Good morning, it's Paul here.

Formatting of pictures - I'm writing these articles in the new Stockopedia site now, so am learning how to format the pictures so that they work in both old & new sites. That went a bit wrong yesterday, as some pictures were over-sized when viewed in the old Stockopedia site. I've made them smaller now, so yesterday's article should now be easy to read in both old & new formats. Anyway, I know what to do now, so it should be fine for this point onward, whichever version of the site you are using.

Estimated time of completion - I have to be finished by 1pm today, with no extensions, as my cousin is coming over to visit, so I'm booked in to be Uncle Paul to his kids for the afternoon!

Update at 13:17 - today's report is now finished.

Agenda for today;

We'll start with 3 profit warnings - De La Rue (LON:DLAR) (yes, it's a small cap now), Synectics (LON:SNX) & Empresaria (LON:EMR)

After that I'll look at a couple of in line updates - Redde (LON:REDD) , Hargreaves Services (LON:HSP)

Then if there's enough time, I'll take a look at the Q3 trading update from Next (LON:NXT) (large cap bellwether, which I always report on here, because it's interesting for read-across to other consumer stocks) EDIT: sorry, ran out of time. We'll look at NXT another day.

As always, please do add your own comments below - it's a team sport!

.

.

De La Rue (LON:DLAR)

Share price: 147p (down c.21% today, at 08:13)

No. shares: 103.9m

Market cap: £152.7m

Trading update (profit warning)

De La Rue plc, the world's premier currency and authentication provider...

We've never written about DLAR before here, because it used to be a mid-cap. Amazingly, for such a prominent international business, the market cap is now down to only £150m.

Things started to go really wrong in 2017, as you can see from the 5-year chart below (note this has an integrated StockRank history chart below it, on the new Stockopedia site, which is a new feature that I really like);

.

.

As you can see from the vertical plunges in share price, there have been several profit warnings, and another one today.

Other things to note, from my brief review this morning of previous announcements this year;

Shareholder dispute - shareholder Crystal Amber has been critical, publicly, of DLAR

Director changes - there seems to have pressure to remove the Chairman. New Chairman appointed on 2 Sep 2019

New CEO appointed on 7 Oct 2019.

Reorganisation - activities are being focused into 2 divisions, currency and authentication. So expect restructuring costs.

Disposal of ID Solutions business for £42m cash, in Oct 2019.

Venezuela - contract ended due to sanctions, left DLAR with a £18m loss (from Edison note, June 2019)

UK Serious Fraud Office - opened investigation into DLAR's activities in the Sudan - suspected corruption. If proven there, could there be a wider problem with corruption perhaps?

Trading update - on 25 July 2019 emphasised heavy weighting for H2 (often a precursor to a profit warning, as has happened now)

Dividends - paid 16.7p on 2 Aug 2019, and 8.3p paid in Jan 2019, which looks reckless given the company's problems. It's highly likely that divis will be reduced, or stopped altogether, I imagine.

Blimey, what a mess! That's not comprehensive, but gives a flavour for this being an increasingly turbulent year for the company. I read somewhere that DLAR also suffered from losing out on the UK Passports contract.

Trading update today - this is the latest;

De La Rue expects H1 2019/20 adjusted operating profits for the half year ended 28th September 2019 to be low-to-mid single digit millions.

Full year 2019/20 adjusted operating profit will be significantly lower than market expectations.

Management, led by the new CEO, is conducting a detailed review of the business and will update the market further when it reports its H1 2019/20 results on 26 November 2019.

Hopefully there will be a broker update available, to quantify things. Unfortunately, I can't find anything yet, so that means I can't take it any further in terms of valuation on a PER basis. It's striking that this business was making a profit of about £50m p.a. previously, in FY 03/2018 and FY 03/2019. So if it is able to recover from multiple setbacks this year, then maybe this could be a recovery share?

Balance sheet - always of critical importance for every company that runs into trouble, because;

A strong balance sheet usually means that management can focus on fixing the problems, without having to worry about solvency. Shareholders have a good chance of recovering their losses once the business recovers, with no dilution.

A weak balance sheet means that management could be forced to do a discounted equity fundraising, thus potentially heavily diluting existing shareholders, and crippling the share price. Or, in the worst case scenario, the shares end up at zero as the business folds.

In a time of economic downturn, which is looking increasingly the case, at least in some sectors, then my focus on balance sheets has become far more important. Experience from previous recessions shows that banks get jittery in times like this, and can pressurise companies to reduce their borrowings, and raise fresh equity. The worst shares to be in right now, are heavily indebted companies, where profits are reducing. Therefore far more care is needed than in the boom years of 2016 & 2017, when practically all shares went up in price, and nobody cared about bank debt & balance sheets. Things have changed fundamentally for the worse, since then, in my view. I think we could see a lot more heavily indebted companies get into serious trouble. So please be careful.

