Good morning, it's Paul here with the SCVR for Wednesday.

See the header above for the running order. It's a mix of small caps & mid caps, as there's not much news today, and I like to look at housebuilders in particular, for read-across on the economy & consumer sentiment/spending. It's fine for us to deviate from the small caps remit when there are other interesting things going on! Reader feedback is that most people actually like it when we veer onto current topics outside small caps, so why not!

Estimated time of completion - probably about 1pm

Edit at 13:26 - today's report is now finished.

Time filler as I wait for the 7am RNS releases

It was certainly an interesting evening yesterday, watching Tesla go even more parabolic, soaring to a peak of something like $970 per share. Then suddenly lurching down by about $100 just before the US close, then settling after-hours (where the US has an active market) at around $900.

This is a very peculiar situation, and reminds me of the late stages of the TMT boom & bust in 1999. Although this time around, the companies that are booming and reaching huge valuations, seem a lot higher quality than the dross that went crazy in price back in 1998-2000 - then eventually joined the 90% fallers club, and often eventually the 99% fallers club - people forget now, but the 2000-2003 bear market was really brutal!

When share prices go parabolic, as Tesla has done, they don't tend to settle quietly settle at a multiple of their previous price (unless it's something like a drug discovery company that has had a major breakthrough). They tend to reach a stratospheric peak, and then crash back down just as fast, often giving up most of the original gains.

Elon Musk should be rushing through an equity fundraising right now, to take advantage of the mania in Tesla shares, but I doubt he will as he seems to not only create, but also believes his own hype. There again, it's difficult not to admire what he has achieved, against the odds, even if the valuation of Tesla is clearly ridiculous.

EDIT: here is a test where the actual range of a Tesla Model 3 turned out to be far lower than claimed, and only marginally ahead of the stunning new electric Porsche Taycan;

Sorry, that's a still of the results of the range test.

Here is the German video;

Also, I wanted to test embedding a video into this article (I've just started using the new Stockopedia site for writing articles, and so far, so good!). Sorry it's in German, but you can work out most of what they're saying. End of edit.

Something has just started bleeping, so looks like we have news coming in...

Lookers (LON:LOOK)

Share price: 55p

No. shares: 390.1m

Market cap: £214.6m

New CEO & COO - the CFO steps up to CEO. He seems to have lots of relevant sector experience. Similarly, the new COO is an internal promotion. I like it when new Directors have plenty of sector experience, as that should mean they know what to do, rather than learning on the job.

Trading update (year end)

Lookers plc ("Lookers" or "the Group"), one of the leading UK motor retail and aftersales service groups, issues a trading update for the 12 months ended 31 December 2019, ahead of the announcement of its results on 11 March 2020.

2019 result - Q4 was challenging as expected, and full year result in-line with the Board's expectations. Given that it's a full year result, they should be reporting on market expectations, not the Board's expectations. Also why is there no footnote telling us what expectations are? So a thumbs down for the unclear wording, and lack of key information.

I've queried this point with the company's advisers, who have said that the company gave guidance to the market on 1 Nov 2019 as follows;

The Group now expects to report underlying profit before tax for the full year of approximately £20m.

It would have made sense to include that as a footnote in today's announcement, to save time.

To put some numbers on that, adj EPS is forecast to drop from 11.0p in 2018 to just 3.1p in 2019. So a bit like Pendragon (LON:PDG) which I reported on here last week, historic levels of profits have collapsed. Pendragon is even worse than Lookers, being loss-making. Once earnings gets close to zero, then valuing shares on a PER basis becomes meaningless, because the actual earnings figures can vary so wildly from forecast, above or below, that PER isn't reliable any more.

2020 trading so far - broadly in line. Expecting another year of new car sales decline. So it's difficult to see any catalyst for higher profits, other than cost-cutting & closing down loss-making branches, where possible.

Net debt - good news that this has reduced to £62m (from £86.9m a year ago), due to property disposals & tighter management of working capital. Bear in mind though, that this is the tip of the iceberg. Car dealers are mainly funded from supplier credit facilities - trade creditors were a massive £1.34bn when last reported at 30 June 2019. That's not a problem though, as it was more than covered by current assets of £1.46bn (mainly inventories & receivables).

