Hi, it's Paul here.

Thanks for the reader requests. As mentioned in the comments below, I much prefer it when readers add a few key points about the company results/trading update, indicating why you think it's interesting. That makes it more interesting for me, and everyone else. Rather than a single sentence asking me to do all the work!

Please note that yesterday's article ended up being a bit of a monster, with 5 companies reported on. Here's the finished article.

A friend flagged up that dotDigital (LON:DOTD) might be affected by the new GDPR regulations re email marketing & spam. These regulations kick in this May, and require email marketers to solicit the permission of everyone on their databases to remain on the database. Obviously this is going to decimate many email databases, and make email marketing/spam very difficult to do. I imagine that might have some negative impact on DOTD, despite it branching out into other channels, such as social media. Maybe GDPR is why it decided to branch out? Anyway, I didn't think of this point yesterday, so just wanted to mention it today (and I've added a post-script to yesterday's report).

This article will take shape during the afternoon & early evening - so please refresh this page later. I'm not a morning person, so generally my articles are mostly written in the afternoons & evening.

Safestyle UK (LON:SFE)

Share price: 119p (down 21.7% today, at 14:51)

No. shares: 82.8m

Market cap: £98.5m

Trading update (profit warning)

Safestyle UK plc, the leading retailer and manufacturer of PVCu replacement windows and doors to the UK homeowner market, today issues an update on current trading.

As you can see from the chart (see below), vertical moves down usually indicate a series of profit warnings in the past, and we have another one today, unfortunately.

Today the company says;

The Group announced on 13 December 2017 that it had seen a continuing deterioration in the market resulting from declining consumer confidence and the Board expected market conditions to continue to be very challenging in 2018.

The activities of an aggressive new market entrant have added to an already competitive landscape and impacted the Group in certain areas of its operations.

As a result, the Group's order intake in 2018 to date has been disappointing and below our expectations.

My initial reaction is that, whilst clearly disappointing, it is rather refreshing to hear a company mention competitor activity harming its trade. Competitors eating their lunch is usually the real reason that most profit warnings occur, yet it's rarely disclosed as the reason. We normally hear waffle about lengthening sales cycles, consumer confidence, Brexit, you name it. When reality of profit warnings is usually that someone else is offering a better value product to potential customers.

This is also a reminder that a high profit margin will tend to attract competition, who erode that margin, over time. This is particularly the case where the product is easy to copy, and pretty-much generic, as is the case with double glazing, patio doors, etc. Anyone can set up a company doing that, with limited capital, and out-source the production, or make it themselves in a small industrial unit - I know people who've done exactly that, who did well during periods of economic growth, but went bust in the next recession.

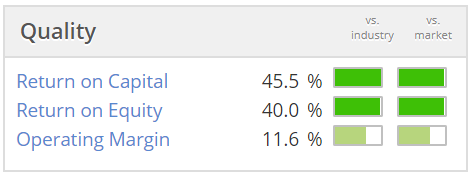

As you can see below, SFE has good quality scores, but there's not really much of an economic moat, so I can see why the margin would come under attack;

So how bad are things?

Guidance for the year ended 31 December 2017 remains unchanged.

The Board now expects Group revenues and underlying profit before tax for the year ending 31 December 2018 to be materially below 2017 levels and current market expectations.

"Materially below" usually means at least 10% below. The unanswered question is, how much more than 10%? Annoyingly, we're not told. Instead, the brokers are told, and then tell us (if you can get access to their notes). Thankfully, 2 update notes are available today on Research Tree, so I'm looking at those now.

Forecasts - one broker reduces its 2018 and 2019 forecasts by about 23% - obviously that's a hefty reduction. 2018 EPS fc is now 11.7p, and 13.0p for 2019 - although my feeling is that we can probably ignore 2019 forecasts, as they might get worse, if competitor activity intensifies.

A second broker has also reduced 2018 EPS fc to 11.6p.

The revised PER is 10.2 times, based on the mid-point of 11.65p broker forecasts for calendar 2018. That might appear cheap, but with earnings now in a clear downtrend, I'd probably want a PER of between 6-8, before I would consider taking a closer look.

Cost-cutting is underway.

Balance sheet - the company says that it's well-funded;

The Group continues to be cash generative, with a strong cash position and robust balance sheet.

Safestyle remains very well invested for any upturn in demand and the Board expects the benefits of its cost savings programme to take effect in 2018, particularly in the second half.

Let's check the balance sheet. It was last reported as at 30 Jun 2017, at the interim results here.

NAV: £39.4m, which includes 3 lines of intangible assets, totalling £17.6m

NTAV: £21.8m - which looks OK.

Working capital: current assets £26.1m (including cash of £17.7m), less current liabilities of £21.9m, giving surplus of £4.2m, and a current ratio of 1.19 - not great, but you have to think about the sector, and how much working capital is needed, on a case by case basis. Given that there's no bank debt, instead having a whacking great pile of cash, this suggests to me that SFE has a favourable working capital structure - i.e. it's probably get cash up-front from its customers, and paying suppliers later.

I like to double check the interest cost on the P&L, to verify that the cash position isn't a year-end blip. Here, the interest cost on the P&L is basically nothing (just £5k), which suggests some sundry interest cost, maybe on a leased car, or similar. Therefore I'm satisfied that the company runs a positive cash balance all year round, hence the current ratio of 1.19 is perfectly sound.

