Good morning, it's Paul here with the SCVR for Weds.

Many thanks to Jack for covering yesterday.

There are loads of results out today, presumably to meet the 6 month deadline for 31 March period ends?

Timings - mostly done by 1pm official finish time.

Update at 14:18 - there's lots more to cover, so I'll probably be carrying on until about 6pm.

Update at 17:39 - today's report is now finished.

Agenda

Boohoo (LON:BOO) - interim results - my favourite share, and one which many readers hold, so despite not being a small cap, I'll look at this, as usual. I think we can do a victory lap, and push the noses of the shorters into their mess! :-)

Topps Tiles (LON:TPT) - trading update

N Brown (LON:BWNG) - trading update

Air Partner (LON:AIR) - half year results to 31 July 2020

Pressure Technologies (LON:PRES) - Major contracts & trading update

Plus anything else that there's time for & looks interesting. Please remember I cannot cover everything, and dull things like in line with expectations updates, don't really add any value. I'm looking for unusually good or bad things, where we can make some money, or avoid losses.

.

Buy the dip, or sell the rally?

A strategy of buying the dip, has worked incredibly well for many years now. I think it's one of the reasons that the market rally from the March lows this year seemed to get out of hand in the USA. As we know, the US market tends to set the tone & the direction for UK markets too.

As mentioned at the time, I hedged my portfolio back in Jan 2020 with some large shorts on US indices. It was a bumpy ride, but thankfully that worked very well, with profits from the shorts more than offsetting the heavy losses on my UK small cap shares. Sometimes people asked me why I blindly held onto things like Revolution Bars (LON:RBG) and French Connection (LON:FCCN) whilst they dropped 90% or more. The answer is because I'd hedged the positions, and that was the strategy I planned. Although, with hindsight, I didn't realise how bad the losses would be, and obviously it would have made sense to ditch them, but never mind. Both are actually very interesting special situations now though.

Unfortunately, over the late spring, and summer, I got it into my head that the US markets had overshot on the upside, and I lost tons of money shorting the US indices. I think sometimes hedging can morph into punting, without you necessarily being aware at the time!

It seemed crazy that US markets had recovered pretty much all the covid losses, despite covid being out of control in a second wave, and the economy recovering, but still on life support. So I've been waiting for a pullback, and it seems to be happening now.

Looking at the chart, I do wonder if "buy the dip" has possibly ended, and maybe the algorithms and hedge funds could now be switching to "sell the rallies?". For what it's worth, that's what I'm doing now, on the US indices, and it's made a few quid in the last few weeks. It's also nice to have a short hedge against my long portfolio.

What do readers think? Are we in a bear market now, I wonder, after a period of (at least in pockets) irrational exuberance, and out of control momentum? Or maybe it's too early to say? I find that charts are great at showing patterns after the event, but not so good at predicting what's going to happen next.

.

.

Boohoo (LON:BOO)

Share price: 384p (down 1.5% today, at 08:29)

No. shares: 1,226.6m

Market cap: £4,710m

(I hold)

Sparkling results today, from this multi-brand (9 at the last count) fashion eCommerce business. The share price anticipated these numbers, as well as brushing aside the supply chain review published recently. That particular teacup has now recovered from storm conditions, despite some journalists' attempts to stir it up as much as possible.

Note that the allure of cheap fast fashion has clearly overwhelmed customers worrying too much about where or how the product is made. Rightly so, as practically the whole sector uses cheap labour from abroad, Bangladesh, etc. Arguably machinists allegedly working in Leicester for low wages because they're simultaneously claiming benefits, is a far more ethical setup than a sweatshop with fire exits chained shut in Bangladesh, and machinists being paid 50p per hour there. But we could discuss that ad infinitum, let's get back to the figures.

