Good morning, it's Paul here with the SCVR for Wednesday.

Estimated timings - there's very little news in my sphere today, so it should be possible to finish by 1pm.

Edit - I got carried away with macro stuff, so need more time to finish the company sections, say by 3pm.

Edit at 15:03 - today's report is now finished.

The Re-opening Trade

This is a theme that I am currently focusing on. As the economy re-opens, then companies are coming alive again, and there could be some bargains around, if the consumer comes out and starts spending again. The market is clearly becoming more optimistic that consumers may be more prepared to get out and spend money, than previously thought. I think that seems correct, for these reasons;

Many people are tired of lockdown. Younger people in particular seem to be realising that (if they have no existing medical conditions and are normal weight) CV-19 presents little to no risk to them. Bournemouth beach was very busy yesterday evening, in the glorious sunshine. I don't see any fear in people's eyes any more, and my hunch is that people could flock to the shops once they re-open, having been deprived of an enjoyable activity for over 2 months. I also think people are getting used to queuing, distancing, and wearing a face mask if they want to. Plus there will be terrific bargains, as fashion retailers rush to clear out excess spring/summer inventories. I reckon we could see a surprisingly strong re-opening of the High Street, but of course that's guesswork at this stage.

Evidence from the USA - is that whilst sales are down, they're not down as much as feared, particularly in apparel I hear.

Bank balances - a friend kindly sent me an interesting article from Bloomberg, stating that during lockdown, Britons have been hoarding cash - because we've got nothing to spend it on! Other than takeaways, beer, and buying random junk on Amazon after consuming the beer! Oh, and gambling online. In March & April, household bank balances rose by £30bn. What's the betting that this fuels a spending spree from 15 June? That sounds plausible to me, and share prices are reflecting the increased likelihood of that happening.

Property REITS - going bananas at the moment, I was a little early to this trade, buying Hammerson (LON:HMSO) and Newriver Reit (LON:NRR) some time ago, but they are now really coming INTU (geddit?!) their own. I reviewed the accounts of both, and concluded that they looked pretty solid on a balance sheet basis, therefore unlikely to go bust. Plus about 10% of HMSO shares were out on loan to shorters. Lovely! We're now seeing a beautiful short squeeze, resulting in HMSO miraculously becoming the 2nd most profitable position in my trading account. If the shops open successfully from 15 June, then landlords may not have to worry so much about rent arrears. HMSO is re-opening its flagship shopping centres on that date. The share price seems to be moving from this is going bust, to this looks like it's going to recover. I love situations like that, especially when shorters become forced buyers, because the upside is large, and it occurs fast.

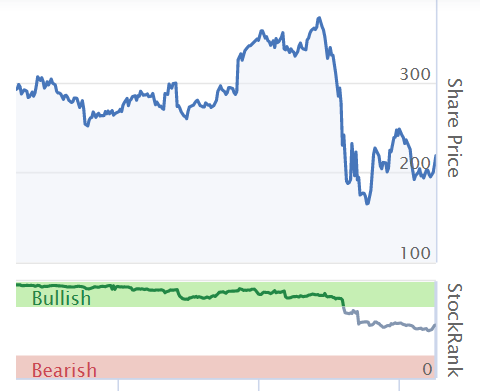

Re-financing - many retailers are successfully refinancing, using equity raises and Govt-backed loan schemes. I'm sure there are likely to be many insolvencies, but perhaps not as many as feared. That's clearly what the share price of Hammerson is telling us;

.

DIY, consumer durables & moving house - being stuck at home for such a long period of time, we must all have become fed up with our surroundings? Therefore are we about to see a DIY boom? Some reports suggest it's already started, with DIY sheds being busy already apparently. Plus, the TV news showed long queues at an IKEA store which had just re-opened. For this reason, I recently bought some Topps Tiles (LON:TPT) - just above my target buying price of 40p. A recent sale & leaseback of property has strengthened its finances (freeholds are glorious things to have tucked away, as they can save the day when a crisis hits, as in this case). I remain bullish on estate agent Foxtons (LON:FOXT) on the basis that it has refinanced successfully, and market conditions could be over the worst. Also, I've recently gone back into Scs (LON:SCS) . Even Marks And Spencer (LON:MKS) is showing some signs of life. Dunelm (LON:DNLM) has been very good, I remain long there - a cracking business, that should do well on re-opening, in my opinion. Norcros (LON:NXR) could be another beneficiary, possibly?