Freehold property - this is another key consideration when valuing car dealers, they often come with a ton of freehold property. So at the moment their shares are really property companies, which do a bit of not-very-profitable car dealing & servicing/repairs on the side!

Lookers owned £248m of freehold property at 30 Jun 2019, and really isn't generating much of a return from them now. Disposing of sites which don't make money, and exploring alternative uses for freeholds, is a key objective in this sector now. Therefore it would be good to see car dealers employ Directors with strong commercial property experience.

FCA investigation - into selling processes is ongoing. No new information provided. I'm steering clear of all car dealers until this is resolved. Why take the risk?

Other things to consider;

- Government ban on internal combustion engines - this has been moved forward from 2040, to 2035, so only 15 years away. Presumably the new electric cars are going to be sold through dealers still, although with far fewer moving parts, they supposedly won't need as much servicing.

- Electric cars - could this be a boom area, once prices fall to more sensible levels, and ranges improve? Said to be fairly imminent.

- Self-driving cars - who knows what might happen here? It's not likely to help sentiments towards dealers though.

My view - there seem far too many things to worry about. But that's why car dealers are cheap. At some point the shares could be attractively cheap based on property assets, and a possible recovery in profits. Consolidation is another factor.

Markets to me are feeling very similar to the late 1990s, when interest in "old economy" shares almost evaporated, as people chased tech stocks higher & higher. It was only when shares became insanely cheap (e.g. trading below their own net cash), and the tech bubble popped, that investors once again started to look at buying sectors that were seen as being in structural decline.

Car dealers feel like they're in that sort of category now. Hence I can't see any point in getting involved.

Touchstar (LON:TST)

Share price: 47.5p (up 8% today, at 13:54)

No. shares: 8.5m

Market cap: £4.0m

(I hold a long position in this share)

Illiquid micro cap, so just a brief mention.

This is a turnaround situation, which as with most turnarounds, is taking a lot longer to work (if it works at all).

Today's positive update is worth noting, but only resulted in very small changes to broker forecast for 2019.

Net cash has improved to £849k, well above forecast of £100k - although it sounds like some of that is one-off favourable working capital movements (e.g. customers paying up-front)

Order book - this is probably the most important bit, with this having risen from £800k on 18 Dec 2019, to £1.7m at end Jan 2020. I would have liked more detail on what is driving the improved order book, but will have to wait until April;

Commenting Ian Martin, Chairman, said: "The Board is delighted that the Company has had a stronger than anticipated finish to 2019 and to be entering 2020 with an encouraging order book. We expect to provide a further update on the outlook for 2020 as part of the announcement of the final results in April."

My view - there are signs of life here, and hopefully it won't need to raise more cash now.

Its legacy business was disposed of, and the new products look very interesting, with a surprising spread of products for lots of sectors - see its website here.

The market cap is only £4m, so if new products take off strongly, then we could have a multi-bagger, who knows? The downside risks are that it might limp along, need to raise more cash, and/or de-list. So very speculative, and illiquid.

EDIT: Many thanks to our subscriber Snoo who has provided this link from Touchstar's website, which gives more detailed info about its new customers. Thanks Snoo! :-)

https://www.touchstar.co.uk/blog/influx-of-orders-for-touchstar

End of edit.

Domino's Pizza (LON:DOM)

Share price: 316.6p (up 6.4% today, at 13:59)

No. shares: 462.2m

Market cap: £1,463.3m

Today's update looks good. People are still buying pizzas, and doing so online.