Looking at DLAR's most recent published balance sheet, as at 30 Mar 2019, this is not a pretty sight. The balance sheet is weak.

NAV: is negative, at -£29.2m

If we remove £33.3m intangible assets, then;

NTAV: negative at -£62.5m - that's bad, but the main culprit is the £78.6m pension deficit - a long term liability. The good news is that's the best type of liability, in that it's manageable, can be paid over a long period of time in agreed instalments, and usually doesn't threaten a business's solvency. So whilst negative NTAV is not ideal, I don't see that necessarily as a huge problem.

Current ratio - this measures the strength of a company's working capital. This measure is poor, at only 0.63. The main culprit here is that the bank borrowings are all included in current liabilities (with nothing in long term liabilities). This must mean bank facilities are due for expiry/renegotiation shortly (not necessarily, see below), which could be a major issue. So make no mistake that this company is reliant on continuing bank support. The risk of it being forced into a discounted equity fundraising, looks quite high. Why on earth didn't management fix the balance sheet previously? Paying out big divis recently looks crazy. No wonder investors kicked out the previous CEO & Chairman.

Net debt as last reported is quite high, but NB. the company raised £42m cash from a recent disposal. That would reduce net debt to £65.5m, which looks a manageable level, where I imagine the bank would be likely to continue supporting the business. That depends though, on the extent of potential losses due to the SFO investigation, and other problems. On balance though, based on the current facts, this looks a survivable situation.

Partially offsetting that, I calculate that the final divi would have been a cash outflow of £17.4m. That would take net debt up to £82.9m.

Note the large size of the bank facilities below. So there's loads of headroom (providing bank covenants are not breached), although I wouldn't be surprised if the bank might want to reduce the size of the facilities, given poor performance;

The Group has a revolving credit facility of £275m. As the drawdown on this facility are typically rolled over on terms of between one and three months the borrowings are disclosed as a current liability. This is notwithstanding the long term nature of this facility which expires in December 2021.

.

My opinion - this is a bit tricky, as I'm not fully up-to-speed with this company. However, based on the above, I think it's worth taking a closer look, to understand the business better, and what sort of recovery might occur. If profits get back to the previous £50-60m p.a. level, then the share price would probably appreciate to 3-4 times the current level. A very attractive possibility, but how likely is that?

Or, are the days of bumper profits now behind them? The obvious question is whether banknotes will still exist in say 20 years' time? The trend seems to be moving towards a cashless society. My eye-opening trip to Zimbabwe in Feb 2019 taught me a lot. Of particular relevance here, is that the corrupt Govt there recently introduced an electronic payment tax of about 2%. It's a simple & very cheap way to collect in tax revenues. How long will it be before other countries cotton on to this and abolish cash altogether, and simply collect in sales taxes by skimming off a few percent from every electronic payment? They still have cash in Zimbabwe, but the locals refer to it as "Monopoly money".

Overall, DLAR is clearly a special situation, not for widows & orphans. For more sophisticated investors, who are able to crunch the numbers sensibly, and assess risk:reward well, then I think this one is worth a closer look. The first step is to try to find an up-to-date broker note, take half of it with a pinch of salt, and work out more conservative figures. If it stacks up then, who knows, this might be a recovery share at some point. Remember that, at some point the market could start anticipating a recovery. Or it might not, if people think the problems are getting worse.

The new CEO is likely to kitchen-sink the next figures, I imagine. Providing the bank remains supportive, and it doesn't get forced into a discounted placing, then recovery could happen. It's got to be seen as high risk though. Is it worth taking that risk? I'm not sure.

.

.

Synectics (LON:SNX)

Share price: 140p (down 22% today, at 10:43)

No. shares: 17.8m

Market cap: £24.9m

Trading update (profit warning)

Synectics plc (AIM: SNX), a leader in the design, integration, control and management of advanced surveillance technology and networked security systems, provides the following update on trading for the year ending 30 November 2019

Note that only c.16k shares have traded so far today, so the share price is effectively meaningless - because only the smallest shareholders can get out. Everyone else is stuck, high & dry. This is where the smallest investors have a wonderful advantage. If you only hold, say 1,000 shares in this company, you can just press a button and exit instantly. That's usually the best thing to do, in most situations, as we saw a couple of years ago with Stockopedia's superb study of profit warnings, "Lessons learned from 245 small cap disasters".

Here's an entertaining video presentation of the study from our Ed, here;

(this works in the new site, but may not work in the old site. If so, here is the YouTube link.

Profit warning today -

Results for the year ending 30 November 2019 are now anticipated to be materially below market expectations...