Overall then, it gets a thumbs up from me as regard the balance sheet - there are no solvency issues here, at the moment.

Dividends - it sounds like the 2017 final divi will still be paid;

The Group will announce its final results for the year ended 31 December 2017 on 22 March 2018 when it expects to declare a final dividend for 2017 of 7.5p in line with its normal 1/3:2/3 policy.

No further guidance is given today by the company on future dividends. However, both brokers updating today hold the divis at about 11.3p in both 2018 & 2019, so obviously the company must have given them a steer on that.

The dividend yield is 9.5%, based on current forecasts of maintaining the 11.3p annual divis. A yield that high is rarely sustained, so it's the market indicating that it thinks there's a high probability of future divis being cut. The dividend cover would also be only just 1x covered, so this again points to risk of divis being cut, if earnings estimates come down any further.

My opinion - this share is now a straightforward punt on whether or not you think management can turn things around. If they are successful, and manage to reverse the trend of profits falling, then the share could be cheap. Alternatively, if competition continues to erode SFE's profits, then we could see another profit warning later in 2018.

I have no idea which outcome is more likely, therefore it's not something I would want to punt on. It strikes me that SFE has had a bumper few years, making excellent profits. This has caught the eye of competitors, who are now competing, and eating some of SFE's lunch.

To my mind, that implies a permanent reduction in profitability at SFE, not a temporary blip. Therefore I categorise this as a bad profit warning - i.e. it's something fundamental that has gone wrong, which would be tough to reverse. As opposed to a good profit warning, which is something temporary & easy to fix has gone wrong. So overall then, it's not for me, and looks like it could be a value trap - something that looks cheap, but isn't.

This sector looks horrible - remember Entu, another double-glazing company, which floated when it was highly profitable, then ended up going bust in a frightening short timescale. Memo to self - don't buy shares in double-glazing companies ever again! A reader also points out the question marks over how double-glazing is sold - high pressure sales, etc.

It's easy to be wise after the event, but I guess the lesson to be learned from this and Entu, is the importance of investing in companies which have an economic moat. Without which, profits can easily decline, or even disappear.

It looks as if SFE should survive, so I don't see any solvency risk here, providing sales really fall off a cliff.

Foxtons (LON:FOXT)

Share price: 76p (down 8.8% today, at market close)

No. shares: 275.1m

Market cap: 209.1m

Quick query - do any readers (maybe one of our many readers who work in the City) know why it is that some companies (as in this case) entitle the RNS "Final Results", but then start the announcement itself with the title "Preliminary Results"? How can results be both final, and preliminary? Surely that's a contradiction?

EDIT: Thanks for the replies in the comments section below. Several readers suggested that "final results" is referring to the distinction between interim & final - i.e. 6 month or 12 month figures. Then the "preliminary results" distinguishes between the initial results announced to the stock market, and the later, more detailed Annual Report. That makes complete sense to me, so thank you for your input!

Foxtons Group plc, London's leading estate agent, today announces its financial results for the year ended 31 December 2017.

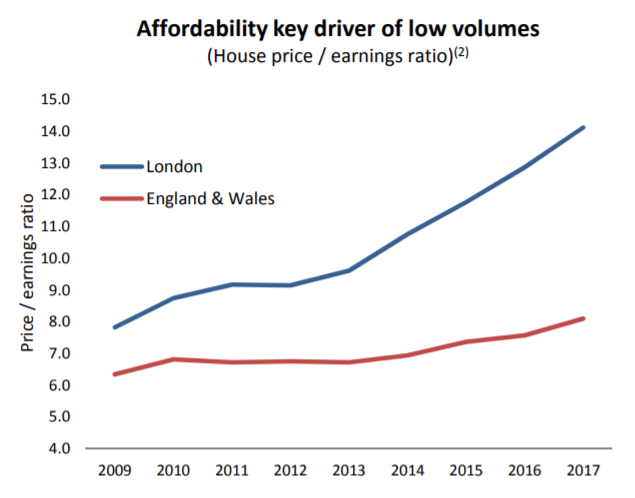

Results presentation - this link contains useful additional colour, on the company's website. It's worth a look, as there are some very interesting charts on the housing market in London & outside - e.g. just look at this affordability chart, where the old rules on house prices vs average earnings have long since disappeared (due to low interest rates, and foreign money flowing into the London market);

(courtesy of Foxtons results presentation)

It's no surprise that these figures are going to be poor, because the London property market has cooled. However, Foxtons has a good split of business between sales and rentals, so that should cushion the downturn.

Sure enough rentals have held up relatively well;

Resilient performance from Lettings business with revenue of 66.3m down 3% versus prior year driven by lower rental rates in the market.

Whereas property sales revenue has fallen sharply, as expected;

Sales revenue of 42.6m, down 23%, a result of continued market weakness causing lower transaction volumes.

Note how the lettings business is now generating nearly all the EBITDA (see table below). Once you include the depreciation charge (of the office fixtures & fittings), then lettings would probably be generating more than 100% of the profit at the moment;

I've looked back to the trading update on 25 Jan 2018, and compared with figures in that, with the actual figures today, and they're all consistent with expectations, e.g.

