Good morning, it's Paul here!

Market overview

It seems to me that the froth is coming off things. We've had a roaring bull market, with lots of speculative stocks zooming up. It's all felt rather euphoric, and it's been ridiculously easy to make money in growth stocks, in the last couple of years.

Conditions like that don't last forever. The skill is not in making money during the euphoric phase of a bull market - that's the easy bit. In fact, it's often the most reckless people who make the most money in bull markets - total junk can easily multibag for a while. The difficulty is hanging on to that money, once the bull turns into a bear. The reason that's tough, is because to maximise the gains in a bull market, you have to do pretty daft things - like ignoring valuations, and conventional value metrics. It's all about running the winners.

Then inevitably, at some point the music stops, and the party's over. Then the momentum stocks nearly all roll over, and give up a lot of the gains. With powerful rallies along the way, to suck people back in. I am seeing a lot of parallels between what's happening now, and my memories of 1998-2000. Excessive valuations for growth companies, in particular. Plus a big appetite for blue sky story stocks, at high valuations again.

I can't predict when the bull market will end. We're long overdue a big correction. So personally I'm feeling pretty cautious at the moment. I'm not interested in opening up any new long positions on expensive growth stocks, and have sold most of the ones I was in - e.g. Purplebricks (LON:PURP) - where the valuation is just too high now.

e-commerce stocks are still very interesting though - because the growth rate is still so high, something like 20% p.a. still in all e-commerce sales in the whole UK. The flipside of that growth, is that the market share has to come from somewhere. So I see older, more traditional retailers as being very vulnerable. Hence I'm short of Marks and Spencer (LON:MKS) , Debenhams (LON:DEB) , and Halfords (LON:HFD) for example.

Overall though, sentiment is really driven by the US markets. So if they keep going up, then the chances are, so will we. That's the bit we can only guess at really.

Retail leases

This is an interesting area of change. In the past, the standard lease terms were 25 year, with upward-only rent reviews. Then that dropped to 15-year leases typically, which has remained the case for several decades now. These horrible, inflexible leases, have killed off many retailers over the years.

However, the turmoil for retailers now means that increasingly they are insisting on only signing more flexible, and shorter leases. Next (LON:NXT) said this earlier this year - they're not taking on leases of more than 10 years, and usually lower.

Rents seem to be falling in many towns too. Next said that it is achieving rent to revenue of 5% on its new sites (as opposed to 7% on existing). This is very interesting, as it helps offset a lot of the other upward cost pressures faced by retailers.

Hence I wouldn't write off conventional retailers just yet. The ones who are flexible, and have short leases (which they can ditch, if the rent becomes unaffordable), and relatively low fit-out costs, could continue to trade well ( Shoe Zone (LON:SHOE) springs to mind).

The dinosaurs with huge property portfolios, and long leases, could end up in real trouble I reckon. So those are the ones to worry about.

Fascinating times!

Fairpoint (LON:FRP)

Delayed accounts are always a massive red flag.

Fairpoint said on 28 Apr 2017 that it intended publishing its 2016 accounts in mid-May 2017.

Then on 24 May 2017 the company said its 2016 results are expected to be published in June 2017.

So here we are, almost at the end of Jun 2017, and it's pretty obvious that something has gone badly wrong. Shares have to be suspended if a company doesn't report its accounts within 6 months.

Suspension of shares - this bombshell was announced at 7:30 this morning:

The Company announces that it has been notified by its bank, AIB Group (UK) plc, that it is unwilling to provide the level of on-going support requested by the Company.

As a result, the Group is unable to sign-off the audit of its annual report and accounts for the year ended 31 December 2016. Consequently, the Company will not be in a position to publish its annual report and accounts for the year ended 31 December 2016 by 30 June 2017 as required by Rule 19 of the AIM Rules for Companies ('AIM Rules').

Dealings in the Company's ordinary shares shall therefore be temporarily suspended under AIM Rule 40 from 7.30 a.m. today until such time as its accounts have been duly published in compliance with AIM Rule 19.

When the bank loses confidence in a company, it's usually the end.

Company law requires that Directors put a company into Administration, if they are trading whilst insolvent (unable to meet liabilities as they fall due). The company could possibly be saved, if a new lender can be found quickly, which the company alludes to today;

The Company is currently participating in discussions with alternative providers of finance who may wish to provide support to the Company's businesses.

Overall, I think shareholders should prepare themselves for a potential 100% loss here.

I'll await developments, as it's probably a bit too early to write a post mortem yet.

6 months ago, I thought there was a good chance the company might be saved. However, events have clearly moved on since then - delayed accounts was the big warning sign. Unfortunately I didn't pick up on that, because I don't follow the company any more (having ditched them a while back), and would have warned readers if I'd spotted it. Hopefully no readers are still holding this share.

Creightons (LON:CRL)

Share price: 32.7p (up 34.8% today)

No. shares: 60.6m

Market cap: £19.8m

Preliminary results - for the year ended 31 Mar 2017.