There are lots of shares which could see a nice uplift, if consumers return to High Streets and shopping malls after re-opening day on 15 June. Hence why this is a particularly interesting area to look for bargains at the moment. Obviously the risk is that if re-opening is a flop, then prices could plunge back down again. I might top slice some holdings just in case.

The other risk is that some business may have permanently moved online, accelerating the slow death of High Streets? Or maybe we need a cull of brands which have had their day? Remember that brands which survive, will enjoy more market share of a probably smaller overall market.

I don't want to hold any of the above-mentioned shares permanently. These are trades, which I'll happily bank the profits on at some stage in the coming weeks/months, and move on. My feeling is that it's best to be in a well-protected bunker, when the 30 June interim results start to come out, in August & September, as the figures are going to look really, really bad. I'm not at all convinced that investors will just shrug off these figures as being a one-off. Some might, but it doesn't need many people to panic sell, to trash the price of smaller caps.

Work from home & Zoom

As mentioned previously, I shorted Zoom on absurd valuation grounds & that Google had recently launched a competing product, free. In recent days, I began to realise, from using Zoom, that if a tech product is taking off, then valuation doesn't really seem to matter in this booming market.

Friends persuaded me to use Zoom, and I now love it! Once a fortnight, I join a virtual p*ssup of my old Uni friends. It was a hoot, and I really enjoyed chatting to a couple of people I've not spoken to for 30 years.

Business meetings seem to now be migrating onto Zoom, and the couple I've participated in, have been very successful. It's not the same as sitting in front of someone, but it's a good substitute. Also, with everyone sitting at home, in casual clothes, I found it more relaxed. Plus of course, all the hassle, expense & wasted time of travelling into London, means that I'm getting a lot more productive.

My family are mainly musicians, and they have started using Zoom for online teaching. They even organised a very successful local concert, to showcase up & coming young musicians. The musical performances were pre-recorded, to get decent sound quality, and the whole thing worked brilliantly. I was amazed at the quality of the video & sound, when I joined the concert party (geddit?!). Discussing it later with my brother, he said the concert had been a great success, that the locals loved it, and donated £450 to pay fees to the young musicians. Isn't that lovely?! Bro said that musicians and colleges are all using Zoom now, and it works so well, he can't see any reason to even try out any alternatives.

Based on the above, I took an £8k loss on my Zoom short, and flipped it round to going long. This product could become ubiquitous, globally, hence trying to quibble over the current valuation was probably wrong.

I hardly ever make profits on shorting stuff that looks over-valued. $TSLA has humiliated me many times, for example!

It's generally better to quickly recognise that something is not going your way, and walk away, rather than stubbornly holding on, and seeing the losses mount. It can always be revisited at a later date, once the froth is starting to come off.

As regards working from home, I've discussed this with lots of my investor & city contacts. Most people seem to absolutely love it, although those with children are looking forward to the schools re-opening! My stockbroker works from home now, and says that with cloud-based software, it works seamlessly. Looking forwards, he may not even need an office in the city. Also, he said "we've got so much more money!" - says he can't believe how many years he suffered an unpleasant & expensive commute into London every weekday, spent £10 every day on lunch/coffees, then paid £7 for a pint of Peroni in some packed bar! Things are likely to be considerably different once this crisis has been overcome.

Personally, I hope we move to a hybrid model. Yes I like Zoom meetings, but I'm also really looking forward to meeting my city friends again for long, boozy lunches in our favourite restaurants, putting the world to rights, and chatting about interesting shares. Also I miss the buzz of the city.

It's great that many organisations, e.g. PIWorld, ShareSoc, and many others, are getting companies to do webinars & presentations for us. This is greatly improving investor access, and levelling up the playing field for people who cannot easily get into London for meetings.

