Good morning, it's Paul here.

Apologies for the mix-up yesterday. Graham & I got our wires crossed, and both thought that the other was writing a report. Anyway, I rectified the situation with a report on 5 companies which I published last night. So yesterday's report looked at;

Interquest (LON:ITQ) - another profit warning

Findel (LON:FDL) - trading well, but I have other concerns

Image Scan Holdings (LON:IGE) - positive trading update (I hold this one personally)

IG Design (LON:IGR) - in line trading update, and decent outlook

Real Good Food (LON:RGD) - another profit warning

Here is the link for yesterday's report.

GYM (LON:GYM)

Share price: 212p (up 3.4% today)

No. shares: 128.2m

Market cap: £271.8m

Interim results - this company operates 97 low cost gyms in the UK. It reports today on the 6 month period to 30 Jun 2017.

The shares listed in Nov 2015, at 195p each. So overall, little share price progress has been made since then, once the initial flurry of excitement wore off, as you can see from the 2-year chart below;

I like the chart - a long period of bottoming out, and now what looks like the start of an up-trend. Could this be a buying opportunity? Let's have a look.

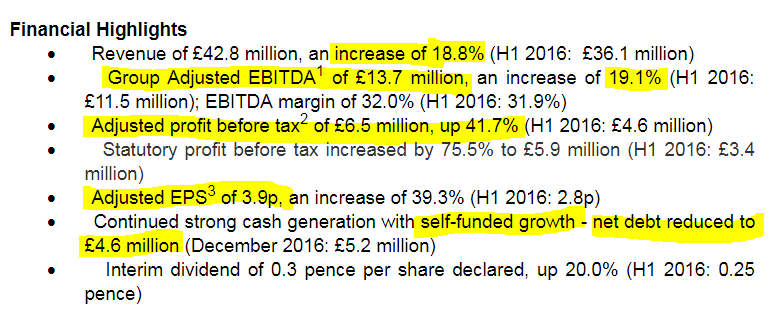

The financial highlights cover the main points, with my highlighting the most important bits;

As you can see, there's good growth. This company is basically a self-funding roll-out - i.e. the cashflows from existing sites are being used to finance the opening of new sites. I really like self-funded roll-outs as investments. The beauty is that investors can just sit back for a few years, and watch the company expand & grow more profitable. That usually leads to considerable share price appreciation.

The main risk to roll outs is that operational problems are considerable. Management has to not only manage the growth, but also keep control of a rapidly growing business, which is far from easy, and requires strong management. The other risk is that competitors spot what you're doing, and copy or improve on the format, thus reducing returns. Other key risks include poor site selection (especially signing up over-rented sites, which become loss-making). Multi-site businesses are also feeling the strain right now from business rates increases, and staff costs (Living Wage, pensions, apprenticeship levy, etc).

This is quite a rapid roll-out;

Expect to achieve the top end of the guidance range of 15 to 20 sites openings for 2017

That's a fairly rapid pace of expansion, given that the company currently has 97 sites. Mind you, having visited a site myself, they're not particularly complex fit-outs. It's just a big space with lots of exercise machines & other equipment in it.

This company says that it is the market leader, in a sector (low cost gyms) with 515 sites (up from 450 in 2016, so competitors are expanding too).

I really like the customer proposition with this company. It's a no-frills gym offering, so particularly no swimming pools. However, they are big, and well-equipped gyms, at an affordable price - average revenue per member is £14.28 per month (down slightly against 2016). The beauty with gyms is that lots of people sign up, but rarely actually use the facilities.

