Morning Everyone,

Thank for the requests - as usual, I prioritise stocks which appear in the comments, while also keeping an eye out myself for new ideas! Paul will be back tomorrow.

Cheers,

Graham

Impax Asset Management (LON:IPX)

- Share price: 161.5p (-3%)

- No. of shares: 128 million

- Market cap: £206 million

This is an environmentally-focused asset manager which I've written about several times this year.

Unfortunately, I didn't have the spare funds to invest in it earlier this year, when it seemed quite cheap against its earnings and prospects.

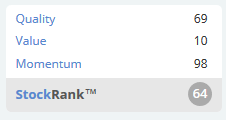

The value proposition is different now that the share price has trebled in a year:

So today's slight dip in the share price is in the context of a company where great things have arguably already been priced in.

The results are excellent, as expected. In the year to September, AuM increased by over 60% (we already knew this thanks to the Q4 update:

Assets under management and advice ("AUM") increased 61% to a new peak of £7.3 billion (2016: £4.5 billion), rising further to £7.6 billion by 31 October 2017

Record net inflows of £2.1 billion across several strategies and geographies

So inflows were responsible for three-quarters of the AuM, with market movements responsible for the rest.

Note also that the $52.5 million acquisition of similar US outfit Pax World is set to complete in Q1 2018. This is a debt-funded acquisition which will increase the company's risk profile in the short-term, but could super-charge earnings per share in future years.

The financial highlights below show the effect of operational leverage, as op. earnings rises at a much faster rate than revenue.

It's worth bearing in mind, naturally, that inflows during the year will not have generated fees for the entire year. You only generate fees on average AuM, not on closing AuM.

Revenue: £32.7 million (2016: £21.1 million)

Operating Earnings: £7.9 million (2016: £4.2 million)

Profit before tax: £5.9 million (2016: £5.2 million)

What may be disappointing investors a little bit is the rather muted PBT figure.

£1 million was spent on advice related to the Pax acquisition. £0.6 million has also been lost in FX translation of the value of foreign currency in advance of that deal. There are some more costs which are contingent on the deal completing.

Without those costs, Impax would have reported a 44% increase in PBT - it just goes to show how expensive deals can be in the short-term, and why organic growth is so valuable.

Overall, though, the results look satisfactory to me. A lot depends now on the deal successfully going ahead.

I've warned previously about inflows being from a relatively small number of customer mandates.

Today we get an update on the level of customer concentration here:

Revenue from three of the Group's customers individually represented more than 10 per cent of Group revenue, equating to £5,243,000, £4,275,000 and £3,428,000 (2016: three, equating to £3,644,000, £3,267,000 and £3,003,000).

As the company gets bigger, it will hopefully also become less risky, from an investment point of view, as customer concentration diminishes. For now, it is still quite heavily concentrated.

One other thing that caught my eye - whatever about the rights and wrongs of climate change/anthropomorphic global warming, it sounds like Impax is excited about its investments in the sphere of resource efficiency. That's a sector which ought to do well, regardless of global climate change agreements:

We see a proliferation of opportunities to invest in smart systems to manage inventory control, production lines and warehouse space, and to reduce transportation costs across most industries, most notably in consumer goods. We are also following the rise of blockchain technology, which has the potential to transform resource efficiency across supply chains.

Outlook statement is confident.

My opinion

The market cap is around the same ratio compared to (pre-Pax) AuM as it was last time I covered it, c. 2.7%. Again, I consider that to be around average.

The Pax deal increases the level of uncertainty but brings with it strong potential rewards.

Overall, then, I have about the same opinion as I did last time. It's a nice company and I still think it has a positive future. The costs associated with integrating Pax may continue to weigh in the short-term, and the valuation is no longer obviously cheap against its peers.

Motorpoint (LON:MOTR)

- Share price: 175.6p (+2%)

- No. of shares: 100 million

- Market cap: £176 million

This is a used car supermarket focusing on the "nearly new" segment (cars less than two years old and with less than 15,000 miles on the clock. It claims to be the largest independent vehicle retailer in the UK.