If there is a mass return to working in offices, then I wonder if the shares which have boomed on working from home, could go into reverse somewhat? Who would want to be a commercial property landlord right now? We could see more vacancies as leases expire & tenants go under, maybe? Although there's also a lot to be said for having employees congregate in one building - usually more gets done, and good businesses build loyalty by bringing people together to fire off each other, etc.

EDIT: Something else I forgot to mention, is that over time, there should be better treatments developed for covid. In the USA they're very bullish on this, even talking about a vaccine later this year. I'm told by experts that this is highly unlikely, but who knows, they could get lucky. If that doesn't happen, then the US markets are clearly too high. On balance, I feel that if better treatments can bring the death rate down to a modest level, then society could get back to normal, with maybe just the most vulnerable being protected. For example people who have had transplants, have to take medication which suppresses their immune system, so are particularly at risk.

Therefore, rather than ranting on all the time about how the US market looks too high, I'm wondering if the market knows something I don't? Plus, as the old adage goes, don't fight the Fed! A year or two down the line, Govts and companies are likely to be drowning in debt, but for the time being, nobody seems to care. I suspect we might be in a new era, where interest rates have to stay at zero forever, regardless of what happens to inflation. QE could then be used indefinitely. Everything I learned at school & Uni about economics, and from my own experience, seems to have gone out of the window. End of Edit.

Oh well, I cannot put it off any longer, I'll have to plough through some rather boring company trading updates.

Let's start with a reader request;

.

Forterra (LON:FORT)

Share price: 215.5p (up 3% today, at 11:39)

No. shares: 200.4m

Market cap: £431.9m

Forterra plc, a leading UK producer of manufactured masonry products, provides this update and further detail on the measures it is taking to mitigate the impact of Covid-19.

Forterra has a 31 Dec 2020 year end.

- Gradual increase in despatches of goods to clients, as they resume operations

- Daily despatches now running at 50% of last year's level

- Revenue down 39% for Jan-May 2020

- April was the low, down 86%, May improved (but still awful) at -62%

- 12 of 18 manufacturing facilities are now operating, should be fully open by end July

- Trade body is forecasting that residential construction will improve in 2021, but still be down 20% on 2019 (seems quite gloomy to me)

- Restructuring underway, which will cost 225 jobs

Liquidity - this is self-explanatory, and sounds as if the company should be alright;

Balance sheet and liquidity

The Group entered the Covid-19 crisis with net debt (pre IFRS 16) of £43.2m at 31 December 2019.

The Group has access to a £150m revolving credit facility which runs to July 2022, which is presently fully drawn. At 31 May 2020 the Group had cash reserves of £79m as well as access to an undrawn overdraft facility of £10m.

In addition, Forterra plc has been confirmed as eligible for the joint HM Treasury and Bank of England Covid Corporate Financing Facility (CCFF) with an issuer limit of £175 million and is now able to access the liquidity available under this facility. The Board does not have any present intention to draw upon this facility, which provides the Group with additional headroom if required.

That's a ton of headroom.

Outlook - well positioned for attractive long-term market fundamentals. This clearly implies that the short & medium term are not looking great.

My opinion - it looks safe, i.e. not going bust.

I'm a little taken aback at how negative the short term outlook sounds. The company is clearly not expecting a V-shaped recovery in construction.

Dividends might be under threat, given the borrowings. I haven't got any recent broker forecasts to work on.

Overall therefore, I'm not really sure how to value this. Personally I would only be interested in buying at a much lower price. If you think the residential construction market could do better than expected, then this looks a decent company, which has produced good historic results.

If we ignore the autumn 2019 surge in price, which was an indiscriminate rally after the Tories won the election & removed Brexit uncertainty, then the current share price is not that much below where it was a year ago. The outlook was vastly better then, than it is now. Therefore, I don't think the current price factors in the radically worse short & medium term outlook.

.