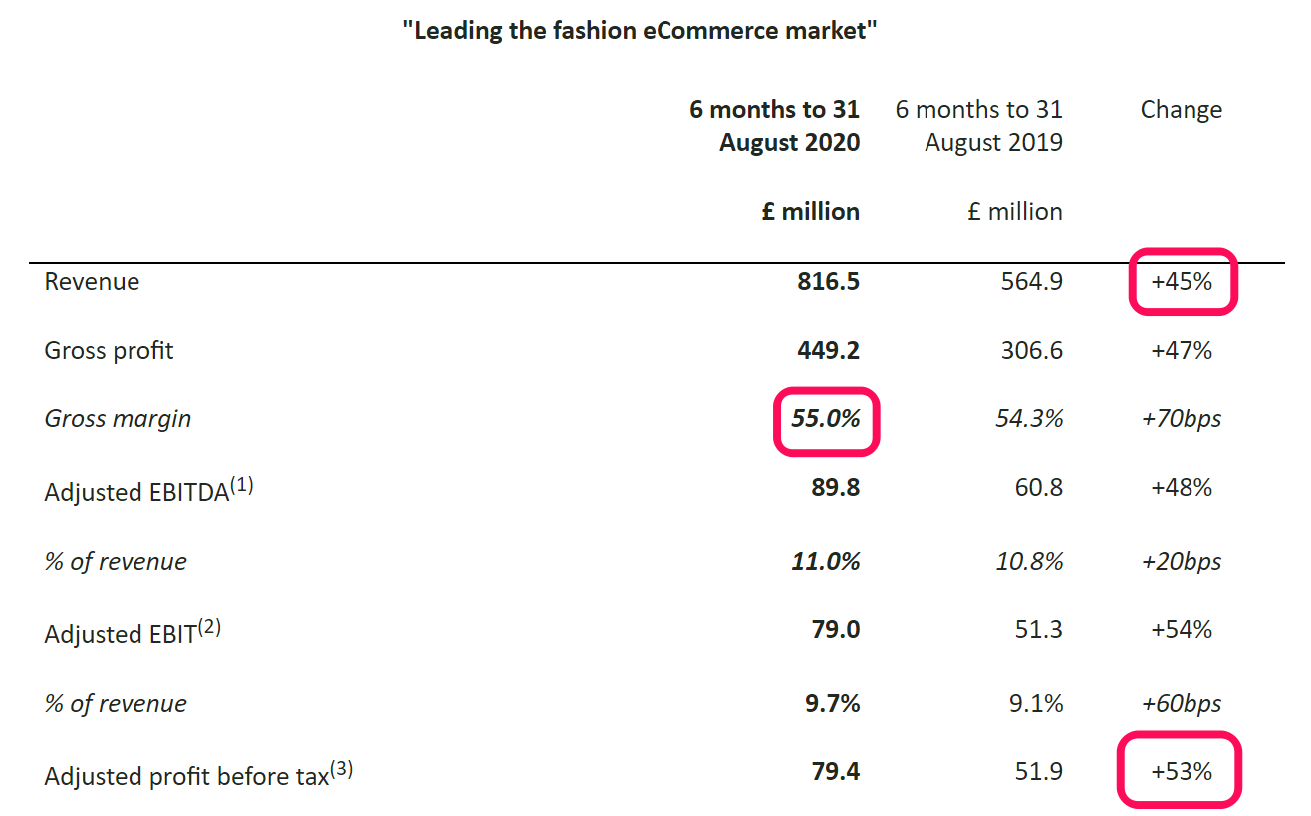

As you can see, the growth is highly impressive, given that this is now a sizeable group;

.

.

A couple of comments from me;

Note the gross margin is strong, and has gone up a bit. There's some wholesaling activity, which is lower margin, so the retail only margin will be higher still than the reported 55% total.

Looking back at the Q1 (Mar-May) trading update published on 17 June 2020, it also reported +45% revenue growth. That was during lockdown though. Hence there was a question mark over whether Q2 would see growth slowing, given that physical shops re-opened. That BOO maintained +45% growth, despite its competitors coming back, is really impressive. BOO seems to have generated its own momentum, and doesn't seem to be affected by what the High Street does.

Guidance is raised for the full year, FY 02/2021;

Group revenue growth for the year to 28 February 2021 is expected to be 28% to 32%, up from approximately 25% as previously guided, with adjusted EBITDA margin for the year at around 10%, increased from the 9.5% to 10% as previously guided. The group has made a good start to the second half of the year, with momentum continuing into September...

That bar looks set low, because H1 revenue is up 45%, hence 28-32% full year implies a big slowdown in growth in H2. History shows that BOO tends to under-promise, and over-deliver.

Its test & repeat model means that supply can be quickly adjusted not just to fashion trends, and repeat orders for bestsellers, but also can be quickly adjusted according to overall macro conditions. Compare that with the big problems physical retailers have with planning product deliveries months in advance.

Downside risks mentioned are;

- Possible downturn in consumer demand in H2

- Returns rate going back to normal levels

- Carriage costs increasing in some overseas markets

- Higher marketing costs in H2 (although that is what drives higher sales, so isn't necessarily a negative)

- Higher capex, to continue automating warehouses, and other IT spend

Medium term guidance unchanged;

Our medium term guidance for 25% sales growth per annum and a 10% adjusted EBITDA margin remains unchanged.