There was some trouble with new sites underperforming not long after it IPO'd, but performance has recovered since then.

This is the common pattern of an IPO coming in quite optimistically, running into serious problems, and then giving investors much more interesting buying opportunities within the first year or two (assuming that the underlying business is sound).

You could buy Motorpoint at nearly a 40% discount to its IPO price within the first year of its IPO, and it remains below its IPO price today:

Today's results show a healthy recovery, with adjusted PBT coming in as expected after the most recent update:

Revenue increased 18% to £483.2m (FY17 H1: £408.9m)

Profit before taxation and exceptional items up 64% to £10.5m (FY17 H1: £6.4m)

Profit before taxation up 304% to £9.7m (FY17 H1: £2.4m)

Just one new site was opened, so hopefully even if it were to underperform, the effect on group earnings would not be so bad.

Today, it's confirmed that the new-ish sites are now maturing well:

The new sites that have opened in the last two years continue to deliver an improving performance as they gain awareness in their local markets and increase our share in the nearly new market.

Outlook is in-line for the full-year result, with management expressing confidence now that H2 started well.

The interim dividend increases 50% in another sign of confidence. and there is a separate announcement of a share buyback of up to £10 million.

I'm a huge fan of share buybacks and I find it really interesting that Motorpoint are choosing to do this.

If I was running a company whose shares I thought were undervalued, and if spare cash flow was available, buying back shares is exactly what I'd do.

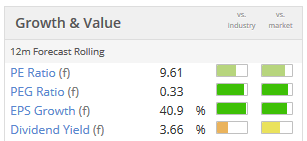

Like many other car retailers, Motorpoint's shares are cheap by conventional metrics. It also has a strong net cash position.

The question is what to do about this - you can do nothing, and accept a mediocre rating (which may be justified after all, given how competitive the industry is, and the macro headwinds).

Alternatively, you can increase the risk profile a bit, but give your long-term shareholders the chance to make a really meaningful return. Buying back shares is a great way to do that - it puts free cash flow to good use, it's cheaper than making acquisitions (lower transaction costs), and it removes shareholders from the register who don't believe that the shares are undervalued.

Maybe other car retailers should follow Motorpoint's lead?

The growth strategy is to open another 20 sites in the medium-term. It currently has 12.

But given what happened with the four underperforming new sites in the last couple of years, it seems to me that it would be better if growth happened at a cautious pace, to avoid running into too many complications all at once.

The company's minimum goal is to open at least one site per year, and that sounds like it would be enough.

The thing is that when the shares are rated on a cheap-ish multiple, then spending spare cash on buy-backs, as the company has announced, can be a lot safer and more productive for shareholders than opening new sites.

Cineworld (LON:CINE)

- Share price: 578.25p (-17%)

- No. of shares: 274 million

- Market cap: £1,584 million

Possible offer for Regal Entertainment Group

This is much bigger than we usually look at here, but is a popular share among readers and is one I've mentioned before.

Last time I mentioned it, I speculated that 2017 would be a better year for box office sales than 2016, based on the release of some slightly more interesting movies, and a few dependable sequels. That has indeed been the case if you look at the US stats here.

Cineworld has produced excellent growth in recent years through the consistent reinvestment of its earnings, and moderate amounts of debt.

This potential deal would transform it entirely:

The Board of Cineworld notes the press speculation regarding a potential acquisition of Regal and confirms that it is in advanced discussions with Regal, the second largest cinema chain in the United States, and is finalising due diligence in relation to a possible all-cash offer to acquire 100% of Regal at a price of US$23.00 per share (the "Potential Transaction").

Before news started to leak, the Regal share price was around $16. That makes for a generous premium at $23.

It also makes for a huge deal worth $3.6 billion or about £2.7 billion. Significantly larger than Cineworld's current market cap!

How to fund it - "incremental debt and a material equity raise".

It would qualify as a reverse takeover under the FCA's listing rules.