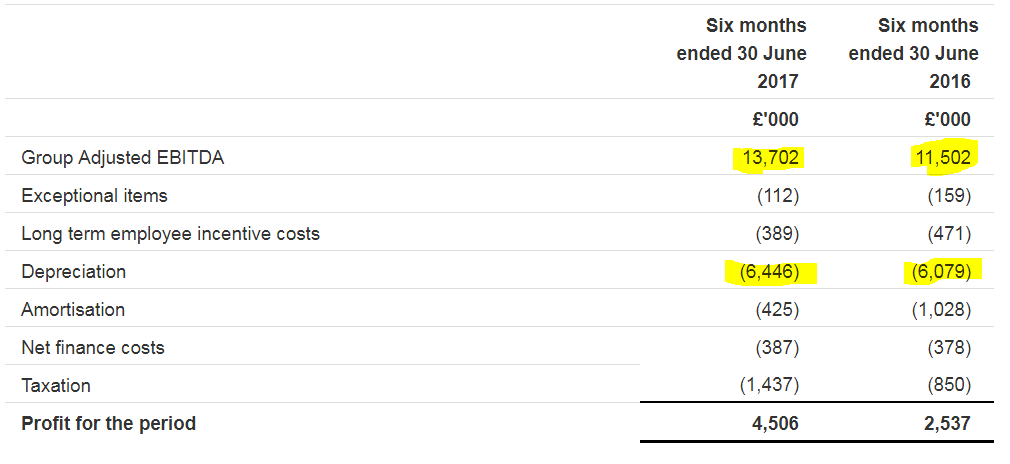

Looking at the figures, the first point which jumps out at me, is the big difference between adjusted EBITDA (up 19.1%), and adjusted earnings is up a much higher amount at +40.3%. The main reconciling item is probably the depreciation charge, so I'll see if I can work that out. Ah, the company has given a reconciliation, and this confirms that the depreciation charge has only risen a modest amount, year-on-year. Therefore that helps boost the percentage increase in adjusted profits.

I'm not explaining this point very well! What I'm trying to say is that the EBITDA figure has risen by £2.2m, but the depreciation charge has only risen by £0.4m, so that gives a leveraged increased in % adjusted profits.

Note also that the site EBITDA margin is good, at 41.5% of revenues.

I've just found an explanation for why the depreciation charge has increased so little;

As a result of the annual assessment of the useful economic lives of property, plant and equipment, the useful economic lives of certain items of leasehold improvements and gym equipment have been increased. This has decreased the depreciation charge for the period by £0.8 million, compared to the depreciation charge under the previous useful economic lives.

Depreciation as a percentage of revenue decreased from 16.8% in the six months ended 30 June 2016 to 15.0% in the six months ended 30 June 2017.

That's a one-off benefit this year, in terms of the increased profit %. Therefore, I would treat the 41.7% increase in adjusted profit with caution. The underlying figure is actually lower than that, since the change in depreciation policy really should be adjusted out, in my view.

EDIT: A broker has estimated that profit would have been up 24%, if the depreciation change is disregarded. So this is quite a significant point to note.

Outlook comments are as expected;

During the second half of 2017 we will continue to implement our plan, opening new sites and bringing to maturity the gyms that have been opened during the last two years.

I am confident that the business is in as strong a position as ever to execute its strategy and deliver further profitable growth.

After a good first half we are on track to meet market expectations for profit for the full year and I am encouraged by the progress we are making.

Balance sheet - this is dominated by fixed assets (note that all property is leasehold), as you would expect. These have a net book value of £104.3m. There are also £48.8m in intangible assets (which I usually write off to nil).

The working capital position looks very weak, with a current ratio of only 0.35. However, in this particular case that doesn't concern me, because the business is so cash generative, and has plenty of headroom on its bank facilities. I think this is just the nature of the business.

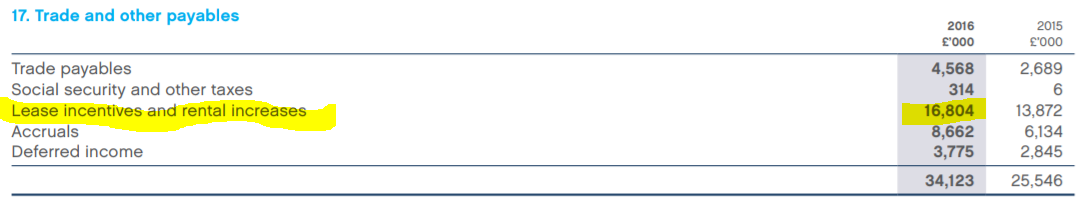

The trade creditors figure of £36.7m is the stand-out number, in that it looks unusually large. No additional detail is given in today's interims. So I've checked the last Annual Report, to see what it contains, as follows;

(NB. figures as at 31 Dec 2016)

I've highlighted the largest number within trade payables, which is £16.8m lease incentives & rental increases. Lease incentives are either cash receipts (reverse premiums) or rent-free periods, which a landlord offers to a new tenant, as an inducement for them to sign the lease. The tenant would end up paying a higher rent, if this type of deal is done, so that's how the landlord recoups the cost in the long run.

In the case of a reverse premium, the way it is accounted for, is like this;

DR Cash £x

CR Trade payables £x

Over a period of time, usually 5 years, the creditor is then gradually fed into the P&L as a negative cost - usually offset against rent payments. What this does is to spread the benefit of the landlord incentive over the number of years that it relates to, as opposed to it being booked as a one-off benefit in year 1.

Anyway, for our purposes, the key point is that whilst this is classified as a creditor on the balance sheet, it's not actually a creditor! i.e. the £16.8m highlighted above does not, under any circumstances, have to actually be paid to anyone. What this means, is that we can safely ignore it, in terms of assessing the company's financial strength.

Overall, NAV is £118.2m. Removing intangibles brings this down to £69.3m. That looks a perfectly adequate capital base, so I'm happy with the balance sheet.