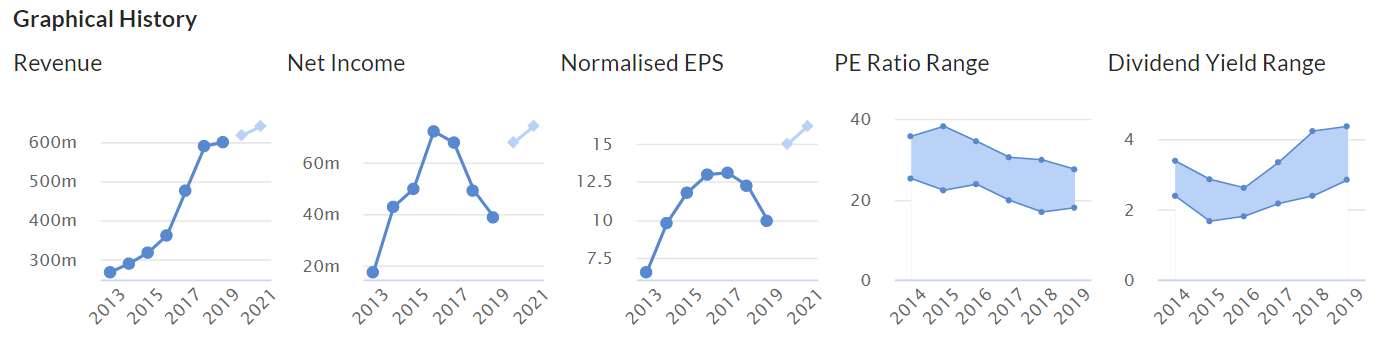

I've just discovered the dividends chart on the new Stockopedia site, very nice!

That's a beautiful progression, and the forecast yield is 3.4% - as of last night, which will have dropped to about 3.1% after today's c.8% share price rise.

I'm impressed with the +4.5% organic sales growth in Q4. Within that UK LFL sales are up 3.9%.

It doesn't seem to show the YTD figures, just Q4.

Overall trading is in line;

UK & ROI Operating Profit expected to be within the range of current market expectations

We get a footnote too, which is so helpful, please would all companies do this - it's not difficult, and you have the information to hand already, why not share it with investors who might struggle to find the information? Plus it saves us a lot of time, given that we have to look at hundreds of different companies;

3 The current range of analyst forecasts for UK & ROI underlying EBIT, of which the company is aware, is £102.1m to £104.1m, with a mean average of £103.1m

My view - neutral, as I've not done enough research on it. But today's update sounds promising. All retail/hospitality operators need to be generating positive LFLs, in order to fund the big increases in payroll costs. Remember that there's a +6.2% increase in Living Wage coming in April. I worked out that Revolution Bars (LON:RBG) needs to generate +2.0% LFLs to cover this (I worked on an estimate of total wages rising 5%), and imagine that the figure would be similar for other food/drink and retail sector operators, including Dominos.

As you can see from the graphs below, its PER has been coming down, and divi yield going up, as it transitioned from an exciting growth share, to a more mature business. As with all franchise businesses, there's always a battle to agree the split of the profits with the franchisees, which I believe has been an issue here.

It will be interesting to see how trade tariffs develop, a key issue for food companies - since the main EU external tariffs apply to food at about 30-40%, and cars 10%. Outside those sectors, EU tariffs are minimal. Depending on what is agreed, Dominos might have an opportunity to lower its food input prices by importing cheaper cheese from outside the EU potentially? Nobody knows at this stage, but it would be important to see what the company says about that. Obviously if tariffs were imposed, and it bought cheese from the EU, then it import prices would go up - which would incentivise Dominos to substitute imports with UK produced cheese. It will be fascinating how all this pans out, and nobody has a clue at this stage.

Redrow (LON:RDW)

Share price: 817p (down c.0.5% today, at 14:02)

No. shares: 352.2m

Market cap: £2,877.5m

Shares in housebuilders have done tremendously well in the last 6 months. They're making ludicrous profits, thanks to the Govt's Help to Buy scheme, and unbelievably low mortgage interest rates - factors which are propping up demand nicely. If people can come up with a 25% deposit, then they're laughing - monthly mortgage payments would then be very affordable. Fix the rate for 5 years cheaply, and pay down some of the capital as you go along (or earn better returns from an investment portfolio perhaps), and it could all look quite rosy for new home buyers.

