Good morning, Paul here!

It's a quick report here today, as I'm heading into London for a lunch meeting for a new IPO, called Quiz. It's in my sector, clothing retail, so should be interesting. I'll let you know if it's any good.

Talking of IPOs, I see that GYG has launched on the stock market today - it's a super yacht painting company. AIM admission RNS is here. I've not had a chance to look at it yet. It seems to be trading at about a 15% premium to the IPO price of 100p. Let's see where it ends up once the flippers have exited! First day premiums don't always last. Although we are in a bull market, so who knows? It looks a bit too niche, and cyclical for my liking.

I think super yachts are the pinnacle of vulgarity and are a way of the super-rich basically sticking 2 fingers up at the mass populace. History shows us that this type of thing is not a sensible way to behave, as it can ultimately trigger revolutions. Sensible rich people are a little more discreet about their wealth.

Taptica International (LON:TAP)

Share price: 376p (up 4.1% today)

No. shares: 60.6m

Market cap: £227.9m

Trading update - this is another Israeli marketing company (we looked at XLM yesterday) which keeps reporting positive trading. Taptica seems to focus on mobile advertising. It has issued a series of positive updates, driving a big rise in share price in the last year.

Today's update sounds very strong. It says that existing customers are spending more on advertising through its platform. Plus there is growth from new geographies, especially Asia-Pacific.

This has resulted in a successful H1;

...As a result, the Company expects to report H1 2017 revenue and adjusted EBITDA significantly ahead of the corresponding period in the prior year.

This is helpfully quantified;

Taptica expects H1 2017 revenue and EBITDA year-on-year growth of more than 25% and 40% respectively

It's great when companies give figures in RNSs, as that removes the usual guesswork. Clarity is always best, as investors can then make more informed decisions.

I'm less keen on the company using adjusted EBITDA as its default profit measure.

The market was already expecting quite big increases in revenues & profit though. Looking at the Stockopedia broker consensus figures, 2017 revenues were already expected to be up by 26%, and net profit up by c.33%.

Therefore it looks like today's trading news was largely baked into the share price already - hence there only being a 4.1% share price rise, at the time of writing.

Outlook comments are positive;

In the second half of the year, the Company remains confident of achieving sustained strong growth as it continues to grow through its international expansion in the Asia-Pacific region as well as other regions.

As a consequence of this and the strong first half performance, the Company expects adjusted EBITDA for FY 2017 to be higher than market expectations.

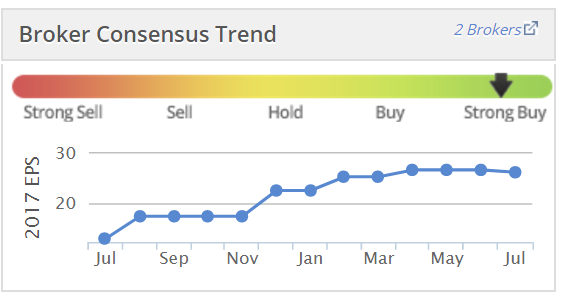

That's good news, and is likely to see brokers move the earnings forecasts up again. See how there has been a remarkable up-trend in the last 12 months, for earnings consensus forecast;

If EPS forecast now goes up to say 30p, then the PER is only about 12.5, which looks terrific value for a company which is growing earnings so strongly.

As always though, with this sector, the big question is whether earnings are sustainable longer term? Things move fast, and with technology changing so fast, who knows?

My opinion - this was a nice little trade for me recently, as it came up on a screen I run periodically for earnings momentum. That is very easy to set up on Stockopedia, and I think there is a ready-made earnings upgrade screen in the screening section of the website.

Repeated earnings upgrades, a low PER, strong growth, and a high StockRank of 92, plus "High Flyer" categorisation definitely make this share worth a closer look.

I reviewed its last (excellent) accounts, back here in Mar 2017.

Topps Tiles (LON:TPT)

Share price: 81.9p (down 1.3% today)

No. shares: 192.4m

Market cap: £157.6m

Q3 trading update - the UK's largest floor tiles specialist.

It reports today on the 13 weeks to 1 Jul 2017.

It's not good - LFL sales are down 4.7%

Mitigating factors are that the prior year comps are high, at +6.2%, which was stimulated by changes in Stamp Duty apparently.

Topps also says that has seen a "modest improvement" recently.

There's a possible small acquisition in the pipeline.

Weaker macro economic conditions.

The company details the actions it is taking to improve performance. My worry is, what would performance be like it they were not working to improve sales? Probably a lot worse.

Overall, I do like this company, it seems a decent business. However, like everyone in retail, they're facing the squeeze of consumers under pressure, combined with unrelenting cost increases. That just doesn't seem a good place for investors to be looking.

Lakehouse (LON:LAKE)

It's always very difficult when there's been a disaster like the Grenfell Tower tragedy.

Everyone thinks about the human consequences first, and making sure that the politicians & civil servants ensure that something like this can never happen again. That's what matters most.

It's bound to have economic consequences for companies in the sector, which also have to be considered.

LAKE put out an RNS last night, which goes into some detail about various negative press stories recently. Apparently one of its subsidiaries maintained, or assessed the fire alarms in Grenfell Tower.

I think this share is best avoided. Even if the company is blameless, that doesn't always matter, as people primarily want a scapegoat. Also it has a very weak balance sheet.

Right, I have to dash. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.