Webinar - I'm going to watch/listen to the analyst/investor webinar at 09:30, if you want to join here are the details;

boohoo group plc will today host a video webcast for analysts and investors at 9.30am (UK time) via the following link:

https://webcasting.buchanan.uk.com/broadcast/5f60844783507b593b4677e3

A replay will subsequently be available from 12 noon via the same link.

EDIT: the webinar has now finished, and it was really excellent, covering a lot of stuff about the new brands acquired, supply chain & margins, etc. Basically what I've been saying here all along is correct - that margins in Leicester are worse than from overseas factories, but it's used for speed & convenience. It's obvious management are very serious about fixing the supply chain problems in Leicester. So that's a dead issue now in my view. The recording is now up - click on the same link above, which will now take you to a recording of the webinar. End of edit.

My opinion - super-bullish, as I've been constantly saying here in recent months. I see this as a unique business, with unstoppable momentum in trading, and expansion. The multi-brand approach, and soaring international sales (now nearly half the total, and growing faster than the UK), mean that this is an almost unique growth proposition.

I think this is a hold forever position for me now, irrespective of valuation. Even if the valuation does become stretched (which it isn't now, in my view), then the group grows into it so fast, that pullbacks are just pauses in the bigger picture.

There's a lesson from the chart below - ignore the background noise, and focus on the company's strong fundamentals.

.

.

The rest of the accounts look clean to me.

My opinion - I think it's heading for 10p per share EPS, and probably double that within another 2-3 years. Hence I reiterate my view that this share could be worth 800-1000p in the medium term.

.

Air Partner (LON:AIR)

Share price: 73p (down c.5% at 11:37)

No. shares: 63.6m

Market cap: £46.4m

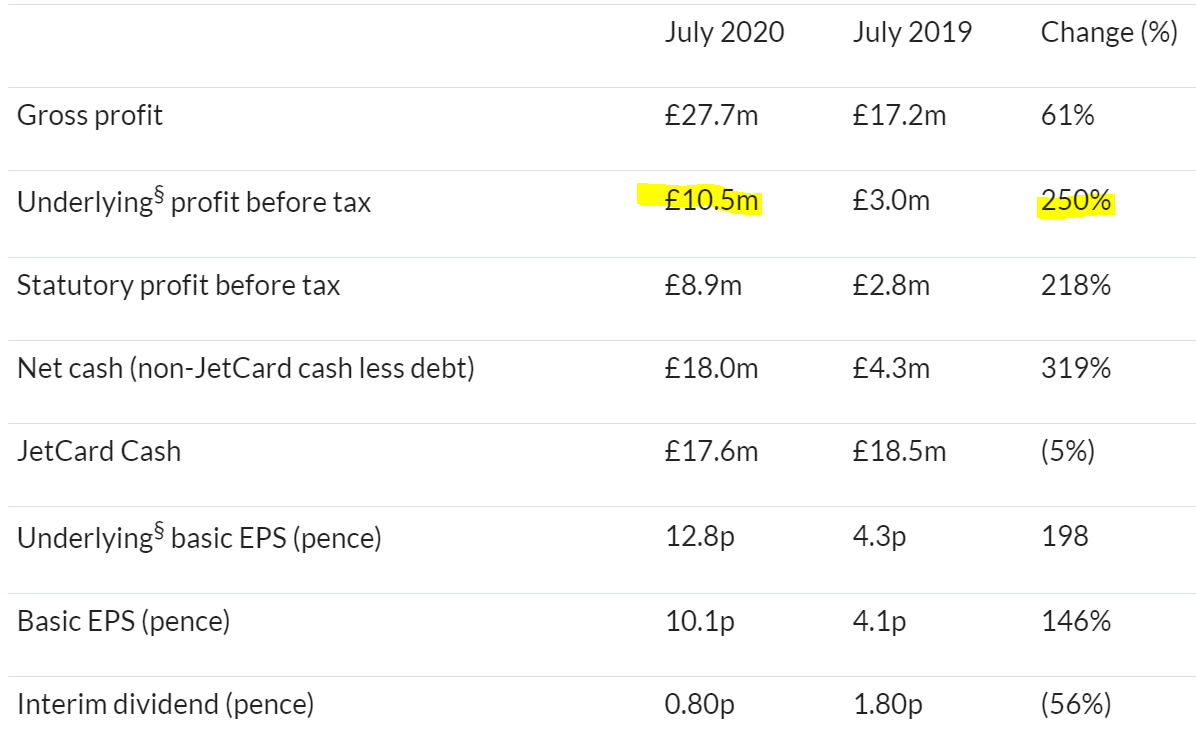

This air services group has updated the market frequently this year, flagging up that H1 would be exceptionally strong, with the outlook for H2 more hesitant.