Actual revenues £117.6m (trading update: c.£117m)

Adjusted EBITDA actual: £15.1m (trading update: £c.£15m)

The individual divisions also performed as indicated in the Jan 2018 trading update. So overall then, no surprises in the headline numbers today. So why has the share price dropped 8.8% today, given that the figures are in line with expectations? It must be down to the outlook comments, let's have a look;

Outlook - the CEO comments are negative re the current sales pipeline;

Looking ahead, we expect trading conditions to remain challenging during 2018, and our current sales pipeline is below where it was this time last year.

The cost actions we have taken and our net cash position mean we are well placed to withstand these conditions and make the investment we have identified.

We are confident that our high-touch approach to customer service and knowledgeable people delivers tangible results for customers differentiating us from the competition. The London property market has attractive long-term characteristics and our brand strength, coverage and approach, position us well to manage through the current market uncertainties and take advantage of any future market recovery."

Those last few words that I've highlighted are really what this share is all about - it's a bet on future market recovery of the predominantly London property market. I'm not sure I'd want to bet on that at the moment, but it could be a good bet at an uncertain point in the future.

Valuation - the 2017 figures show adjusted EPS of only 2.6p (2016: 5.7p). So the 2017 PER is 29.2, and if profits recover in future back to 2016 levels, then the PER would be 13.3. So it's not madly exciting, even if future profits do recover to 2016 levels (which would be a 119% increase in earnings from 2017.

Balance sheet - so is this business in financial trouble? I don't think so. The profitable lettings business looks able to support the group, even when trading is poor in sales.

Also, it has a sound balance sheet. Here are my usual points;

NAV: £140.9m, but assets are dominated by intangibles of £120.1m

NTAV: £20.8m - however there is another factor to consider here, namely;

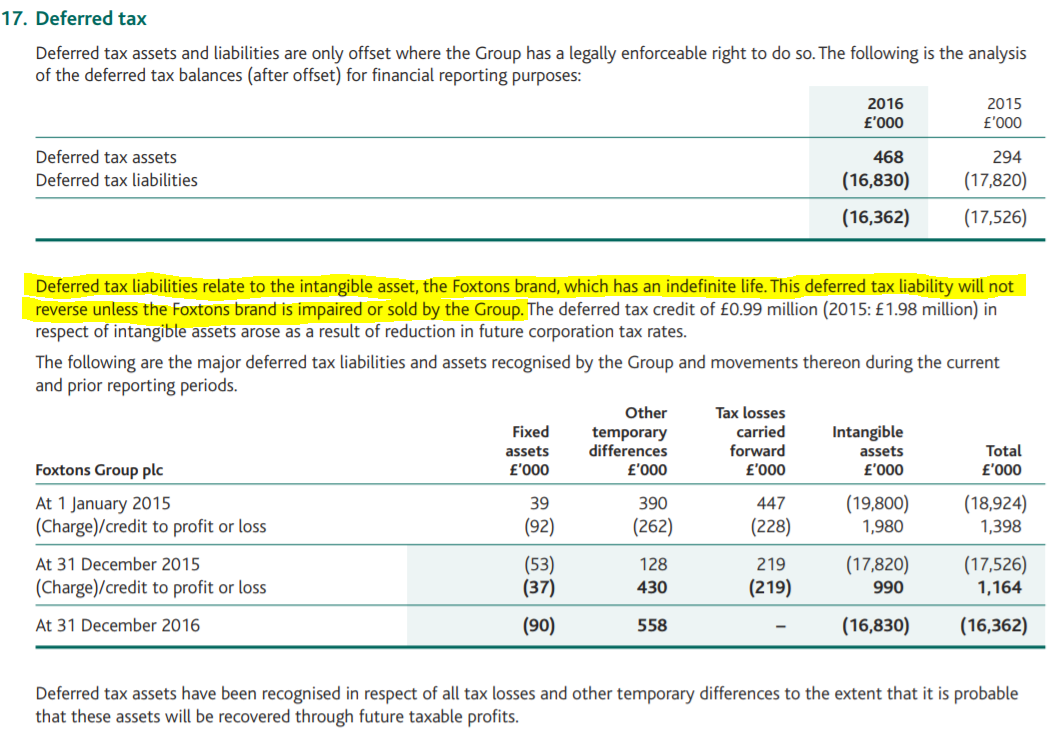

Deferred tax liability (within non-current liabilities) of £16.8m jumps out at me as being a large & unusual item. So I've checked back to the 2016 Annual Report, which explains that it relates to the £99m within intangible assets for the arbitrary valuation put on the "Foxtons" brand - a figure which is not amortised.

Here is the detail from note 17 of Foxtons 2016 Annual Report;

I'm the first to admit that corporation tax is not my area of expertise, which is one of the reasons why I failed my PEII exams 25 years ago. Deferred tax in particular was an area that totally flummoxed me, despite having it explained to me lots of times.

However, I think what the above is saying, is that the deferred tax creditor on Foxtons balance sheet, shown as a liability, isn't really a liability - see the highlighted text above. I would be grateful if any tax experts in the house could confirm that my view is right or wrong.