Bank facilities - these look well-structured, and note that the company has only drawn down £10m of a total £40m bank facilities. So it is well-financed, and can comfortably afford to continue its rapid expansion using cashflows, and maybe a bit more bank funding if required. There are no issues here anyway, it all looks fine to me.

Cashflow - this is terrific. The business model generates loads of cash, which is then mostly used for capex - mainly new site openings. In H1 net operating cashflow was £14.5m (up from £13.9m in H1 last year) - remember these are just half year figures. The full year net cashflow in 2016 was £27.0m (before £0.9m exceptional costs). This is a fabulously cash generative business.

I'm not sure how much of the capex is for new sites, and how much is maintenance capex on existing sites. It would be good to find out the split. The narrative does mention a 5-year refit cycle.

Dividends - are negligible at the moment, but when the business matures, it will have the capacity to pay generous divis. So something to bear in mind for the future.

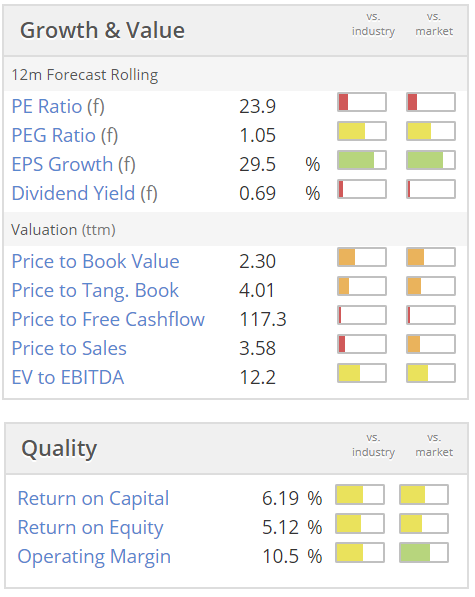

Valuation - I think we've established that this is an attractive business, which is trading well. As a self-funding roll-out, it's not going to be cheap. Here are the Stockopedia stats;

I think that valuation, a forward PER of 23.9, looks about right. It's justified by the strong earnings growth, and the roll-out working well, in my opinion.

My opinion - I like it. This seems a high quality company, which is performing well. It has a sound balance sheet, and is self-funding its own roll-out. Customers obviously like the format, and I've tried it out myself, and can confirm that the facilities are good, and excellent value for money.

I reckon that the revenues might be a lot more sticky than some people think. The worry is that, in times of recession, gym memberships are often cancelled, as one of the few discretionary items of spending that we can cut when times are hard. However, at just £14 a month, it wouldn't surprise me if GYM customers keep their membership going, even when they're feeling the pinch. It's such a small monthly outgoing, for considerable health benefits.

I must admit to being tempted to buy some shares in this company. I'm pretty certain that, on a buy and forget basis, this would probably be a good investment over say a 5-year period.

My main reservation is that it's difficult to see much short-term upside on a valuation which is already quite high. So on balance, I think it might be best to go on my watchlist, as the type of share I would buy at a lower price, if markets generally have a wobble.

EDIT: Many thanks to reader "bestace" who has kindly flagged up the investor presentation on GYM (LON:GYM) website.

HSS Hire (LON:HSS)

Share price: 47.35p (down 14.7% today)

No. shares: 170.2m

Market cap: £80.6m

Interim results - covering the 26 weeks ended 1 Jul 2017.

HSS is a tool & equipment hire business, in the UK & Ireland.

Graham reported on a poor Q1 update in his report here on 24 May 2017, so I've just read that to refresh my memory.

The company seems to be undergoing a restructuring, which the company describes as "substantial operating model changes".

The highlights section looks awful to me - an adjusted loss before tax of -£14.2m in H1. This compares with a £2.2m equivalent profit in H1 last year. That's really bad, especially as the company has a very strained balance sheet, with tons of debt.

Debt interest is a highly material cost, therefore I would ignore the 3 items above my highlighting, as they're meaningless (due to them ignoring interest costs).

Note that the divi has been passed.

The company says that the trends improved in Q2 compared with Q1. So this share is really a punt on the company being able to turn itself around before it goes bust. Looking back to Q1, the adjusted EBITA loss was -£4.5m. In the table above, H1 on the same basis is -£7.3m. Therefore, by deduction this means Q2 was -£2.8m. That's still bad, although it is at least a smaller loss than in Q1.

Cost savings - of £13m have been targeted, compared to the Q1 run rate.

Outlook comments;

So it's a profit warning for Q3.

With a -£7.3m EBITA loss for H1, the £8-11m profit range for H2 means that the company seems likely to report a small adjusted EBITA profit for the whole year, of c. £1-4m. That's all very well, but bear in mind that the interest cost last year was £14.7m. So assuming something similar this year, a small EBITA profit would turn into a hefty loss before tax for the full year of £10-13m.