As I reported here on 2 July, the company indicated it had made at least £10m profit in the first 5 months of the year.

Another update I covered here on 15 July, said that July trading was normalising, and the outlook uncertain, and costs having been cut.

Well done to the company & its advisers for being very open about the one-off nature of its H1 trading boom, and thereby keeping investor expectations grounded. The key boost seems to have come from repatriation flights due to covid, and air freight of medical PPE.

The H1 figures do indeed look marvellous as expected;

.

However, since this a clearly one-off blowout performance, we should not be valuing the company on any multiple of these numbers. That said, my view is that the company was able to profit from the crisis so significantly, is impressive. Clearly there must be some entrepreneurial people at AIR, able to fix up shrewd deals, which are the type of people I like to back.

Also we could see a similar crisis in the autumn/winter, if covid once again worsens, which is looking increasingly likely of late. Other parts of AIR have struggled though, so it's not a case that all divisions are doing well.

Current trading sounds nothing like the H1 boom time;

· Gross profit for the first two months of Q3 is down year-on-year, although this has been offset by a reduced cost base and governmental support across our various markets, where available

· Private Jet enquiries continue to increase from the low levels seen in Q2

· COVID-19 related activity in Group Charter and Freight has now stabilised, albeit against a rapidly changing market environment

· Visibility in Charter remains limited, however we are seeing some green shoots of recovery within the Safety & Security division

Outlook - only a "modest profit" in H2;

...although the continual, and often sudden, changes in the COVID-19 operating environment make it very difficult to predict the remainder of the financial year with any degree of certainty. As a result, we will not be reinstating market guidance beyond the end of this financial year, although we do expect to report a modest profit for the second half of the year.

Dividends - resumed, but lower, which doesn't send a great signal;

interim dividend of 0.80p per share, down 55.6% from last year's 1.80p. The Board's objective is to establish a level of dividends that is sustainable, well covered by the Group's earnings, and that can be increased over time. The level of this interim dividend is consistent with this policy.

Balance sheet - is not actually that strong overall, NAV: £21.8m, deduct £19.3m of intangibles & goodwill, gives us NTAV of only £2.5m. And remember that is after £7.05m (from cashflow statement) from issue of new shares. Without that, NTAV would have been negative.

The balance sheet is flattered by favourable working capital. But remember that all the cash is spoken for, either belonging to other people (see deferred income) or will be needed to pay other creditors.

Current assets: £46.3m

Current liabilities: £(45.8)m

Net current assets: £0.5m

The above figures demonstrate that the cash piles are spoken for, and are not surplus assets.

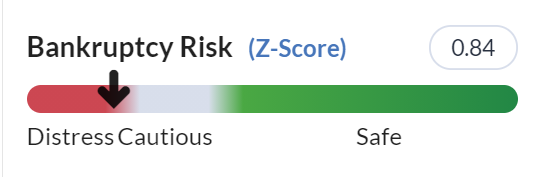

Altman agrees, with a weak reading on the Z-score. Although this will probably not include the most recent placing, which is likely to have moved it out of the distress, and into the cautious zone, at a guess.

.

My opinion - a fantastic H1 performance, but very much one-off in nature it seems. I think the best way of looking at it, is that H1 was a bonus for the company, has helped strengthen its finances, but shouldn't be used to value the shares.

Given the above, I reckon the valuation is currently probably about right.

If you're gloomy about covid, then AIR could be a beneficiary again from one-offs. Although do bear in mind that its other divisions could suffer from reduced travel if covid worsens in future. So it's not a one-way bet re covid, something that is explained in the commentary today from the company.

The forward looking metrics don't look realistic to me, in terms of the 2021/22 earnings forecast, so caution is urged there.

.

.

** BREAKING NEWS **

Tasty (LON:TAST)

2p - mkt cap £2.8m

Update

With such a tiny market cap, it's not worth mentioning for itself, but rather for the interesting read-across for other struggling hospitality & retailing companies.

My view is that restructuring though a CVA or the more risky pre-pack administration, is not just desirable, it's essential, for struggling companies with leases that tie them to now uneconomic rents.