Therefore, if I'm correct, then we should add back the £16.8m deferred tax liability to NTAV, which I'll call adjusted NTAV, of £37.6m. That looks a healthy position.

Working capital looks fine, with a current ratio of 1.65, which includes net cash of a healthy £18.6m.

Overall then, the balance sheet gets a thumbs up from me.

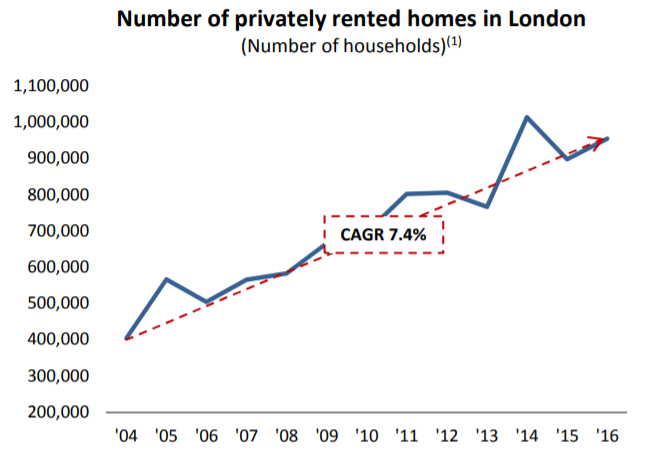

My opinion - this is a tricky one. I can see why some people might like this share as a recovery play. Foxtons lettings business is in a strongly growing market, and it seems to be the dominant player;

(source: Foxtons results presentation)

The ban on tenant lettings fees come in next year, I believe, but presumably the charges would just be shifted onto landlords, who would themselves try to recover them through higher rents? So it could end up being a circular movement of costs perhaps? Although there could be some impact on Foxtons profits perhaps, I don't know? It's worth considering as a risk, anyway.

Foxtons does have a dominant market position in London, but I'm a bit sceptical about whether that is secure? They try to charge more than competitors, and hence could end up being dis-intermediated by pure online players. Meanwhile, the heavy costs of maintaining a London branch network could become increasingly onerous. I can't find anything about business rates in today's announcement, but they're generally going up, sometimes quite a lot, in London.

On the plus side (for the company, if not its staff), staff remuneration is flexible, as it's heavily linked to commission. That provides cost flexibility in a downturn.

Overall, I'm not sure about this one. Has it bottomed out yet (see 2-year chart below). At some point the market usually changes from glass half empty, to glass half full, anticipating a recovery. Although after an extraordinary boom in London property, maybe things are now just settling back into a more normal level of activity? Might the Government reverse its disastrous & utterly stupid Stamp Duty hikes, which have helped kill off the top end of the market? How might Brexit affect the London market? Will there be an exodus of wealthy foreigners, or could the UK become a more attractive tax haven, and see a further influx? Will there be riots if more & more London property is left empty by foreign speculator buyers? Will Jeremy Corbyn get into office and seize unused property, triggering a mass sell-off? There are so many unknowns, that for me, this one probably has to be filed in the "too difficult" tray.

Avingtrans (LON:AVG)

Share price: 226p (flat on the day, at 12:54)

No. shares: 30.7m

Market cap: £69.4m

Avingtrans plc, which designs, manufactures and supplies critical components, modules, systems and associated services to the energy, medical and industrial sectors, today announces its interim results for the six months ended 30 November 2017.

This is going to be a tricky one to review, as the numbers are greatly affected by the acquisition of Hayward Tyler Group plc (HTG)

Note also that the acquisition of HTG seemed to complete on 1 Sep 2017, so it only contributed 3 months to the P&L, for H1 figures ending 30 Nov 2017.

H1 revenues up 14.9% organically, but up 180% once HTG is included, so clearly this acquisition is massively affecting the numbers, making prior year comparatives meaningless.

Adjusted loss before tax of -£0.1m is similar to the prior year's H1 of -£0.2m.

I don't know what more I can say about profitability, since it all depends on how the businesses integrate, and what happens in terms of future orders, etc. Let's look at the outlook comments for some guidance.

Outlook - there's not really anything much here that helps me;

Avingtrans is a niche engineering market leader in the Energy and Medical sectors. We expect that the recent acquisitions (particularly that of HTG) will afford investors another opportunity to build enduring value with us in an exciting clutch of engineering market niches. We will continue to be frugal and seek to crystallise value and return capital, if the timing is right.

Our strategy continues to produce significant new business wins which support our results and provide good visibility of longer term earnings - e.g. the contract with KHNP, recently announced. We have an enviable customer base which we can continue to build upon and differentiated product niches where the Group already is, or can be, world-leading. We are well placed to benefit from renewed market growth and further market consolidation, particularly across the Energy sector.

Metalcraft, Hayward Tyler and Peter Brotherhood are clear leaders in their chosen niche markets, providing customers with consistent quality as part of a world class journey. We believe that Scientific Magnetics can be the key to growing the Medical division and to develop tangible value for shareholders in the longer term.

With attractive structural growth markets and durable customer relationships, we remain optimistic about the future of the Group. In our acquisition activities, we will seek to conduct our efforts rigorously and efficiently, with an underpinning ethos that any deal should be for the benefit of all stakeholders and should build sustainable long-term value, consistent with our PIE strategy.

