p.

Including share buybacks, Cenkos has returned £105.6 million to shareholders since flotation in 2006. I should point out that's significantly greater than the current market cap!

This is what you want to see from a company like this. Paying out most of its earnings, while retaining sufficient funds for regulatory capital purposes, means that shareholders get immediately and strongly rewarded for taking the risk of holding a stock with such cyclical and unpredictable earnings.

And there is little point in those earnings being reinvested back into the business, since there are probably no reliable ways to earn an attractive return on additional capital, given the nature of this industry and the maturity of this particular company. So large dividends and share buybacks are exactly right.

Outlook sounds fine according to the new CEO, who had been a non-executive director since 2012.

We have made a very good start to the second half of the year. There is institutional demand to fund high quality companies and ideas. Since July we have been engaged in relation to a number of significant fundraisings and our pipeline for the rest of the year is encouraging.

My opinion: I don't think anything has fundamentally changed at Cenkos, so I consider it a pretty reasonable investment around these levels. I think I'd almost certainly get my money back in dividends and share buybacks, so for me, it's not a speculative investment at all. It won't be the next big growth stock, but it will make an honest effort to pay you over the years.

As an interesting anecdote, the founder sold a large chunk of his shares at 107.5p in 2010, describing the share price at the time as ludicrously cheap. I wonder what he thinks about the share price now!

£RM2

- Share price: 6p (pre-open)

- No. of shares: 407 million

- Market cap: £24 million

I identified this manufacturer of high-tech pallets as a short/sell idea at the UK Investor Show in April this year (along with £FJET).

The share price is down nearly 75% since then, but I don't consider this to have been a particularly clever call. The company has been a basket case for investors and the writing has been on the wall for some time now.

Today's results show H1 revenue unchanged at $3.7 million and a slightly reduced loss of $19 million.

It's trying to outsource produce to China, having already partially outsourced it to Mexico, but needs more funds to make this happen.

Today's statement estimates that cash reverses are sufficient to last to February 2018, or potentially Q3 2018 if it can sell some legacy assets. But the big picture is grim:

Should the Company not be able to secure sufficient additional funding, it will not be able to face liabilities generated by contractual commitments, including those for manufacturing and operations.

Worth noting that the value of inventories remains elevated at $17.5 million, or more than twice annualised sales.

My opinion: Totally uninvestable.

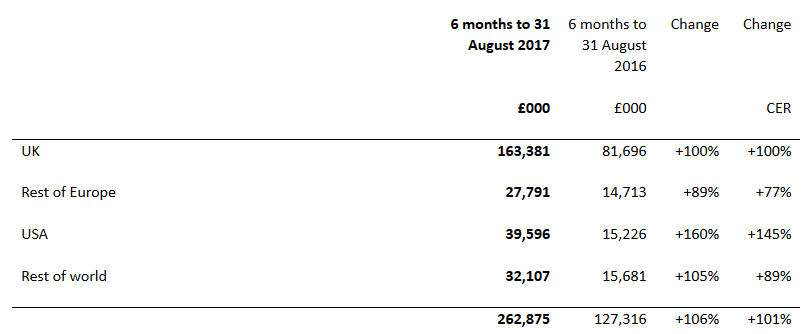

I'd like to think that Stockopedia agrees with me, as the StockRank is just 11.

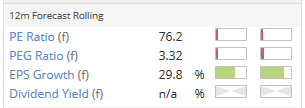

Boohoo.Com (LON:BOO)

- Share price: 243.75p (-6%)

- No. of shares: 1148 million

- Market cap: £2,800 million

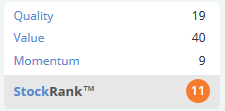

The online fashion retailer reports another impressive set of figures:

Excluding the PrettyLittleThing and Nasty Gal divisions, revenue at Boohoo increased by 43% (40% at constant FX), while gross margin was down 300bps to 52.3%.

The corresponding growth rates at the interim results last year, before PLT and Nasty Gal were as follows: revenue +40% (41% at constant FX), and gross margin down 480bps to 55.3%.