I've taken a quick look at the rules for reverse takeovers. Speaking very roughly, I think that any deal which involves the taking over of a larger company by a smaller company counts as a reverse takeover (the Consideration Test at this link). I could be wrong on that.

What this means is that Regal shareholders won't necessarily end up being majority shareholders of the combined group. If Cineworld raises enough funds from existing shareholders, and borrows enough additional funds, then existing Cineworld shareholders could remain in charge. We will have to see the finalised terms of the deal.

For now, I am not surprised that the shares have fallen, in advance of a very large equity raise. Anybody who doesn't want to contribute to the equity raise is going to end up diluted, and even those who do participate will face the risks associated with a higher debt load, assuming that the deal goes ahead.

But 17% being such a large fall suggests that rather large numbers of existing shareholders disapprove of the deal and do not want to stick around to see what happens.

Anybody holding it needs to decide for themselves.

My opinion

For me, this deal is too big. There must ways to gain access to the US market without buying the second-biggest operator!

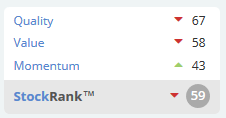

Remember that the StockReports are available for international markets, so you can easily look at Regal's stats here.

By my calculations, the proposed deal will involve paying 23x Regal's 2017 forecast earnings, or 22x 2018 forecast earnings.

Like Cineworld, Regal earns a fairly ordinary return on capital and appears to be carrying around $2 billion in debt. That means the enterprise value for this deal is more like $5.6 billion, or over £4 billion.

Again, it's just too big. I would be selling if I owned Cineworld.

Versarien (LON:VRS)

- Share price: 39p (-12%)

- No. of shares: 147.5 million

- Market cap: £58 million

This is an advanced materials business, still at an early stage financially, but with rapidly increasing revenues. It sells "a range of standard and customer specific thermal products", along with various graphene and plastic products. In total, it has five subsidiaries with a quite diverse range of capabilities.

Operational highlights sound good, and include winning a couple of competitive tenders from the Centre for Process Innovation. It also received its largest order so far which must have been from Rolls-Royce Holdings (LON:RR.) ("the UK's largest aero engine manufacturer").

Financial highlights for the half-year are as follows:

Group revenues increased by 167% to £4.38 million (H1 2016: £1.64 million)

LBITDA* reduced to £0.43 million (H1 2016: £0.80 million)

Loss before tax almost halved to £0.77 million (H1 2016: £1.47 million)

LBITDA is the loss before interest, tax, etc.

Graphene sounds like the exciting part:

We continue to see significant interest from global OEM's wishing to use and evaluate the benefits of using our graphene powder and ink in their applications. The results of these collaborations will be known over the coming months, but require the purchase of additional equipment to satisfy just their sample and testing requirements....

Our focus now, is on ensuring that we support our potential large scale customers in conjunction with the renowned connections we have with both the Universities of Cambridge and Manchester, both of whom are shareholders in both the graphene companies and Versarien.

The company raised £2.8 million (net of expenses) this month, to buy new equipment for graphene production.

My opinion

It's a small, loss-making company. So I'm probably going to be cautious about it, as you'd expect.

For small companies, it's helpful to look at their gross margin to get an indicator of the value-add they perform. Hopefully, as they grow, operational leverage will kick in and then their gross profits will dwarf their operating expenses. That's the ideal, anyway.

The gross margin achieved by Versarien in the period was 24%. Of course, this is complicated by the fact that Versarien has several different pieces to it, and its mix of activities several years from now might be completely different to mix of activities it does today.

But for the sake of comparison, look at Morgan Advanced Materials (LON:MGAM), which has a market cap of c. £900 million. It produces advanced ceramics, carbon, alloys and graphite.

Morgan Advanced Materials (LON:MGAM) has a gross margin of about 60%. To me, that's what a really good margin looks like in the materials business.

So I'd have to be a bit sceptical about Versarien for now. Also, the valuation prices in quite a lot of success, since it is many multiples of forecast revenues out to 2019.

Good luck to any of you who are holding it, this one is not for me!

That's all from me today. Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.