Balance sheet - this is as at 30 Nov 2017, so it includes the HTG acquisition.

NAV: £69.6m

NTAV: £28.8m - as you would expect, after making a big acquisition, there's a lot of goodwill/intangibles on the balance sheet. At least NTAV is still decently positive though.

Cash position: £6.76m in cash, less £7.18m current borrowings, less £4.73m in long-term borrowings, arrives at net debt of £5.2m, plus another £3.0m on finance leases, giving total net debt of £8.2m. The company says this is low, but that rather depends on what level of profitability it achieves in future, which is currently unclear.

Pension fund(s) - there's a small pension asset of £343k shown in fixed assets. This might be a deficit when calculated on an actuarial basis, so that would need to be checked out. Since both companies were listed, it should be quite easy to look back at the previous RNSs, and our reports here, to ascertain what pension issues there were separately at both AVG and HTG, then combine them to see what the total looks like. There's no further information given in today's interim results.

Overall then, I can't see any issues in particular with this balance sheet, so it gets a cautious thumbs up.

Broker research - since we're largely in the dark about how the enlarged group might perform in future, broker notes are more important than usual.

There are 2 notes on Research Tree, published this morning. Both have almost identical figures, so as with most small caps, the broker forecasts are really the company's forecasts, issued via a third party.

We have c.4p forecast EPS for this year, 05/2018.

Then c.9p forecast EPS for next year ending 05/2019, which is starting quite soon, so I think we should value the share on a multiple of this forecast. I would say a PER of maybe 12-15 might be appropriate? That indicates a share price target for me of 108p to 135p.

The share price is actually 226p, so the market is currently clearly assuming that broker forecasts are way too conservative, and that the company will thrash them. Otherwise, we have a problem. If the company only meets these forecasts, then the share price should be a lot lower.

Possibly the bar is being set low, to allow the company to out-perform, and put out positive trading updates in future? There's a lot to be said for under-promising and over-delivering, but I'm just flagging up that significant out-performance against forecast is already in the price.

My opinion - I've followed Avingtrans for a few years now, and have been impressed with how adept management have proven at making both good acquisitions, and disposals. Note that there was a significant tender offer in 2016, returning value to shareholders, as well as divis.

Therefore, at this stage, with it being difficult to predict how the combined group will perform, this share is really all about backing good management. We haven't got numbers to rely on, in valuing the share, so a bit of a leap of faith is necessary. Therefore, I feel that more detailed research would be needed on the company's markets, which seem specialised.

It's not really the sort of thing that interests me, but I'll keep an eye on it, to see how things pan out in future.

Science (LON:SAG)

Share price: 210p (down 2.3% today)

No. shares: 39.4m

Market cap: £82.7m

Science Group plc (the 'Company') together with its subsidiaries ('Science Group' or the 'Group') is an international consultancy providing applied science, product development, technology advisory and regulatory services to a client base in medical, food & beverage and commercial markets.

Through organic investment and acquisitions, funded primarily from operating cash flow, the Group continues to develop an integrated offering of science-based services.

Timeliness of accounts is something I very much like, as it's usually indicative of a strong finance team, with good internal controls. So this company issuing its audited accounts within 2 months of the year-end is pretty good.

I am unfamiliar with this company, but see that it changed its name in July 2015 from "Sagentia" (which does ring a bell), to "Science". I last reviewed its figures here 4 years ago, so we're probably overdue an update.

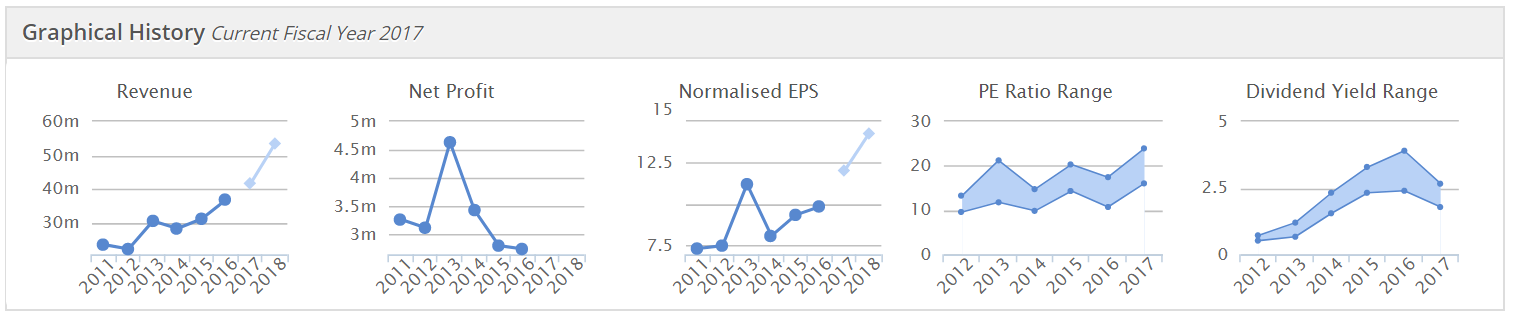

A 60-second review of the StockReport tells me that;

- It has a decent amount of net cash, relative to the market cap (comparing Mkt Cap with Enterprise Value, at the top of the StockReport)