Here we have to play the silly game of trying to interpret the wording. I hate that. Why can't companies just give us a figure, or a range of likely outcomes? It's possible, and other companies do it. They're going to give the house broker the likely numbers, so withholding them from everyone else is just wrong.

It's very much a mixed bag. The core division is actually doing well;

The Group's core Systems division, supplying Synectics' high end proprietary surveillance systems globally, has performed well in the year so far and is expected to generate results ahead of the Board's expectations...

The other, smaller division is doing badly;

However, this positive momentum has been more than offset by continued weakness in the Group's UK integration businesses in security and mobile transport...

Reasons given are;

- UK market conditions remain difficult

- Customer orders deferred

- Bus manufacturer went bust (Wrightbus in N.Ireland - which has recently been rescued)

.

More detail is in the RNS, if you're interested.

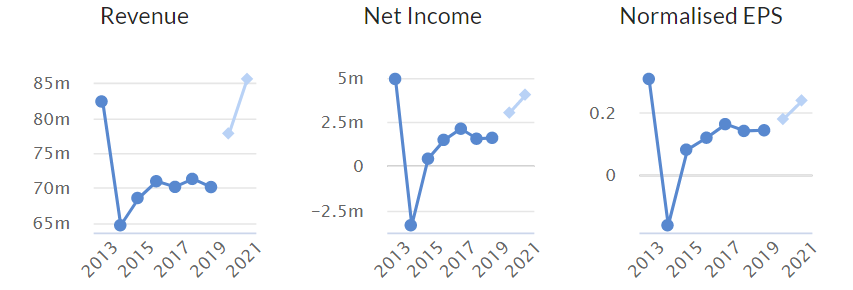

The Stockopedia graphs below show that this business seems to tick along, making £2-3m profit (note that the figures shown are net profit, after tax) on about £70m revenues. The light blue blobs (forecast figures) will obviously come down somewhat, to probably about the same as the historic norm.

.

Balance sheet - is strong, with a decent level of net cash, and strong current ratio. No issues here at all, so this looks a safe situation.

My opinion - this is a decent little business. With problems confined to the non-core division, it should be relatively straightforward to restructure, or dispose of that bit. Leaving a core business that's humming along nicely, and generating about a 10% operating margin (in recent interims).

I quite like it. This looks good value, and the problems seem to fall within the fixable, temporary, not too serious category.

If I held this share, I'd probably be inclined to hold, and buy more if the share price really craters further - which it might do if any larger holders decide to try to dump in the market. You never know what the share price is going to do, in something this illiquid.

Today's announcement is a setback, but not a disaster by any means. Given the strong balance sheet, then I imagine divis are probably fairly safe. After today's fall, the yield is probably about 5% - not bad.

.

.

Empresaria (LON:EMR)

Share price: 43.5p (down 14% today, at 11:41)

No. shares: 49.0m

Market cap: £21.3m

Empresaria (AIM: EMR), the international specialist staffing group, provides the market with an update on trading and operations.

This group is a collection of staffing businesses, in various countries, which seem to be run largely independently.

- UK Engineering - this is the main problem, and is expected to make a £1.5m loss this year, FY 12/2019. "Material restructuring" is already underway.

- Brexit delay - expected to cause further uncertainty.

- German business - suffering from automotive sector decline.

- It's not all bad news though;

The impact of these challenges has largely been offset by the positive growth seen in many other businesses in the Group, but the net impact at the full year is now expected to be negative.

.

Quantifying the damage - great to see that this company is following best practice, and giving us the necessary information;

We anticipate that the Group's full year adjusted profit before tax is now expected to be at least £9m.

Significant actions have been taken in the impacted businesses in the UK and Germany to right size their cost base with the full benefit of this expected to come through in 2020.

Previous guidance at the adjusted PBT level seems to have been about £11.4m (based on a broker note from a few months ago).

This business is only valued at £21.3m, yet even after this profit warning, it's set to make £9m in 2019. That seems remarkably good value. Although there is a concern that profit expectations are being lowered so late in the financial year. That implies a lower level of profit than £9m at an ongoing run rate. There again, costs are being stripped out from restructuring, which should move the profit run rate back up again.

My opinion - my main concern here is the balance sheet. NTAV is only about £1m, and the business totally relies on bank financing to support its large receivables book. The main risk here is that, if trading deteriorates further, then those bank facilities could be under threat. We saw that happen at Staffline (LON:STAF) with devastating results for the share price.

Therefore it's good to see management taking prompt action to restructure, to protect profitability.

We saw with Staffline (LON:STAF) (in which I no longer hold a position) how quickly things can unravel, if the bank get jittery. Staffline also mentioned that a tight labour market in the UK means that companies are wanting to take on permanent staff, to lock in good people, rather than using agencies so much. That might possibly affect EMR too?