If TAST can ditch its historic leases, and reset the viable sites onto lower rents, then it could be a long-term survivor. I wouldn't buy the shares personally unless/until that step is taken, as mentioned before. Even then, with a market cap this low, there's a significant risk that, as part of a restructuring, management might also decide to cut costs/hassle, by de-listing.

Anyway, this is what the company has said today;

In light of the continued economic uncertainty and the impact of COVID-19 related restrictions, the Company has secured a £1.25 million, four year term loan from its existing bankers, Barclays Bank plc (the "Facility"), in order to strengthen its balance sheet and provide additional working capital support.

The Facility is available to be drawn down until 7 February 2021, however, draw down is restricted until the future of the Company is assured through restaurant closures and creditor arrangements. The Facility has a capital repayment holiday of 12 months and carries interest at a rate of 4.5% per annum over the Bank of England Base Rate, following draw down.

The Board of Tasty confirms that, whilst no decision has yet been made, it is continuing to work with its advisers, KPMG, to assess the potential impact of COVID-19 on the business and the various strategic options available to the Company, including a potential company voluntary arrangement.

The Company will commence consensual negotiations with landlords and other creditors shortly and anticipates that this process will be completed by the end of November 2020. The Board believes that given the recently announced additional COVID-19 related regulations and the probability of future tighter restrictions in the near future, all potential options should continue to be explored but, with creditor assistance, a more formal procedure may be avoided.

Cleverly worded but to my mind, that is as clear as day, that Tasty is saying to landlords, that we need you to agree to rent cuts, or we'll do a CVA.

The problem generally, is that whilst many landlords are being co-operative, there are enough who aren't to make a consensual, informal process very unlikely to succeed. I mean generally, as obviously I don't have any inside knowledge re Tasty.

Therefore, I think we should work on the assumption that Tasty is very likely to do a CVA in Dec 2020, or maybe earlier. This would enable it to ditch non-viable units, and secure viable rents on the remainder. At that point, it would look like an investable business to me again, providing there is some assurance that it's going to remain listed.

Key point - CVAs or pre-packs are now the only viable option for struggling multi-site operators in hospitality & retailing.

So far we have;

Quiz (LON:QUIZ) (I hold) - already done a pre-pack, and has got remaining shops onto turnover rents, ditched shops that were not viable.

Revolution Bars (LON:RBG) - considering a CVA (very likely to happen, in my opinion)

Tasty (LON:TAST) - as above, sounds like a CVA is on the way.

What's particularly interesting with TAST, is that the bank is making drawdown of the loan dependent on getting some kind of restructuring done. Very sensible on the part of the bank! It suggests that banks are seeing the sense in their clients doing CVAs, and are supportive of this being done.

New Look was an interesting recent example of a CVA that succeeded, despite several big name landlords publicly condemning it & voting against. When push came to shove, the landlords backed down and voted for it, because they didn't want empty units, even if the terms of the CVA were unpalatable.

So many private companies are doing CVAs at the moment, that it's difficult to see how listed companies that are struggling can avoid following suit. I wish French Connection (LON:FCCN) (I hold) would get on it with it, and restructure, it's long overdue. With Hilco (a restructuring expert) having recently extended a new asset backed loan to FCCN, I hope very much that it is trying to persuade the CEO to ditch the problem leases through a CVA. Then the company/shares could have a much better future.

We'll see a lot more of these restructurings, I reckon. There could be some excellent investment opportunities, so I'll be watching closely & assessing them as they arise.

.

Topps Tiles (LON:TPT)

Share price: 49p (down 6%, at 14:53)

No. shares: 195.0m

Market cap: £95.6m

Strong finish to the year, modest pre-tax profits expected

Topps Tiles Plc (the "Group"), the UK's leading tile specialist, announces a trading update for the 52 week period ended 26 September 2020.

There's a very clear table given, so we can see the monthly trend of retail + online sale over the last 6 months. Top marks for clarity here;

.

As you can see, sales were badly impacted in lockdown, and since re-opening the company is recouping some lost sales, although nowhere near as much as was lost previously during lockdown.

Current trading sounds OK for retail (the main business);

Our order bay2 at period end was significantly ahead of the prior year level, providing a positive outlook as we start the new financial year.

2 Orders received from customers which are in process but not yet fulfilled

The commercial business is rebuilding more slowly, but it's immaterial at just under 4% of total revenues for the year.