- Seems to have a sound balance sheet (since P/TBV is 3 - a healthy level)

- Has a middling forward PER of 15.2

- Pays fairly modest divis (with a yield of 2.1%), which look to have plateued in size

- Has middling quality scores on Stockopedia

- Revenue growth appears to have been funded internally, as the share count has barely moved in 6 years - quite often that is indicative of a company where management holds a lot of shares & therefore doesn't like to be diluted (I'll check that later. EDIT - sure enough, the Chairman Martyn Ratcliffe owns 34.1% of the company - major shareholders see here)

- Profit growth looks lacklustre, apart from a bumper year in 2013

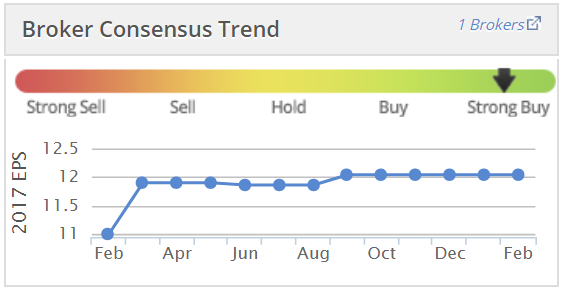

- StockRank of 78 says that the Stockopedia computers like it, so it's unlikely to be a basket case. Note that the Momentum score is very high, at 85, suggesting brokers could have been increasing EPS forecasts - this is confirmed from the graph showing EPS forecast has risen from 11p to 12p in the last year (see below)

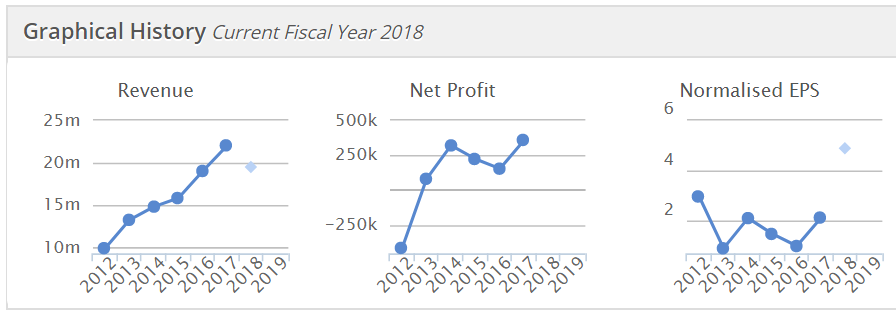

- The graphical history looks OK, but a lot hinges on the forecasts for 2017 & 2018 being achieved (the lighter blue blobs below).

It's amazing how much you can glean, very quickly from the StockReports, when first looking at an unfamiliar share.

Here is the broker consensus EPS graph, over the last 12 months, showing an improving outlook for profitability. Although as always, we should treat forecasts with a considerable degree of caution, as they are very often wrong, sometimes wildly wrong;

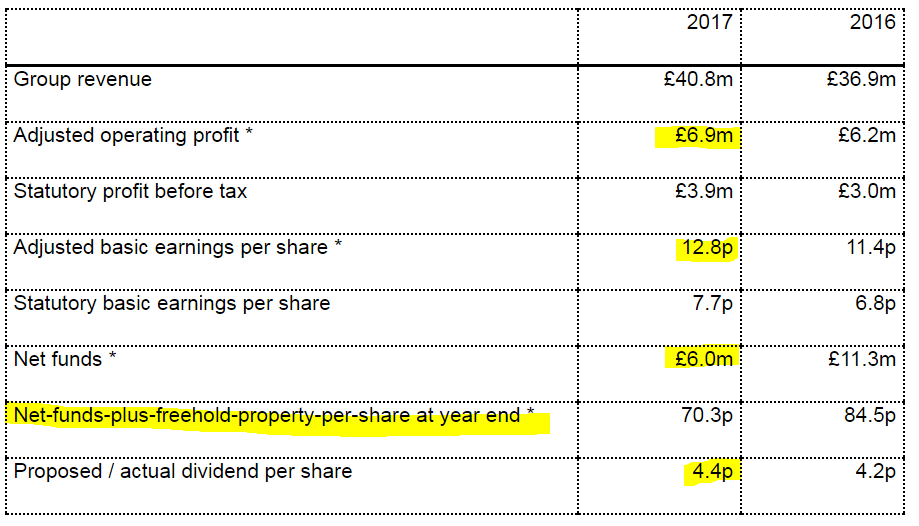

Here are the highlights from its 2017 annual results;

Comments on the above;

- Excellent operating profit margin of 16.9%, similar to prior year of 16.8% - this suggests to me that this is probably a quality business, with strong pricing power.

- Adjusted EPS up 12.3% to 12.8p, giving a PER of 16.4 - but remember to adjust this down, to take into account net cash

- Note from the narrative that nearly all of the profit gain occurred from favourable movement in forex of £0.6m

- I've never seen this before - "Net-funds-plus-freehold-property-per-share at year end" - I love it! Companies with freehold property should flag up these important assets in the highlights. In my view, freehold property is second only to cash in desirability.

- Divis up a bit, but why so stingey with the payout, given the balance sheet strength?