Angling Direct (LON:ANG)

Share price: 62p (flat today, at 13:27)

No. shares: 64.6m

Market cap: £40.1m

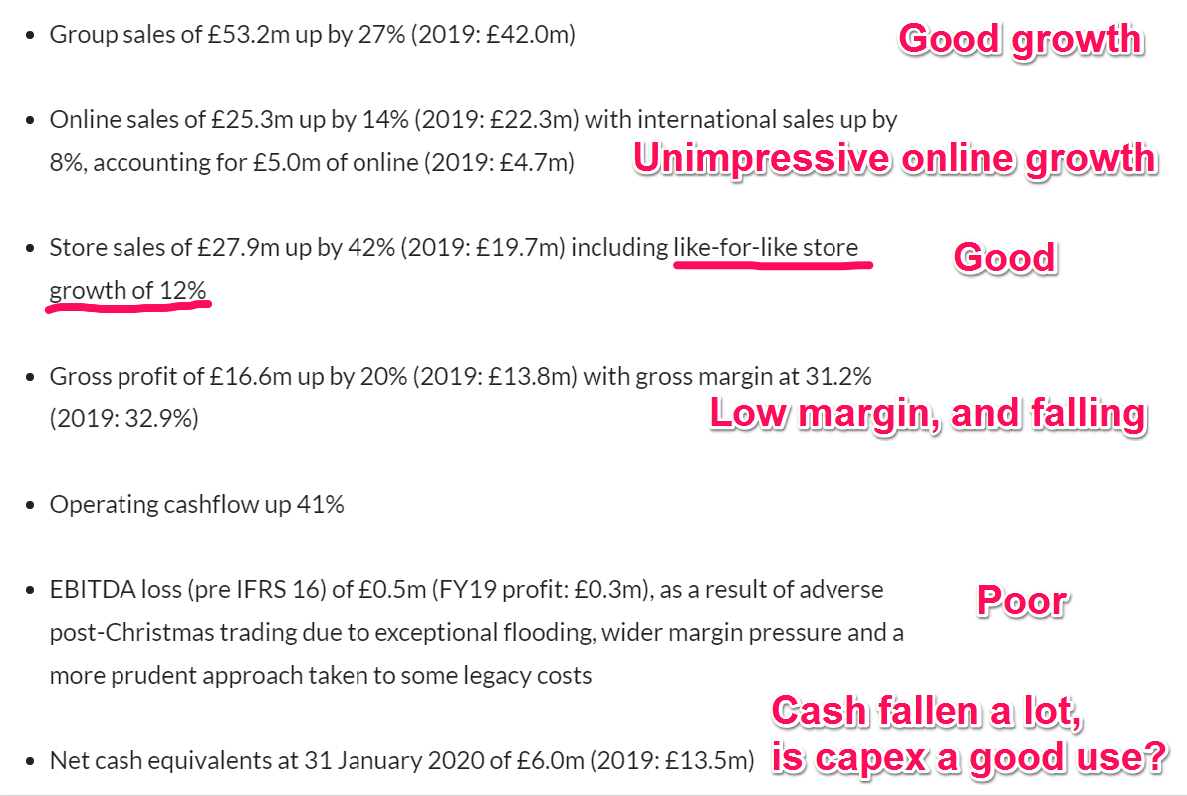

Angling Direct plc (AIM: ANG), the largest specialist fishing tackle and equipment retailer in the UK, is pleased to announce its audited financial results for the twelve months ended 31 January 2020.

Let's try something new! I've added my very brief comments to the financial highlights section;

.

I think that's pretty much put me off wanting to dig any deeper. It's too low margin. That's tolerable for an online only business, but not one which has lots of shops too.

Cash is being spent on capex, acquisitions, and large inventories, but what for? There's no return for shareholders, because it doesn't make a profit.

I cannot see any attraction to this share.

.

Vertu Motors (LON:VTU)

Share price: 30.0p (up <1% today, at 14:24)

No. shares: 369.2m

Market cap: £110.8m

Vertu Motors plc, the automotive retailer with a network of 133 sales and aftersales outlets across the UK, announces its final results for the year ended 29 February 2020.

FY 02/2020 results were in line with expectations, at £23.5m adj PBT - not a lot, on £3.1bn revenues.

Guidance - none given.

As you can see, the share price has rebounded very nicely, and is now back to the bottom of the range it traded before covid. Given the situation, I can't see any point in spending any more time on this. The valuation was attractive around 20p, but is probably about right, now it's rebounded to 30p.

.

.

I'll leave it there for today. See you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.