Net debt - this is the elephant in the room, at a gigantic £230.6m.

I would be worried about possible covenant breaches, given the very poor performance year to date. Nothing is said about this in today's announcement.

Unless performance drastically improves, I cannot see how the company would be able to renew its debt facilities. Its revolving credit facility expires in Feb 2019, and the Senior Secured Notes expire in 1 Aug 2019.

This looks a very similar situation to Johnston Press (LON:JPR) - where the company looks unlikely to be able to refinance its loan notes when they fall due. In the worst case scenario, that means the equity could end up being worth nothing.

The hire fleet has a book value of £125.6m (see note 9 in today's announcement). So to have net debt which is £105m greater than the book value of the hire fleet, looks an extremely imprudent state of affairs.

The bank and the loan note holders must be praying that the company's performance improves in time for them to get their money back in 2019. If not, then a hefty, dilutive equity fundraising could be the only option to refinance the company next year, in advance of debt facilities expiring.

My opinion - I've repeatedly warned about this company's awful balance sheet, right from the moment it floated in Feb 2015. Net tangible assets were negative, at -£54.1m at 1 Jul 2017.

The balance sheet would need to be strengthened by at least £100m in fresh equity before I would consider this share investable.

Tool hire businesses can be good investments when the cycle is turning up. They then see leveraged increases in profits. However, in the good times, capacity tends to increase until there is a glut. Then weaker players end up going bust in recessions, when over-supply meets sharply reduced demand. So a classic cyclical business model. The UK economy is showing some worrying signs of a slowdown possibly on the horizon, so I'm not currently amenable to the idea of buying into very cyclical shares like this.

Given poor trading, and a train wreck balance sheet, I have no idea why anyone would want to hold this share. Risk:reward looks pretty bad. I suppose an optimist might imagine that the company's turnaround plan could make it much more profitable. That has actually happened at competitor Speedy Hire (LON:SDY) so it's a possibility.

The trouble is that cashflow generated would really just be servicing the debt interest. It doesn't look in a position to pay divis for the time being.

Trouble is, the downside risk is very considerable here. Laden with so much debt, I wouldn't be at all surprised if HSS goes bust in the next recession. Therefore, for me it remains uninvestable due to its financial weakness. If risk:reward is poor, then it's best just to steer clear, in my view.

OptiBiotix Health (LON:OPTI)

Share price: 68.5p (down 2.8% today)

No. shares: 78.5m

Market cap: £53.8m

Half yearly report - for the 6 months ended 31 May 2017.

This company describes itself as;

OptiBiotix Health plc (AIM: OPTI), a life sciences business developing compounds to tackle obesity, high cholesterol and diabetes

I note that it has produced negligible turnover to date, and is loss-making. So that's normally the type of thing that I would ignore - as they nearly always go wrong as investments/punts, in the long run. There can be huge speculative moves up during bull markets though, for this type of story stock.

Anyway, I just thought it might be useful to do a quick review of today's numbers, so that we have something in the archive to refer back to in future.

Reading through the results statement, there's not really any point in me analysing the numbers, because again revenues were negligible at £75k. The company's valuation clearly hinges entirely on future expectations of revenues & profit from new products that are in the pipeline.

There was an operating loss of £981k in H1.

An exceptional profit of £4.1m was booked from OPTI spinning off one of its subsidiaries, with a separate AIM listing, SkinBioTherapeutics (LON:SBTX) . That is shown as an investment on OPTI's balance sheet.

Cash - cash is king at jam tomorrow stocks. In this case, it reports £1.9m in cash, and there are negligible creditors. That looks enough to last about a year, assuming no meaningful revenues appear. So possibly looking a little tight? The company reckons it has enough cash though, but blue sky companies always say that, then do more Placings!

Contracts/agreements - the company has an impressive-sounding list of deals underway, with named partners. So this gives some confidence that it's not just all hot air.

Although personally I'd want to see some of these agreements actually generating some real cash inflows before considering investing here.

My opinion - I don't touch companies like this, as practically all of them go wrong, after all the hype dies down. Maybe there's something good here, it's impossible for me to tell at this stage.

Although I do like the newsflow, which sounds credible. Also management seemed credible in a video I watched online.

Overall, it's too speculative for me at this stage, but I'll monitor future results to see if there's any commercial substance to the company. The danger is that people chase up the share price on promising-sounding newsflow, but then hard cashflows fail to materialise. That's the outcome with most jam tomorrow companies on AIM - things tend to take far longer, and cost far more, than originally anticipated.

I've got an open mind though, so will keep an eye on this company for signs of genuine commercial progress.

That's it from me today! See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.