Good morning!

The RNS feed today is uninspiring, frankly.

To add to the gloom, the market is awash with red ink and is down by 1.3% as I write this.

In particular, I have a holding in British American Tobacco (LON:BATS), which is lower on news that cigarette consumption is reducing at a faster-than-expected rate, mostly because people are switching to alternatives more quickly than anticipated.

But the tobacco sector doesn't explain why the market as a whole is weaker. Mainstream media tries to help us understand the wider malaise:

The blue-chip index took a tumble after the opening bell on Wednesday, falling 0.7 per cent as traders struggled to find anything other than the US-China trade war to focus on.

That doesn't help us much, I'm afraid. Oftentimes, it's not clear why the market is doing what it is doing - the only ones who know are the ones doing the big buying and selling on that day.

Whatever the reason, I've taken advantage of the improved pricing this morning to increase my FTSE exposure, via put options. I haven't got my buying boots on properly yet but I would if we saw the index back around 6500-6600. Might be waiting a while for that!

Here's my latest portfolio breakdown, including cash and the funds in my derivatives account:

- Equities 85%

- Fixed Income 8%

- Cash 4%

- Derivative account 3%

This doesn't tell the whole story, however, as my derivatives trades are leveraged to a significant degree. If I take into account the use of leverage and the underlying exposures, the breakdown looks like this:

- Equities 73%

- Fixed Income 7%

- Cash 3%

- Derivative exposure 17%

Quite a big difference, I think you'll agree!

If you have a spread betting or CFD account, I can't emphasis enough how important it is to understand the notional amount you are betting on. I'm sure most of you already do this, but if anyone out there doesn't do it as a matter of routine, you really should start doing it!

To emphasise the point: if you wouldn't spend £100k on a short-term trade with real money, then it might not be a good idea to do it with borrowed money, either. The losses won't be much smaller for doing it with borrowed money, but they might be a lot quicker.

I'm probably preaching to the converted here, but I just thought I'd mention it on a quiet news day.

As for my own plans: if the market remains around the current levels for the rest of the year, and I never get my juicy buying opportunities, I plan to continue buying small amounts of quality companies at regular intervals, to keep the portfolio around 80%-90% invested in equities.

Today we have a few updates from:

- Spectra Systems (LON:SPSY)

- XLMedia (LON:XLM)

- Netcall (LON:NET)

- Essensys (ESYS)

- Trainline (no ticker)

Spectra Systems (LON:SPSY)

- Share price: 130.5p (+5%)

- No. of shares: 46.5 million

- Market cap: £61 million

FY 2019 guidance gets another upgrade at this mysterious company. It makes machinery and technology for the authentication of banknotes, cigarette boxes, etc.

I've just been having a look at its previous broker profit forecasts.

In March, brokers were guiding for $4 million in FY 2019 and $4.4 million in FY 2020 (on an adjusted pre-tax basis). The broker said their estimates were set "with the usual upgrade potential".

Today, the FY 2019 guidance has indeed been upgraded, from $4 million to $4.4 million. One might almost suspect that an upgrade cycle has been deliberately orchestrated.

The company says the gains have come from "a combination of central bank sensor related research funding and strong first half of the year optical materials sales".

It's too opaque for me, so there seems little point in continuing this analysis.

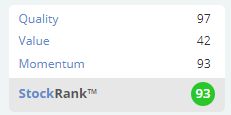

It does enjoy a StockRank of 93, so it ticks a lot of quantitative boxes, and it has been a big winner for investors in recent years. Please note that it is incorporated in the United States.

XLMedia (LON:XLM)

- Share price: 52.75p (+3%)

- No. of shares: 209 million

- Market cap: £110 million

This update is merely in line with expectations, so in normal circumstances I wouldn't bother commenting on it.

However, at a P/E multiple of 5x, these aren't normal circumstances for XLMedia. The market has stopped believing in it, after it had a change of strategy.

It is now focused on publishing, as a website owner, sending its users to gambling companies and financial products.

The non-Executive Chairman says:

As a consequence of the current weakness in the Company's share price and pending approval at today's AGM granting the Company authority to buy shares, we intend to continue the share buyback programme that was initiated in December 2018.

Credit where it is due: XLMedia has reduced its share count from 221 million to 209 million, and is doing the right thing by continuing to buy back shares at these depressed levels.

It's not something I'm going to participate in myself, because I am extremely selective when it comes to foreign companies listed on AIM. The only Israeli stock in my portfolio is 888, a FTSE-350 component, and even that one has been a difficult investment so far.

In summary, this is beyond my risk tolerance, but I acknowledge that the risk:reward could be favourable at current levels. Cash was reported for December 2018 at $47.6 million (the company has been buying back shares since then).

It would be a red flag for me if the buybacks were cancelled or reduced to pursue another acquisition. How could anything be cheaper than its own shares at this level?

Netcall (LON:NET)

- Share price: 51.5p (-9%)

- No. of shares: 143 million

- Market cap: £74 million

I've never looked at this before, but am mentioning it in response to reader comments.

Netcall plc (AIM: NET), the leading provider of Low-code and customer engagement softwaretoday provides an update on trading for the year ending 30 June 2019.

I don't understand what this company does but I might be able to help untangle the RNS a little.

This is a profit warning with product revenues coming in lower than expected. Purchase delays from the NHS and cannibalisation by Netcall's cloud-based products are blamed.

The company is around flat in terms of net debt, with cash almost matching gross debt as of April month-end. We can assume there is an element of window-dressing.

Outlook: "very optimistic".

My view: Not having studied this before, all I can say is that it's clearly very expensive compared to short-term earnings. The latest broker note suggests that the P/E ratio for FY June 2020 is 60x. According to Stockopedia, using last night's numbers, the ValueRank is just 10.

I'm afraid I don't see the sort of rapid top-line growth which would help me to understand this valuation.

Essensys (LON:ESYS)

- Share price: 151p (placing price)

- No. of shares: 48 million

- Market cap: £72.6 million

Admission to trading on AIM and First Day of Dealings

This describes itself as: "the leading provider of mission-critical SaaS platforms and on-demand cloud services to the high growth flexible workspace industry".

In other words, it's hitting three of the absolute hottest themes in the stock market right now:

- SaaS

- Cloud

- Flexible workspace

For context, the loss-making company WeWork has recently signalled an intention to IPO. Its private market valuation has soared to $47 billion.

As the writer at Vox says in relation to WeWork's acquisition spree:

Viewed in one light, what you have is a wildly overvalued real estate leasing company that is flailing around, trying to take advantage of private markets’ excessive enthusiasm for anything tech-related in desperate hope of hitting on something that works.

Well put. Investors are desperate to put money into hi-tech stories right now. And they've also fallen in love with the flexible workspace meme.

According to the admission document, Essensys generated revenues of £9.6 million in the six months ending January 2019, resulting in adjusted net income of £500k. This was before share based payment expenses of £700k.

In the previous financial year, profits of £400k were generated from revenues of £16 million.

Well done to the company and its bankers for achieving a market cap in excess of £70 million and raising £28 million (half of it for the benefit of selling shareholders). I expect that their timing will turn out to have been impeccable.

Trainline (owner of trainline.com) is seeking to raise £75 million and list on the Main Market.

This is "the leading independent rail and coach travel platform selling rail and coach tickets to millions of travellers worldwide, enabling them to seamlessly search, book and manage their journeys all in one place via its highly rated website and mobile app..."

I use this website myself but never realised how international it is - active in 45 countries, apparently. I look forward to learning more about it in due course.

Time's up for now, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.