Quite a few friends hold this share, so I'm delighted to see that it is today's top % riser. They'll be putting out the bunting no doubt, as it's party time! I'll have to dust down my disco shoes. Only joking - they never get dusty, due to constant use!

The company manufactures toiletries & fragrances.

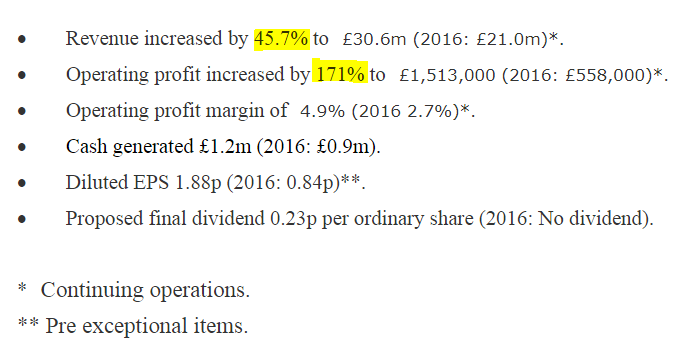

The financial highlights look fantastic - look at that growth;

The key questions are;

- What has caused this strong growth in revenues & profit? and,

- Is it sustainable?

The Chairman sounds upbeat, and mentions increased production capacity;

"Creightons Plc ends the reporting period with an enhanced production capability now able to support innovation, design, development and production across the spectrum from value to premium market.

We believe this, with the increased production capacity, strengthens and improves the resilience of the business and will ensure the Group is well positioned to sustain profitable operations and to continue to seize new opportunities as they emerge in a consolidating market."

The MD added;

"The management team has achieved a significant improvement in the customer base, both in the UK and overseas, with a broader range of products, expansion in the premium sector, extended production capability and capacity, and continued positive cash generation. The Group is poised for further growth."

Balance sheet - looks very good. No issues at all that I can see.

NAV is £8.5m. There are only £0.5m in intangible assets, so NTAV is a healthy £8.0m

Working capital is plentiful, with a current ratio of 2.40, which is very strong.

My opinion - these are excellent numbers, and the company really seems to be on a roll. It has introduced a small dividend of 0.23p, for a yield of 0.7%. I would expect that divi yield to rise, if excellent trading continues.

The share price has already more than 3-bagged in the last year, so improved performance is now baked into the share price. The PER is 17.4 (based on 1.88p diluted EPS), so to be considered good value, the company would need to grow earnings further.

So the shares are now up with events, in terms of 2016/17 results. It sounds as if profits could grow further, which is what could propel the share price upwards even more. Looks an interesting situation, and well worth a closer look. Well done to existing holders!

Crawshaw (LON:CRAW)

Share price: 25.1p (down 13.6% today)

No. shares: 113.0m

Market cap: £28.4m

AGM Trading & Strategic Update - covering the 20 weeks to 18 Jun 2017 (since the company has a January year end).

LFL sales are still negative;

Group sales were up 5.1% for the first 20 weeks of the financial year with like-for-like sales down 4.5% for the same period.

The trading performance of the business continues to be stable following the improvement in like-for-like sales from the initiatives introduced throughout the estate.

Personally I wouldn't describe -4.5% LFLs as "stable".

The big issue here is how will the relationship with major shareholder 2Sisters Food Group pan out? Nothing much is said on this issue, apart from generally soothing words;

Following the announcement of our strategic partnership with the 2Sisters Food Group, we are making good progress on the transitional plans and operational synergies that will deliver the expected customer and financial benefits.

The standalone fresh meat factory shops are all trading in line with expectations. A further 4 new shops of this type are to be opened later this year.

Directorspeak;

"We are pleased with the progress we've made and the continued level of stability achieved in the core business against the current backdrop of industry-wide cost pressures and a challenging consumer environment.

Our new fresh meat factory shops continue to perform well and we are further encouraged by our most recent opening at Crystal Peaks, Sheffield. Our strategic focus for the rest of this year will be to open 4 more fresh meat factory shops and to ensure that we are maximising the customer and financial benefits of the new supply partnership across the estate."

My opinion - I've ummed & erred on this one, and just can't make up my mind.

It made a brief appearance in BMUS, but then I got cold feet & threw it out. At first, I quite liked the supply partnership with equity investor 2Sisters. However, on pondering it more, I came round to the view that the inherent conflict of interest with this arrangement made the share too difficult to value.

It might work out well, and 2Sisters might push a lot of cheap product into CRAW, in order to boost its profits, and drive up the share price. Alternatively, 2Sisters might seek to maximise its own profits, by getting rid of unwanted stock through Crawshaws.

I generally don't like any related party arrangements. It's much better when things are all done at arms length. For this reason, I have to file Crawshaws in the "too difficult" tray.

Incidentally, I've been updating my reports further in the afternoon & evenings this week, so there might be new sections you've missed. So if you're interested, it might be worth having a quick look on the SCVR landing page, which lists them all (scroll down).

Sorry, didn't manage to do any more sections on this report, was too tired. Sometimes it flows easily, sometimes it's a struggle.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.