Liquidity sounds fine, and it's great to see the company quantifying the short term benefits from Govt support - all companies must do this, as it's key information we need to know;

At period end the Group had c.£25 million of net cash and available cash headroom of c.£74 million within its financing facilities. This includes around c.£7 million relating to year end working capital timing and c.£6 million relating to VAT deferrals, both of which will represent cash outflows in the new financial year.

Outlook - most companies are including words of caution, to cover themselves in case covid conditions worsen, so I don't see anything company-specific to worry about below;

"I remain very positive about the longer term outlook for the Group but also recognise that the continuing impact of the Covid-19 pandemic may lead to more difficult trading conditions over the short to medium term. As market leader, and with our strong balance sheet, the business is well positioned to navigate these conditions and to meet future challenges."

My opinion - I don't see anything in this update to justify a 6% fall in share price. Maybe some punters just decided to bank profits after a reasonable run of late?

Maybe it's the reminder (already known) that FY 09/2020 is only likely to be slightly above breakeven, that triggered profit taking? I don't know.

The last balance sheet was OK, not strong particularly. The sale & leaseback of property has helped liquidity since then.

I tend to blow hot & cold on this share. I imagine it should produce better results in FY 09/2021, and we know that it can withstand lockdown without serious damage. So I can see the merits of the share, but it doesn't excite me at all, so would rather keep my money in other things with perhaps more upside? Not that there's anything wrong with TPT. There's also the issue of the leases. It's trading too well to be able to restructure them probably. Whereas weaker competition might be able to do a CVA and thereby gain a competitive advantage?

.

.

N Brown (LON:BWNG)

55p (up 8%) - mkt cap £156m

This has been slowly ticking up in price on my screen today, so thought I'd better take a look at its trading update.

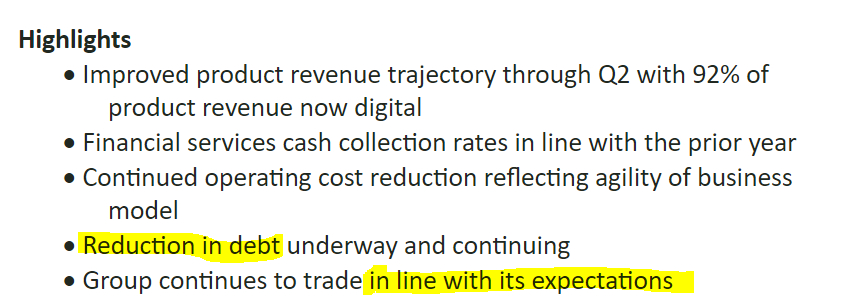

To save me re-typing it, here's a picture of the highlights;

.

This share was being shorted a fair bit earlier this year, and it was a nice little trade, buying for a short squeeze, which paid off. Maybe the same thing could be happening again?

My opinion - neutral. I find it too difficult to come to a firm view on this company. The problem is that, whilst product sales are now 92% online, it doesn't really make any money from product sales. Instead, the highly regulated and expensive consumer credit offering is what generates the profit.

It looks cheap on a low earnings multiple, but are those earnings sustainable? Who knows?

The balance sheet has a very large consumer receivables book, mostly funded with bank debt. So maybe you need experience of the financial services sector to properly understand the risk:reward of BWNG's business model? Not my specialist area.

On balance, I'd be more inclined to be long, rather than short, but overall just think I'll focus on other things I understand better. Today's update sounds mildly reassuring., but doesn't particularly change the investment case either way.

.

Pressure Technologies (LON:PRES)

64.5p (unch) - mkt cap £12m

I hadn't realised how small the market cap had got when I put this on the list.

Today's update seems to be a profit warning, disguised as a contract win announcement!

... a loss-making performance at Group level is expected for the current financial year.

I don't think I'll cover this company again, as its performance seems too erratic, since it's dealing with quite big, specialised engineering contracts.

.

Studio Retail (LON:STU)

248p (up 6%) - mkt cap £214m

I've had a very quick look at the trading update from this unusual group, which shares some similarities to BWNG's business model - selling products online, but profits coming from offering consumers credit on them. It used to be Findel. There's been a long-standing disposal which has been held up for ages by regulatory issues. Also I can't remember what the £20m covid bad debt is, but it's material, so I'm flagging it.

I'm not going to look any deeper into this, but readers might want to, because this sounds encouraging;

... we currently expect the adjusted profit before tax from continuing operations* (including the impact of IFRS 16) for FY21 to be ahead of our previous internal expectations.

.

That's me done for today, see you in the morning!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.