Good morning, it's Paul here with the SCVR for Weds.

Estimated timings - there's not a great deal of small cap news today, so I should be finished by 1pm.

Today's report is now finished.

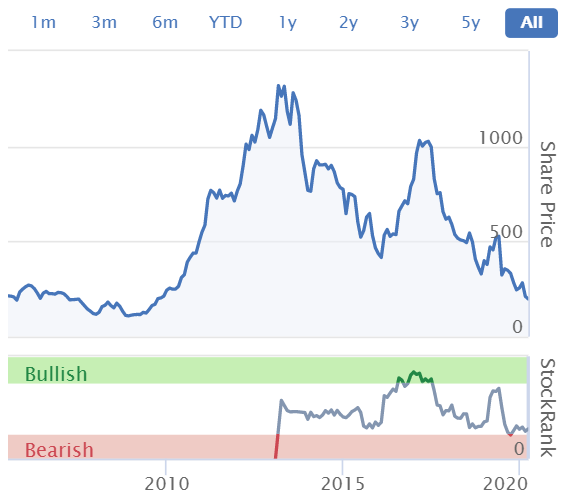

Dialight (LON:DIA)

Share price: 199p (up 10% today)

No. shares: 32.6m

Market cap: £64.9m

Dialight plc (LSE: DIA.L), the global leader in sustainable LED lighting for industrial applications, is today issuing the following update relating to its manufacturing footprint further to its announcement on 21 April 2020.

Today's update comes just 8 days after its last update, so I need to look back at that first. I'll summarise the 21 April update below;

21 April update - summary of key points -

- Temporarily suspended production in Mexican & Malaysian factories - applied for "essential business" orders

- Order intake normal until softening in late March

- Order by region - USA (largest market) resilient, EMEA "significantly impacted" by lockdowns, APAC "more resilient"

- Cost cutting - usual stuff e.g. suspending capex & discretionary spending, furlough (number not stated) & pay cuts

- Board - taking 20% pay cut, Chairman waiving fees for now (impressive leadership/commitment, good for him!)

- Net debt slightly down from 31 Dec 2019. Now £16.2m - unwinding working capital (worth noting, as once business improves, likely to suck cash back into receivables & inventories)

- Bank - £25m facility to Feb 2023. Talking to bank about enlarging facility & relaxing covenants

- Expectations for 2020 significantly reduced (no figures given). Confident about longer term

That all sounds fairly much as I would expect. The funding position looks potentially problematic, if bank not prepared to be flexible. Dialight has not performed very well in recent years, hence bank support may not necessarily be a given, if things get seriously bad in 2020. Depends if it is able to qualify for a Govt loan guarantee scheme? Clearly that would help greatly.

29 April update (today) - summary -

- Mexican factory can now re-open, in phases starting today

- Malaysian factory also re-starting (underway)

- This means all facilities will be operating, albeit at reduced capacity

Balance sheet - at end 2019 looks OK, but inventories look too high.

My opinion - it's impossible to value at this stage, as there's no visibility on sales/losses.

Relying on bank support for now is OK, but Dialight would probably need to raise fresh equity once business is recovering, to fund increased working capital, and reduce bank debt. Plus remember that losses in 2020 (which seem likely as it wasn't making much profit even before Covid-19) would lease a permanent scar on its balance sheet. This is a theme I keep referring to. I suspect some investors are not factoring in that, even if trading returns to normal in 2021, many companies will be left with a hole in their balance sheets from the substantial losses likely to have been incurred in 2021. That's likely to require an ongoing tidal wave of equity raises, for some time to come. So far so good, with decent companies apparently having no trouble tapping shareholders for fresh equity. But what happens in say 6 months time, when lower quality companies try to raise more equity? That could prove difficult, and lead to possible deeply discounted fundraisings, for survival. Especially if the markets overall drop back again from the recent, large rally.

Overall then, I'm cautiously avoiding stuff like this, which wasn't a very good company before Covid, and might need to raise more equity from the likely big losses in 2020.

.

Nwf (LON:NWF)

Share price: 200p (up 21% today)

No. shares: 48.75m

Market cap: £97.5m

NWF Group plc ('NWF' or the Group), the specialist distributor of fuel, food and feed across the UK...

This is a strong update today, key points (not comprehensive) -

- Maintaining operations well, despite Covid-19

- Staff treated as key workers, some working from home, nobody furloughed, and no Govt support sought

- Managing costs & balance sheet flexibility

- Strong position - plenty of headroom on £65m bank facility (only £17.4m drawn down at end March)

- Strong H1 (to end Nov 2019), Q3 (to end Feb 2020) in line, and Q4 so far significant increase in demand.

- Fall in oil price helping profits

- FY 05/2020 significantly ahead of last year

That's all great, but the outlook doesn't sound as good;

Uncertain outlook, activity levels expected to reduce in May 2020. No guidance for FY 05/2021

My opinion - I think the market might have jumped the gun on this, and the share price hitting a new 12-month high today seems incongruous, given the uncertain outlook. It seems to me that there could be some one-offs in the surge in demand from Mar 2020 - nervous customers stocking-up as Covid began to bite, maybe? The boost to profits from oil price volatility is also a one-off.

For that reason, I definitely won't be buying into the 20% spike today.

All done for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.