So far, so good - there's enough of interest above to make me want to continue looking at this, despite being on my 4th glass of fizz now (it's 11pm, and Asda are doing a wonderful deal on Lanson, only £22 per bottle, so temptation overtook me when popping in earlier for some ready meals & spinach).

Possible downsides - being a consultancy, it's a people-business, which generally I try to avoid. The risks are that staff can demand the upside in higher pay & bonuses in the good times, and/or leave to set up in competition with their former employer, taking their expertise & contacts with them. Also the commentary today refers to;

the inherent volatility associated with a project-based consultancy...

Other points of interest

- Genuinely international, with 43% of core business revenues in USA, and Europe (excl. UK) at 36%, which should provide some nice cushioning against forex movements.

- Big acquisition, of £13.2m in Sept 2017, of Technology Services Group, funded from existing cash pile.

- Freehold property of £21.7m - that's 26% of the market cap.

Balance sheet - this looks peculiar, with a ton of freehold property, financed with bank debt on a fixed rate (until 2026 - a smart move, I would say) of 3.5%. Plus a big cash pile - earning next-to-nothing in interest.

Here are the usual figures, with my comments;

NAV: £37.7m

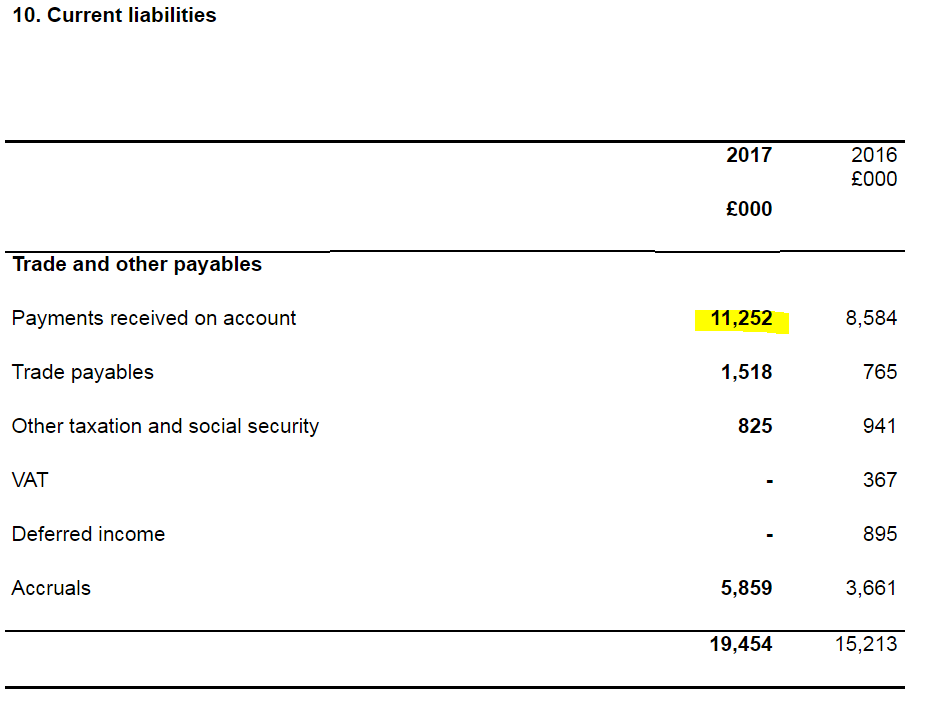

NTAV: £16.7m - this is less than I was expecting actually, at 42.4p per share.

The reason is shown in note 10;

The £19.5m trade payables figure looked way too high to me, and the reason is that the company is collecting in tons of cash up-front, from its customers. Therefore the £19.9m of cash shown within current assets, is not really the group's cash. £11.25m of it is customer monies, paid up-front. So I would be inclined to offset the two, and arrive at a more meaningful cash balance of £8.7m.

So caution is needed here, not to run away with the wrong idea that the company is swimming in assets. There are 2 key points;

1) The freehold property of £21.7m actually has £13.9m of bank debt associated with it, so net that comes out at £7.8m in equity within freeholds. I don't know what the open market value of the freeholds is though, which could be above or below book value.

2) The cash pile of £19.9m has been boosted heavily by £11.25m of customer funds provided up-front. So I would net those off, to get £8.65m of genuine net cash, calculated on a more prudent basis.

So, whilst its balance sheet is good, I think the company is perhaps guilty of exaggerating that strength in the narrative & highlights! It always pays to double-check the detail.

Note also that receivables look a bit on the high side to me. So I were meeting management, I'd want to drill in to what payment terms are offered to customers, and whether the company is tight enough on chasing up overdue customer payments?

Performance share plan - I don't have time to go into this now, as I've almost finished my bottle of Lanson, so am starting to feel a bit woozy. This is just to flag that today's results narrative sets out a new, or changed incentive scheme for staff. The preamble makes a compelling case for doing this, so I wouldn't automatically dismiss it.

My opinion - this is just an initial review, but I like what I see.

There's something different about companies which have big Director shareholdings. They usually tend to be more long-term, and prudent in their thinking. This is why renowned investors Lord Lee, and David Stredder, swear by family-controlled, or management-controlled businesses, as great long-term investments. That approach has certainly worked brilliantly for them both.