Given how cheap it is though, all these risks are probably priced in more than enough with EMR.

I'm very tempted to catch the falling knife here.

.

.

Redde (LON:REDD)

Share price: 112.3p (up <1% today, at 12:33)

No. shares: 306.9m

Market cap: £344.6m

Founded in 1992 and working predominantly with insurance companies, insurance brokers, prestige motor dealerships, and large national fleet owners the Group provides a range of accident management, incident management and legal services.

The Group is one of the market leaders in its fields of business; it delivers accident management solutions to motorists ensuring that they remain mobile until their own vehicles are repaired or until they are put in a position to obtain a replacement and it provides legal services ensuring that they are properly compensated for their injuries and losses....

.

Current trading - nothing particularly interesting, it's in line. Q1 covers the period Jul-Sep 2019, since the company's year end is 30 June 2020;

The first quarter’s trading of the new financial year is in line with management expectations.

Dividends - is what this share is all about. There are some eye-openings figures here;

Shareholders are being asked today to approve a final dividend of 6.15 pence per share, amounting to £18.8m which, if approved, will be paid on Thursday 7 November 2019 to those shareholders who were on the register at the close of business on Friday 4 October 2019. This dividend, if approved, will result in total dividends in respect of the year ended 30 June 2019 amounting to 11.65 pence per share totalling £35.8m in aggregate and will be our sixteenth consecutive dividend since June 2013. Payments since that date will amount to £176.2m representing 61.30p per share.

Remarkable stuff! At the current share price, that's a 10.4% dividend yield. As we know, yields that high are generally not considered sustainable. If REDD does manage to keep generating enough profit & cashflow to maintain these huge divis, then the share price would be very likely to rise.

Note how the share price has not recovered yet from the profit warning early this year;

.

My opinion - there's one big issue with this company. It makes so much cash from its customers, that competitors are muscling in on it. That's how capitalism works - if there's not a big enough moat, then competition erodes big profits.

Dealing with large insurance companies, REDD's problem is that if any of the bigger ones switch to a competitor, then it dents REDD's profits - that's what happened earlier in 2019. There was talk of another major insurer also thinking about jumping ship.

This suggests to me that another profit warning is probably inevitable at some point. I've no idea when, it could be soon, or it could be years into the future, who knows? The fundamental problem is that REDD makes too much profit, and its customers have woken up to that reality. So even if they stay with REDD, they're likely to push hard to get the price down.

The market is pricing all this in, hence investors get fantastic divis for now, to compensate them for the risk they're taking that they could wake up one day and find they've lost 30% of their capital, if more big contracts are lost.

Therefore, to me it makes complete sense that the share price has rebased from c.200p (when people thought the divis were safe), to c.120p now that the market has realised the divis may not be safe after all.

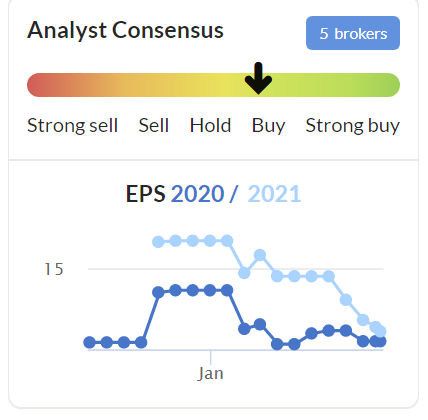

I can see the merits of both the bull & bear case here, and overall I'm neutral. Good luck if you hold. The company does seem to have stabilised quite well after the profit warning. Although note that forecasts for FY 06/2021 have come down a fair bit, from 15.6p to 13.6p on this chart (I've already asked the programmers at Stocko HQ to sort out the inadequate y-axis labelling!);

.

.

.

I've run out of time now. (having spent 6 hours on the above, so I'm not shirking!)

Hargreaves Services (LON:HSP) - AGM Statement says it's trading in line. It's very difficult to analyse, as the main business (UK coal distribution) is in terminal wind-down. There are some other bits & bobs, including an engineering business. Property assets are probably the most interesting part. It's therefore quite a complicated special situation, which I'm probably not going to cover again.

Angle (LON:AGL) - positive test results for its cancer detecting machines. Don't know why the share price has fallen on this news.

Next (LON:NXT) - I might circle back to this in future, but it's a large cap, so covered everywhere else. It seems to show a softening of sales in Q3 (both shops & online), but profit guidance unchanged at £725m. What a class act this business is. It's gradually morphing into an online fashion portal. Probably the only retail share I'd want to own.

.

Thanks for reading & commenting. See you tomorrow! Tomorrow's report will be early, and shorter, because I'm jetting off to Malta for a break.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.