I'm not going through all the numbers, but just want to pick out a few interesting points of wider interest.

A few interesting snippets from today's interim results from Redrow;

- Net cash of £14m - housebuilders have much stronger balance sheets than in the past, so should weather the next downturn a lot better than in 2008.

- Market conditions sound fine;

Current market conditions, combined with our very strong order book give me confidence this will be yet another year of progress for Redrow and our expectations for the full year remain unchanged."

- Gross margin is extremely high by historic standards, at 23.9%

- Help to Buy used by 36% of customers - hence this scheme is critical for housebuilders continued level of profitability

Planned changes to Help to Buy next year will limit the scheme to first-time buyers and introduce regional price caps. Whilst we expect this will see demand increase in the short-term from buyers that will not qualify for the scheme in 2021, we continue to urge government to review the caps that, as they stand, will disadvantage buyers in the North and Midlands.

- Pricing stable

- Cost inflation - not a problem apparently;

We anticipate underlying build cost inflation will reduce in calendar year 2020 to around 3% and will be largely offset by modest house price gains.

- Online reservations system proving very popular

- Planning system - ongoing delays

- Current trading - "resilient", with reservations up 15% by value cf LY

- Balance sheet is fantastic, very strong indeed

- Sounds like the party is still in full swing;

With our very strong order book, a promising start to the second-half and a more stable political outlook, prospects are encouraging and I am confident this will be another year of progress for Redrow.

Stockopedia loves it;

Barratt Developments (LON:BDEV)

Share price: 860p (up 4.7% today at 12:35)

No. shares: 1,018.3m

Market cap: £8,757.4m

Why is it in a small caps report? It just is.

This has impressed the market (share price up 4.7%) more than Redrow (up 0.5%).

Stellar operating profit margin of 19.4% - before ultra low interest rates and help to buy, housebuilders used to make margins of 10% and under. It's all a bit crazy now - borrowers loading up on cheap debt, to line the pockets of shareholders in house-building companies. Heaven help us, if interest rates ever return to historically normal levels. To people of my age (51) and over, this feels like a strange parallel universe, where everything's gone mad. To the under 30's, this all feels normal. Therefore it's so difficult to assess risk, and where all this ends?

Anyway, here are a few key snippets;

- H1 results (to 31 Dec 2019) look quite good - profit before tax up 3.7%

- Full year FY 06/2020 outlook fine - in line with expectations

- More special returns to shareholders planned

- Good start to H2

- Shortage of skilled workers, mitigated by using some prefab parts, and simpler housing designs

- Continued to see attractive land buying opportunities

- Build cost inflation of 3% (same as Redrow)

- Fantastic, ungeared balance sheet

My opinion - it's difficult not to be impressed with both these housebuilders. They're operating in pretty much ideal economic conditions, with the main risks being something untoward causing interest rates to rise, or Govt ending the Help to Buy scheme (said to be renewed with tweaks for 2 more years).

As long as nothing changes with those risk factors, then housebuilders look set to continue churning out huge profits, and passing on the loot to shareholders.

Frontier Developments (LON:FDEV)

Share price: 1257p (down 13% today, at 13:07)

No. shares: 38.9m

Market cap: £489.0m

I've had a quick look at the interim results, and decided to file it in the "too difficult" tray. Sorry about that.

Computer games companies are tough to analyse - you need to dig into all the detail of each games franchise, and its prospects. Results are lumpy - it had a blow out half year in the 6m to 30 Nov 2018, making £17.2m operating profit. This time around the comparative half year is only £4.5m operating profit.

So unfortunately, I have no idea how to value this share, nor how to assess its prospects.

Balance sheet looks OK, with £28.9m in cash.

Lease liabilities jump out at me as looking high.

Share price looks very volatile, suggesting that the market doesn't really know how to value it either, or that perceptions of its progress are subject to change a lot.

This is a hot sector, but not one that I feel I have any edge in, so it's not of interest.

Quite an exciting chart here!

All done for today. Thanks for adding your comments, a very interesting discussion on Tesla!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.