You get the occasional bad apple, like Interquest (LON:ITQ) , where lousy management run the business into the ground, and then try to pinch it from outside shareholders on the cheap (just look at the profit warnings, collapse in share price, sneaky attempts to go private by the back door, etc). By and large though, I am increasingly drawn to businesses with committed management who are major shareholders.

Therefore, whilst I don't know much about Science, on this review of its results, I am happy to add it to my list of things that require a closer look, when time permits. However, like many small caps at the moment, the chart is showing signs of investor fatigue, or topping out. So there probably isn't any great rush to get involved right now;

Croma Security Solutions (LON:CSSG)

Share price: 103p (up 17.7% today, at market close)

No. shares: 15.9m

Market cap: £16.4m

Croma Security Solutions Group plc the AIM listed total security services provider announces its unaudited interim results for the six months to 31 December 2017.

Several readers have asked me to look at these results. I assumed Croma was a me-too type of CCTV company, but it seems to have a more diverse product offering, despite being a tiny company - only £16.4m market cap.

Here are some interesting clips from today's interim results narrative;

- Strong trading performance driven by the high demand for increased security from both the private and public sector

- Both divisions Croma Vigilant and Croma Systems have been successful in securing new and maintaining existing business

- ...secured the largest manned guarding contract in the Company's history worth 27 million in total over 6 years, commencing in the current year; and

- become accredited to provide security for local communities as "replacement police support"

Outlook for 2018 -

Ideally placed to deliver a record performance for the full year

Look to maintain progressive dividend policy for FY 2017

Interim results show PBT up fourfold to £1.0m - just in H1.

Is this just a one-off, due to a big contract or two, I wonder? What is the company's history like?

As you can see, it has a history of making c.£250k profit p.a. Therefore £1m H1 profit announced today, is on a completely different scale. That's great, but it also needs to be carefully scrutinised, as there's an elevated risk it could be a one-off. I'd need a lot of convincing that this is a new, much higher, and sustainable level of profitability, before I'd be prepared to value the company on a multiple of the latest earnings.

Reading more, of the RNS, this (at least partially) confirms my caution;

"Profits for H1 are well in excess of the whole of last year so we are on track for this to be a record year for the business.

While there have been some premium one-off contracts within the H1 trading performance, this has been combined with long-term contract wins which will commence in the second half.

Moreover, we believe security will continue to be an increasing priority for government and the commercial world and that Croma's combination of technically innovative security solutions delivered with an ex-military ethos differentiates us and makes us well placed to continue to gain market share."

No split is given between one-offs, and new contracts, so I see this as incomplete information, making it impossible to value the share.

I like the "ex-military ethos" comment above. There are far too many thugs operating as security guards. So with good screening, I think an ex-forces recruitment process would be a good thing.

Anecdotally, back in the 1990s, I can remember being initially reluctant to employ ex-forces people, as they struggled to fit in, and seemed awkward at interviews, and with little relevant experience for the commercial world. However, an employment agency persuaded me to employ a couple of ex-services people. One of them even begged me to give him a job at interview, which was quite shocking, saying that he was over-qualified, and just wanted a chance to prove himself in the commercial world.

The result was not perfect - they had some, shall we say quirks (e.g. being overly sexist in a business that was 90% female, which went down like a lead balloon), "banter" that went down like a lead balloon (e.g. jokes about staff having the painters in, etc), appallingly rude telephone manner, etc. BUT, the work got done, on time, every month, without fail (it was payroll, so pretty important, and bloody difficult to find good people in that space).

So I had my work cut out to smooth over numerous indiscretions by my ex-military staff. However, they were easily the most loyal & hard-working people, who would take work home without complaint, and work all weekend if necessary, I could rest assured that the payroll would run smoothly, and 3,000 people would get paid. Apart from the time that Lloyds Bank rejected the entire company's payroll run, over a technicality that a few thousand tiny cheques had not technically cleared. That's why I almost vomit every time I see that silly black horse advert, telling us (falsely) that Lloyds has been by our side for 350 years. They really haven't - Lloyds Bank destroyed many good businesses in the 1990s.

How did we get onto this? Back to balance sheets! I am thinking of changing my nickname from Paulypilot, to PaulyBalanceSheet;

Balance sheet -

NAV: £10.77m

NTAV: £2.5m

Current ratio: 1.38 - that looks OK, but I'd like to see the balance sheet strengthened a bit more, if it's going to continue expanding.

Cash position: £1.37m in cash, and it seems to have paid off borrowings in the last year. That's excellent.

Receivables - look reasonable, for annualised revenues.

My opinion - this looks worth a closer look.

Although I'm a bit sceptical about how sustainable this level of higher profitability is. The company/group seems to be in a sweet spot, which may or may not continue. Do they have a moat? Security manning services have little moat. Although, if a company does a great job, then clients are likely to stick with them, rather than move to a mickey mouse outfit that is cheap, but inept.

It's not the sort of thing I would buy (too small & unpredictable), but it looks potentially interesting. If management is capable of winning highly profitable contracts once, then who knows, that could continue?

I'll be having a lie-in tomorrow morning, so expect updates in the afternoon & evening. Apologies for any typos, am too tired to go back & check/correct.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.