Good afternoon! It's Paul here.

There's not much news today, so I might circle back to some of the reader requests from yesterday.

What a crazy market this is! Growth companies in particular seem to be roaring ahead almost every day. Stretched valuations don't seem to be an impediment for further price rises. It's all beginning to feel a lot like 1998-9 again, and that didn't end well.

There again, the companies that are roaring up in price generally seem to be proper businesses, and not the blue sky nonsense that went bonkers back then during the TMT boom & bust.

With major economies around the world generally doing quite well, it's not clear what catalyst there is to trigger a sell-off. So for the time being, I'm minded to keep my long positions running (as opposed to moving into cash).

Of course we do have the worry of the possibility of a Jeremy Corbyn victory on June 8th. As his approach would undoubtedly be anti-business, and lead to higher taxes, then I imagine it would absolutely smash share prices. How likely is it though? Very unlikely, in my view, but you never know. My feeling is that the closer the polls get, then the more motivated the Tory vote will be - turning out in force to stop Corbyn.

The politics of it doesn't really matter for the purposes of these reports, it's the impact on the market that worries me, so is worth flagging the risk. Cautious people might take some money off the table, just in case? I've decided not to take any action, as I think it's so unlikely that the Tories won't win a workable majority. Sadly, there really isn't any alternative, as the choices range from bad to diabolical, in my view.

Styles and Wood (LON:STY)

Share price: 366.5p (up 4.4% today)

No. shares: 8.7m

Market cap: £31.9m

AGM statement (trading update) - this company describes itself as "the integrated property services and project delivery specialist".

This sounds reassuring;

"The Group's trading in the year to date has been in line with management expectations.

The Order Book for the year ending 31st December 2017 now stands at £136.6m, some 36% ahead of prior year, with a traditional seasonal weighting towards the second half of the year.

It says that recent acquisitions are performing well.

Encouraging details are given of contract wins.

Outlook comments sound positive;

Board remains confident in the outlook for the Group and looks forward to reporting on further progress in 2017."

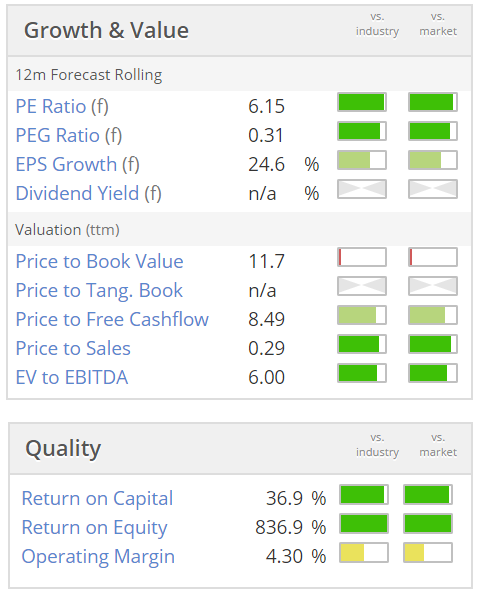

Valuation - this is looking good value on a very low forward PER;

On the downside, because it has a weak balance sheet, there are currently no dividends.

Although with the balance sheet having improved considerably after a restructuring, and retained profits helping to rebuild it, then I imagine divis could be on the cards in the not-too-distant future maybe?

Most recent accounts - I reviewed them here, on 27 Apr 2017.

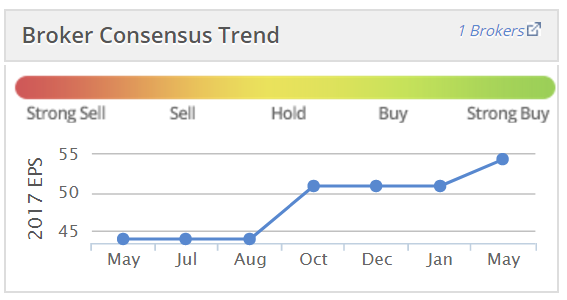

Broker forecasts - have been in a positive trend. Some of this might be because of acquisitions, I'm not sure. Still a good trend though;

My opinion - I don't usually buy shares in low margin contractors any more. The sector is too accident-prone, in terms of profit warnings when big contracts go wrong in some way.

That said, at the current valuation, this is looking very tempting. My finger is hovering over the buy button, and I think this could have maybe 20-30% upside in it, possibly? What do readers think? Are any of you tempted?

Sorry, I didn't get round to doing any more writing - am still swamped with things to do connected with my recent house move. Normal service will resume shortly!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.