So the growth rate at constant FX is marginally lower this time, and the gross margin has fallen 780bps over two years. That seems like a lot of lost margin to me, but perhaps its the price of achieving sequential sales growth of c. 40%.

The overall operating margin has improved from 6.6% to 7.6% over two years. Moving in the right direction at least but perhaps more could have been expected?

Guidance

Full-year revenue growth is now anticipated to be 80% (up from previous guidance 60%).

As a result of significantly better-than-expected revenue growth from PrettyLittleThing and our investment in price, promotion and marketing, we now expect group adjusted EBITDA margins to be between 9% and 10%.

Every improvement in guidance was compared against prior guidance, but it's necessary to scroll back to the last trading update to see that prior guidance for EBITDA margin was "around 10%".

So the plan is clearly for accelerated revenue growth, at the cost of some more weakness in margins.

A new warehouse is set to double existing capacity by January 2018.

I seem to recall Boohoo being slow to set up an app. While the percentage of sessions which are app-based is unclear, mobile devices are now 70% of sessions. Surely that means a good app is critical!

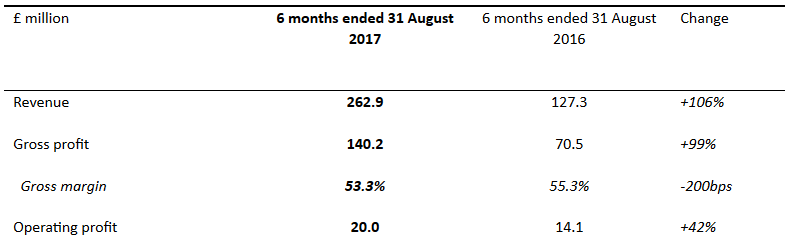

Growth by geographical market is as follows (note that these % growth numbers are not like-for-like and have been exaggerated by the acquisitions):

My opinion: What is there to say, that hasn't been said already? I summarised my view on this when I covered it in June - I said that it's probably overvalued, along with other quality growth stocks at the moment. But it's a fine company nonetheless.

Active customer numbers growing by 29% would not on its own be sufficient to justify the prevailing valuation, in my view, but the average order value and frequency of orders have also been steadily increasing.

Putting my bear hat on for a minute, I'd say that economic stress would put the brakes on order value and order frequency, and that Boohoo's growth would then be reliant primarily on the growth in customer numbers.

It would still be a quality growth stock, but the valuation might be a bit more terrestrial and a bit less stratospheric.

Strix (LON:KETL)

- Share price: 136.375p (-0.5%)

- No. of shares: 190 million

- Market cap: £259 million

The Strix website proudly states that its products are used about a billion times a day. I think that says a lot about caffeine addiction in addition to what it says about the success of the company! It's in the business of making kettle controls, and has been listed only since August.

Today's results for the period ended in June are in line with expectations, and look solid.

- Revenue up 6.7% to £42 million

- Adjusted EBITDA up 6.1% to £14.2 million

- PBT up 9.6% to £10.3 million.

Export sales are up 10% which is despite a 10% decline in China, whose stronger 2016 result was apparently due to a health scare. Strix thinks its market share there is c. 50% - amazing if true! It has a large factory in Guangzhou, China, and an estimated 38% global market share by volume.

The products must be extremely low-cost if 38% global market share translates to c. £40 million revenue over six months!

An interim maiden dividend of 1p will be paid in November.

Outlook is line with full year expectations.

My opinion: This is an interesting addition to AIM. It has been listed at a fairly ordinary valuation and perhaps that reflects the cheapness of the products themselves. Strix mentions "continued pressure from copyists" as a challenge it faces in China, where competitors no doubt can offer all sorts of even cheaper component parts.

But taking a look at its website, Strix's quality controls look utterly comprehensive, with certifications from a wide variety of bodies including Intertek (LON:ITRK). There are also four US patents mentioned.

So I'm open to the idea that Strix's competitive advantage is here to stay, and that the shares are priced favourably for investors.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.